Enlarge image

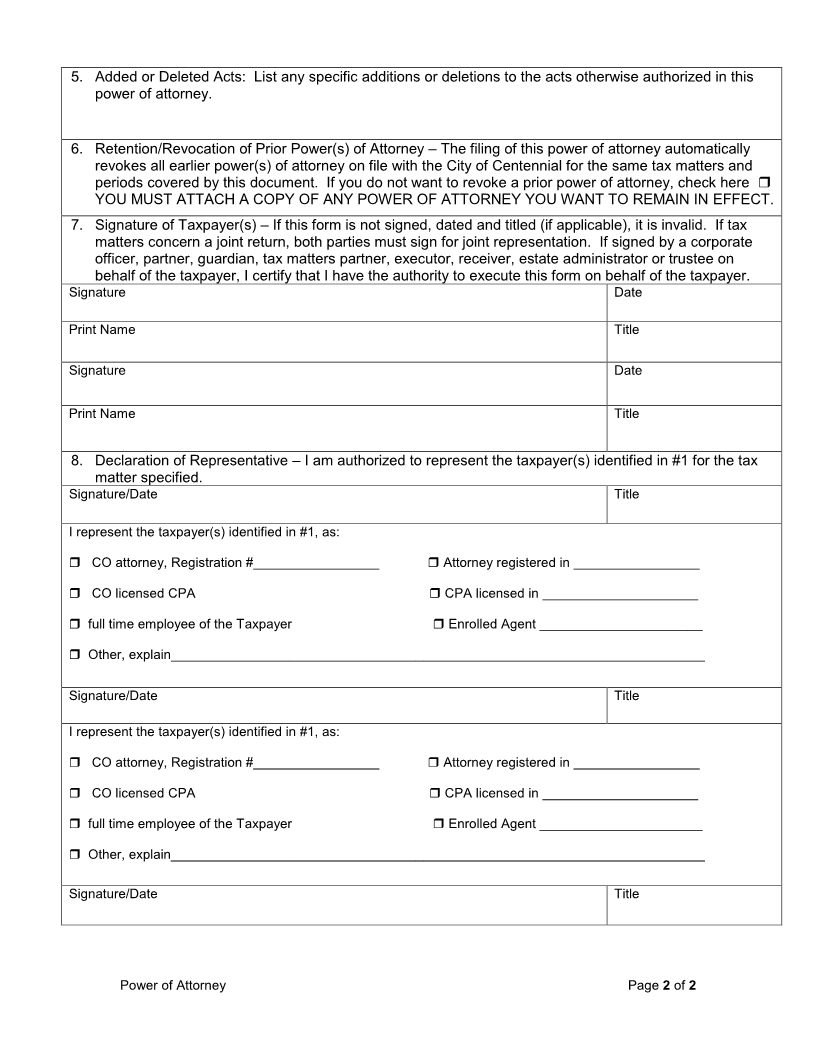

Power of Attorney

Sales and Use Tax Division

1. Taxpayer information and identification. Taxpayers must sign on reverse side.

Taxpayer Name(s) and address (include any trade name or DBA). Daytime Phone Number

( )

Email Address

City of Centennial Sales Tax License

Colorado Dept of Revenue Sales Tax No.

Social Security Number for Individual

2. Representative(s). Representative(s) must sign on the reverse side.

Hereby appoint(s) the following representative(s) as attorney(s)-in-fact

A. Name(s) and address Phone Number

( )

Fax Number

( )

Email Address

Attorney Registration Number or FEIN

B. Name(s) address Phone Number

( )

Fax Number

( )

Email Address

Attorney Registration Number or FEIN

3. Tax matters approved for representation:

City of Centennial Sales Tax Period From __________ to ___________

City of Centennial Building Materials Used Tax and/or Identification Number (permit or VIN)

Motor Vehicle Use Tax

4. Acts Authorized – The representatives are authorized to receive and inspect confidential tax information

and records and to perform any and all acts that the taxpayer named above can perform with respect to

the tax matters described in #3, for example, the authority to sign and bind the taxpayer above to

agreements, consents, or other documents. The authority does not include the power to receive refund

checks or the deleted acts specifically addressed in #5.

13133 East Arapahoe Road Centennial, Colorado 80112 303.325.8000 www.centennialco.gov