Enlarge image

Tennessee Business Tax

Manual

March 2022

Enlarge image |

Tennessee Business Tax

Manual

March 2022

|

Enlarge image |

Contents

Chapter 1: Introduction .............................................................................................. 10

History ........................................................................................................................................................... 10

Brief Business Tax Overview................................................................................................................... 11

Nature of the Business Tax ..................................................................................................................... 12

1. State-Level and Municipal-Level Taxes .................................................................................. 12

Application.................................................................................................................................................... 14

1. Doing Business .............................................................................................................................. 14

2. Imposition ....................................................................................................................................... 14

3. Business Tax Classifications ...................................................................................................... 15

4. Retailer vs. Wholesaler................................................................................................................ 15

Chapter 2: Who is Subject to Tennessee Business Tax? ............................................... 16

Historical Context ....................................................................................................................................... 16

1. Pre-2014 Tax Periods................................................................................................................... 16

2. Periods Beginning on or after January 1, 2014 .................................................................... 17

Present Law.................................................................................................................................................. 18

1. Substantial Nexus......................................................................................................................... 19

2. Activities Engaged in this State ................................................................................................. 20

3. Nexus in Tennessee – Other Tennessee Taxes ................................................................... 21

4. Establishing a Location, Outlet, or Other Place of Business ............................................ 23

Chapter 3: Registration and Licensing ........................................................................ 25

Registration .................................................................................................................................................. 25

1. In-State Businesses ...................................................................................................................... 25

2. Out-of-State Businesses ............................................................................................................. 26

Business License......................................................................................................................................... 26

1. Standard Business License ........................................................................................................ 27

2. Minimum Activity License .......................................................................................................... 28

3. Transferring Licenses .................................................................................................................. 28

4. Contractors..................................................................................................................................... 28

2 | P ag e

|

Enlarge image | Closing a Business...................................................................................................................................... 29 1. Successor Liability ........................................................................................................................ 30 Chapter 4: Determining Gross Sales............................................................................ 32 Gross Sales ................................................................................................................................................... 32 Taxable Sales ............................................................................................................................................... 32 1. Casual and Isolated Sales........................................................................................................... 33 2. Sales of Services............................................................................................................................ 34 3. Sales of Intangible Personal Property .................................................................................... 37 4. Installation Sales ........................................................................................................................... 38 5. Sales to Employees ...................................................................................................................... 39 6. Installment and Credit Sales ..................................................................................................... 39 7. Lay-Away Sales .............................................................................................................................. 39 Sales Price..................................................................................................................................................... 40 1. Exclusions ....................................................................................................................................... 40 2. Expenses Passed Through to the Customer ........................................................................ 41 Reporting Methods .................................................................................................................................... 42 Chapter 5: Classifications ........................................................................................... 43 Classifications Generally .......................................................................................................................... 43 1. Classification 1............................................................................................................................... 43 2. Classification 2............................................................................................................................... 44 3. Classification 3............................................................................................................................... 44 4. Classification 4............................................................................................................................... 48 5. Classification 5............................................................................................................................... 48 6. Antique Malls, Flea Markets, Gun Shows, Etc....................................................................... 48 7. Transient Vendors ........................................................................................................................ 49 8. Miscellaneous Industry Specific Classifications................................................................... 49 Retailer vs. Wholesaler ............................................................................................................................. 57 1. Retail Sales...................................................................................................................................... 57 2. Wholesale Sales............................................................................................................................. 58 3 | P ag e |

Enlarge image | 3. Sales for Resale ............................................................................................................................. 59 4. Wholesaler to Wholesaler Sales ............................................................................................... 60 5. Retailer to Retailer Sales............................................................................................................. 61 Tax Rates....................................................................................................................................................... 61 Chapter 6: Filing Requirements .................................................................................. 64 Filing the Return ......................................................................................................................................... 64 1. Payments......................................................................................................................................... 64 2. Electronic Filing ............................................................................................................................. 64 3. State-Level and Municipal-Level Filings ................................................................................. 65 4. Consolidated Returns .................................................................................................................. 66 5. Single-Member LLC Filing ........................................................................................................... 68 Filing Period ................................................................................................................................................. 68 Filing Due Dates .......................................................................................................................................... 69 1. Due Dates........................................................................................................................................ 69 2. Filing Extension ............................................................................................................................. 70 3. Estimated Assessment ................................................................................................................ 70 Final Returns ................................................................................................................................................ 71 1. Filing Requirements for Final Returns .................................................................................... 71 2. Tax Clearance................................................................................................................................. 72 3. Events Not Resulting in a Final Return ................................................................................... 73 Overpayments............................................................................................................................................. 73 Penalties........................................................................................................................................................ 74 1. Penalties and Penalty Rates ...................................................................................................... 74 2. Penalty Waivers ............................................................................................................................. 75 Interest .......................................................................................................................................................... 77 Assessments ................................................................................................................................................ 77 1. Assessment Following an Audit................................................................................................ 77 2. Estimated Assessment ................................................................................................................ 78 Statutes of Limitations.............................................................................................................................. 78 4 | P ag e |

Enlarge image |

1. Assessments................................................................................................................................... 78

2. Refunds............................................................................................................................................ 79

3. Extensions....................................................................................................................................... 79

Record Maintenance and Retention ..................................................................................................... 80

Chapter 7: Sourcing and Distribution.......................................................................... 81

Sourcing ........................................................................................................................................................ 81

1. In-State Taxpayers other than Video Programmers, Mobile Telecommunications

Providers, and Classification 4 Contractors.................................................................................... 81

2. Out-of-State Taxpayers other than Video Programmers, Mobile

Telecommunications Providers, and Classification 4 Contractors .......................................... 81

3. Taxpayers with both In-State and Out-of-State Locations other than Classification 4

Contractors............................................................................................................................................... 82

4. Contractors..................................................................................................................................... 82

5. Video Programmers ..................................................................................................................... 83

6. Mobile Telecommunications Service Providers................................................................... 84

Distributions ................................................................................................................................................ 85

1. In-state Taxpayer Distributions ................................................................................................ 85

2. Municipal-Level Business Tax Collections from In-state Taxpayers .............................. 85

3. Fees Levied Under Tenn. Code Ann. § 67-4-710.................................................................. 86

4. Taxpayers Without Licenses or Locations ............................................................................. 86

5. Audited Taxpayers........................................................................................................................ 86

Chapter 8: Exemptions and Exclusions ....................................................................... 87

Exempt Sales of Services .......................................................................................................................... 87

1. Medical, Dental, and Allied Health Services.......................................................................... 88

2. Legal Services................................................................................................................................. 89

3. Educational Services .................................................................................................................... 89

4. Services Rendered by Nonprofit Membership Organizations ........................................ 90

5. Domestic Services Provided in Private Households........................................................... 91

6. Nonprofit Educational and Research Agencies ................................................................... 91

5 | P ag e

|

Enlarge image |

7. Services by Religious and Charitable Organizations .......................................................... 92

8. Accounting, Auditing, and Bookkeeping Services ............................................................... 93

9. Public Utilities ................................................................................................................................ 93

10. Banking and Related Functions ........................................................................................... 96

11. Insurance Services .................................................................................................................. 97

12. Operators of Residential and Nonresidential Buildings.............................................. 98

13. Lessors of Real Property ........................................................................................................ 99

14. Veterinary Services .................................................................................................................. 99

15. Architecture, Engineering, and Land Surveying Services ........................................... 100

16. Services Provided by Farmers to Other Farmers ......................................................... 101

Other Miscellaneous Exemptions ....................................................................................................... 101

1. Services Sold for a Lump Sum ................................................................................................ 101

2. Services for Affiliated Entities .................................................................................................. 102

3. Internet Services.......................................................................................................................... 102

Taxable Sales by Providers of Exempt Services .............................................................................. 102

Persons/Entities ........................................................................................................................................ 103

1. Radio and Televisions Stations ............................................................................................... 104

2. Providers of Direct-to-Home Satellite Services.................................................................. 105

3. Publishers or Printers of Newspapers and other Periodicals ....................................... 105

4. Qualified Blind Persons and Disabled Veterans................................................................ 105

5. Manufacturers ............................................................................................................................. 107

6. Persons with Taxable Sales < $10,000.................................................................................. 113

7. Persons Making Casual and Isolated Sales ......................................................................... 114

8. Taxpayers Responsible for Other Privilege Taxes ............................................................ 115

Exempt Sales.............................................................................................................................................. 115

1. Qualified Amusement Activities ............................................................................................. 115

2. Agricultural Sales ........................................................................................................................ 116

3. Sales of Intangibles .................................................................................................................... 116

4. Wholesaler to Wholesaler ........................................................................................................ 117

6 | P ag e

|

Enlarge image |

5. Sales or Rentals of Real Property........................................................................................... 117

6. Sales of Items Donated to Religious and Charitable Institutions................................. 119

7. Freight & Delivery Charges ...................................................................................................... 119

Exclusions ................................................................................................................................................... 119

Chapter 9: Deductions .............................................................................................. 121

Overview ..................................................................................................................................................... 121

1. Cash Discounts ............................................................................................................................ 121

2. Returned Items............................................................................................................................ 121

3. Trade-In Allowances................................................................................................................... 122

4. Repossessed Goods................................................................................................................... 122

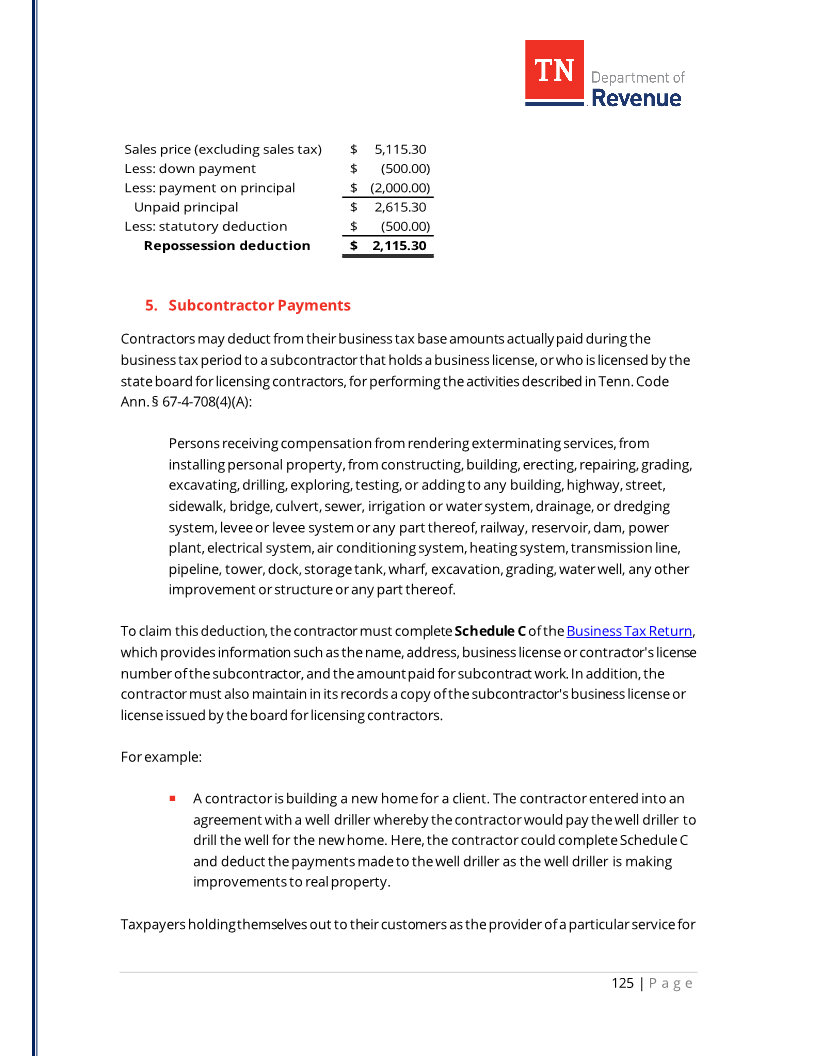

5. Subcontractor Payments.......................................................................................................... 125

6. Sales of Services Delivered to a Location Outside Tennessee ...................................... 126

7. Sales of Tangible Personal Property in Interstate Commerce ...................................... 127

8. School to Student Sales ............................................................................................................ 128

9. Bad Debts...................................................................................................................................... 128

10. Miscellaneous Federal and State Excise Taxes ............................................................. 129

11. Accommodation Sales .......................................................................................................... 130

12. Patronage Dividends............................................................................................................. 131

13. Public Warehousing and Storage – Leases..................................................................... 132

14. Motor Vehicle Rentals – Refundable Deposits .............................................................. 132

15. Funeral Directors – Cash Advances .................................................................................. 132

Chapter 10: Credits................................................................................................... 133

Overview ..................................................................................................................................................... 133

Personal Property Taxes ........................................................................................................................ 133

1. Personal Property Taxes Assessed During Audit .............................................................. 134

2. Taxes Paid on Property Leased or Rented .......................................................................... 134

3. Providers of Video Programming Services.......................................................................... 135

4. Special School District Taxes ................................................................................................... 135

5. Property Transferred to a Government Entity................................................................... 136

7 | P ag e

|

Enlarge image | Privilege Taxes........................................................................................................................................... 136 Chapter 11: Industry-Specific Guidance .................................................................... 137 Contractors ................................................................................................................................................ 137 1. Overview........................................................................................................................................ 137 2. Reporting Sales and Progress Payments............................................................................. 137 3. Deemed Location........................................................................................................................ 137 4. In-State Contractors................................................................................................................... 138 5. Out-of-State Contractors .......................................................................................................... 142 6. Subcontractors ............................................................................................................................ 144 7. Speculative Builders................................................................................................................... 146 Agriculture .................................................................................................................................................. 146 1. Agricultural Commodity Brokers ........................................................................................... 146 2. Agricultural Exemptions ........................................................................................................... 147 Mobile Telecommunications Providers ............................................................................................. 147 1. Registration and Reporting...................................................................................................... 148 2. Sales of Phones and Accessories from Outside the State.............................................. 149 3. Personal Property Tax Credit .................................................................................................. 149 4. Sales of Internet Access ............................................................................................................ 149 Performance Entities............................................................................................................................... 150 1. In-state Performance Entities ................................................................................................. 150 2. Out-of-State Performance Entities ........................................................................................ 151 3. Are Touring Artists Transient Vendors? ............................................................................... 151 Traveling Photographers........................................................................................................................ 151 Lottery Commissions .............................................................................................................................. 152 Funeral Directors...................................................................................................................................... 152 1. Unit Price ....................................................................................................................................... 152 2. Itemization .................................................................................................................................... 153 3. Cash Advances............................................................................................................................. 153 Cemeteries and Memorial Gardens ................................................................................................... 154 8 | P ag e |

Enlarge image |

Municipal Airports.................................................................................................................................... 154

Leased Departments ............................................................................................................................... 154

Commission Agents ................................................................................................................................. 155

Vending Machines .................................................................................................................................... 155

Antique Malls, Flea Markets, Craft Shows, Antique Shows, Gun Shows, and Auto Shows 155

1. Fee in Lieu of Business Tax...................................................................................................... 156

2. Businesses Selling Antiques at Least 5 Days Per Week................................................... 157

Transient Vendors.................................................................................................................................... 157

1. Temporary Premises ................................................................................................................. 157

2. Transient Vendor License Fee................................................................................................. 158

3. Transient Vendors and Business Tax.................................................................................... 158

Food Trucks................................................................................................................................................ 159

9 | P ag e

|

Enlarge image |

Chapter 1: Introduction

History

The Tennessee General Assembly passed the “Business Tax Act of 1971” (the “Act”) as a

replacement to a local property tax (commonly referred to as an “ad valorem tax”) imposed

on business inventories. However, the Tennessee State Constitution required that inventory

be “taxed according to its value,” and thus, Tennessee courts ruled that the Act could not be

applied in lieu of the ad valorem tax but instead had to be applied in addition to the ad

valorem tax.

Because this was not the intent of the General Assembly, in 1971, the General Assembly

held a Limited Constitutional Convention to amend Article II, Section 28 of the Tennessee

State Constitution. This amendment stated the General Assembly “may levy a gross receipts

tax on merchants and businesses in lieu of ad valorem taxes on the inventories of

merchandise held by such merchants and businesses.” The amendment became effective in

1973.

As described by the Tennessee Court of Appeals in 1979, the General Assembly desired this

shift from a local ad valorem tax to a gross receipts tax, in part, because of following tax

disparity:

It is our opinion that one of the purposes of the Constitutional Amendment of 1973

was to prevent repressive taxation whereby unsold inventories of merchants, who

most likely had to borrow funds at substantial interest rates to obtain those

inventories, would be taxed on an ad valorem basis while such inventories

1

remained unsold in these merchants' hands...

The Act eliminated this disparity by allowing merchants to pay the business tax (a tax on

gross sales) in lieu of the ad valorem tax. At the time of enactment, the business tax was

comprised of two parts – a county-level tax and a city-level tax. In its original form, the

appropriate local governmental body had to adopt the tax. Additionally, the local

governmental body administered the tax and remitted a portion of the tax collected to the

Department of Revenue (the “Department”).

Beginning January 1, 2010, in accordance with Public Chapter 530, 2009 Acts, the

Department assumed responsibility for administering and collecting the business tax. All

businesses subject to the tax were to file tax returns with, and remit the tax to, the

10 | P ag e

|

Enlarge image |

Department. However, the general structure of the tax remained the same under the 2009

amendment.

Effective January 1, 2014, in accordance with Public Chapter 313, 2013 Acts the structure of

the business tax changed. Significantly, Public Chapter 313 changed the county tax to a

uniform state-level tax. While the Department still distributes the state-level tax to the

counties where a taxpayer performs business, counties no longer adopt or impose the tax.

Local municipalities, however, still must adopt a municipal-level tax.

Finally, in 2016, the Revenue Modernization Act (the “RMA”) made the most recent

substantial change to the business tax statutes by codifying substantial nexus (see Chapter

2 of this Manual for more information). After passage of the RMA, the Department updated

sixteen different business tax rules and regulations, including three rules repealed in their

entirety.

Brief Business Tax Overview

The business tax statutes are found in Tenn. Code Ann. § 67-4-701 through Tenn. Code Ann.

2

§ 67-4-730 and the business tax rules and regulations are found inENN T.COMP .R. & EGS R.

3

1320-4-5-.01 through TENN .COMP .R.& EGSR. 1320-4-5-.61.

The business tax is a privilege tax on the privilege of doing business by making sales of

tangible personal property and services within Tennessee and its local jurisdictions. While

anyone doing business in the state is subject to the state-level business tax, unless

specifically exempt, each municipality must adopt the tax to impose it within its city limits.

The business tax applies to a taxpayer’s gross sales (see Chapter 4 for more information on

what constitutes “gross sales”). Taxpayers multiply the gross sales derived from taxable sales

per location by the appropriate state and local tax rates to calculate the amount of tax owed

per location. There are several different business tax rates. The rates are determined based

on the taxpayer’s “dominant business activity” (see Chapter 5 for more information on

Classifications) and whether the taxpayer is a wholesaler or a retailer (see Chapter 5 for

more information on retailer/wholesalers).

In general, all sales of tangible personal property and services made in Tennessee will be

subject to the business tax. However, there are several exceptions and exemptions

discussed throughout this Manual.

11 | P ag e

|

Enlarge image |

Nature of the Business Tax

As stated above, the Tennessee business tax is imposed on the privilege of doing business in

the state of Tennessee. Unlike sales tax, which principally applies to retail sales of tangible

personal property and certain specifically listed services, business tax applies to all taxable,

non-exempt sales of services and sales of tangible personal property. Business tax applies at

both the retail and wholesale sales. Businesses may invoice the business tax as a separate

item and pass it on to its customer, though this amount is included in the sales tax and

4

business tax base.

1. State-Level and Municipal-Level Taxes

Business tax is comprised of two separate but complementary taxes: a state-level tax and a

municipal-level tax. Generally, every entity making sales of tangible personal property and/or

5

services in Tennessee is subject to the state-level tax. Entities may be subject to the

municipal-level tax if they have a business location in a municipality that has enacted the tax.

The sections below provide a high-level overview of when a business is subject to business

tax (see Chapter 2 of this Manual for a more detailed discussion of when a business is

subject to business tax by having “nexus” with the state and Chapter 7 for a more detailed

discussion on how the tax revenue is distributed).

State-Level Tax

Every person doing business in Tennessee with a physical location or place of business in the

state is subject to the state-level business tax unless specifically exempt. For business tax

purposes, “person” is defined as an “individual, firm, partnership, joint venture, association,

corporation, estate, trust, business trust, receiver, syndicate, or other group or combination

6

acting as a unit.” The term “person” does not include the United States of America, the State

of Tennessee, or any political subdivision of the two; electric membership cooperatives or

7

utility districts.

A person without a physical location or place of business in Tennessee will be subject to the

state-level business tax if that person has substantial nexus (see pg. 19) in the state and

performs any of the following activities:

Sells tangible personal property that is shipped or delivered to a location in this

state;

12 | P ag e

|

Enlarge image |

Sells a service that is delivered to a location in this state (see Chapter 4 for more

information on services);

Leases tangible personal property that is located in this state; or

Makes sales as a natural gas marketer to customers located within this state through

the presence in this state of the seller's property, pipeline capacity, or through the

presence in this state of the seller's representatives acting on behalf of the seller to

solicit orders, provide customer service, or conduct other activities in furtherance of

8

such sales in this state.

Municipal-Level Tax

Each municipality, by passing a resolution or ordinance, may elect to levy the municipal-level

9

business tax on any business activity conducted within its borders. Currently, 215

municipalities impose the business tax. Unlike with the state-level business tax, a person

10

must have a physical location, place of business, or other location in a municipality to be

subject to the municipal-level business tax. If a taxpayer’s business is located in a

municipality that has enacted business tax, the taxpayer is required to pay both the state-

level and municipal-level business tax.

Please see Chapter 11 for special rules that apply to cable, telecom, and other specific

industries. The taxpayer should contact the municipality or the county assessor if there is

any question that the business may not be inside city limits.

A list of cities imposing business tax is available HERE on the Department’s website.

If a taxpayer’s business location is not included on the list, the taxpayer may still be subject

to municipal-level business tax. Many areas in Tennessee are governed by and/or part of

adjoining incorporated cities. For example, Antioch, Tennessee is not a city on the list,

however it is part of Metropolitan Nashville, and the Nashville city business tax is due.

Additionally, a county may have a multi-tiered, municipal-level business tax system. For

example, Davidson County has a general services district and an urban services district. The

city of Nashville is part of the Davidson County urban services district. Taxpayers can

determine if their business is part of an urban services district if they are located in the

urban services district for property tax purposes.

13 | P ag e

|

Enlarge image |

Application

1. Doing Business

Business tax is a privilege tax levied upon the privilege of doing business in the state of

Tennessee. Business is defined as “any activity engaged in by any person, or caused to be

engaged in by the person, with the object of gain, benefit, or advantage, either direct or

11

indirect.”

Business does not include:

Occasional and isolated sales (see Chapter 4) by someone not normally engaged in

12

the business of selling the type of property being sold; or

Utilization of a property management company to manage vacation lodging for

overnight property rentals by an individual property owner. However, business tax

still applies to the rental of the property. The property management company would

be responsible for filing. See the section titled Sales or Rentals of Real Property in

Chapter 8 of this manual for more information .

However, business does include any other activity of the individual property owner that is

subject to the business tax.

2. Imposition

Business tax is imposed on a business’s gross sales of tangible personal property and

services. The vocations, occupations, businesses, or business activities listed in Tenn. Code

Ann. §§ 67-4-708(1)-(5) are taxable privileges subject to Tennessee’s state-level business tax.

Tenn. Code Ann. §§ 67-4-708(1)-(4) detail the taxable privileges subject to Tennessee’s

municipal-level business tax.

For information on vocations, occupations, businesses, or activities subject to business tax,

please see Chapter 5 of this Manual. For more information on sales and services that are

excluded from business tax and exempted sales, services, or entities, please see Chapter 8

of this Manual.

14 | P ag e

|

Enlarge image |

3. Business Tax Classifications

An entity’s business tax classification determines the rate of tax that will apply. Businesses

choose their classification for each of their locations based on the “dominant business

activity” of the location. “Dominant business activity” is the activity that produces the most

13

taxable income for the business location.

There are five major business tax classifications as well as a separate category for antique

malls, flea markets, transient vendors, and the like. Some classifications have subcategories

that are discussed in more detail in Chapter 5. Business tax classifications are found in Tenn.

Code Ann. § 67-4-708. Only one classification is allowed per business location.

The business tax classifications each contain several business activities that businesses must

choose to categorize as their dominant business activity. As the classifications increase in

number from Classification 1 up to Classification 5, the types of business activities change in

character from activities that meet basic needs such as the provision of food for home

preparation in Classification 1 to the relatively small subset of industrial loan and thrift

companies in Classification 5.

Businesses engaged in the business activity of selling tangible personal property that is not

14

listed in any other section of Tenn. Code Ann. § 67-4-708 file under Classification 2.

Businesses engaged in the sale of services not otherwise specified file under Classification

15

3.

A detailed analysis of the business tax classifications is available in Chapter 5 of this Manual.

4. Retailer vs. Wholesaler

Businesses must also determine if they are primarily engaged in the business of making

retail sales or wholesale sales. The determination of whether a business is a retailer or

wholesaler is made on a location-by-location basis. This is important because the business

tax rate differs for retailers and wholesalers at a given location. Generally, a business is a

retailer if 50% or more of taxable gross sales are retail sales and a wholesaler if more than

16

50% of taxable gross sales are wholesale sales. For more information on retailers and

wholesalers, please see Chapter 5 of this Manual.

15 | P ag e

|

Enlarge image |

Chapter 2: Who is Subject to Tennessee Business Tax?

Historical Context

As covered in Chapter 1, the Tennessee business tax has undergone numerous statutory

changes to adapt to modern business practices and e-commerce. One of the most important

changes is to the application of “nexus,” which describes the connection that must be

present before a taxing jurisdiction has the right to impose a tax on a business. An entity

must have some contact or connection with a state before the state may constitutionally levy

a tax. The question becomes, at what point is that connection sufficient to subject a person

to taxation in the state?

1. Pre-2014 Tax Periods

For periods beginning on or before January 1, 2014, Tennessee law provided that making

sales by engaging in any vocation, occupation, business, or business activity listed in the

business tax statutes is a privilege on which each county or incorporated municipality, or

17

both, may levy a privilege tax.

Furthermore, TENN .COMP .R.& EGSR. 1320-04-05-.28(1) (2000) (“Rule 28”) stated that the

business tax applies to each place, location, or outlet in the state from which business is

carried on.

Therefore, the Tennessee business tax applied to a person who made sales or performed

services at a place of business or other location in Tennessee.

During this period, the Department considered a taxpayer that did not have a physical place

of business in Tennessee, but that operated through a warehouse or other location in

Tennessee, whether or not the warehouse or other location is owned by the taxpayer, to

have a business location where its sales were sourced. This was based onENN T.COMP .R.&

REGS. 1320-04-05-.14 (“Rule 14”). Rule 14 states that:

“[S]ales of tangible personal property and services by a licensed wholesaler or

retailer from a central warehouse or other distribution point other than his principal

place of business shall be subject to the appropriate wholesale or retail tax, and

persons making such sales shall be liable for the business tax for that location.”

16 | P ag e

|

Enlarge image |

Accordingly, the Department imposed business tax on sales of tangible personal property

made from a warehouse or other location in Tennessee at which a taxpayer maintained the

tangible personal property sold.

The Department also utilized the “sufficient local incidence” test. The United States Supreme

Court coined the term “sufficient local incident” to illustrate when a business’s in-state

activity rose to the level to contribute to the establishment and maintenance of an in-state

18

market. This level of activity was sufficient to satisfy U.S. Constitutional requirements.

In Westinghouse Electric Corp. v. King, 678 S.W.2d 19 (Tenn. 1984), the Tennessee Supreme

Court established as the relevant question of whether a taxpayer is subject to the business

tax as whether there is a “sufficient local incident” upon which to base the tax. It concluded

that a taxpayer who had marketing offices within the state and technical engineers

performing work within the state had “sufficient local incident” to Tennessee such that its

receipts from its sales to Tennessee customers were subject to business tax.

In Boeing Equipment Holding Company v. Tennessee State Board of Equalization, 1987 WL 15202

(Tenn. Ct. App., August 7, 1987), the Tennessee Court of Appeals found an out-of-state

taxpayer subject to business tax even though it had no offices or employees in Tennessee.

To take advantage of an ad valorem tax exemption for inventories located in the state, the

taxpayer argued it was subject to business tax based on the presence of tangible personal

property leased to persons in Tennessee. The court found the taxpayer had a “sufficient

local incident” based on the taxpayer owning property in Tennessee and receiving income

from leases on that property. It concluded that the taxpayer “engaged in the ‘local business

19

of renting [property] located in this state.’”

The Westinghouse andBoeing casesboth suggested that a taxpayer need not have an office or

physical business location in Tennessee to be subject to business tax.

2. Periods Beginning on or after January 1, 2014

The Tennessee General Assembly clarified the application of the business tax as applied to

out-of-state businesses with the “Uniformity and Small Business Relief Act of 2013” (the

“Act”).

Effective for periods beginning on or after January 1, 2014, the law was amended to state the

following:

17 | P ag e

|

Enlarge image |

[T]he making of sales by engaging in any vocation, occupation, business, or business

activity listed described, or referred to in § 67-4-708(1)-(5)” (the classifications section

20

of the business tax statute) is subject to the state-level business tax.

[T]he making of sales by engaging in any vocation, occupation, business, or business

activity listed, described, or referred to in § 67-4-708(1)-(4)” (the classifications section

21

of the business tax statute) is subject to the municipal-level business tax.

The Act also added that:

[A]ny person engaged in any vocation, occupation, business, or business activity

listed, described, or referred to in § 67-4-708(1)-(5) without establishing a physical

location, outlet, or other place of business in the state” is subject to the state-level

22

business tax but exempt from the municipal-level business tax.

For purposes of the state-level business tax, to be engaged in business in this state

23

includes performing a service that is received by a customer in this state.

Thus, for periods beginning after January 1, 2014, a taxpayer need not have a

location in Tennessee to be subject to the state-level business tax but must have a

physical location to be subject to the municipal-level business tax.

Present Law

A business entity located in the state will be subject to the state-level business tax if its gross

receipts sourced to all of its locations within a county are $10,000 or more, and it is not

24

specifically exempt from business tax. An entity is also subject to the municipal-level

business tax if it is in a municipality that has enacted the tax and its gross receipts sourced

25

to its locations within the municipality are $10,000 or more. (See Chapter 7 for more

information on sourcing). Please note, there are provisions that apply to

telecommunications and cable providers, vending machine operators, and overnight lodging

rentals. These provisions are discussed later in this Manual.

A business entity that is located outside of the state will be subject to the state-level business

tax if it has:

Substantial nexus with the state;

18 | P ag e

|

Enlarge image |

Is engaged in this state in one of the activities listed under Tenn. Code Ann.§ 67-4-

717(a); and

Its gross receipts within a county are $10,000 or more.

As stated in Chapter 1, the business tax is comprised of a state-level tax and a municipal-

level tax. Out-of-state business entities are exempt from the municipal-level business tax.

