Enlarge image

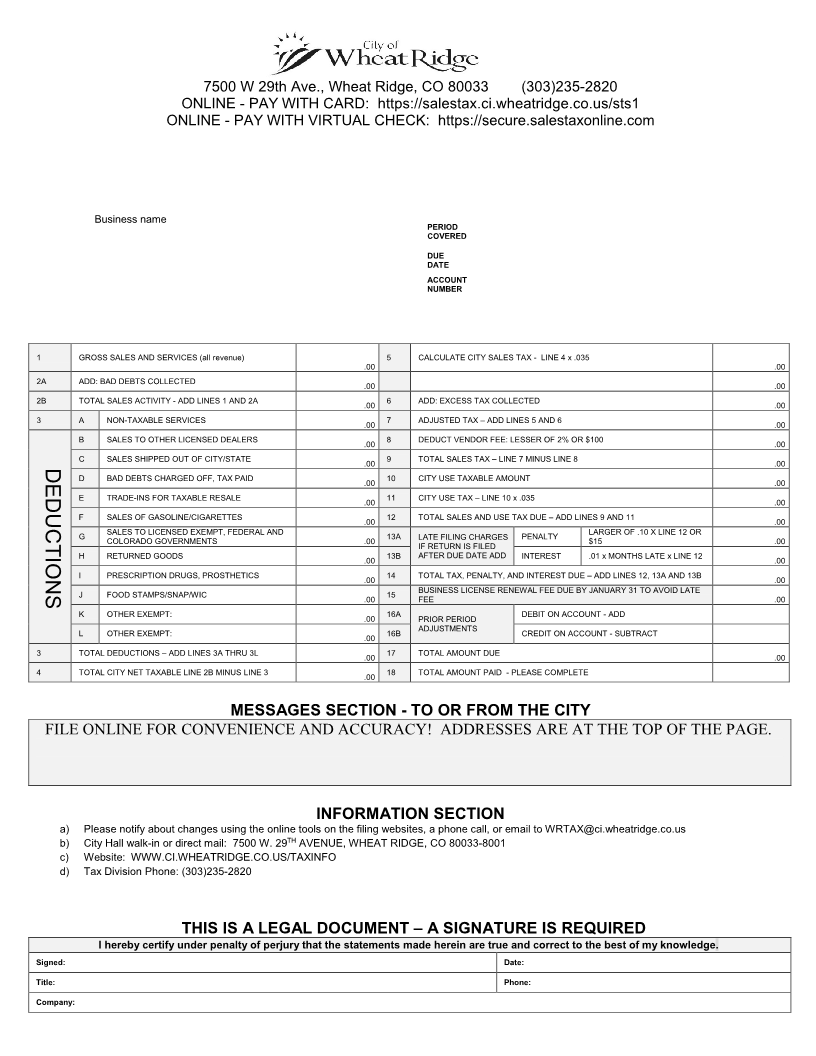

7500 W 29th Ave., Wheat Ridge, CO 80033 (303)235-2820

ONLINE - PAY WITH CARD: https://salestax.ci.wheatridge.co.us/sts1

ONLINE - PAY WITH VIRTUAL CHECK: https://secure.salestaxonline.com

Business name PERIOD

COVERED

DUE

DATE

ACCOUNT

NUMBER

1 GROSS SALES AND SERVICES (all revenue) 5 CALCULATE CITY SALES TAX - LINE 4 x .035

.00 .00

2A ADD: BAD DEBTS COLLECTED .00 .00

2B TOTAL SALES ACTIVITY - ADD LINES 1 AND 2A .00 6 ADD: EXCESS TAX COLLECTED .00

3 A NON-TAXABLE SERVICES .00 7 ADJUSTED TAX – ADD LINES 5 AND 6 .00

B SALES TO OTHER LICENSED DEALERS .00 8 DEDUCT VENDOR FEE: LESSER OF 2% OR $100 .00

DEDUCTIONS C SALES SHIPPED OUT OF CITY/STATE .00 9 TOTAL SALES TAX – LINE 7 MINUS LINE 8 .00

D BAD DEBTS CHARGED OFF, TAX PAID .00 10 CITY USE TAXABLE AMOUNT .00

E TRADE-INS FOR TAXABLE RESALE .00 11 CITY USE TAX – LINE 10 x .035 .00

F SALES OF GASOLINE/CIGARETTES .00 12 TOTAL SALES AND USE TAX DUE – ADD LINES 9 AND 11 .00

G SALES TO LICENSED EXEMPT, FEDERAL AND 13A LATE FILING CHARGES PENALTY LARGER OF .10 X LINE 12 OR

COLORADO GOVERNMENTS .00 IF RETURN IS FILED $15 .00

H RETURNED GOODS .00 13B AFTER DUE DATE ADD INTEREST .01 x MONTHS LATE x LINE 12 .00

I PRESCRIPTION DRUGS, PROSTHETICS .00 14 TOTAL TAX, PENALTY, AND INTEREST DUE – ADD LINES 12, 13A AND 13B .00

J FOOD STAMPS/SNAP/WIC .00 15 BUSINESS LICENSE RENEWAL FEE DUE BY JANUARY 31 TO AVOID LATE

FEE .00

K OTHER EXEMPT: .00 16A PRIOR PERIOD DEBIT ON ACCOUNT - ADD

L OTHER EXEMPT: .00 16B ADJUSTMENTS CREDIT ON ACCOUNT - SUBTRACT

3 TOTAL DEDUCTIONS – ADD LINES 3A THRU 3L .00 17 TOTAL AMOUNT DUE .00

4 TOTAL CITY NET TAXABLE LINE 2B MINUS LINE 3 .00 18 TOTAL AMOUNT PAID - PLEASE COMPLETE

MESSAGES SECTION - TO OR FROM THE CITY

FILE ONLINE FOR CONVENIENCE AND ACCURACY! ADDRESSES ARE AT THE TOP OF THE PAGE.

INFORMATION SECTION

a) Please notify about changes using the online tools on the filing websites, a phone call, or email to WRTAX@ci.wheatridge.co.us

b) City Hall walk-in or direct mail: 7500 W. 29 THAVENUE, WHEAT RIDGE, CO 80033-8001

c) Website: WWW.CI.WHEATRIDGE.CO.US/TAXINFO

d) Tax Division Phone: (303)235-2820

THIS IS A LEGAL DOCUMENT – A SIGNATURE IS REQUIRED

I hereby certify under penalty of perjury that the statements made herein are true and correct to the best of my knowledge.

Signed: Date:

Title: Phone:

Company: