Enlarge image

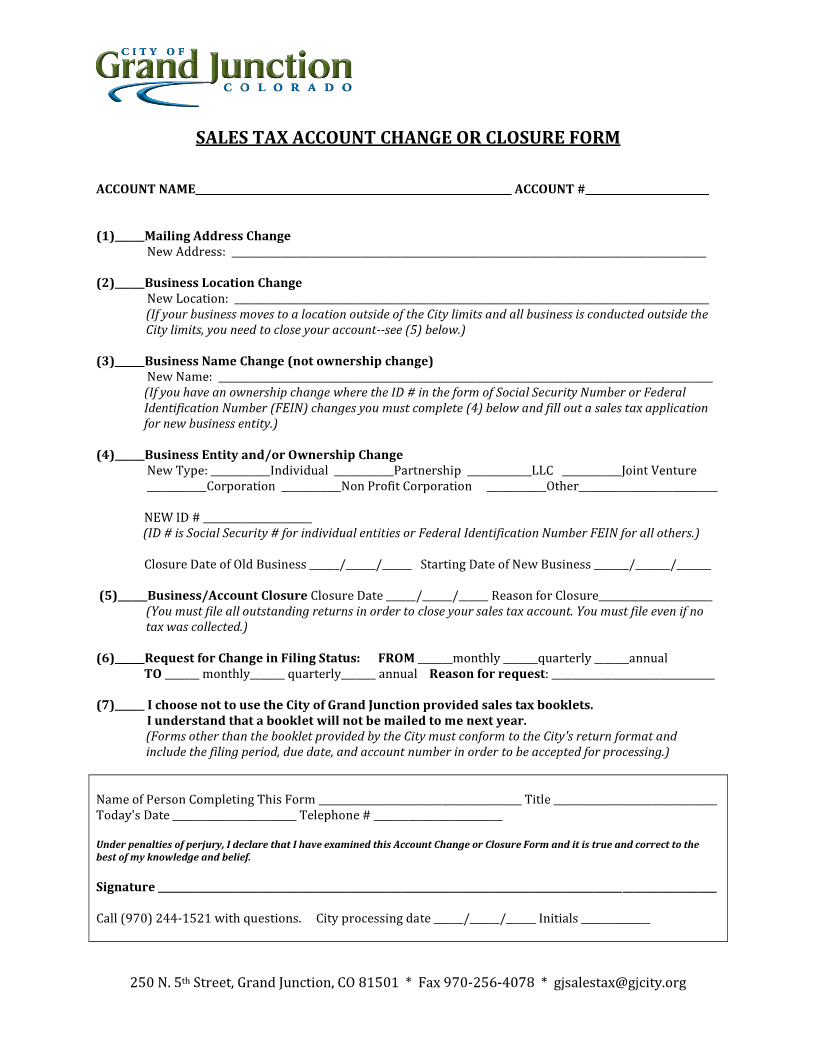

SALES TAX ACCOUNT CHANGE OR CLOSURE FORM

ACCOUNT NAME________________________________________________________________ ACCOUNT #_________________________

(1)______Mailing Address Change

New Address: ________________________________________________________________________________________________

(2)______Business Location Change

New Location: ________________________________________________________________________________________________

(If your business moves to a location outside of the City limits and all business is conducted outside the

City limits, you need to close your account--see (5) below.)

(3)______Business Name Change (not ownership change)

New Name: ____________________________________________________________________________________________________

(If you have an ownership change where the ID # in the form of Social Security Number or Federal

Identification Number (FEIN) changes you must complete (4) below and fill out a sales tax application

for new business entity.)

(4)______Business Entity and/or Ownership Change

New Type: ____________Individual ____________Partnership _____________LLC ____________Joint Venture

____________Corporation ____________Non Profit Corporation ____________Other____________________________

NEW ID # ______________________

(ID # is Social Security # for individual entities or Federal Identification Number FEIN for all others.)

Closure Date of Old Business ______/______/______ Starting Date of New Business _______/_______/_______

(5)______Business/Account Closure Closure Date ______/______/______ Reason for Closure_______________________

(You must file all outstanding returns in order to close your sales tax account. You must file even if no

tax was collected.)

(6)______Request for Change in Filing Status: FROM _______monthly _______quarterly _______annual

TO _______ monthly_______ quarterly_______ annual Reason for request: _________________________________

(7)______I choose not to use the City of Grand Junction provided sales tax booklets.

I understand that a booklet will not be mailed to me next year.

(Forms other than the booklet provided by the City must conform to the City's return format and

include the filing period, due date, and account number in order to be accepted for processing.)

Name of Person Completing This Form _________________________________________ Title _________________________________

Today's Date _________________________ Telephone # __________________________

Under penalties of perjury, I declare that I have examined this Account Change or Closure Form and it is true and correct to the

best of my knowledge and belief.

Signature _________________________________________________________________________________________________________________

Call (970) 244-1521 with questions. City processing date ______/______/______ Initials ______________

250 N. 5 thStreet, Grand Junction, CO 81501 * Fax 970-256-4078 * gjsalestax@gjcity.org