Enlarge image

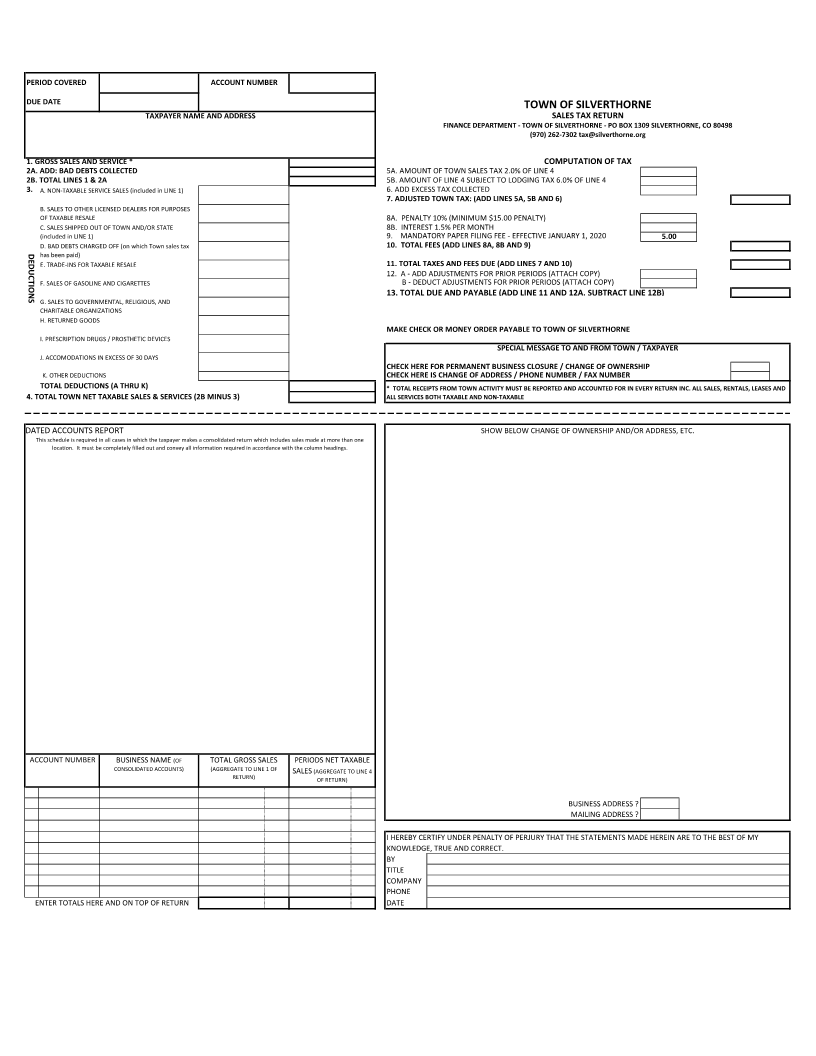

PERIOD COVERED ACCOUNT NUMBER

DUE DATE TOWN OF SILVERTHORNE

TAXPAYER NAME AND ADDRESS SALES TAX RETURN

FINANCE DEPARTMENT - TOWN OF SILVERTHORNE - PO BOX 1309 SILVERTHORNE, CO 80498

(970) 262-7302 tax@silverthorne.org

1. GROSS SALES AND SERVICE * COMPUTATION OF TAX

2A. ADD: BAD DEBTS COLLECTED 5A. AMOUNT OF TOWN SALES TAX 2.0% OF LINE 4

2B. TOTAL LINES 1 & 2A 5B. AMOUNT OF LINE 4 SUBJECT TO LODGING TAX 6.0% OF LINE 4

3. A. NON-TAXABLE SERVICE SALES (included in LINE 1) 6. ADD EXCESS TAX COLLECTED

7. ADJUSTED TOWN TAX: (ADD LINES 5A, 5B AND 6)

B. SALES TO OTHER LICENSED DEALERS FOR PURPOSES

OF TAXABLE RESALE 8A. PENALTY 10% (MINIMUM $15.00 PENALTY)

C. SALES SHIPPED OUT OF TOWN AND/OR STATE 8B. INTEREST 1.5% PER MONTH

(included in LINE 1) 9. MANDATORY PAPER FILING FEE - EFFECTIVE JANUARY 1, 2020 5.00

DEDUCTIONS D. BAD DEBTS CHARGED OFF (on which Town sales tax 10. TOTAL FEES (ADD LINES 8A, 8B AND 9)

has been paid)

E. TRADE-INS FOR TAXABLE RESALE 11. TOTAL TAXES AND FEES DUE (ADD LINES 7 AND 10)

12. A - ADD ADJUSTMENTS FOR PRIOR PERIODS (ATTACH COPY)

F. SALES OF GASOLINE AND CIGARETTES B - DEDUCT ADJUSTMENTS FOR PRIOR PERIODS (ATTACH COPY)

13. TOTAL DUE AND PAYABLE (ADD LINE 11 AND 12A. SUBTRACT LINE 12B)

G. SALES TO GOVERNMENTAL, RELIGIOUS, AND

CHARITABLE ORGANIZATIONS

H. RETURNED GOODS

MAKE CHECK OR MONEY ORDER PAYABLE TO TOWN OF SILVERTHORNE

I. PRESCRIPTION DRUGS / PROSTHETIC DEVICES

SPECIAL MESSAGE TO AND FROM TOWN / TAXPAYER

J. ACCOMODATIONS IN EXCESS OF 30 DAYS

CHECK HERE FOR PERMANENT BUSINESS CLOSURE / CHANGE OF OWNERSHIP

K. OTHER DEDUCTIONS CHECK HERE IS CHANGE OF ADDRESS / PHONE NUMBER / FAX NUMBER

TOTAL DEDUCTIONS (A THRU K) * TOTAL RECEIPTS FROM TOWN ACTIVITY MUST BE REPORTED AND ACCOUNTED FOR IN EVERY RETURN INC. ALL SALES, RENTALS, LEASES AND

4. TOTAL TOWN NET TAXABLE SALES & SERVICES (2B MINUS 3) ALL SERVICES BOTH TAXABLE AND NON-TAXABLE

SCHEDULE C - CONSOLIDATED ACCOUNTS REPORT SHOW BELOW CHANGE OF OWNERSHIP AND/OR ADDRESS, ETC.

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one

location. It must be completely filled out and convey all information required in accordance with the column headings.

ACCOUNT NUMBER BUSINESS NAME (OF TOTAL GROSS SALES PERIODS NET TAXABLE

CONSOLIDATED ACCOUNTS) (AGGREGATE TO LINE 1 OF SALES (AGGREGATE TO LINE 4

RETURN) OF RETURN)

BUSINESS ADDRESS ?

MAILING ADDRESS ?

I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE STATEMENTS MADE HEREIN ARE TO THE BEST OF MY

KNOWLEDGE, TRUE AND CORRECT.

BY

TITLE

COMPANY

PHONE

ENTER TOTALS HERE AND ON TOP OF RETURN DATE