Enlarge image

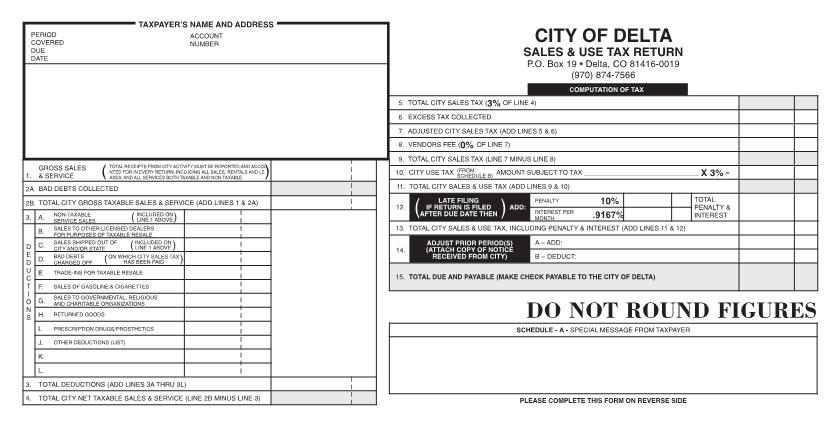

TAXPAYER’S NAME AND ADDRESS

PERIOD ACCOUNT

COVERED NUMBER CITY OF DELTA

DUE SALES & USE TAX RETURN

DATE

P.O. Box 19 • Delta, CO 81416-0019

(970) 874-7566

COMPUTATION OF TAX

5. TOTAL CITY SALES TAX (3% OF LINE 4)

6. EXCESS TAX COLLECTED

7. ADJUSTED CITY SALES TAX (ADD LINES 5 & 6)

8. VENDORS FEE (0% OF LINE 7)

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED AND ACCOU 9. TOTAL CITY SALES TAX (LINE 7 MINUS LINE 8)

& SERVICE

1. GROSS SALES (ASES,NTED FORANDINALLEVERYSERVICESRETURN,BOTHINCLUDINGTAXABLEALLANDSALES,NON-TAXABLE.RENTALS AND)LE10. CITY USE TAX SCHEDULE(FROM B)AMOUNT SUBJECT TO TAX _______________________________ X 3% =

2A. BAD DEBTS COLLECTED 11. TOTAL CITY SALES & USE TAX (ADD LINES 9 & 10)

LATE FILING ADD: PENALTY TOTAL

IF RETURN IS FILED PENALTY &

2B. TOTAL CITY GROSS TAXABLE(SALESINCLUDEDLINE 1 ABOVE&ONSERVICE) (ADD LINES 1 & 2A) 12. (AFTER DUE DATE THEN ) MONTHINTEREST PER 10% INTEREST

3. A. SERVICE SALESNON-TAXABLE .9167%

B. FOR PURPOSES OF TAXABLE RESALESALES TO OTHER LICENSED DEALERS 13. TOTAL CITY SALES & USE TAX, INCLUDING PENALTY & INTEREST (ADD LINES 11 & 12)

D SALES SHIPPED OUT OF ADJUST PRIOR PERIOD(S) A – ADD:

E C. CITY AND/OR STATE (INCLUDED ONLINE 1 ABOVE ) 14. (ATTACH COPY OF NOTICE B – DEDUCT:

D D. CHARGEDBAD DEBTSOFF (ON WHICHHAS BEENCITY SALESPAID TAX) RECEIVED FROM CITY)

U E. TRADE-INS FOR TAXABLE RESALE 15. TOTAL DUE AND PAYABLE (MAKE CHECK PAYABLE TO THE CITY OF DELTA)

C

T F. SALES OF GASOLINE & CIGARETTES

I

O G. ANDSALESCHARITABLETO GOVERNMENTAL,ORGANIZATIONSRELIGIOUS

N H. RETURNED GOODS

S DO NOT ROUND FIGURES

I. PRESCRIPTION DRUGS/PROSTHETICS SCHEDULE - A - SPECIAL MESSAGE FROM TAXPAYER

J. OTHER DEDUCTIONS (LIST)

K.

L.

3. TOTAL DEDUCTIONS (ADD LINES 3A THRU 3L)

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS LINE 3) PLEASE COMPLETE THIS FORM ON REVERSE SIDE