Enlarge image

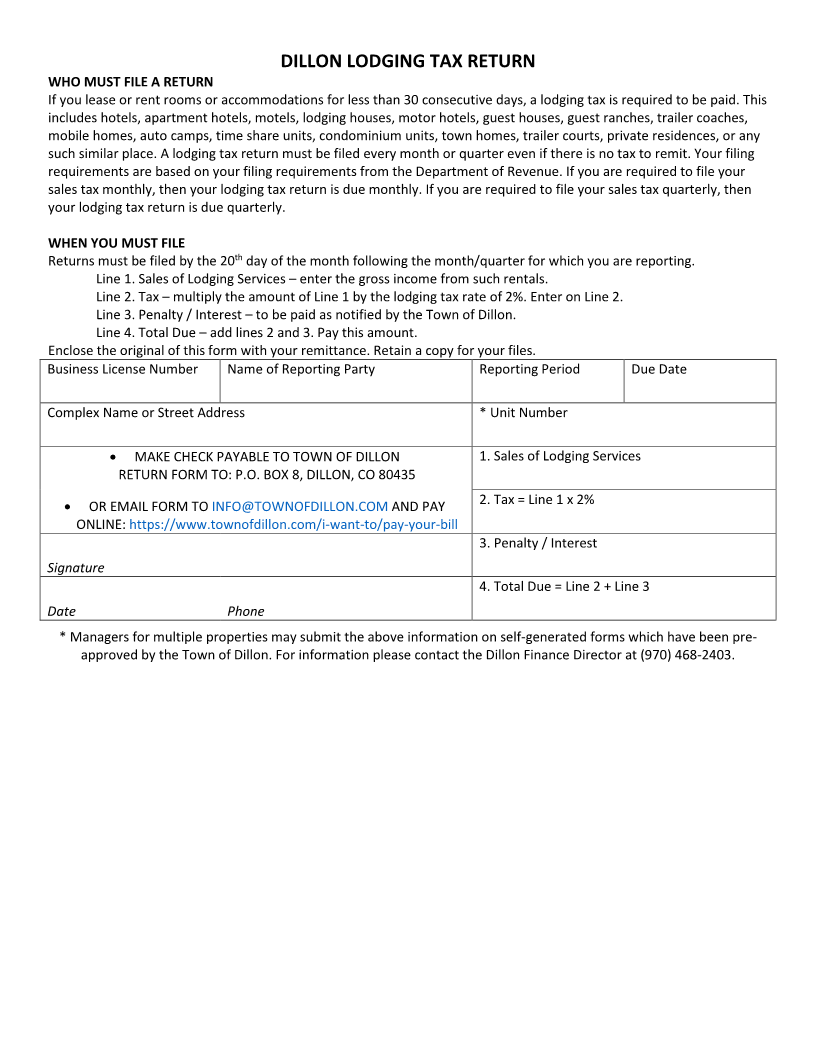

DILLON LODGING TAX RETURN

WHO MUST FILE A RETURN

If you lease or rent rooms or accommodations for less than 30 consecutive days, a lodging tax is required to be paid. This

includes hotels, apartment hotels, motels, lodging houses, motor hotels, guest houses, guest ranches, trailer coaches,

mobile homes, auto camps, time share units, condominium units, town homes, trailer courts, private residences, or any

such similar place. A lodging tax return must be filed every month or quarter even if there is no tax to remit. Your filing

requirements are based on your filing requirements from the Department of Revenue. If you are required to file your

sales tax monthly, then your lodging tax return is due monthly. If you are required to file your sales tax quarterly, then

your lodging tax return is due quarterly.

WHEN YOU MUST FILE

th

Returns must be filed by the 20 day of the month following the month/quarter for which you are reporting.

Line 1. Sales of Lodging Services – enter the gross income from such rentals.

Line 2. Tax – multiply the amount of Line 1 by the lodging tax rate of 2%. Enter on Line 2.

Line 3. Penalty / Interest – to be paid as notified by the Town of Dillon.

Line 4. Total Due – add lines 2 and 3. Pay this amount.

Enclose the original of this form with your remittance. Retain a copy for your files.

Business License Number Name of Reporting Party Reporting Period Due Date

Complex Name or Street Address * Unit Number

• MAKE CHECK PAYABLE TO TOWN OF DILLON 1. Sales of Lodging Services

RETURN FORM TO: P.O. BOX 8, DILLON, CO 80435

2. Tax = Line 1 x 2%

• OR EMAIL FORM TO INFO@TOWNOFDILLON.COM AND PAY

ONLINE: https://www.townofdillon.com/i-want-to/pay-your-bill

3. Penalty / Interest

Signature

4. Total Due = Line 2 + Line 3

Date Phone

* Managers for multiple properties may submit the above information on self-generated forms which have been pre-

approved by the Town of Dillon. For information please contact the Dillon Finance Director at (970) 468-2403.