While the business tax is comprised of a municipal-level and state-level tax,

the county in which a business is located is relevant for sourcing and nexus

purposes.

1. Substantial Nexus

A business must have substantial nexus with this state to be subject to the business tax. The

Revenue Modernization Act (“the RMA”) codified the substantial nexus standard in 2015. It

became effective for tax years beginning on or after January 1, 2016. Substantial nexus is:

Any direct or indirect connection of the taxpayer to this state such that the taxpayer

can be required under the Constitution of the United States to remit the tax imposed

26

under this part.” Such connections include, but are not limited to, the following:

The business is organized or commercially domiciled in Tennessee;

The business owns or uses its capital in Tennessee;

The business has systematic and continuous business activity in Tennessee that

has produced gross receipts attributable to customers in Tennessee;

The business has a “bright-line presence” in Tennessee, which applies when any

of the following metrics are met:

o Total Tennessee business receipts during the tax period exceed the

lesser of $500,000 or 25% of the business’s total receipts everywhere

during the tax period;

o The business’s average value of real and tangible personal property

owned or rented and used in Tennessee during the tax period exceeds

19 | P ag e

|

Enlarge image |

the lesser of $50,000 or 25% of the average value of all the business’s

total real and tangible personal property; or

o The total amount of compensation paid by the business in Tennessee

during the tax period exceeds $50,000 or 25% of the business’s total

27

compensation pay by the business.

Businesses formed and operating in Tennessee will always have nexus in this

state. The question of nexus applies to out-of-state businesses with a limited

connection to the state.

Foreign entities must have effectively connected income with a United States trade or

business, as determined by the Internal Revenue Code (“IRC”), to have substantial nexus in

this state. If a business treated as a foreign corporation under the IRC has no effectively

connected income, it also does not have substantial nexus in Tennessee.

Effective for tax periods beginning January 1, 2016, the RMA’s substantial nexus standard

expands the number of businesses that might have nexus in Tennessee. Businesses that

would have been subject to the business tax before the RMA (and the substantial nexus

definition) will continue to be subject to the tax even if they do not meet any of the bright-

line tests. However, under the substantial nexus definition, some out-of-state businesses

that previously were not subject to business tax may now be subject to the tax. In other

words, the nexus provisions in existence pre-RMA are still in effect, RMA simply expanded

upon those provisions.

It is not required that a taxpayer have bright-line presence to have

substantial nexus with Tennessee. A taxpayer may have substantial nexus

with Tennessee with lesser amounts of property, payroll, and receipts in

Tennessee if it has any connection with the state that requires it to remit tax

under the United States Constitution, such as performing services in the

State.

2. Activities Engaged in this State

In addition to having substantial nexus, a business must also be engaged in one of the

activities in Tenn. Code Ann. § 67-4-717(a) before being subject to the business tax. This

section states that a business “engaged in this state” in any “vocation, occupation, business,

or business activity set forth as taxable under § 67-4-708(1)-(5), the classifications section of

20 | P ag e

|

Enlarge image |

the business tax statute, with or without establishing a physical location, outlet, or other

place of business in the state, shall be subject to the tax.” The phrase "engaged in this state"

shall include, but not be limited to, any of the following:

The sale of tangible personal property that is shipped or delivered to a location in

this state;

The sale of a service that is delivered to a location in this state; or

28

The leasing of tangible personal property that is located in this state.

3. Nexus in Tennessee – Other Tennessee Taxes

As mentioned above, nexus describes a connection that must be present before a taxing

jurisdiction has the right to impose a tax on an entity’s activity. Determining whether a

taxpayer has nexus in Tennessee for business tax is a different process than the

determination of whether a taxpayer has nexus for Tennessee sales and use tax and

franchise and excise tax. However, all businesses located in this state have nexus for sales

and use tax, franchise and excise tax, and business tax.

Sales and Use Tax

Out-of-state dealers engaged in the following activities are considered to have nexus in this

state:

Use of employees, agents, or independent contractors to solicit sales in Tennessee;

Use of third parties in Tennessee to conduct substantial business activities in

Tennessee;

Maintaining inventory in Tennessee and using in-state independent contractors to

fulfill Tennessee retail sales of that inventory;

In-state promotional activity by company personnel, including participation in trade

shows;

Physical Tennessee business presence of a subsidiary that is acting as an agent of

the out-of-state dealer or that is conducting activities in Tennessee on behalf of such

21 | P ag e

|

Enlarge image |

a dealer (e.g., a retail store that takes returns of purchases made online from

parent);

Use of company-owned trucks or use of contract-carriers acting as an agent for the

seller;

Maintaining a store, office, warehouse, showroom, or other place of business in

Tennessee;

Leasing or renting tangible personal property in Tennessee;

Repairing, installing, or assembling tangible personal property in Tennessee or the

use of an agent or independent contractor to perform those services in Tennessee;

Providing telecommunication services to subscribers located in Tennessee;

Providing any taxable service in Tennessee; and

Use of an in-state party to route customers to the out-of-state dealer (commonly

known as “click-through nexus”).

Pursuant to the Wayfair decision, out-of-state dealers with no physical presence in

Tennessee that make sales that exceed $100,000 to customers in this state during the

previous tax year also have substantial nexus in Tennessee for sales and use tax purposes.

For more information on sales and use tax nexus requirements, see the Department’s Sales

and Use Tax Manual.

Franchise and Excise Tax

A taxpayer without a physical presence in the state may have substantial nexus in the state

for franchise and excise tax purposes if it meets the bright-line presence definition of

substantial nexus. A taxpayer meets the bright-line presence standard for substantial nexus

for franchise and excise tax if a taxpayer has:

At least $50,000 of property or payroll in the state;

At least $500,000 of receipts in the state; or

22 | P ag e

|

Enlarge image |

At least 25% of its total property, payroll, or receipts in Tennessee.

A taxpayer that does not meet the bright-line presence standards may also have substantial

nexus in the state if its contact with the state is sufficient. For example:

A business engaged in systematic and continuous business activity in the state that

has produced receipts attributable to Tennessee customers will have substantial

nexus with the state.

For more information on nexus for franchise and excise tax, see the Department’s Franchise

and Excise Tax Manual.

4. Establishing a Location, Outlet, or Other Place of Business

All persons that are subject to the state-level business tax and have a physical location,

outlet, or other place of business within a municipality in this state shall also be subject to

the municipal-level business tax. Persons that do not have a physical location, outlet, or

other place of business within a municipality in this state shall not be subject to the

29

municipal-level business tax.

Persons engaged in the business of selling tangible personal property or services from a

central warehouse or distribution point other than their principal place of business are liable

30

for business tax at that location. For example:

A furniture store is principally located in Nashville, Tennessee. The Nashville location

is advertised on its website, the taxpayer lists this address on its registration

documents, and this is where the showroom is located. The business also has a

warehouse located in Murfreesboro, Tennessee. As new furniture models are

introduced, the taxpayer occasionally holds “warehouse sales” whereby the

warehouse is opened to the public to display and sell the overstock merchandise.

The taxpayer, therefore, should register and pay business tax for its Murfreesboro

location as well.

In the case of an audit, auditors will consider several factors when determining whether a

taxpayer has established a location, outlet, or other place of business in Tennessee

including:

23 | P ag e

|

Enlarge image |

The amount of time a person has engaged in business in Tennessee;

The regularity in which a person engages in business in Tennessee;

Whether the business holds itself out as having a location in Tennessee;

Taxable receipts generated within a jurisdiction;

Whether or not employees of a business are located in this state;

Whether or not the business has Tennessee payroll receipts in its franchise and

excise tax apportionment factor;

Whether the business intends to operate at a location in Tennessee on a more than

temporary basis; and

Whether or not a taxpayer leases or owns property in Tennessee.

This is not an exhaustive list of factors. Each business is unique; thus, an auditor may use

other facts or circumstances to determine whether a seller of tangible personal property or

a service provider has established a location. For example:

A California information technology (“IT”) consultancy firm (“CA IT Company”) enters a

2-year contract with a Memphis, Tennessee business. The contract is valued at

$5,000,000 dollars and the CA IT Company will have a team of 20 consultants

working full-time from the Memphis business’s headquarters. The consultants will

have designated parking spaces, designated office spaces, security access to the

headquarters building, and access to the internet network. The CA IT Company has

information on its website that it’s performing work in numerous states and cities,

including Memphis, Tennessee. Under these circumstances, the California IT

Company has likely established a business location in Memphis, Tennessee and

should register and pay both state-level and municipal-level Tennessee business tax.

24 | P ag e

|

Enlarge image |

Chapter 3: Registration and Licensing

Registration

Every person subject to state-level and/or municipal-level business tax must register with the

31

Department of Revenue (the “Department”) before engaging in business in the state.

The Department registers businesses under one consolidated business tax account. For

businesses with multiple locations, the Department will register each business location, both

in state and out-of-state (if applicable) by assigning separate profile identifications under the

consolidated account to reflect business tax activity at each location. Providing information

for each location is necessary to account for variations in dominant business activity and to

ensure the proper distribution of funds to cities and counties. For example, a business set

up as an LLC may have multiple subsidiaries that each have different dominant business

activities. Taxpayers may review this account information by logging into their Tennessee

32

Taxpayer Access Point (“TNTAP”) account.

Taxpayers may have both in state and out-of-state locations with taxable receipts. Please see

Chapter 7 for more information on sourcing sales receipts.

1. In-State Businesses

Businesses with a Tennessee location may register for business tax directly with the

Department or through the county clerk in the county where the business is located.

Businesses located in a city that has enacted the municipal-level business tax may register

33

directly with the Department or through the appropriate city official.

When a taxpayer registers directly with the Department, the taxpayer does not have to

communicate with the county clerk to alert the county clerk of the registration. The county

clerk receives the data transmitted by the taxpayer when the taxpayer registers with the

Department. The same is true when a taxpayer registers through TNTAP, or with the county

clerk. Upon registration, both the county clerk and the Department receive the taxpayer’s

registration information.

Industrial loan and thrift companies located in Tennessee must register directly with the

34

Department. Industrial loan and thrift companies are not required to obtain a business

license or register with a city or county.

25 | P ag e

|

Enlarge image |

Businesses may register with the Department through TNTAP.

Multiple In-State Locations

35

Businesses with multiple locations must register and remit tax for each location. As stated

above, the taxpayer will have one consolidated account with a specific identifier for each

individual location. If the business is not located in Tennessee, it must register directly with

the Department. Taxpayers who extend operations into other counties or cities without

establishing an office, headquarters, or other place of business generally do not have to

36

register in such counties. Please see Chapter 2 for more information on activities or actions

the Department considers when determining if a business has established a location.

2. Out-of-State Businesses

Businesses that do not have a Tennessee location but are still subject to the business tax

must register directly with the Department through TNTAP.

Business License

In addition to registering, generally every in-state business subject to state-level or

municipal-level business tax must also obtain a business license before engaging in business

37

in this state. Businesses meeting specific gross sales thresholds may forego obtaining a

standard business license in favor of a minimum activity license.

38

Businesses must display each respective business license at each of their locations. The

licenses vary based upon gross sales thresholds, which are as follows:

Standard business license: More than $10,000 in gross sales;

Minimum activity license: Between $3,000 and $10,000 in gross sales; and

Businesses with less than $3,000 in gross sales do not have to obtain a business

license. Either a minimum activity license or a standard license may be obtained.

Businesses choosing to have a standard business license must file a business tax return with

the Department and remit tax for that location. The minimum tax is $22 for each location -

$44 if located in a city as both city and state tax are due.

26 | P ag e

|

Enlarge image |

The Department does not issue business licenses. These licenses are issued by the

appropriate county clerk or city official. Businesses must contact local county clerks and city

officials if there are issues in obtaining a business license.

1. Standard Business License

Taxpayers with more than $10,000 in Tennessee gross sales must apply for a standard

business license. Each standard business license is $15. Each license is valid for 1 year and

expires 30 days after the due date of the taxpayer’s return. When the taxpayer files the

return and pays the business tax due, the county clerk and/or appropriate city official will

automatically renew the license at no additional cost.

How to Obtain a Standard Business License

In-State Businesses

Businesses obtain a standard business license from the county clerk of the county in which

the business is located. Businesses located in a municipality that has enacted the municipal-

level business tax must also obtain a standard business license from the appropriate city

official.

Multiple In-State Locations

A business with multiple locations is required to get a standard business license by

registering with the county and/or city for each location. Businesses with multiple locations

that fall within the minimum activity license range must also obtain such a license for each

39

location. Each minimum activity license is subject to the $15 fee.

Out-of-State Businesses

Although out-of-state businesses must register with the Department and pay the state-level

business tax, business licenses are generally not required nor issued by the state. If a

business license is not required, the out-of-state business is not required to pay a $15 fee.

