Enlarge image

Office Use: Date Received: _________ Received By: _________ License No.: _________

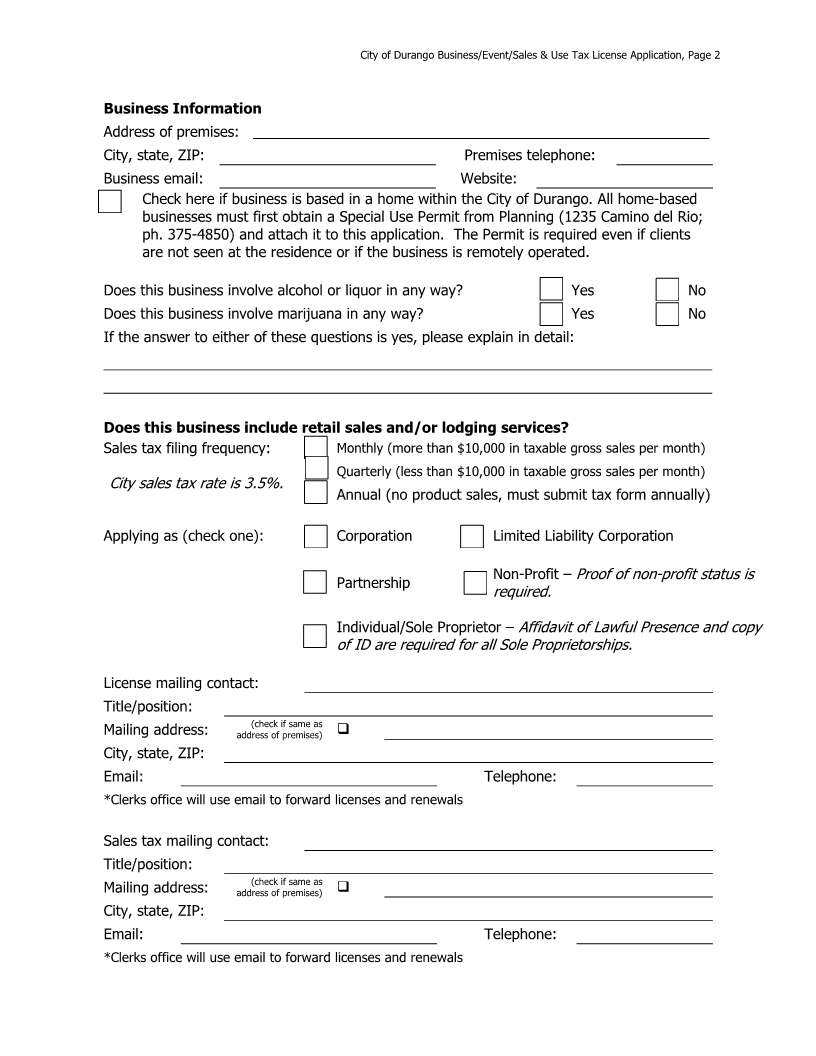

Business/Event/Sales & Use Tax License Application

Applicant business name: ___________________________________________________

Trade name (D/B/A): ______________________________________________

Start date of doing business in Durango: _____________________________________

Select one of the following (required):

New license application _ _ _ _ _ _ _ _ _ _ _ $30.00 $ ______

(Includes existing businesses under new ownership)

Change of business location _ _ _ _ _ _ _ _ _ _ _ $30.00 $ ______

(For an active license relocating within Durango city limits)

Previous location address: __________________________________

Select one of the following licenses:

A. Annual Business License

Determined by the number of owners and employees working

within the City of Durango, includes Sales Tax License

0-5 employees _ _ _ _ _ _ _ _ _ _ _ $50.00 $ ______

6-10 employees _ _ _ _ _ _ _ _ _ _ _ $78.00 $ ______

11-20 employees _ _ _ _ _ _ _ _ _ _ _ $105.00 $ ______

21 employees and over _ _ _ _ _ _ _ _ _ _ _ $122.00 $ ______

B. Events License , based on the number of events a vendor

plans to attend within the City of Durango in this calendar year:

0-15 events _ _ _ _ _ _ _ _ _ _ _ $25.00 $ ______

Over 15 events _ _ _ _ _ _ _ _ _ _ _ $50.00 $ ______

C. Sales Tax Only License _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ $25.00 $ ______

Business has no physical presence in the City of Durango; business

does not send a salesperson, delivery truck, or representative into

the City; product is shipped into the City by common carrier.

Additional annual license fees, if applicable:

Lodgers tax license _ _ _ _ _ _ _ _ _ _ _ $25.00 $ ______

Cross connection control technician _ _ _ _ _ _ _ _ _ _ _ $50.00 $ ______

Pawnbroker/Second hand goods dealer _ _ _ _ _ _ _ _ _ _ _ $50.00 $ ______

Tree trimmer license _ _ _ _ _ _ _ _ _ _ _ $90.00 $ ______

Solicitation License w/ background check and ID Badge

(each permitted solicitor) _ _ _ _

$105.00 $ ______

*Please mail in Application and Fees to process. Durango sales tax rate is 3.5% as of July 1, 2019.

Total all license fees payable to the City of Durango: $ _____