Enlarge image

SALES TAX DIVISION

PO BOX 0845 - LOVELAND, CO 80539-0845 SALES TAX RETURN

(970) 962-2708 FAX (970) 962-2927 CITY OF LOVELAND

EMAIL: salestaxtax@cityofloveland.org

www.cityofloveland.org/salestax

TAXPAYER NAME & ADDRESS PERIOD DUE DATE CITY LICENSE #

ONLINE FILING IS AVAILABLE AT A ZERO RETURN MUST BE FILED IF NO TAX IS DUE

www.cityofloveland.org/departments/finance/sales-tax/citizen-access

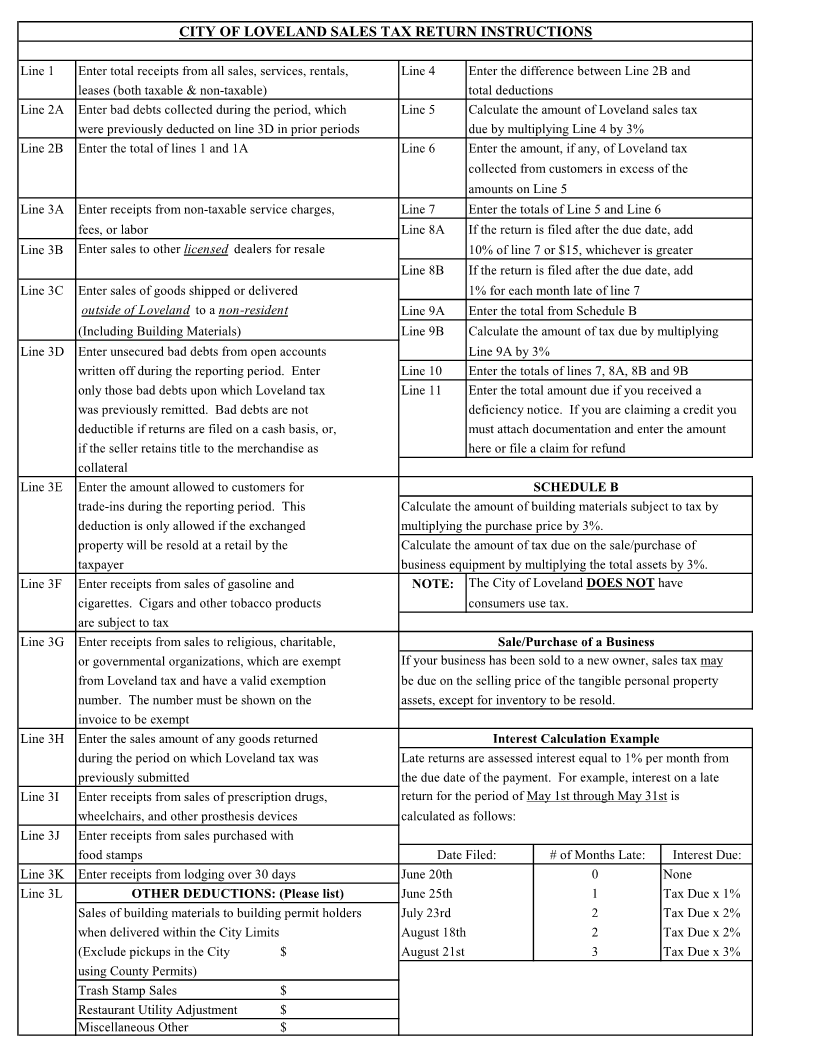

1. GROSS SALES AND SERVICE: 5. Amount of City Sales Tax:

(TOTAL RECEIPTS, BEFORE SALES TAX, 3.0% of Line 4

FROM CITY ACTIVITY MUST BE REPORTED 6. ADD: Excess Tax Collected:

INCLUDING ALL SALES, RENTALS, LEASES, & 7. Total City Sales Tax:

SERVICES, BOTH TAXABLE & NON-TAXABLE) (Add lines 5 and 6)

2A. ADD: BAD DEBTS COLLECTED 8A: Penalty: 10%

of line 7 or $15,

2B: TOTAL OF LINES 1 & 2A Late Filing: If whichever is

3. A. Non-Taxable Service or Labor: Return is Filed greater

B. Sales To Other Licensed Dealers After Due Date

for Purposes of Taxable Resale 8B: Then Add: Interest: 1%

per Month of

D C. Sales Shipped Out of City: line 7

E D. Bad Debts Charged Off: 9A. Amount Subject to Tax

D (on which tax was previously paid) from Schedule B:

U E. Trade-in For Taxable Resale: 9B. 3.0% of line 9A

C F. Sales of Gasoline and Cigarettes: 10. Total Tax Due & Payable:

T G. Sales to Governmental, Religious, (add lines 7, 8A, 8B, 9B)

I and Charitable Organizations: 11. Adjustments Prior Periods:

O H. Returned Goods: (attach copy of notice)

N (on which tax was previously paid) TOTAL DUE & PAYABLE:

S I. Prescription Drugs & Prosthetic Payable to:

Devices: City of Loveland

J. Food Stamps:

K. Lodging Over 30 Days: SCHEDULE B

L. Other (Please Explain): Purchase Price

TOTAL DEDUCTIONS (Total of Lines 3A - 3L) Building Materials Subject to Use Tax: $

4. TOTAL NET TAXABLE SALES & SVCS: Sale/Purchase of Business Equipment: $

(line 2B minus total deductions)

Total Price Subject to Tax $

SHOW BELOW ANY CHANGE OF BUSINESS NAME, OWNERSHIP, OR ADDRESS (Enter Total on Line 9A)

I, hereby certify, under penalty of perjury, that the statements made herein

are to the best of my knowledge true and correct.

Name:

Signature:

BUS. ADDRESS MAILING ADDRESS Phone:

DATE OF BUSINESS CLOSURE OR SALE: E-Mail:

Date:

Revised November 2019 Page 1