Out-of-state contractors with more than $50,000 in gross sales annually in a city or county

must obtain a business license in that city or county. Please see the section on the following

page titled Contractors.

27 | P ag e

|

Enlarge image |

2. Minimum Activity License

The General Assembly created the minimum activity license to ease the tax compliance

burden on small businesses. A business is required to apply for a minimal activity license

from the appropriate county and/or municipality for each location at which its gross sales

40

are more than $3,000 but less than $10,000. Each time a business applies for a minimal

activity license, it must pay a required $15 fee to each county and, if applicable, city.

Businesses with gross sales of $3,000 or less may obtain a minimal activity

license but are not required to do so.

3. Transferring Licenses

Generally, businesses may not transfer their business license to a different taxpayer or to a

different location owned by the same taxpayer. However, a taxpayer may transfer its

business license to a different location within the same municipality one time per tax year

without obtaining a new business license. The taxpayer must notify the appropriate county

clerk and city official of this change at least 5 days prior to the last day of business at the

41

prior location.

4. Contractors

Special registration and licensing rules apply to contractors. For business tax purposes, a

contractor has a “deemed location” in a county and/or municipality based not only on

domicile or physical location, but also where the contractor has taxable sales of more than

42

$50,000 for work performed in the jurisdiction.

The contractor will need to correctly determine the jurisdiction of each job to correctly file as

city and county, and districts for metropolitan governments. When the charges billed exceed

$50,000 for work performed in a deemed location, during the tax period, the contractor is

required to register for business tax and pay the one-time standard business license fee of

$15 for that location to the county and municipality, if within a city’s limits. Taxable sales of

more than $50,000 received during the tax period will be reported on the return for the

deemed location.

28 | P ag e

|

Enlarge image |

Taxable sales of $50,000 or less for compensation from contracts in a county and/or

municipality other than the contractor’s place of domicile or location must be reported on

the return for the county and/or municipality of domicile or location.

Therefore, all taxable receipts for work done in any county will be subject to the state tax.

However, where those sales are sourced, and which county is apportioned the tax still

depends on whether work is done in a deemed location.

For example:

A Tennessee contractor who normally works in Wilson County is hired to repave I-24

between downtown Nashville and Clarksville and completes the work in one

calendar year. The contractor should register for business tax where the contractor

is receiving gross income prior to beginning work. In this case, the contractor should

register for business tax, obtain business licenses, and pay license fees in

Metropolitan Nashville, Davidson County, Cheatham County, the City of Pleasant

View, Robertson County, the City of Coopertown, Montgomery County, and the City

of Clarksville. The revenue should be allocated to these jurisdictions in a manner that

reflects the amount of work completed in each jurisdiction, e.g., revenue per number

of paved miles.

Closing a Business

Any person liable for any tax, penalty, or interest levied under the business tax who:

Sells the person’s business or stock of goods;

Changes the legal structure of the business (i.e., from sole proprietor to corporation,

corporation to limited liability company, etc.); or

Closes the business

43

must file a final return and payment within 15 days of selling or closing the business.

For example:

29 | P ag e

|

Enlarge image |

If a contractor finishes a job in a city with no prospect of another job in the same city

and would like to close the business tax account in that jurisdiction, the contractor

should notify the Department and file a final return.

A taxpayer who ceases business activity but does not properly terminate

will still be liable for the applicable minimal business tax.

Businesses holding a minimum activity license should contact the county clerk and city

recorder’s office to advise them the business is no longer operational.

Taxpayers closing their account should also contact the Department. Most account closures

can be handled by calling the Department at (800) 342-1003 (Nashville-area and out-of-state:

(615) 253-0600).

1. Successor Liability

The person’s successor, successors, or assignees, if any, must withhold enough of the

purchase money to cover the taxes, interest, and penalties due and unpaid until the former

owner can produce a receipt from the Commissioner of Revenue showing that the taxes

44

have been paid, or a certificate stating that no taxes, interest, or penalties are due.

If the purchaser of a business or stock of goods fails to withhold the purchase money as

indicated, the purchaser will be personally liable for the payment of the taxes, interest, and

penalties accruing and unpaid on account of the operation of the business by any former

45

owner or operator.

The amount of the purchaser’s liability for payment of such taxes, interest, and penalties

cannot exceed the amount of purchase money paid by the purchaser to the seller in good

46

faith and for full and adequate consideration in money or money’s worth.

“Purchase money” includes cash paid, purchase money notes given by the purchaser to the

seller, the cancellation of the seller’s indebtedness to the purchaser, the fair market value of

property or other consideration given by the purchaser to the seller. It does not include

indebtedness of the seller either taken or assumed by the purchaser when a tax lien has not

47

been filed.

30 | P ag e

|

Enlarge image |

The purchaser shall have no liability for taxes, penalties, and interest if the Department of

Revenue releases the former owner, owners, or assigns from the original liability for such

taxes, interest, or penalty through payment of the amount due, and settlement with the

48

Department.

For example:

Assume that a purchaser receives, in good faith and without knowledge of any false

statement therein, an affidavit from the seller at the time of the purchase. The

affidavit states under oath the amount of such taxes, interest, and penalty due and

unpaid by the seller to the Department through the date of purchase, or a statement

from the seller that there are no due and unpaid taxes, interest, and penalty. The

purchaser in good faith withholds and sets aside from the purchase money to be

paid to the seller in an amount sufficient to pay the amount of taxes, penalty, and

interest shown to be unpaid by the seller’s affidavit.

If that purchaser tenders a copy of the seller’s affidavit by registered or certified mail

to the Department’s Collection Services Division, the purchaser will be released from

any liability, in excess of that which is shown on the affidavit, for taxes, penalty, and

interest unpaid by the previous owner, owners, or assigns.

That will not be the case, however, if the Commissioner notifies the purchaser of the

correct tax liability at the correct return address provided by the purchaser within 15

days of receipt of the affidavit.

31 | P ag e

|

Enlarge image |

Chapter 4: Determining Gross Sales

Gross Sales

The business tax is based on a business’s gross taxable sales (also referred to as “gross

receipts”) per location. A business’s gross sales are comprised of all the business location’s

sales without any deduction whatsoever of any kind or character, unless specifically

49

provided by Tennessee law. Gross sales are multiplied by the appropriate classification

rate to calculate the amount of tax owed per location.

Generally, all sales of tangible personal property and services made in Tennessee will be