Enlarge image

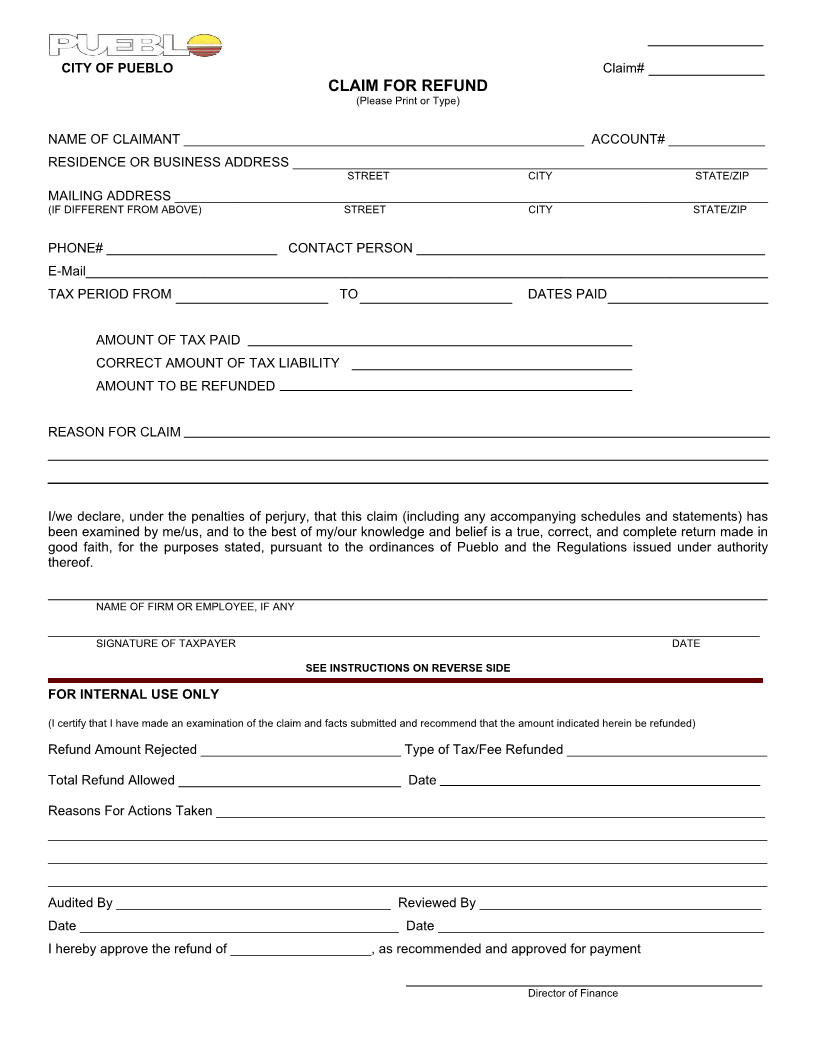

CITY OF PUEBLO _____________Claim#

CLAIM FOR REFUND

(Please Print or Type)

NAME OF CLAIMANT ______________________________________________________ ACCOUNT# _____________

RESIDENCE OR BUSINESS ADDRESS ________________________________________________________________

STREET CITY STATE/ZIP

MAILING ADDRESS ________________________________________________________________________________

(IF DIFFERENT FROM ABOVE) STREET CITY STATE/ZIP

PHONE# _______________________ CONTACT PERSON _______________________________________________

E-Mail____________________________________________________________________________________________

TAX PERIOD FROM TO DATES PAID

AMOUNT OF TAX PAID

CORRECT AMOUNT OF TAX LIABILITY

AMOUNT TO BE REFUNDED

REASON FOR CLAIM

I/we declare, under the penalties of perjury, that this claim (including any accompanying schedules and statements) has

been examined by me/us, and to the best of my/our knowledge and belief is a true, correct, and complete return made in

good faith, for the purposes stated, pursuant to the ordinances of Pueblo and the Regulations issued under authority

thereof.

_________________________________________________________________________________________________

NAME OF FIRM OR EMPLOYEE, IF ANY

________________________________________________________________________________________________________________________

SIGNATURE OF TAXPAYER DATE

SEE INSTRUCTIONS ON REVERSE SIDE

FOR INTERNAL USE ONLY

(I certify that I have made an examination of the claim and facts submitted and recommend that the amount indicated herein be refunded)

Refund Amount Rejected ___________________________ Type of Tax/Fee Refunded ___________________________

Total Refund Allowed ______________________________ Date

Reasons For Actions Taken __________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Audited By _____________________________________ Reviewed By ______________________________________

Date ___________________________________________ Date ____________________________________________

I hereby approve the refund of ___________________, as recommended and approved for payment

________________________________________________

Director of Finance