Enlarge image

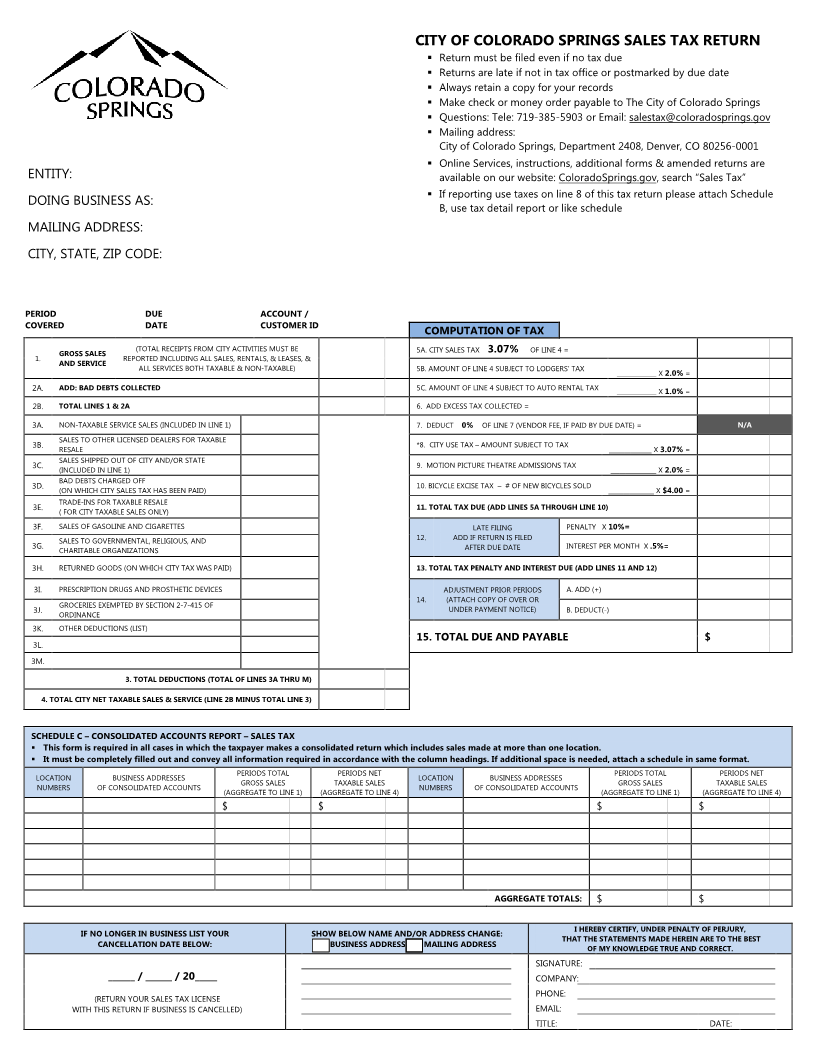

CITY OF COLORADO SPRINGS SALES TAX RETURN

Return must be filed even if no tax due

Returns are late if not in tax office or postmarked by due date

Always retain a copy for your records

Make check or money order payable to The City of Colorado Springs

Questions: Tele: 719-385-5903 or Email: salestax@coloradosprings.gov

Mailing address:

City of Colorado Springs, Department 2408, Denver, CO 80256-0001

Online Services, instructions, additional forms & amended returns are

ENTITY: available on our website: ColoradoSprings.gov, search “Sales Tax”

If reporting use taxes on line 8 of this tax return please attach Schedule

DOING BUSINESS AS: B, use tax detail report or like schedule

MAILING ADDRESS:

CITY, STATE, ZIP CODE:

