Enlarge image

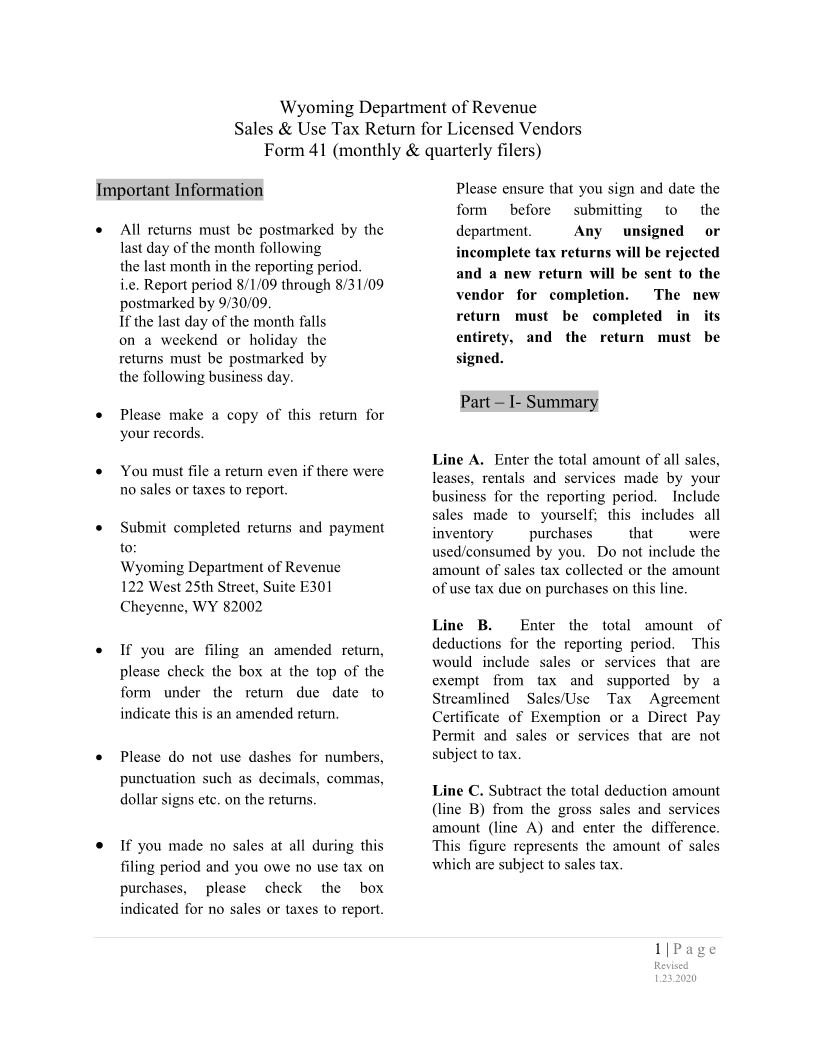

Wyoming Department of Revenue

Sales & Use Tax Return for Licensed Vendors

Form 41 (monthly & quarterly filers)

Important Information Please ensure that you sign and date the

form before submitting to the

All returns must be postmarked by the department. Any unsigned or

last day of the month following incomplete tax returns will be rejected

the last month in the reporting period.

and a new return will be sent to the

i.e. Report period 8/1/09 through 8/31/09

vendor for completion. The new

postmarked by 9/30/09.

If the last day of the month falls return must be completed in its

on a weekend or holiday the entirety, and the return must be

returns must be postmarked by signed.

the following business day.

Part – I- Summary

Please make a copy of this return for

your records.

Line A. Enter the total amount of all sales,

You must file a return even if there were

leases, rentals and services made by your

no sales or taxes to report.

business for the reporting period. Include

sales made to yourself; this includes all

Submit completed returns and payment inventory purchases that were

to: used/consumed by you. Do not include the

Wyoming Department of Revenue amount of sales tax collected or the amount

122 West 25th Street, Suite E301 of use tax due on purchases on this line.

Cheyenne, WY 82002

Line B. Enter the total amount of

If you are filing an amended return, deductions for the reporting period. This

would include sales or services that are

please check the box at the top of the

exempt from tax and supported by a

form under the return due date to Streamlined Sales/Use Tax Agreement

indicate this is an amended return. Certificate of Exemption or a Direct Pay

Permit and sales or services that are not

Please do not use dashes for numbers, subject to tax.

punctuation such as decimals, commas,

Line C. Subtract the total deduction amount

dollar signs etc. on the returns.

(line B) from the gross sales and services

amount (line A) and enter the difference.

If you made no sales at all during this This figure represents the amount of sales

filing period and you owe no use tax on which are subject to sales tax.

purchases, please check the box

indicated for no sales or taxes to report.

1 |Page

Revised

1.23.2020