Enlarge image

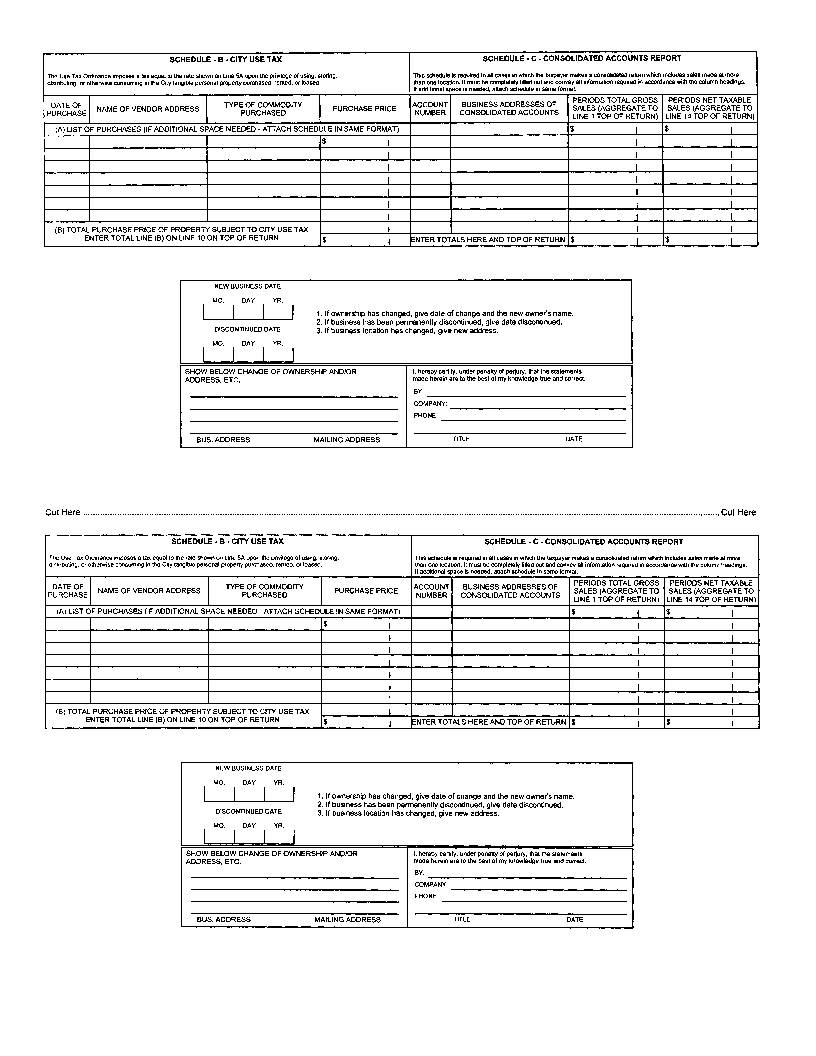

IF USE TAX RETURN· COMPLETE SCHEDULE B (REVERSE). BEGIN ON LINE 10 CITY OF PUEBLO

IF THIS RETURN INCLUDES SALES FOR MORE THAN ONE LOCATION. COMPLETE

SCHEDULE "C" (REVERSE) P.O. BOX 1427 COMPUTATION OF

GROSS SALES (TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED ANO PUEBLO, CO 81002 719 553-2659 TAX

1 · AND SERVICE ~~ieusNl~g :~r ~~R~~:~ =~i~r~iieA~~~L~~:T~~~~~~· SA. AMOUNT OF CITY SALES TAX: LINE 4 X3.70%

2A. ADD: BAD DEBTS COLLECTED B. AMOUNT OF LINE 4 SUBJECT TO LODGERS TAX: X4.30%

2B. TOTAL LINES 1 & 2A C. ADMISSIONS: X3.00%

3. A. ~~~V;~~iis(INCLUDED IN ITEM 1 ABOVE) D. MEDICAL MARIJUANA: X4.30%

6. ADD: EXCESS TAX COLLECTED

7. ADJUSTED CITY TAX: ADD (LINES SA, B. C, 0, & 6)

(ON WHICH CITY SALES 8. (LEFT BLANK INTENTIONALLY)

TAX HAS BEEN PAID)

9. TOTAL TAX (ITEM 7MINUS 8)

D E. TRADE•INS FOR TAXABLE RESALE

E 10. CITY USE TAX· AMOUNT SUBJECT TO TAX: X 3.70%

D f. SALES OF GASOLINE ANO CIGARETTE 11. TOTAL TAX DUE (ADD LINES 9 AND 10)

u

C

T I AT[t IL NG

I H. RETURNED GOODS All~E~~~~ND~T~ll~~~N ADD INTEREST 1% PER MONTH:

0

N t--------------+------~--; 13. TOTAL TAX, PENAL TY, ANO INTEREST DUE (ADO LINES 11 AND 12)

s PRESCRIPTIONS/PROSTHETICS

J. GROCERIES ADJ US I l\1EN f PKIOR Pl RODS A-ADD:

ATTACH COPY OF OVl R OR

I UND[f-ff'AY/..1[NT NOTICF - B,DEDUCT:

K. LODGING OVER 30 DAYS MAKE CHECK OR MONEY CITY OF

15. TOTAL DUE AND PAYABLE:

L. OTHER ORDER PAYABLE TO: PUEBLO

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3 Note: Per ordinance a return is mandated to be filed

ATHROUGHL) regardless if tax is due. Must be recejyed in our office

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS

TOTAL LINE 3) by due date.

MO/YR DAY MO YR USE FOR ALL REF!'RENCE

PERIOD DUE ACCOUNT

COVERED DATE NUMBER

KEEP THIS COPY

Cut Here ...................................................................................................................................................................................................................................................................... Cut Here

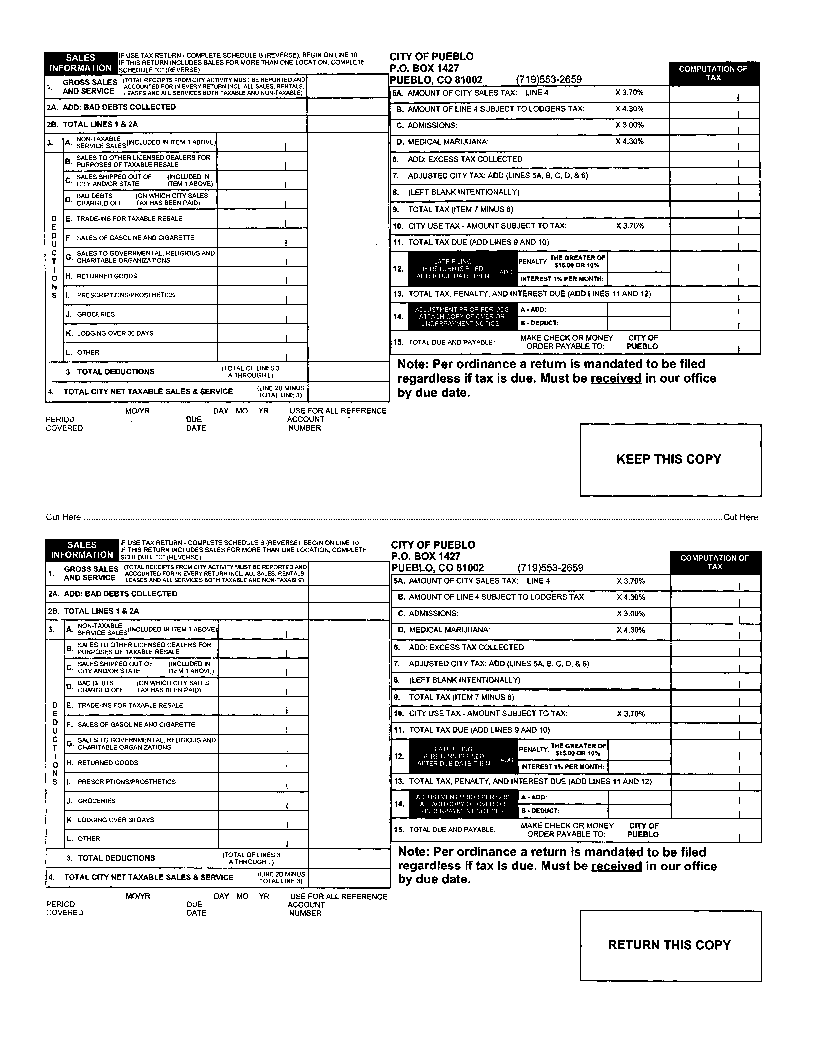

IF USE TAX RETURN· COMPLETE SCHEDULE B (REVERSE). BEGIN ON LINE 10 CITY OF PUEBLO

IF THIS RETURN INCLUDES SALES FOR MORE THAN ONE LOCATION, COMPLETE

.. .. SCHEDULE •c•(REVERSE) P.O. BOX 1427 COMPUTATION OF

PUEBLO, CO 81002 (719)553-2659 TAX

SA. AMOUNT OF CITY SALES TAX: LINE 4 X3.70%

2A. ADD: BAD DEBTS COLLECTED B. AMOUNT OF LINE 4 SUBJECT TO LODGERS TAX: X4.30%

2B. TOTAL LINES 1 & 2A C. ADMISSIONS: X3.00%

3. A. ~~~v:t~Jiis(INCLUDED IN ITEM 1 ABOVE) D. MEDICAL MARIJUANA: X4.30%

6. ADO: EXCESS TAX COLLECTED

7. ADJUSTED CITY TAX: ADO (LINES SA, B, C, 0, & 6)

(ON WHICH CITY SALES 8. (LEFT BLANK INTENTIONALLY)

TAX HAS BEEN PAID)

9. TOTAL TAX (ITEM 7 MINUS 8)

0 E. TRADE-INS FOR TAXABLE RESALE

E 10. CITY USE TAX· AMOUNT SUBJECT TO TAX: X3.70%

D F. SALES OF GASOLINE AND CIGARETTE 11. TOTAL TAX DUE (ADD LINES 9AND 10)

u

~ G. ~~~~~T:~~Eo6~~~~l~it~:ELIGIOUS AND LAIE f-lLING

0 I H. RETURNED GOODS A~~t:~~~~ND~/E\~~N ADD INTEREST 1 % PER MONTH:

N

S PRESCRIPTIONS/PROSTHETICS 13. TOTAL TAX, PENALTY, AND INTEREST DUE (ADO LINES 11 AND 12)

J. GROCERIES AO~USTMLNT PR OR PlR ODS A•ADD:

AT JACH COPY Of OVLR. OR

I UNLJ[RPAYMFN I NOT C[ B•DEDUCT:

K. LODGING OVER 30 DAYS MAKE CHECK OR MONEY CITY OF

15. TOTAL DUE AND PAYABLE:

L. OTHER ORDER PAYABLE TO: PUEBLO

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3 Note: Per ordinance a return is mandated to be filed

ATHROUGHL)

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS regardless if tax is due. Must be recejyed in our office

TOTAL LINE 3) by due date.

MO/YR DAY MO YR USE FOR ALL REFERENCE

PERIOD DUE ACCOUNT

COVERED DATE NUMBER

RETURN THIS COPY