Enlarge image

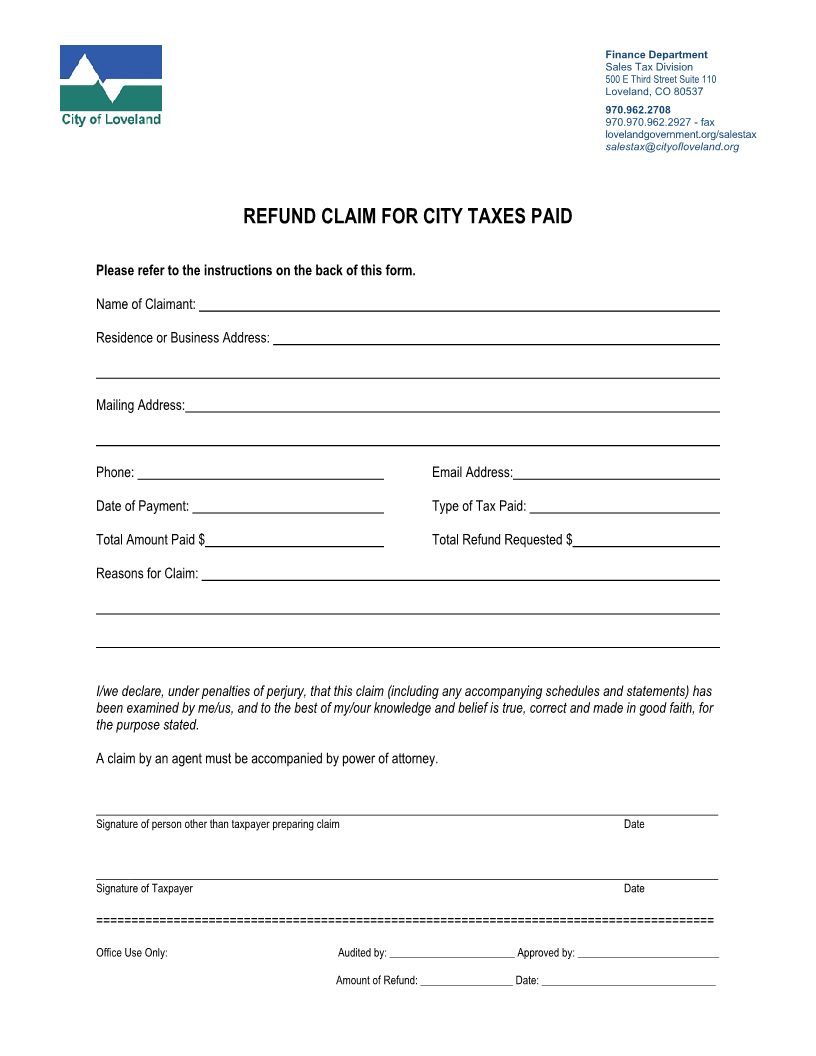

Finance Department

Sales Tax Division

500 E Third Street Suite 110

Loveland, CO 80537

970.962.2708

970.970.962.2927 - fax

lovelandgovernment.org/salestax

salestax@cityofloveland.org

REFUND CLAIM FOR CITY TAXES PAID

Please refer to the instructions on the back of this form.

Name of Claimant:

Residence or Business Address:

Mailing Address:

Phone: Email Address:

Date of Payment: Type of Tax Paid:

Total Amount Paid $ Total Refund Requested $

Reasons for Claim:

I/we declare, under penalties of perjury, that this claim (including any accompanying schedules and statements) has

been examined by me/us, and to the best of my/our knowledge and belief is true, correct and made in good faith, for

the purpose stated.

A claim by an agent must be accompanied by power of attorney.

_____________________________________________________________________________________________

Signature of person other than taxpayer preparing claim Date

_____________________________________________________________________________________________

Signature of Taxpayer Date

========================================================================================

Office Use Only: Audited by: _______________________ Approved by: __________________________

Amount of Refund: _________________ Date: ________________________________