Enlarge image

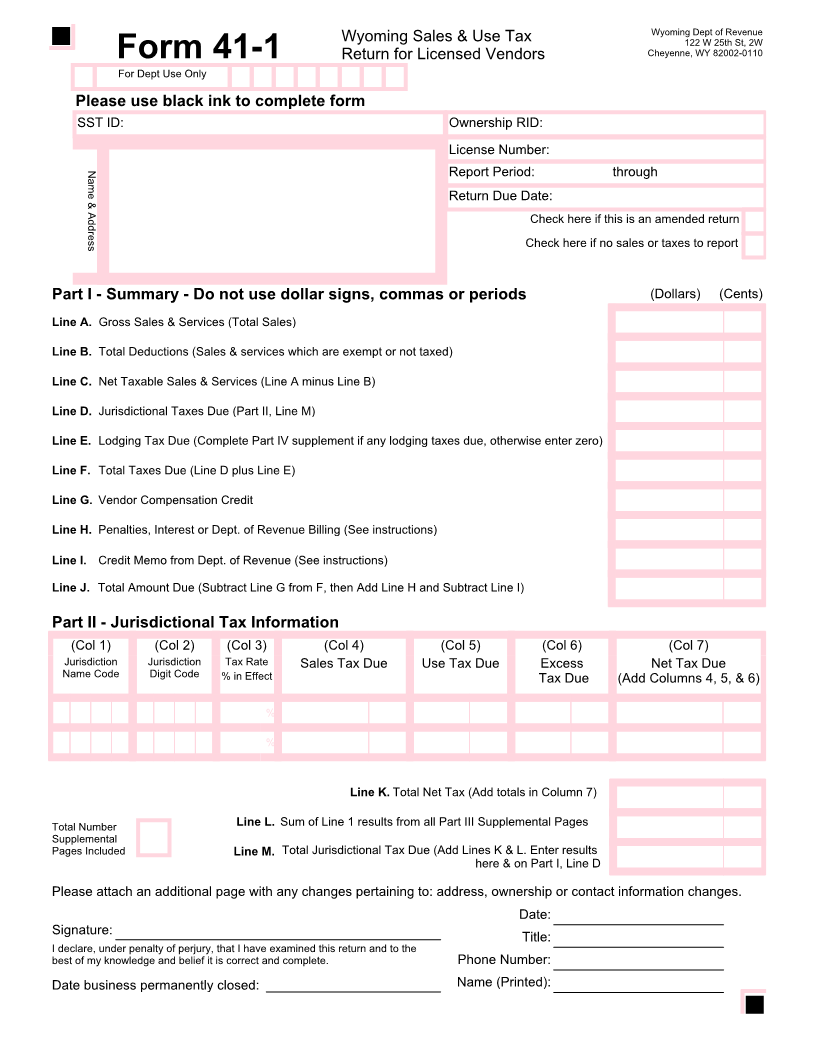

Wyoming Dept of Revenue

Wyoming Sales & Use Tax 122 W 25th St, 2W

Cheyenne, WY 82002-0110

Form 41-1 Return for Licensed Vendors

For Dept Use Only

Please use black ink to complete form

SST ID: Ownership RID:

License Number:

Name & Address

Report Period: through

Return Due Date:

Check here if this is an amended return

Check here if no sales or taxes to report

Part I - Summary - Do not use dollar signs, commas or periods (Dollars) (Cents)

Line A. Gross Sales & Services (Total Sales)

Line B. Total Deductions (Sales & services which are exempt or not taxed)

Line C. Net Taxable Sales & Services (Line A minus Line B)

Line D. Jurisdictional Taxes Due (Part II, Line M)

Line E. Lodging Tax Due (Complete Part IV supplement if any lodging taxes due, otherwise enter zero)

Line F. Total Taxes Due (Line D plus Line E)

Line G. Vendor Compensation Credit

Line H. Penalties, Interest or Dept. of Revenue Billing (See instructions)

Line I. Credit Memo from Dept. of Revenue (See instructions)

Line J. Total Amount Due (Subtract Line G from F, then Add Line H and Subtract Line I)

Part II - Jurisdictional Tax Information

(Col 1) (Col 2) (Col 3) (Col 4) (Col 5) (Col 6) (Col 7)

Jurisdiction Jurisdiction Tax Rate Sales Tax Due Use Tax Due Excess Net Tax Due

Name Code Digit Code % in Effect Tax Due (Add Columns 4, 5, & 6)

%

%

Line K. Total Net Tax (Add totals in Column 7)

Total Number Line L. Sum of Line 1 results from all Part III Supplemental Pages

Supplemental

Pages Included Line M. Total Jurisdictional Tax Due (Add Lines K & L. Enter results

here & on Part I, Line D

Please attach an additional page with any changes pertaining to: address, ownership or contact information changes.

Date:

Signature:

Title:

I declare, under penalty of perjury, that I have examined this return and to the

best of my knowledge and belief it is correct and complete. Phone Number:

Date business permanently closed: Name (Printed):