Enlarge image

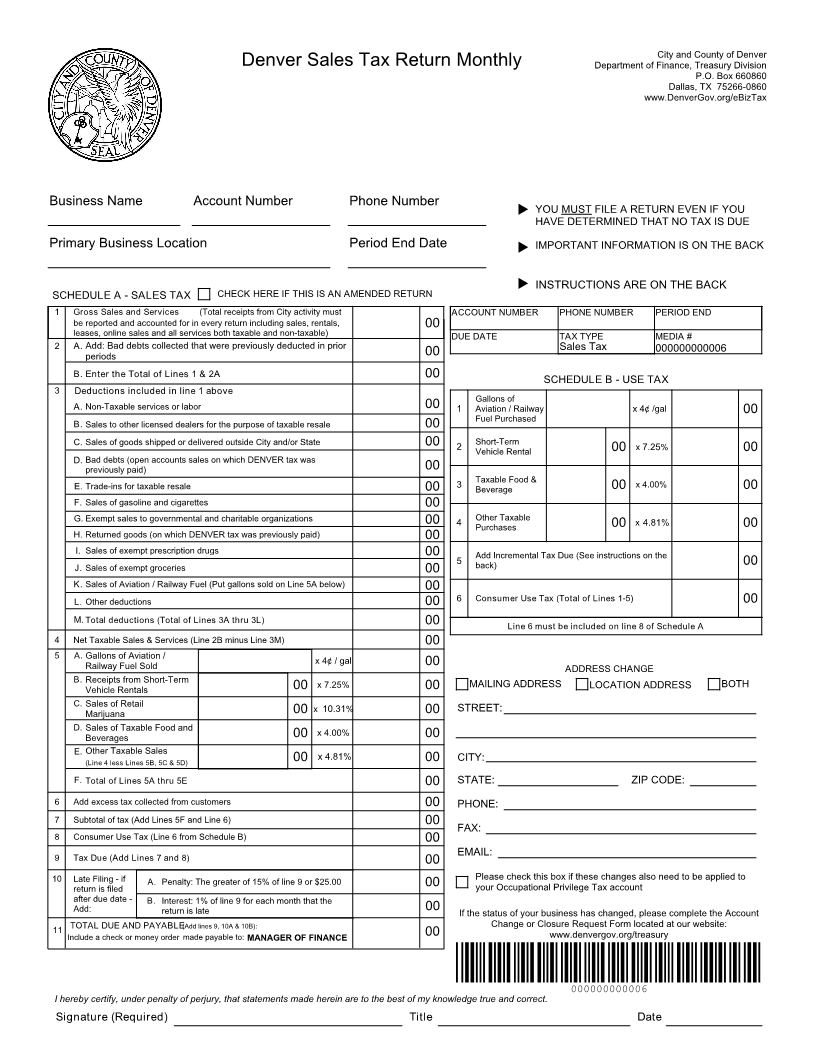

Denver Sales Tax Return Department of Finance,City and CountyTreasuryofDivisionDenver

Monthly

P.O. Box 660860

Dallas, TX 75266-0860

www.DenverGov.org/eBizTax

Business Name Account Number Phone Number

u YOU MUST FILE A RETURN EVEN IF YOU

HAVE DETERMINED THAT NO TAX IS DUE

Primary Business Location Period End Date IMPORTANT INFORMATION IS ON THE BACK

u

u INSTRUCTIONS ARE ON THE BACK

SCHEDULE A - SALES TAX CHECK HERE IF THIS IS AN AMENDED RETURN

1 Gross Sales and Services (Total receipts from City activity must ACCOUNT NUMBER PHONE NUMBER PERIOD END

be reported and accounted for in every return including sales, rentals, 00

leases, online sales and all services both taxable and non-taxable) DUE DATE TAX TYPE MEDIA #

2 A. Add: Bad debts collected that were previously deducted in prior 00 20-Dec-9999 Sales Tax 0000000000064268195847

periods

B. Enter the Total of Lines 1 & 2A 00 SCHEDULE B - USE TAX

3 Deductions included in line 1 above

Gallons of

A. Non-Taxable services or labor 00 1 Aviation / Railway x 4¢ /gal 00

B. Sales to other licensed dealers for the purpose of taxable resale 00 Fuel Purchased

C. Sales of goods shipped or delivered outside City and/or State 00 2 Short-Term 00 x 7.25% 00

Vehicle Rental

D. Bad debts (open accounts sales on which DENVER tax was 00

previously paid)

E. Trade-ins for taxable resale 00 3 Taxable Food & 00 x 4.00% 00

Beverage

F. Sales of gasoline and cigarettes 00

G. Exempt sales to governmental and charitable organizations 00 4 Other Taxable 00 x 4.81% 00

Purchases

H. Returned goods (on which DENVER tax was previously paid) 00

I. Sales of exempt prescription drugs 00 Add Incremental Tax Due (See instructions on the 00

5

J. Sales of exempt groceries 00 back)

K. Sales of Aviation / Railway Fuel (Put gallons sold on Line 5A below) 00

L. Other deductions 00 6 Consumer Use Tax (Total of Lines 1-5) 00

M. Total deductions (Total of Lines 3A thru 3L) 00 Line 6 must be included on line 8 of Schedule A

4 Net Taxable Sales & Services (Line 2B minus Line 3M) 00

5 A. Gallons of Aviation / x 4¢ / gal 00

Railway Fuel Sold ADDRESS CHANGE

B. Receipts from Short-Term 00 x 7.25% 00 MAILING ADDRESS LOCATION ADDRESS BOTH

Vehicle Rentals

C. Sales of Retail 00 x 10.31% 00 STREET:

Marijuana

D. Sales of Taxable Food and 00 x 4.00% 00

Beverages

E. Other Taxable Sales

(Line 4 less Lines 5B, 5C & 5D) 00 x 4.81% 00 CITY:

F. Total of Lines 5A thru 5E 00 STATE: ZIP CODE:

6 Add excess tax collected from customers 00 PHONE:

7 Subtotal of tax (Add Lines 5F and Line 6) 00

FAX:

8 Consumer Use Tax (Line 6 from Schedule B) 00

EMAIL:

9 Tax Due (Add Lines 7 and 8) 00

10 Late Filing - if A. Penalty: The greater of 15% of line 9 or $25.00 00 Please check this box if these changes also need to be applied to

return is filed your Occupational Privilege Tax account

after due date - B. Interest: 1% of line 9 for each month that the 00

Add: return is late If the status of your business has changed, please complete the Account

TOTAL DUE AND PAYABLE Change or Closure Request Form located at our website:

11 (Add lines 9, 10A & 10B): 00 www.denvergov.org/treasury

Include a check or money order made payable to: MANAGER OF FINANCE

0000000000064268195847

I hereby certify, under penalty of perjury, that statements made herein are to the best of my knowledge true and correct.

Signature (Required) Title Date