Enlarge image

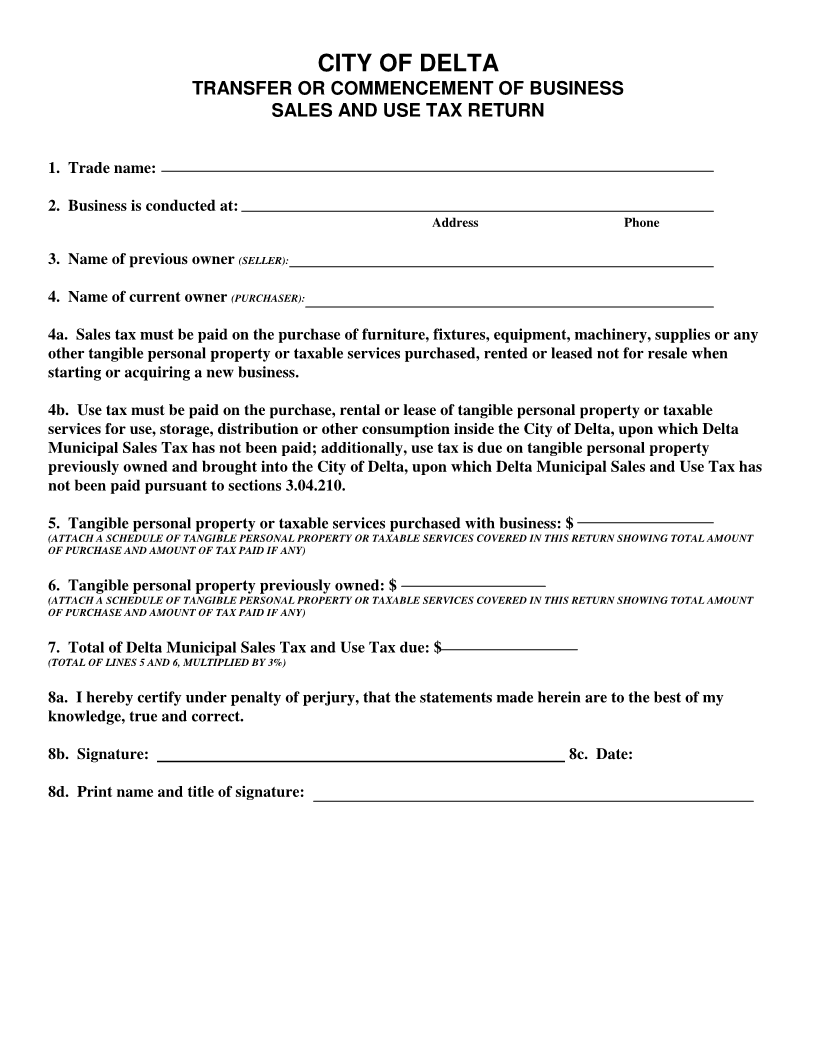

CITY OF DELTA

TRANSFER OR COMMENCEMENT OF BUSINESS

SALES AND USE TAX RETURN

1. Trade name:

2. Business is conducted at:

Address Phone

3. Name of previous owner (SELLER):

4. Name of current owner (PURCHASER):

4a. Sales tax must be paid on the purchase of furniture, fixtures, equipment, machinery, supplies or any

other tangible personal property or taxable services purchased, rented or leased not for resale when

starting or acquiring a new business.

4b. Use tax must be paid on the purchase, rental or lease of tangible personal property or taxable

services for use, storage, distribution or other consumption inside the City of Delta, upon which Delta

Municipal Sales Tax has not been paid; additionally, use tax is due on tangible personal property

previously owned and brought into the City of Delta, upon which Delta Municipal Sales and Use Tax has

not been paid pursuant to sections 3.04.210.

5. Tangible personal property or taxable services purchased with business: $

(ATTACH A SCHEDULE OF TANGIBLE PERSONAL PROPERTY OR TAXABLE SERVICES COVERED IN THIS RETURN SHOWING TOTAL AMOUNT

OF PURCHASE AND AMOUNT OF TAX PAID IF ANY)

6. Tangible personal property previously owned: $

(ATTACH A SCHEDULE OF TANGIBLE PERSONAL PROPERTY OR TAXABLE SERVICES COVERED IN THIS RETURN SHOWING TOTAL AMOUNT

OF PURCHASE AND AMOUNT OF TAX PAID IF ANY)

7. Total of Delta Municipal Sales Tax and Use Tax due: $

(TOTAL OF LINES 5 AND 6, MULTIPLIED BY 3%)

8a. I hereby certify under penalty of perjury, that the statements made herein are to the best of my

knowledge, true and correct.

8b. Signature: 8c. Date:

8d. Print name and title of signature: