Enlarge image

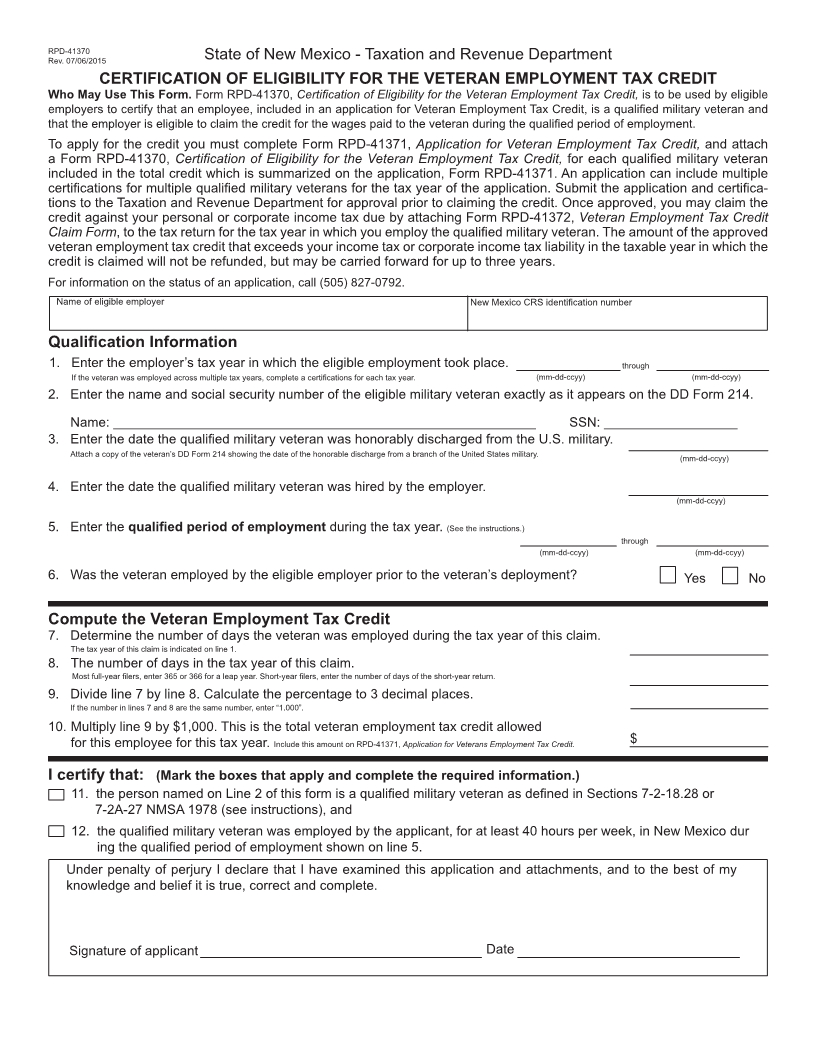

RPD-41370

Rev. 07/06/2015 State of New Mexico - Taxation and Revenue Department

CERTIFICATION OF ELIGIBILITY FOR THE VETERAN EMPLOYMENT TAX CREDIT

Who May Use This Form. Form RPD-41370, Certification of Eligibility for the Veteran Employment Tax Credit, is to be used by eligible

employers to certify that an employee, included in an application for Veteran Employment Tax Credit, is a qualified military veteran and

that the employer is eligible to claim the credit for the wages paid to the veteran during the qualified period of employment.

To apply for the credit you must complete Form RPD-41371, Application for Veteran Employment Tax Credit, and attach

a Form RPD-41370, Certification of Eligibility for the Veteran Employment Tax Credit, for each qualified military veteran

included in the total credit which is summarized on the application, Form RPD-41371. An application can include multiple

certifications for multiple qualified military veterans for the tax year of the application. Submit the application and certifica-

tions to the Taxation and Revenue Department for approval prior to claiming the credit. Once approved, you may claim the

credit against your personal or corporate income tax due by attaching Form RPD-41372, Veteran Employment Tax Credit

Claim Form, to the tax return for the tax year in which you employ the qualified military veteran. The amount of the approved

veteran employment tax credit that exceeds your income tax or corporate income tax liability in the taxable year in which the

credit is claimed will not be refunded, but may be carried forward for up to three years.

For information on the status of an application, call (505) 827-0792.

Name of eligible employer New Mexico CRS identification number

Qualification Information

1. Enter the employer’s tax year in which the eligible employment took place. through

If the veteran was employed across multiple tax years, complete a certifications for each tax year. (mm-dd-ccyy) (mm-dd-ccyy)

2. Enter the name and social security number of the eligible military veteran exactly as it appears on the DD Form 214.

Name: _________________________________________________________ SSN: __________________

3. Enter the date the qualified military veteran was honorably discharged from the U.S. military.

Attach a copy of the veteran’s DD Form 214 showing the date of the honorable discharge from a branch of the United States military. (mm-dd-ccyy)

4. Enter the date the qualified military veteran was hired by the employer.

(mm-dd-ccyy)

5. Enter the qualified period of employment during the tax year. (See the instructions.)

through

(mm-dd-ccyy) (mm-dd-ccyy)

6. Was the veteran employed by the eligible employer prior to the veteran’s deployment? Yes No

Compute the Veteran Employment Tax Credit

7. Determine the number of days the veteran was employed during the tax year of this claim.

The tax year of this claim is indicated on line 1.

8. The number of days in the tax year of this claim.

Most full-year filers, enter 365 or 366 for a leap year. Short-year filers, enter the number of days of the short-year return.

9. Divide line 7 by line 8. Calculate the percentage to 3 decimal places.

If the number in lines 7 and 8 are the same number, enter “1.000”.

10. Multiply line 9 by $1,000. This is the total veteran employment tax credit allowed

for this employee for this tax year. Include this amount on RPD-41371, Application for Veterans Employment Tax Credit. $

I certify that: (Mark the boxes that apply and complete the required information.)

11. the person named on Line 2 of this form is a qualified military veteran as defined in Sections 7-2-18.28 or

7-2A-27 NMSA 1978 (see instructions), and

12. the qualified military veteran was employed by the applicant, for at least 40 hours per week, in New Mexico dur

ing the qualified period of employment shown on line 5.

Under penalty of perjury I declare that I have examined this application and attachments, and to the best of my

knowledge and belief it is true, correct and complete.

Signature of applicant Date