Enlarge image

Finance

th

250 North 5 Street

Grand Junction, Colorado 81501

(970) 244-1521

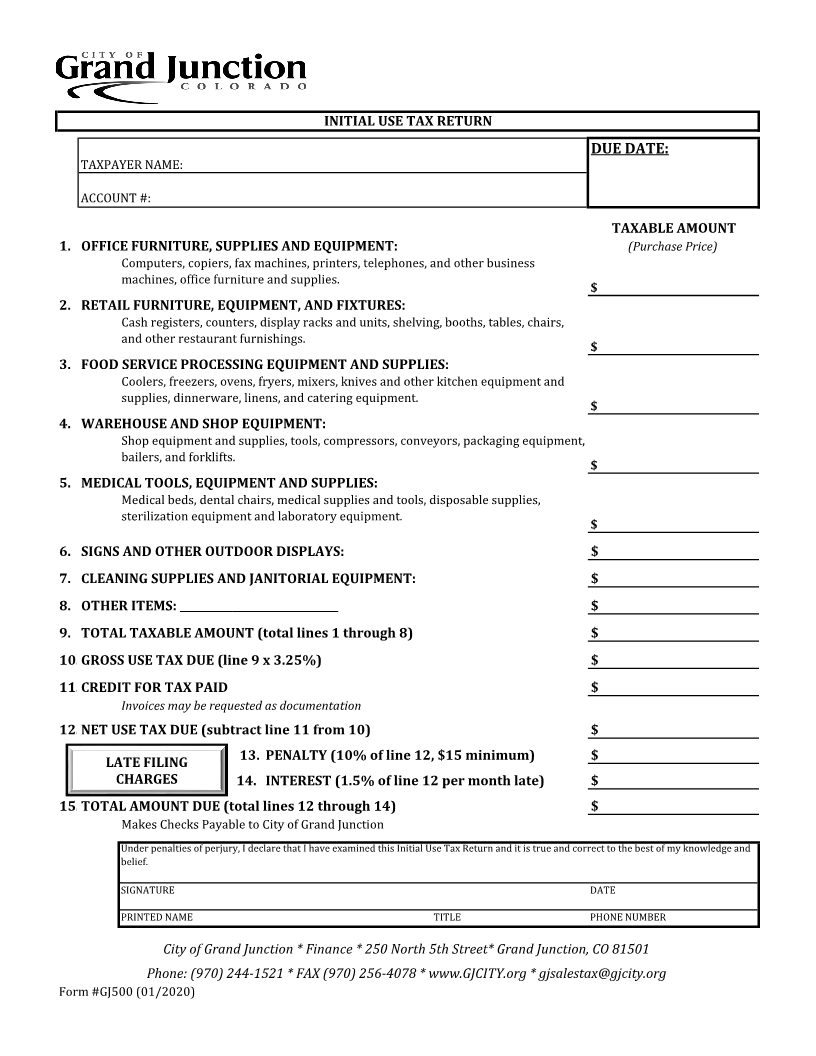

Initial Use Tax Return

Use Tax is due on the purchase price of assets and property that will be used or consumed in Grand Junction

when no previous sales tax has been paid. If City of Grand Junction sales tax is not paid to the vendor at the

time of purchase, use tax is due and must be remitted directly to the City.

Initial Use Tax is due on business assets and supplies when an individual opens a new business or purchases an

existing business. Initial Use Tax must be reported on the Initial Use Tax Return. Subsequent use tax must be

reported on the City Sales and Use Tax Return.

• New Businesses: Individuals opening new business establishments must pay use tax (32. 5%) on

business assets and supplies purchased for use or consumption in the City of Grand Junction business

when sales tax has not previously been paid on these items.

th

o DUE DATE: Initial Use Tax is due on the 20 of the month following the first day of

business.

• Acquired Business: Use tax is due on tangible personal property (except inventory held for lease, rental

or resale) which is acquired with the purchase of a business. Use Tax is due at the rate of 32. 5% of the

purchase price of the assets acquired as long as the purchase price is not less than fair market value of

the assets. Acceptable evidence of purchase price includes the bill of sale or purchase agreement. When

the transaction is a lump-sum transaction, use tax is due on the book value of the assets acquired. When

a business is sold in exchange for the assumption of outstanding indebtedness, the tax shall be paid on

the fair market value of all taxable tangible personal property acquired by the purchaser.

th

o DUE DATE: Initial Use Tax is due on the 20 of the month following the date of sale.

PLEASE FILL OUT THE RETURN ON THE BACK OF THIS PAGE AND

RETURN WITH PAYMENT TO:

City of Grand Junction

Finance

th

250 North 5 Street

Grand Junction, Colorado 81501

QUESTIONS:

Phone: (970) 244-1521