Enlarge image

Reset This Form

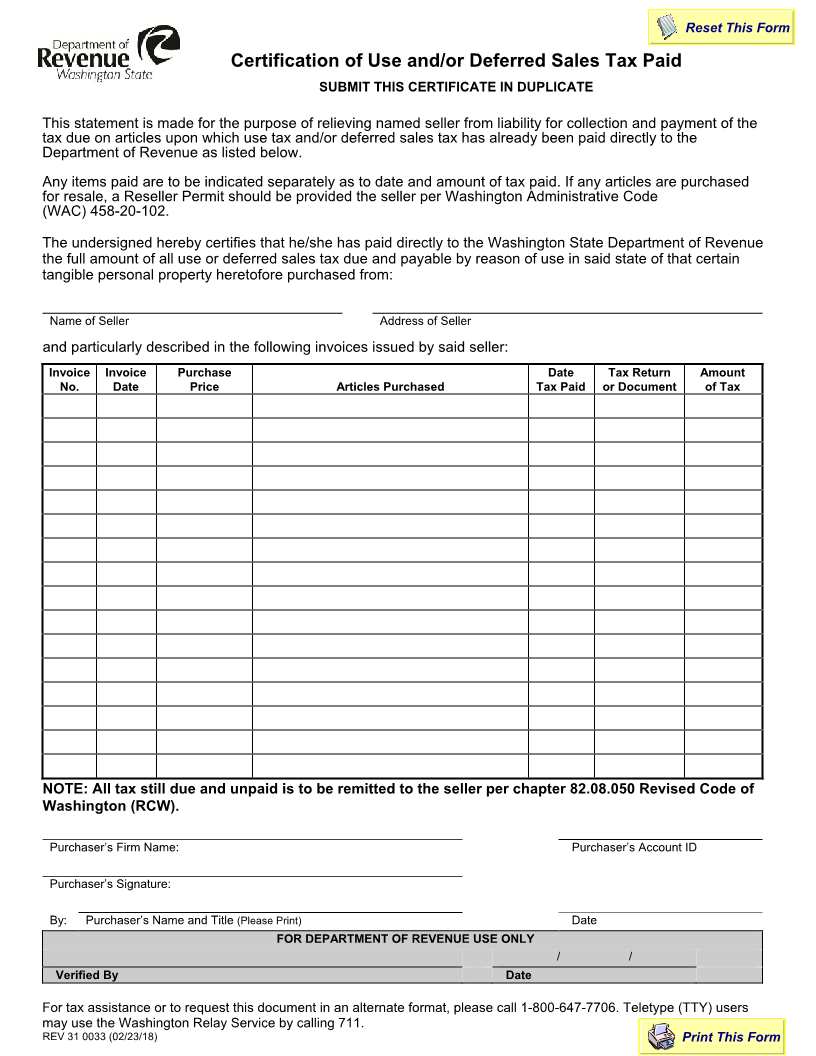

Certification of Use and/or Deferred Sales Tax Paid

SUBMIT THIS CERTIFICATE IN DUPLICATE

This statement is made for the purpose of relieving named seller from liability for collection and payment of the

tax due on articles upon which use tax and/or deferred sales tax has already been paid directly to the

Department of Revenue as listed below.

Any items paid are to be indicated separately as to date and amount of tax paid. If any articles are purchased

for resale, a Reseller Permit should be provided the seller per Washington Administrative Code

(WAC) 458-20-102.

The undersigned hereby certifies that he/she has paid directly to the Washington State Department of Revenue

the full amount of all use or deferred sales tax due and payable by reason of use in said state of that certain

tangible personal property heretofore purchased from:

Name of Seller Address of Seller

and particularly described in the following invoices issued by said seller:

Invoice Invoice Purchase Date Tax Return Amount

No. Date Price Articles Purchased Tax Paid or Document of Tax

NOTE: All tax still due and unpaid is to be remitted to the seller per chapter 82.08.050 Revised Code of

Washington (RCW).

Purchaser’s Firm Name: Purchaser’s Account ID

Purchaser’s Signature:

By: Purchaser’s Name and Title (Please Print) Date

FOR DEPARTMENT OF REVENUE USE ONLY

/ /

Verified By Date

For tax assistance or to request this document in an alternate format, please call 1-800-647-7706. Teletype (TTY) users

may use the Washington Relay Service by calling 711.

REV 31 0033 (02/23/18) Print This Form