Enlarge image

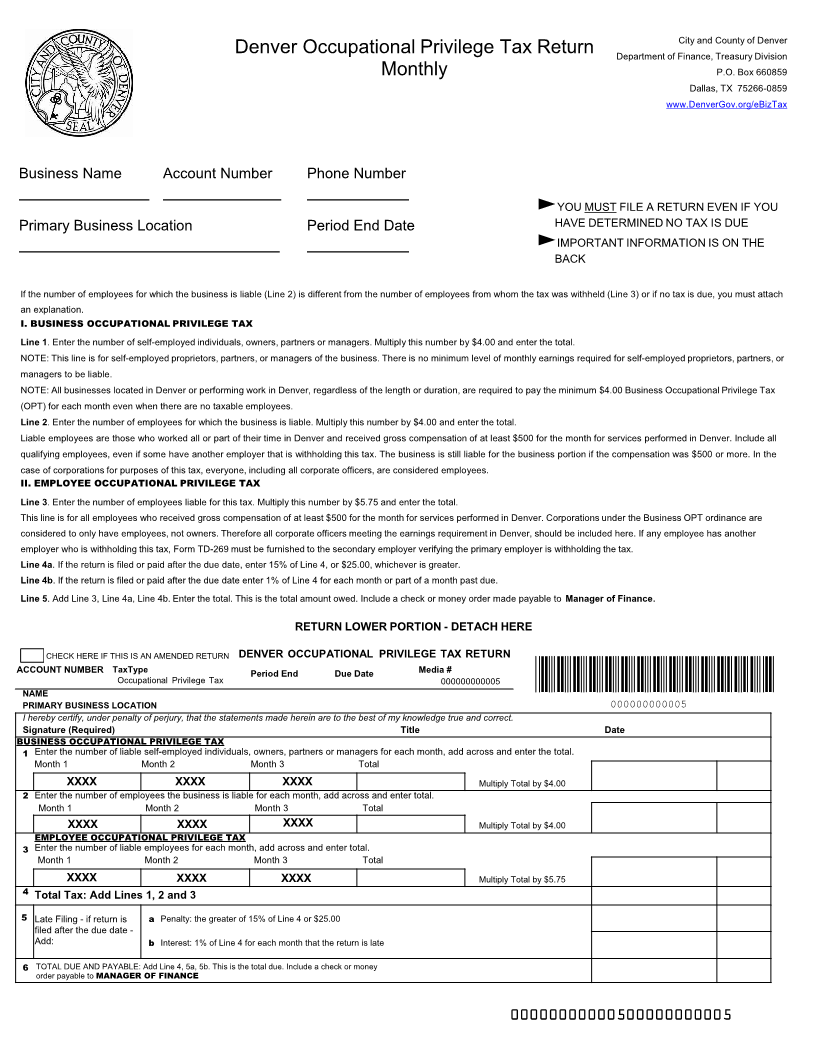

City and County of Denver

Denver Occupational Privilege Tax Return Department of Finance, Treasury Division

Monthly P.O. Box 660859

Dallas, TX 75266-0859

www.DenverGov.org/eBizTax

Business Name Account Number Phone Number

YOU MUST FILE A RETURN EVEN IF YOU

Primary Business Location Period End Date HAVE DETERMINED NO TAX IS DUE

IMPORTANT INFORMATION IS ON THE

BACK

If the number of employees for which the business is liable (Line 2) is different from the number of employees from whom the tax was withheld (Line 3) or if no tax is due, you must attach

an explanation.

I. BUSINESS OCCUPATIONAL PRIVILEGE TAX

Line 1. Enter the number of self-employed individuals, owners, partners or managers. Multiply this number by $4.00 and enter the total.

NOTE: This line is for self-employed proprietors, partners, or managers of the business. There is no minimum level of monthly earnings required for self-employed proprietors, partners, or

managers to be liable.

NOTE: All businesses located in Denver or performing work in Denver, regardless of the length or duration, are required to pay the minimum $4.00 Business Occupational Privilege Tax

(OPT) for each month even when there are no taxable employees.

Line 2. Enter the number of employees for which the business is liable. Multiply this number by $4.00 and enter the total.

Liable employees are those who worked all or part of their time in Denver and received gross compensation of at least $500 for the month for services performed in Denver. Include all

qualifying employees, even if some have another employer that is withholding this tax. The business is still liable for the business portion if the compensation was $500 or more. In the

case of corporations for purposes of this tax, everyone, including all corporate officers, are considered employees.

II. EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

Line 3. Enter the number of employees liable for this tax. Multiply this number by $5.75 and enter the total.

This line is for all employees who received gross compensation of at least $500 for the month for services performed in Denver. Corporations under the Business OPT ordinance are

considered to only have employees, not owners. Therefore all corporate officers meeting the earnings requirement in Denver, should be included here. If any employee has another

employer who is withholding this tax, Form TD-269 must be furnished to the secondary employer verifying the primary employer is withholding the tax.

Line 4a. If the return is filed or paid after the due date, enter 15% of Line 4, or $25.00, whichever is greater.

Line 4b. If the return is filed or paid after the due date enter 1% of Line 4 for each month or part of a month past due.

Line5. Add Line 3, Line 4a, Line b.4Enter the total. This is the total amount owed. Include a check or money order made payable to Manager of Finance.

RETURN LOWER PORTION - DETACH HERE

CHECK HERE IF THIS IS AN AMENDED RETURN DENVER OCCUPATIONAL PRIVILEGE TAX RETURN

ACCOUNT NUMBER TaxType Period End Due Date Media #

Occupational Privilege Tax 000000000005

NAME

PRIMARY BUSINESS LOCATION 000000000005

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

Signature (Required) Title Date

BUSINESS OCCUPATIONAL PRIVILEGE TAX

1 Enter the number of liable self-employed individuals, owners, partners or managers for each month, add across and enter the total.

Month 1 Month 2 Month 3 Total

XXXX XXXX XXXX Multiply Total by $4.00

2 Enter the number of employees the business is liable for each month, add across and enter total.

Month 1 Month 2 Month 3 Total

XXXX XXXX XXXX Multiply Total by $4.00

EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

3 Enter the number of liable employees for each month, add across and enter total.

Month 1 Month 2 Month 3 Total

XXXX XXXX Multiply Total by $5.75

4 XXXX

Total Tax: Add Lines 1, 2 and 3

5 Late Filing - if return is a Penalty: the greater of 15% of Line 4 or $25.00

filed after the due date -

Add: b Interest: 1% of Line 4 for each month that the return is late

6 TOTAL DUE ANDMANAGERPAYABLE:OFAddFINANCELine 4, 5a, 5b. This is the total due. Include a check or money

order payable to

00000000000500000000005