Enlarge image

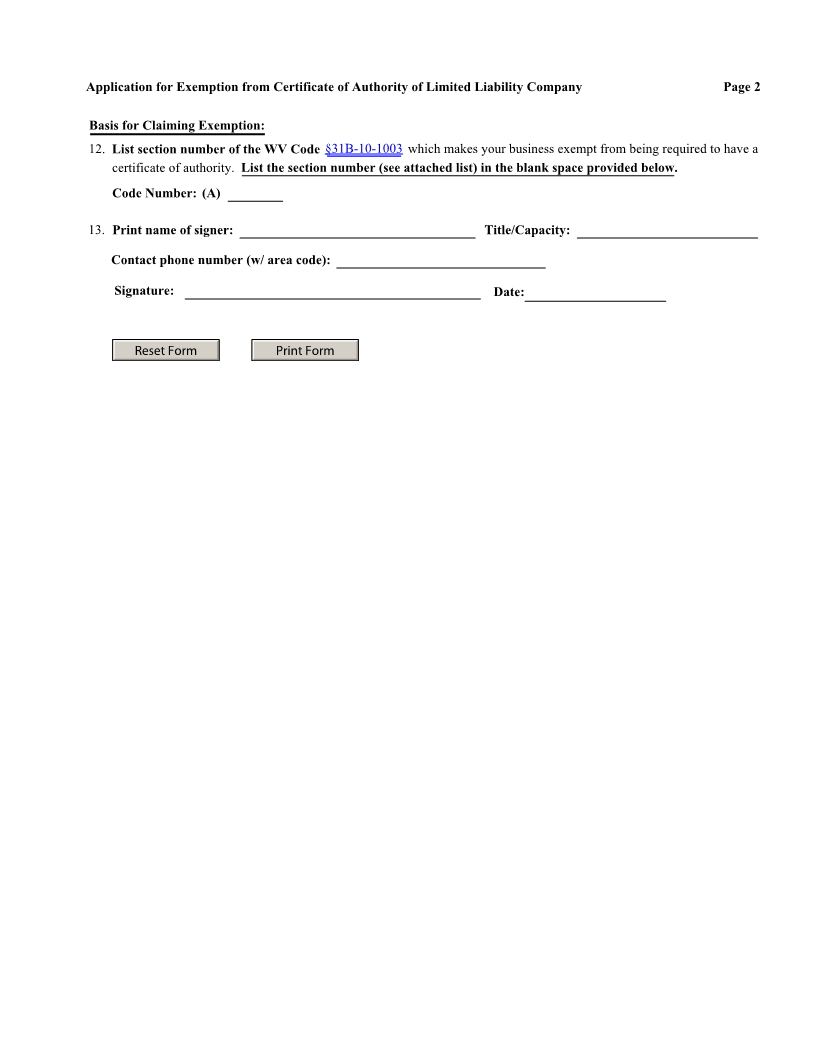

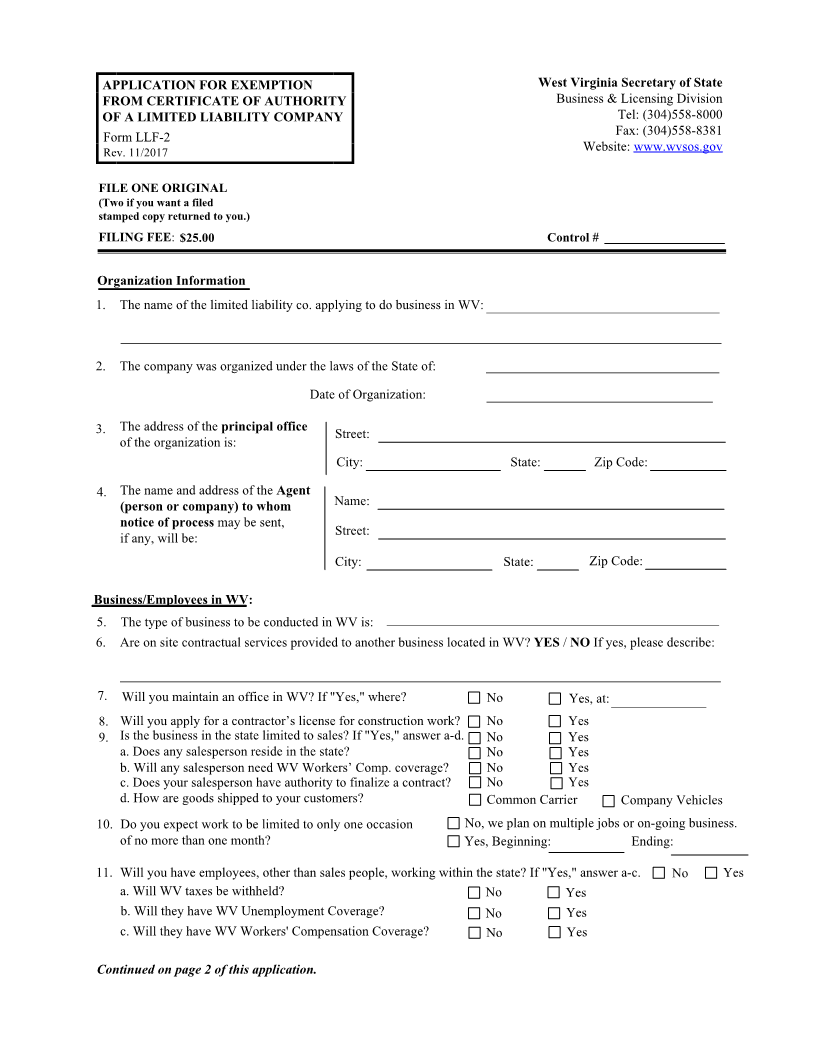

APPLICATION FOR EXEMPTION West Virginia Secretary of State

FROM CERTIFICATE OF AUTHORITY Business & Licensing Division

OF A LIMITED LIABILITY COMPANY Tel: (304)558-8000

Fax: (304)558-8381

Form LLF-2

Rev. 11/2017 Website: www.wvsos.gov

FILE ONE ORIGINAL

(Two if you want a filed

stamped copy returned to you.)

FILING FEE:$25.00 Control #

Organization Information

1. The name of the limited liability co. applying to do business in WV: _________________________________

_____________________________________________________________________________________

2. The company was organized under the laws of the State of: _________________________________

Date of Organization: ________________________________

3. The address of the principal office Street:

of the organization is:

City: State: Zip Code:

4. The name and address of the Agent

(person or company) to whom Name:

notice of process may be sent,

Street:

if any, will be:

City: State: Zip Code:

Business/Employees in WV:

5. The type of business to be conducted in WV is: _______________________________________________

6. Are on site contractual services provided to another business located in WV?YES /NO If yes, please describe:

.

_____________________________________________________________________________________

7. Will you maintain an office in WV? If "Yes," where? No Yes, at: _______________

8. Will you apply for a contractor’s license for construction work? No Yes

9. Is the business in the state limited to sales? If "Yes," answer a-d. No Yes

a. Does any salesperson reside in the state? No Yes

b. Will any salesperson need WV Workers’ Comp. coverage? No Yes

c. Does your salesperson have authority to finalize a contract? No Yes

d. How are goods shipped to your customers? Common Carrier Company Vehicles

10. Do you expect work to be limited to only one occasion No, we plan on multiple jobs or on-going business.

of no more than one month? Yes, Beginning: Ending:

11. Will you have employees, other than sales people, working within the state? If "Yes," answer a-c. No Yes

a. Will WV taxes be withheld? No Yes

b. Will they have WV Unemployment Coverage? No Yes

c. Will they have WV Workers' Compensation Coverage? No Yes

Continued on page 2 of this application.