Enlarge image

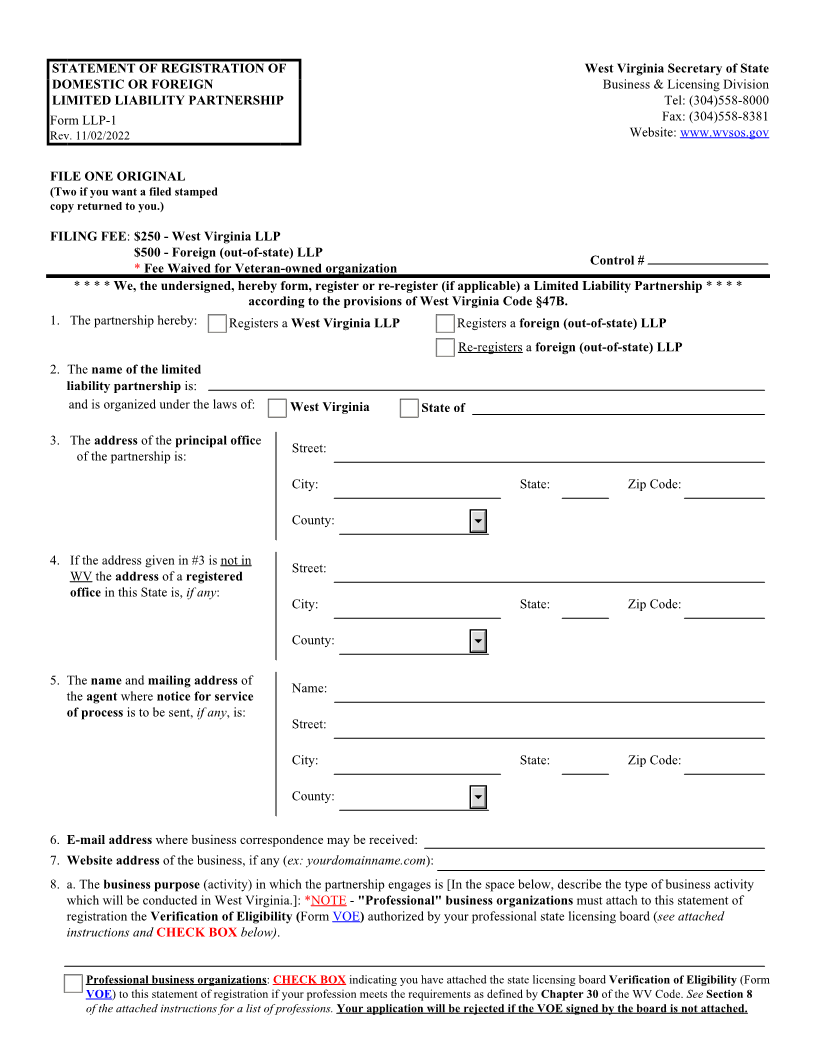

STATEMENT OF REGISTRATION OF West Virginia Secretary of State

DOMESTIC OR FOREIGN Business & Licensing Division

LIMITED LIABILITY PARTNERSHIP Tel: (304)558-8000

Form LLP-1 Fax: (304)558-8381

Rev. 11/02/2022 Website: www.wvsos.gov

FILE ONE ORIGINAL

(Two if you want a filed stamped

copy returned to you.)

FILING FEE:$250 - West Virginia LLP

$500 - Foreign (out-of-state) LLP

Control #

* Fee Waived for Veteran-owned organization

* * * * We, the undersigned, hereby form, register or re-register (if applicable) a Limited Liability Partnership * * * *

according to the provisions of West Virginia Code §47B.

1. The partnership hereby: Registers a West Virginia LLP Registers a foreign (out-of-state) LLP

Re-registers a foreign (out-of-state) LLP

2. The name of the limited

liability partnership is:

and is organized under the laws of: West Virginia State of

3. The address of the principal office

Street:

of the partnership is:

City: State: Zip Code:

County:

4. If the address given in #3 is not in

Street:

WV the address of a registered

office in this State is, if any:

City: State: Zip Code:

County:

5. The name and mailing address of

Name:

the agent where notice for service

of process is to be sent, if any, is:

Street:

City: State: Zip Code:

County:

6. E-mail address where business correspondence may be received:

7. Website address of the business, if any (ex: yourdomainname.com):

8. a. The business purpose (activity) in which the partnership engages is [In the space below, describe the type of business activity

which will be conducted in West Virginia.]: *NOTE - "Professional" business organizations must attach to this statement of

registration the Verification of Eligibility (Form VOE) authorized by your professional state licensing board (see attached

instructions and CHECK BOX below).

Professional business organizations: CHECK BOX indicating you have attached the state licensing board Verification of Eligibility (Form

VOE) to this statement of registration if your profession meets the requirements as defined by Chapter 30 of the WV Code. See Section 8

of the attached instructions for a list of professions. Your application will be rejected if the VOE signed by the board is not attached.