Enlarge image

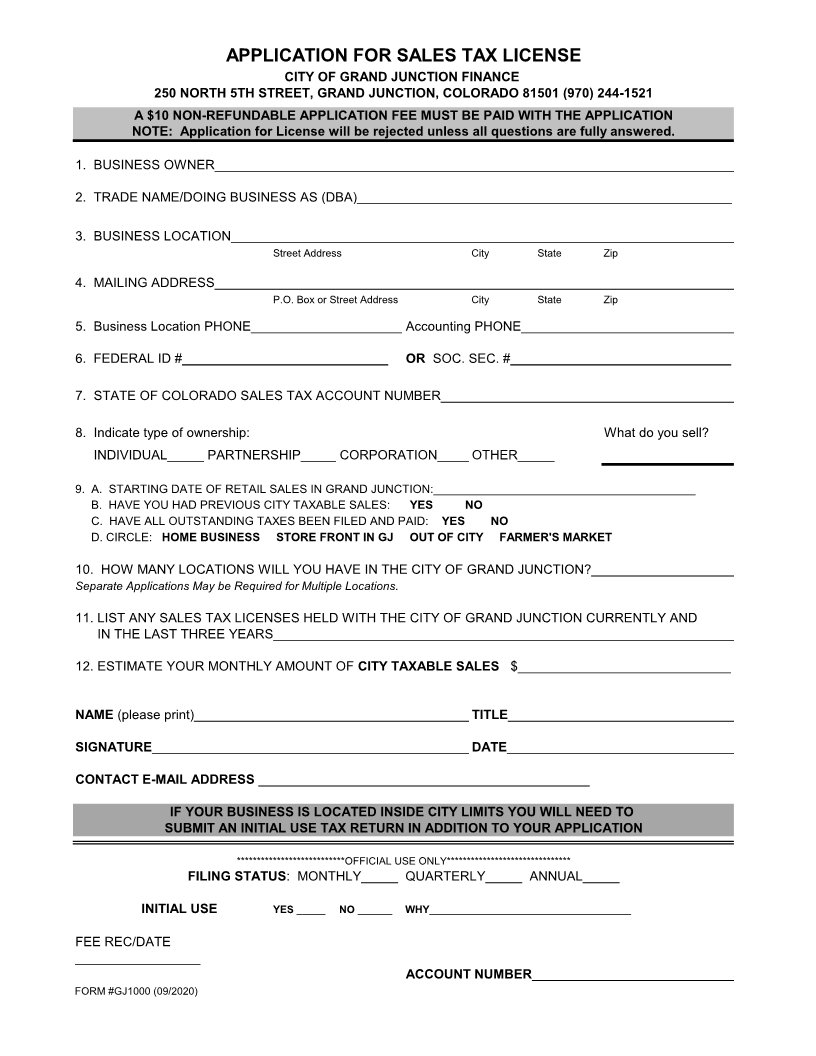

APPLICATION FOR SALES TAX LICENSE

CITY OF GRAND JUNCTION FINANCE

250 NORTH 5TH STREET, GRAND JUNCTION, COLORADO 81501 (970) 244-1521

A $10 NON-REFUNDABLE APPLICATION FEE MUST BE PAID WITH THE APPLICATION

NOTE: Application for License will be rejected unless all questions are fully answered.

1. BUSINESS OWNER_______________________________________________________________________

2. TRADE NAME/DOING BUSINESS AS (DBA)___________________________________________________

3. BUSINESS LOCATION_____________________________________________________________________

Street Address City State Zip

4. MAILING ADDRESS_______________________________________________________________________

P.O. Box or Street Address City State Zip

5. Business Location PHONE_____________________Accounting PHONE_____________________________

6. FEDERAL ID #____________________________ OR SOC. SEC. #______________________________

7. STATE OF COLORADO SALES TAX ACCOUNT NUMBER________________________________________

8. Indicate type of ownership: What do you sell?

INDIVIDUAL__________PARTNERSHIP__________CORPORATION__________OTHER_____

9. A. STARTING DATE OF RETAIL SALES IN GRAND JUNCTION:________________________________________

B. HAVE YOU HAD PREVIOUS CITY TAXABLE SALES: YES NO

C. HAVE ALL OUTSTANDING TAXES BEEN FILED AND PAID: YES NO

D. CIRCLE: HOME BUSINESS STORE FRONT IN GJ OUT OF CITY FARMER'S MARKET

10. HOW MANY LOCATIONS WILL YOU HAVE IN THE CITY OF GRAND JUNCTION?____________________

Separate Applications May be Required for Multiple Locations.

11. LIST ANY SALES TAX LICENSES HELD WITH THE CITY OF GRAND JUNCTION CURRENTLY AND

IN THE LAST THREE YEARS_______________________________________________________________

12. ESTIMATE YOUR MONTHLY AMOUNT OF CITY TAXABLE SALES $_____________________________

NAME (please print)________________________________________TITLE_______________________________

SIGNATURE_____________________________________________DATE_______________________________

CONTACT E-MAIL ADDRESS _____________________________________________

IF YOUR BUSINESS IS LOCATED INSIDE CITY LIMITS YOU WILL NEED TO

SUBMIT AN INITIAL USE TAX RETURN IN ADDITION TO YOUR APPLICATION

***************************OFFICIAL USE ONLY*******************************

FILING STATUS: MONTHLY_____ QUARTERLY_____ ANNUAL_____

INITIAL USE YES _____ NO ______ WHY___________________________________

FEE REC/DATE

_________________

ACCOUNT NUMBER____________________________

FORM #GJ1000 (09/2020)