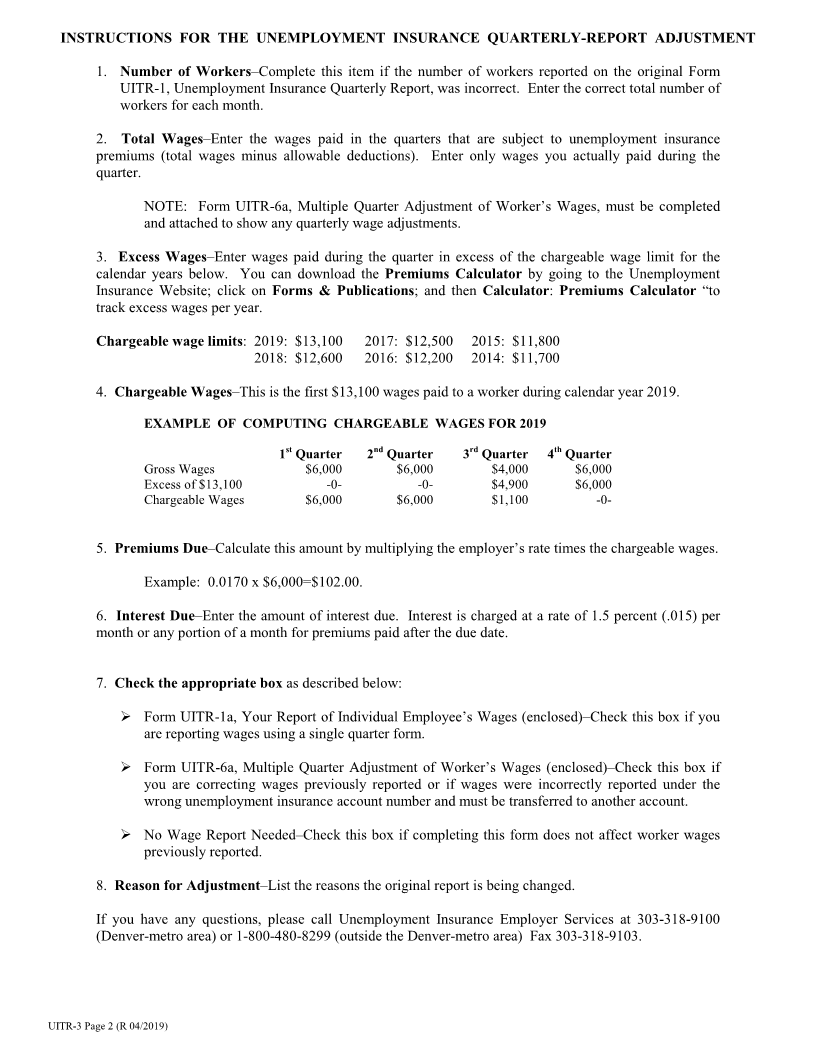

Enlarge image

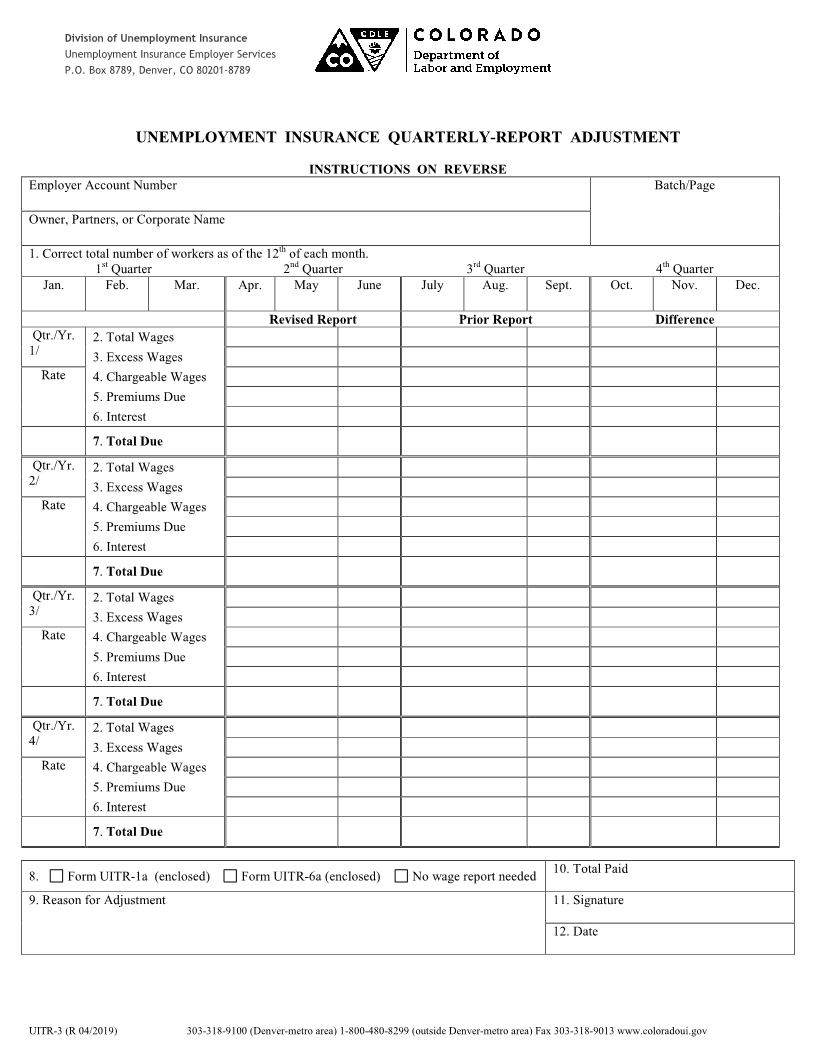

Division of Unemployment Insurance

Unemployment Insurance Employer Services

P.O. Box 8789, Denver, CO 80201-8789

UNEMPLOYMENT INSURANCE QUARTERLY-REPORT ADJUSTMENT

INSTRUCTIONS ON REVERSE

Employer Account Number Batch/Page

Owner, Partners, or Corporate Name

th

1. Correct total number of workers as of the 12 of each month.

st nd rd th

1 Quarter 2 Quarter 3 Quarter 4 Quarter

Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec.

Revised Report Prior Report Difference

Qtr./Yr. 2. Total Wages

1/ 3. Excess Wages

Rate 4. Chargeable Wages

5. Premiums Due

6. Interest

7.Total Due

Qtr./Yr. 2. Total Wages

2/ 3. Excess Wages

Rate 4. Chargeable Wages

5. Premiums Due

6. Interest

7.Total Due

Qtr./Yr. 2. Total Wages

3/ 3. Excess Wages

Rate 4. Chargeable Wages

5. Premiums Due

6. Interest

7 .Total Due

Qtr./Yr. 2. Total Wages

4/ 3. Excess Wages

Rate 4. Chargeable Wages

5. Premiums Due

6. Interest

7 .Total Due

10. Total Paid

8. Form UITR-1a (enclosed) Form UITR-6a (enclosed) No wage report needed

9. Reason for Adjustment 11. Signature

12. Date

UITR-3 (R 04/2019) 303-318-9100 (Denver-metro area) 1-800-480-8299 (outside Denver-metro area) Fax 303-318-9013 www.coloradoui.gov