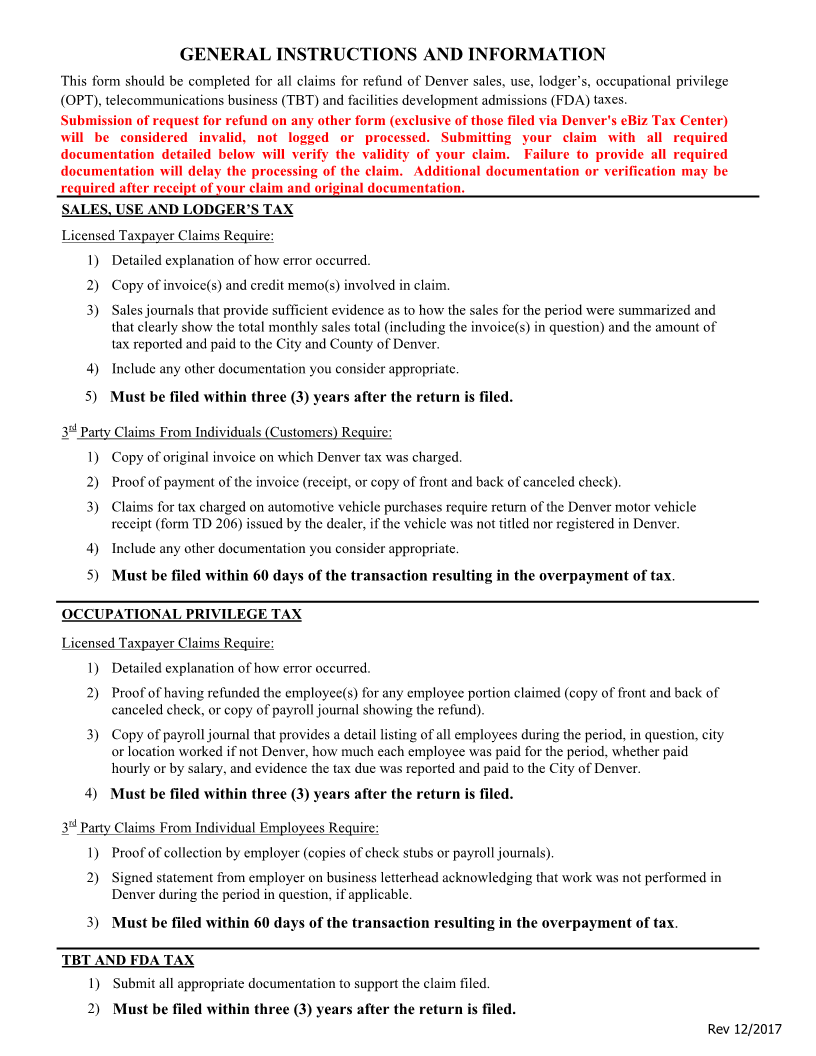

Enlarge image

RETURN TO:

Refund@denvergov.org

CITY AND COUNTY OF DENVER OR

Department of Finance – Refunds

CLAIM FOR REFUND

201 W. Colfax Ave.

MC 1001 Dept 1009

Sales Tax Use Tax Lodger’s Tax Occupational Privlegei Tax Denver, Colorado 80202

TBT FDA License Fee Phone: (720) 913-9955

Licensed Taxpayer Claims – (Claims filed by taxpayers licensed with the City and County of Denver)

Name of Claimant __________________________________________________ Ph. #___________________________

Refund Mailing Address_____________________________________________________________________________

Street City State Zip

Contact Person ____________________________________ mE- ail:________________________________

Amount of Claim for Refund $ _______________________ Denver Account # _______________________

Period(s) Being Claimed: _______________________

rd

3 Party Claims – (Claims filed by purchasers/employees not licensed with the City and County of Denver)

Must be filed within 60 days of transaction resulting in overpayment of tax – see instructions

Name of Claimant _________________________________________________ Ph. #____________________________

Refund Mailing Address ____________________________________________________________________________

Street City State Zip

Contact Person ___________________________________ E-mail: _____________ __________________________

Amount of Claim for Refund $ ______________________

Tax Paid to: ______________________________________ Date(s) Tax Paid: _______________________________

Statement of REASON FOR REFUND CLAIM

I hereby certify, under penalty of perjury, that the statements made herein are true and correct to the best of my knowledge. I understand

that making false statements in connection with an application for refund is a violation of the Denver Revised Municipal Code and may

be punishable by fines not to exceed $999.00 and/or imprisonment of up to one (1) year.

Unsigned forms will be considered incomplete and not logged or processed .

_______________________________________________________ ___________________________

Signature of Claimant Date

_______________________________________________________

Print Name

OFFICIAL USE ONLY

Adjustments Total $_________________ Denied Total $_________________ Interest Total__________________

REFUND AMOUNT APPROVED $ ____________________________

REVIEWER__________________________________________________ Date___________________ _ _

SUPERVISOR________________________________________________ Date____________________ _

MANAGER__________________________________________________ Date____________________ _

DIRECTOR __________________________________________________ Date____________________ _

Rev 12/201 8