Enlarge image

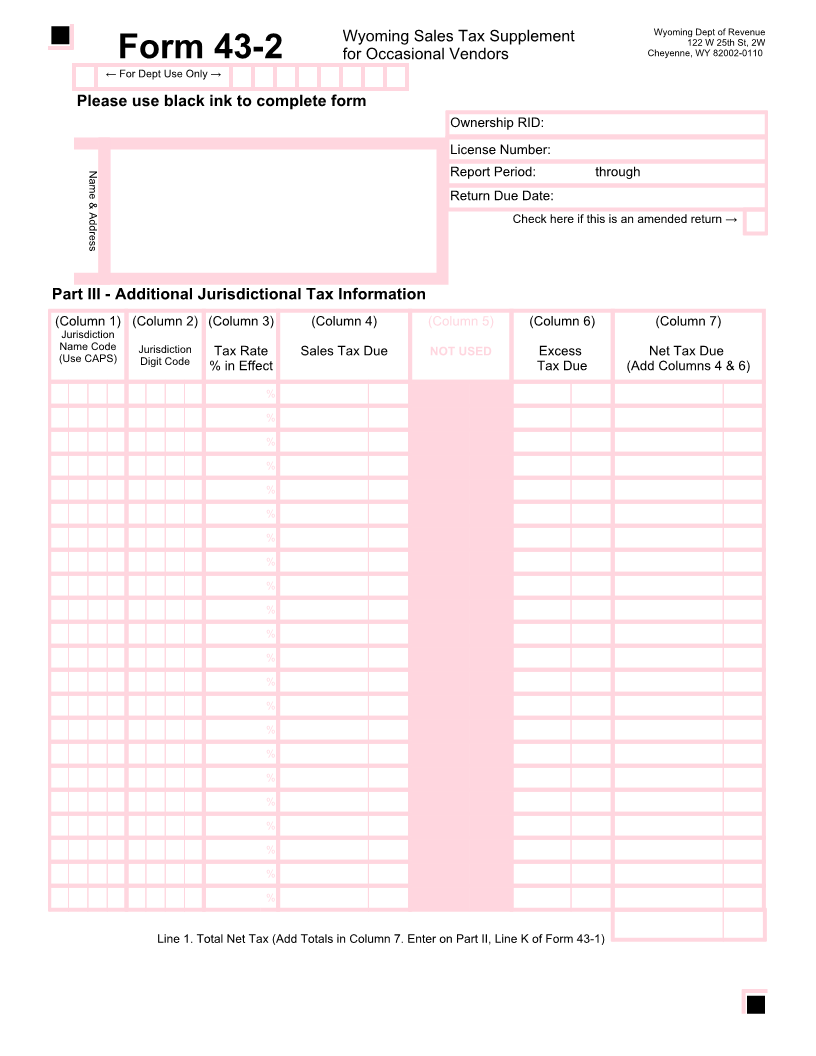

Wyoming Dept of Revenue

Wyoming Sales Tax Supplement 122 W 25th St, 2W

Form 43-2 for Occasional Vendors Cheyenne, WY 82002-0110

ĸ )RU 'HSW 8VH 2QO\ ĺ

Please use black ink to complete form

Ownership RID:

License Number:

Name & Address

Report Period: through

Return Due Date:

&KHFN KHUH LI WKLV LV DQ DPHQGHG UHWXUQ ĺ

Part III - Additional Jurisdictional Tax Information

(Column 1) (Column 2) (Column 3) (Column 4) (Column 5) (Column 6) (Column 7)

Jurisdiction

Name Code Jurisdiction Tax Rate Sales Tax Due NOT USED Excess Net Tax Due

(Use CAPS)

Digit Code % in Effect Tax Due (Add Columns 4 & 6)

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

%

Line 1. Total Net Tax (Add Totals in Column 7. Enter on Part II, Line K of Form 43-1)