PERIOD DUE ACCOUNT /

COVERED DATE CUSTOMER ID COMPUTATION OF TAX

1. GROSS SALES (TOTAL RECEIPTS FROM CITY ACTIVITIES MUST BE 5A. CITY SALES TAX 3.07% OF LINE 4 =

AND SERVICE REPORTED INCLUDING ALL SALES, RENTALS, & LEASES, &

ALL SERVICES BOTH TAXABLE & NON-TAXABLE) 5B. AMOUNT OF LINE 4 SUBJECT TO LODGERS’ TAX _____________ X 2.0% =

2A. ADD: BAD DEBTS COLLECTED 5C. AMOUNT OF LINE 4 SUBJECT TO AUTO RENTAL TAX _____________ X 1.0% =

2B. TOTAL LINES 1 & 2A 6. ADD EXCESS TAX COLLECTED =

3A. NON-TAXABLE SERVICE SALES (INCLUDED IN LINE 1) 7. DEDUCT 0% OF LINE 7 (VENDOR FEE, IF PAID BY DUE DATE) = N/A

3B. SALES TO OTHER LICENSED DEALERS FOR TAXABLE *8. CITY USE TAX – AMOUNT SUBJECT TO TAX ______________ X 3.07% =

RESALE

3C. SALES SHIPPED OUT OF CITY AND/OR STATE 9. MOTION PICTURE THEATRE ADMISSIONS TAX _______________ X 2.0% =

(INCLUDED IN LINE 1)

3D. BAD DEBTS CHARGED OFF 10. BICYCLE EXCISE TAX – # OF NEW BICYCLES SOLD _______________ X $4.00 =

(ON WHICH CITY SALES TAX HAS BEEN PAID)

3E. TRADE-INS FOR TAXABLE RESALE 11. TOTAL TAX DUE (ADD LINES 5A THROUGH LINE 10)

( FOR CITY TAXABLE SALES ONLY)

3F. SALES OF GASOLINE AND CIGARETTES LATE FILING PENALTY X 10%=

SALES TO GOVERNMENTAL, RELIGIOUS, AND 12. ADD IF RETURN IS FILED INTEREST PER MONTH X .5 % =

3G. CHARITABLE ORGANIZATIONS AFTER DUE DATE

3H. RETURNED GOODS (ON WHICH CITY TAX WAS PAID) 13. TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12)

3I. PRESCRIPTION DRUGS AND PROSTHETIC DEVICES ADJUSTMENT PRIOR PERIODS A. ADD (+)

GROCERIES EXEMPTED BY SECTION 2-7-415 OF 14. (ATTACH COPY OF OVER OR B. DEDUCT(-)

3J. ORDINANCE UNDER PAYMENT NOTICE)

3K. OTHER DEDUCTIONS (LIST)

3L. 15. TOTAL DUE AND PAYABLE $

3M.

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3A THRU M)

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS TOTAL LINE 3)

SCHEDULE C – CONSOLIDATED ACCOUNTS REPORT – SALES TAX

This form is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location.

It must be completely filled out and convey all information required in accordance with the column headings. If additional space is needed, attach a schedule in same format.

LOCATION BUSINESS ADDRESSES PERIODS TOTAL PERIODS NET LOCATION BUSINESS ADDRESSES PERIODS TOTAL PERIODS NET

NUMBERS OF CONSOLIDATED ACCOUNTS GROSS SALES TAXABLE SALES NUMBERS OF CONSOLIDATED ACCOUNTS GROSS SALES TAXABLE SALES

(AGGREGATE TO LINE 1) (AGGREGATE TO LINE 4) (AGGREGATE TO LINE 1) (AGGREGATE TO LINE 4)

$ $ $ $

AGGREGATE TOTALS: $ $

IF NO LONGER IN BUSINESS LIST YOUR SHOW BELOW NAME AND/OR ADDRESS CHANGE: I HEREBY CERTIFY, UNDER PENALTY OF PERJURY,

CANCELLATION DATE BELOW: BUSINESS ADDRESS / MAILING ADDRESS THAT THE STATEMENTS MADE HEREIN ARE TO THE BEST

OF MY KNOWLEDGE TRUE AND CORRECT.

SIGNATURE:

______ / ______ / 20_____ COMPANY:

(RETURN YOUR SALES TAX LICENSE PHONE:

WITH THIS RETURN IF BUSINESS IS CANCELLED) EMAIL:

TITLE: DATE: