Enlarge image

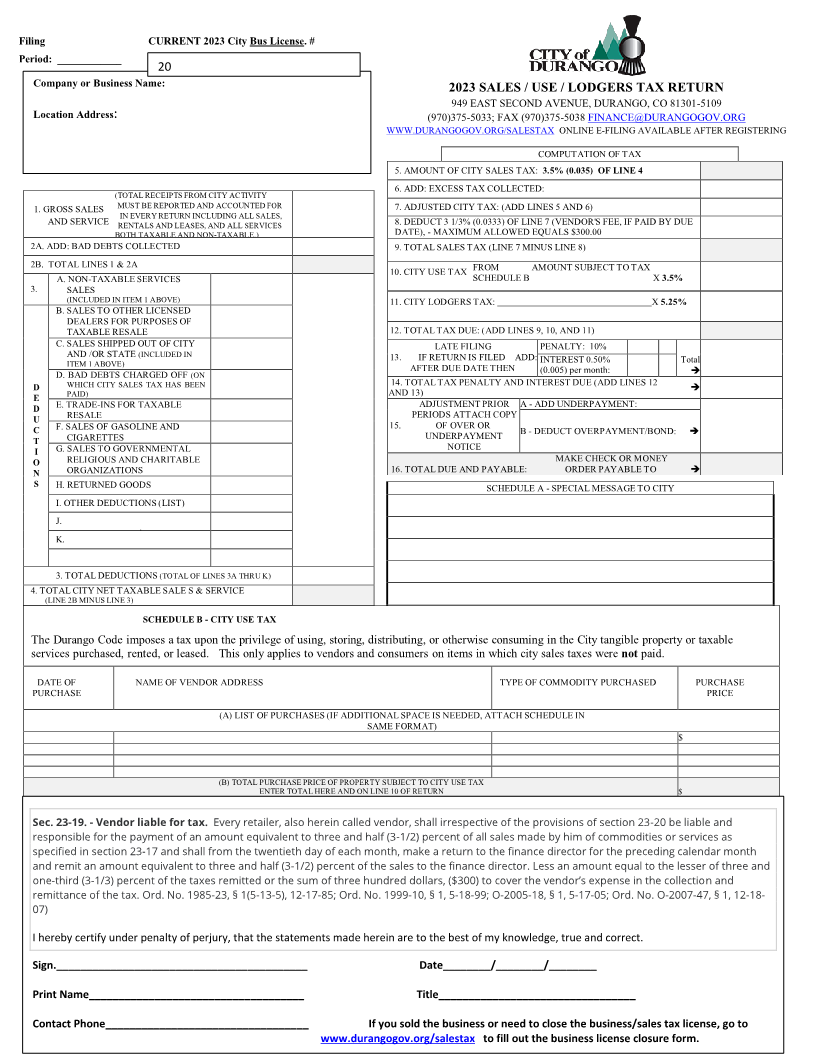

Filing CURRENT 2023 City Bus License. #

Period: ____________

20

Company or Business Name: 2023 SALES / USE / LODGERS TAX RETURN

949 EAST SECOND AVENUE, DURANGO, CO 81301-5109

Location Address: (970)375-5033; FAX (970)375-5038 FINANCE@DURANGOGOV.ORG

WWW.DURANGOGOV.ORG/SALESTAX ONLINE E-FILING AVAILABLE AFTER REGISTERING

COMPUTATION OF TAX

5. AMOUNT OF CITY SALES TAX: 3.5% (0.035) OF LINE 4

(TOTAL RECEIPTS FROM CITY ACTIVITY 6. ADD: EXCESS TAX COLLECTED:

1. GROSS SALES MUST BE REPORTED AND ACCOUNTED FOR 7. ADJUSTED CITY TAX: (ADD LINES 5 AND 6)

AND SERVICE IN EVERY RETURN INCLUDING ALL SALES, 8. DEDUCT 3 1/3% (0.0333) OF LINE 7 (VENDOR'S FEE, IF PAID BY DUE

RENTALS AND LEASES, AND ALL SERVICES

BOTH TAXABLE AND NON-TAXABLE.) DATE), - MAXIMUM ALLOWED EQUALS $300.00

2A. ADD: BAD DEBTS COLLECTED 9. TOTALMAXIMUMSALESALLOWEDTAX (LINEEQUALS7 MINUS$300.00LINE 8)

2B. TOTAL LINES 1 & 2A

A. NON-TAXABLE SERVICES 10. CITY USE TAX SCHEDULEFROM BAMOUNT SUBJECT TO TAX X3.5%

3. SALES

(INCLUDED IN ITEM 1 ABOVE) 11. CITY LODGERS TAX: X 5.25%

B. SALES TO OTHER LICENSED

DEALERS FOR PURPOSES OF

TAXABLE RESALE 12. TOTAL TAX DUE: (ADD LINES 9, 10, AND 11)

C. SALES SHIPPED OUT OF CITY

AND /OR STATE (INCLUDED IN LATE FILING PENALTY: 10%

AFTER DUE DATE THEN (0.005) per month: ➔

ITEM 1 ABOVE) 13. IF RETURN IS FILED ADD: INTEREST 0.50% Total

D. BAD DEBTS CHARGED OFF (ON 14. TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 12 ➔

D WHICH CITY SALES TAX HAS BEEN AND 13)

E PAID)

D E. TRADE-INS FOR TAXABLE ADJUSTMENT PRIOR A - ADD UNDERPAYMENT:

U RESALE

C F. SALES OF GASOLINE AND PERIODS ATTACH COPY ➔

UNDERPAYMENT

CIGARETTES 15. OF OVER OR B - DEDUCT OVERPAYMENT/BOND:

T

I G. SALES TO GOVERNMENTAL NOTICE

O RELIGIOUS AND CHARITABLE MAKE CHECK OR MONEY

N

ORGANIZATIONS 16. TOTAL DUE AND PAYABLE: ORDER PAYABLE TO ➔

SCHEDULE A - SPECIAL MESSAGE TO CITY

S H. RETURNED GOODS CITY OF DURANGO

I. OTHER DEDUCTIONS (LIST)

J.

.

K.

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3A THRU K)

4. TOTAL CITY NET TAXABLE SALE S & SERVICE

(LINE 2B MINUS LINE 3)

SCHEDULE B - CITY USE TAX

The Durango Code imposes a tax upon the privilege of using, storing, distributing, or otherwise consuming in the City tangible property or taxable

services purchased, rented, or leased. This only applies to vendors and consumers on items in which city sales taxes were not paid.

DATE OF NAME OF VENDOR ADDRESS TYPE OF COMMODITY PURCHASED PURCHASE

PURCHASE PRICE

(A) LIST OF PURCHASES (IF ADDITIONAL SPACE IS NEEDED, ATTACH SCHEDULE IN

SAME FORMAT)

$

(B) TOTAL PURCHASE PRICE OFPROPERTYSUBJECT TO CITY USETAX

ENTER TOTAL HERE AND ON LINE 10 OFRETURN $

Sec. 23-19. - Vendor liable for tax. Every retailer, also herein called vendor, shall irrespective of the provisions of section 23-20 be liable and

responsible for the payment of an amount equivalent to three and half (3-1/2) percent of all sales made by him of commodities or services as

specified in section 23-17 and shall from the twentieth day of each month, make a return to the finance director for the preceding calendar month

and remit an amount equivalent to three and half (3-1/2) percent of the sales to the finance director. Less an amount equal to the lesser of three and

one-third (3-1/3) percent of the taxes remitted or the sum of three hundred dollars, ($300) to cover the vendor’s expense in the collection and

remittance of the tax. Ord. No. 1985-23, § 1(5-13-5), 12-17-85; Ord. No. 1999-10, § 1, 5-18-99; O-2005-18, § 1, 5-17-05; Ord. No. O-2007-47, § 1, 12-18-

07)

I hereby certify under penalty of perjury, that the statements made herein are to the best of my knowledge, true and correct.

Sign.__________________________________________ Date________/________/________

Print Name____________________________________ Title_________________________________

Contact Phone__________________________________ If you sold the business or need to close the business/sales tax license, go to

www.durangogov.org/salestax to fill out the business license closure form.