Enlarge image

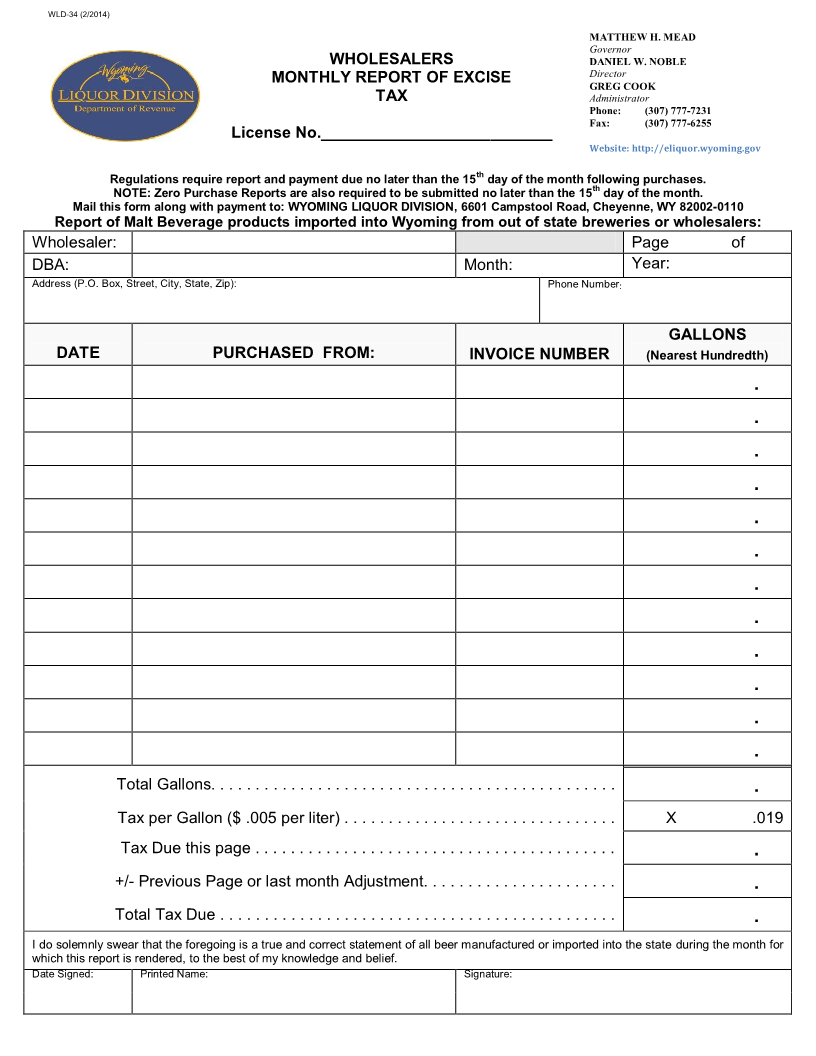

WLD-34 (2/2014)

MATTHEW H. MEAD

Governor

WHOLESALERS DANIEL W. NOBLE

MONTHLY REPORT OF EXCISE Director

GREG COOK

TAX Administrator

Phone: (307) 777-7231

License No.__________________________ Fax: (307) 777-6255

Website: http://eliquor.wyoming.gov

th

Regulations require report and payment due no later than the 15 day of the month following purchases.

th

NOTE: Zero Purchase Reports are also required to be submitted no later than the 15 day of the month.

Mail this form along with payment to: WYOMING LIQUOR DIVISION, 6601 Campstool Road, Cheyenne, WY 82002-0110

Report of Malt Beverage products imported into Wyoming from out of state breweries or wholesalers:

Wholesaler: Page of

DBA: Month: Year:

Address (P.O. Box, Street, City, State, Zip): Phone Number:

GALLONS

DATE PURCHASED FROM: INVOICE NUMBER (Nearest Hundredth)

.

.

.

.

.

.

.

.

.

.

.

.

Total Gallons. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax per Gallon ($ .005 per liter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X .019

Tax Due this page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

+/- Previous Page or last month Adjustment. . . . . . . . . . . . . . . . . . . . . . .

Total Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I do solemnly swear that the foregoing is a true and correct statement of all beer manufactured or imported into the state during the month for

which this report is rendered, to the best of my knowledge and belief.

Date Signed: Printed Name: Signature: