Enlarge image

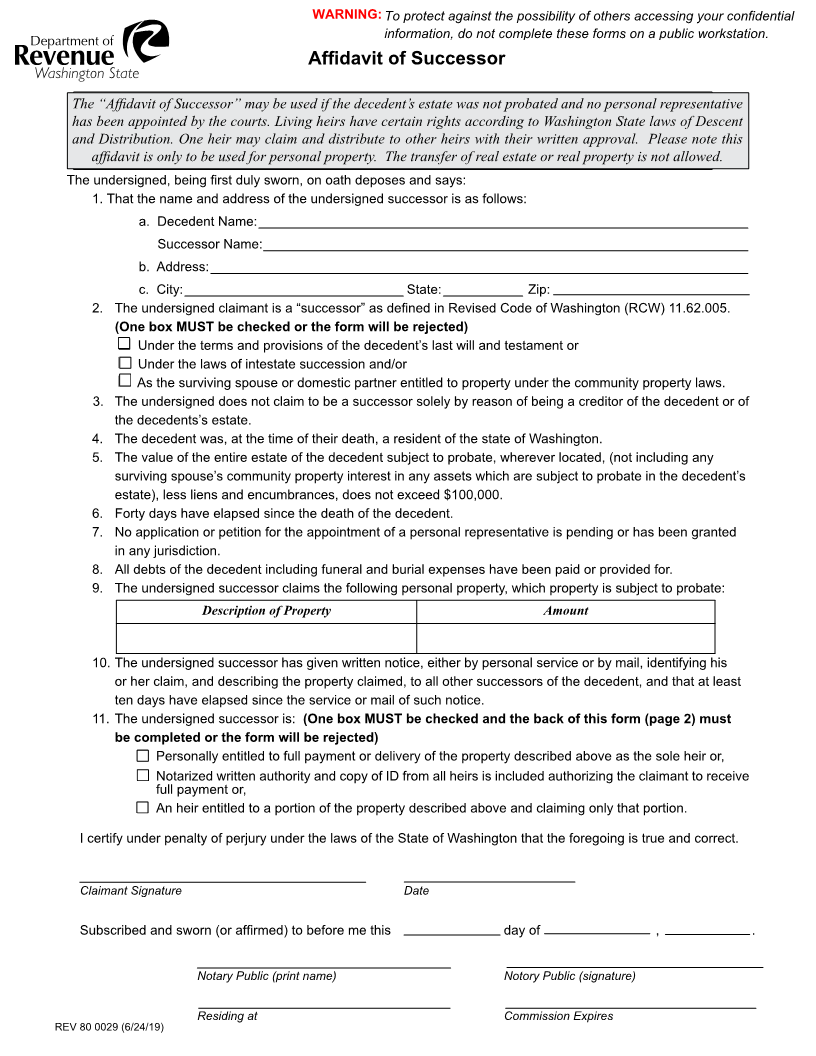

WARNING: To protect against the possibility of others accessing your confidential

information, do not complete these forms on a public workstation.

Affidavit of Successor

The “Affidavit of Successor” may be used if the decedent’s estate was not probated and no personal representative

has been appointed by the courts. Living heirs have certain rights according to Washington State laws of Descent

and Distribution. One heir may claim and distribute to other heirs with their written approval. Please note this

affidavit is only to be used for personal property. The transfer of real estate or real property is not allowed.

The undersigned, being first duly sworn, on oath deposes and says:

1.That the name and address of the undersigned successor is as follows:

a. Decedent Name:

Successor Name:

b. Address:

c. City: State: Zip:

2. The undersigned claimant is a “successor” as defined in Revised Code of Washington (RCW) 11.62.005.

(One box MUST be checked or the form will be rejected)

Under the terms and provisions of the decedent’s last will and testament or

Under the laws of intestate succession and/or

As the surviving spouse or domestic partner entitled to property under the community property laws.

3. The undersigned does not claim to be a successor solely by reason of being a creditor of the decedent or of

the decedents’s estate.

4. The decedent was, at the time of their death, a resident of the state of Washington.

5. The value of the entire estate of the decedent subject to probate, wherever located, (not including any

surviving spouse’s community property interest in any assets which are subject to probate in the decedent’s

estate), less liens and encumbrances, does not exceed $100,000.

6. Forty days have elapsed since the death of the decedent.

7. No application or petition for the appointment of a personal representative is pending or has been granted

in any jurisdiction.

8. All debts of the decedent including funeral and burial expenses have been paid or provided for.

9. The undersigned successor claims the following personal property, which property is subject to probate:

Description of Property Amount

10. The undersigned successor has given written notice, either by personal service or by mail, identifying his

or her claim, and describing the property claimed, to all other successors of the decedent, and that at least

ten days have elapsed since the service or mail of such notice.

11. The undersigned successor is: (One box MUST be checked and the back of this form (page 2) must

be completed or the form will be rejected)

Personally entitled to full payment or delivery of the property described above as the sole heir or,

Notarized written authority and copy of ID from all heirs is included authorizing the claimant to receive

full payment or,

An heir entitled to a portion of the property described above and claiming only that portion.

I certify under penalty of perjury under the laws of the State of Washington that the foregoing is true and correct.

Claimant Signature Date

Subscribed and sworn (or affirmed) to before me this day of , .

Notary Public (print name) Notory Public (signature)

Residing at Commission Expires

REV 80 0029 (6/24/19)