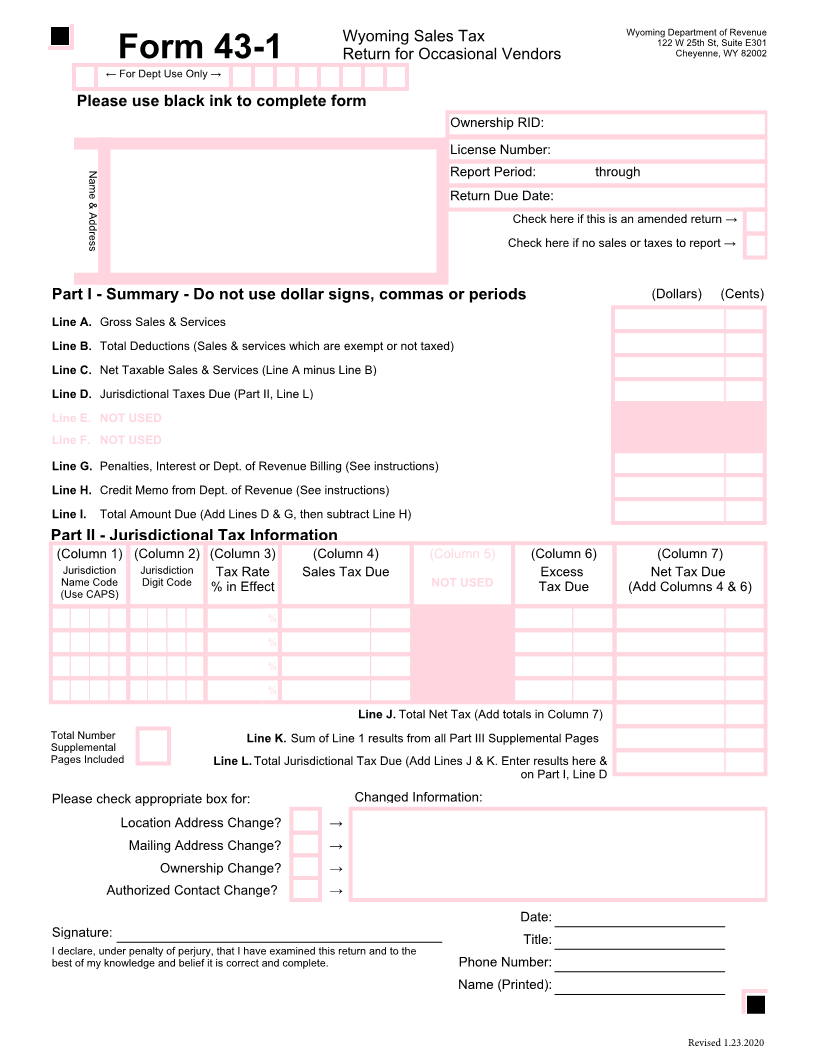

Enlarge image

Wyoming Dep

Wyoming Sales Tax artment of Revenue

122 W 25th St, Suite E301

Form 43-1 Return for Occasional Vendors Cheyenne, WY 82002

Please use black ink to complete form

Ownership RID:

License Number:

Name & Address

Report Period: through

Return Due Date:

Part I - Summary - Do not use dollar signs, commas or periods (Dollars) (Cents)

Line A. Gross Sales & Services

Line B. Total Deductions (Sales & services which are exempt or not taxed)

Line C. Net Taxable Sales & Services (Line A minus Line B)

Line D. Jurisdictional Taxes Due (Part II, Line L)

Line E. NOT USED

Line F. NOT USED

Line G. Penalties, Interest or Dept. of Revenue Billing (See instructions)

Line H. Credit Memo from Dept. of Revenue (See instructions)

Line I. Total Amount Due (Add Lines D & G, then subtract Line H)

Part II - Jurisdictional Tax Information

(Column 1) (Column 2) (Column 3) (Column 4) (Column 5) (Column 6) (Column 7)

Jurisdiction Jurisdiction Tax Rate Sales Tax Due Excess Net Tax Due

Name Code Digit Code % in Effect NOT USED Tax Due (Add Columns 4 & 6)

(Use CAPS)

%

%

%

%

Line J. Total Net Tax (Add totals in Column 7)

Total Number Line K. Sum of Line 1 results from all Part III Supplemental Pages

Supplemental

Pages Included Line L. Total Jurisdictional Tax Due (Add Lines J & K. Enter results here &

on Part I, Line D

Please check appropriate box for: Changed Information:

Location Address Change? ĺ

Mailing Address Change? ĺ

Ownership Change? ĺ

Authorized Contact Change? ĺ

Date:

Signature:

Title:

I declare, under penalty of perjury, that I have examined this return and to the

best of my knowledge and belief it is correct and complete. Phone Number:

Name (Printed):

Revised 1.23.2020