Enlarge image

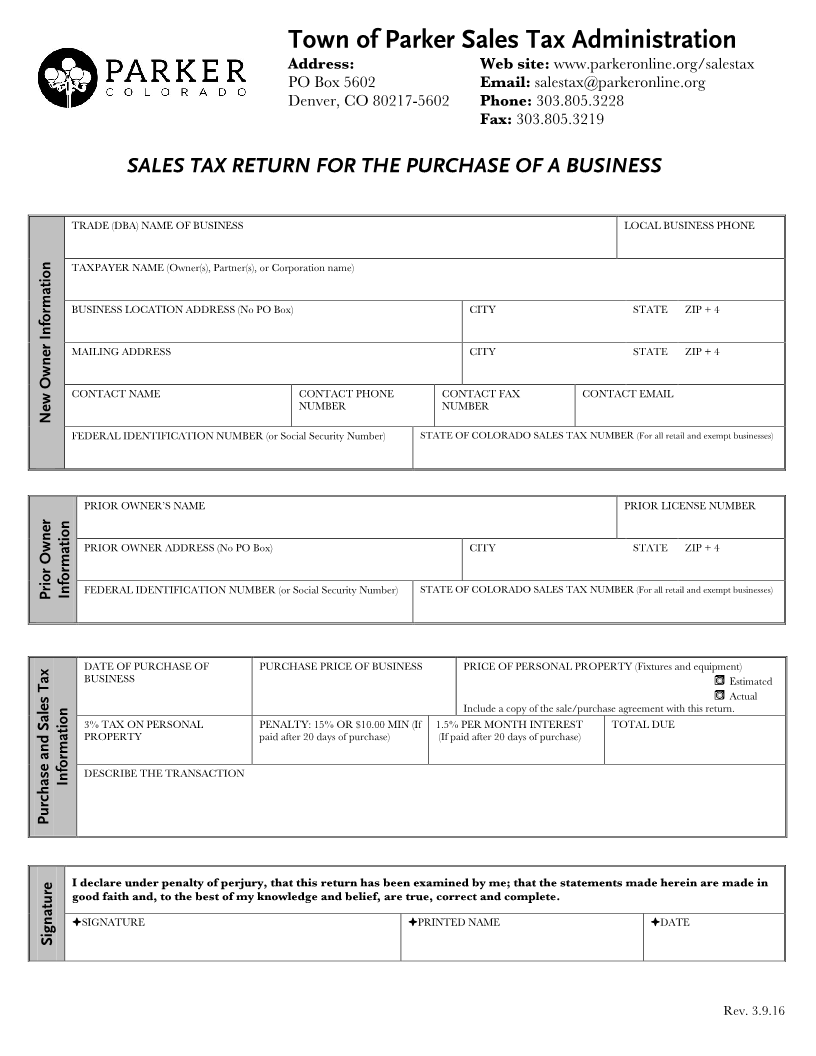

Town of Parker Sales Tax Administration Address: Web site: www.parkeronline.org/salestax PO Box 5602 Email: salestax@parkeronline.org Denver, CO 80217-5602 Phone: 303.805.3228 Fax: 303.805.3219 SALES TAX RETURN FOR THE PURCHASE OF A BUSINESS TRADE (DBA) NAME OF BUSINESS LOCAL BUSINESS PHONE TAXPAYER NAME (Owner(s), Partner(s), or Corporation name) BUSINESS LOCATION ADDRESS (No PO Box) CITY STATE ZIP + 4 MAILING ADDRESS CITY STATE ZIP + 4 CONTACT NAME CONTACT PHONE CONTACT FAX CONTACT EMAIL NUMBER NUMBER New Owner Information FEDERAL IDENTIFICATION NUMBER (or Social Security Number) STATE OF COLORADO SALES TAX NUMBER (For all retail and exempt businesses) PRIOR OWNER’S NAME PRIOR LICENSE NUMBER PRIOR OWNER ADDRESS (No PO Box) CITY STATE ZIP + 4 Prior Owner Information FEDERAL IDENTIFICATION NUMBER (or Social Security Number) STATE OF COLORADO SALES TAX NUMBER (For all retail and exempt businesses) DATE OF PURCHASE OF PURCHASE PRICE OF BUSINESS PRICE OF PERSONAL PROPERTY (Fixtures and equipment) BUSINESS Estimated Actual Include a copy of the sale/purchase agreement with this return. 3% TAX ON PERSONAL PENALTY: 15% OR $10.00 MIN (If 1.5% PER MONTH INTEREST TOTAL DUE PROPERTY paid after 20 days of purchase) (If paid after 20 days of purchase) Information DESCRIBE THE TRANSACTION Purchase and Sales Tax I declare under penalty of perjury, that this return has been examined by me; that the statements made herein are made in good faith and, to the best of my knowledge and belief, are true, correct and complete. SIGNATURE PRINTED NAME DATE Signature Rev. 3.9.16