Enlarge image

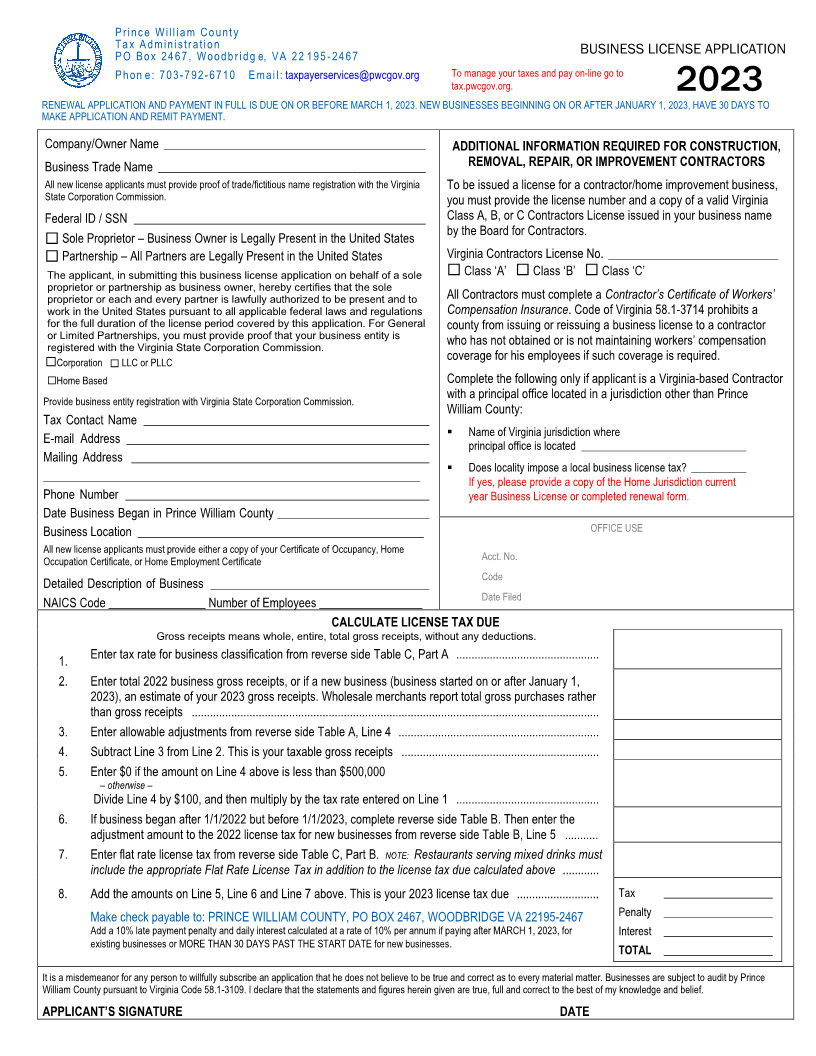

Pri nc e W ill ia m Co unt y

Ta x A dm i ni str ati on BUSINESS LICENSE APPLICATION

PO Box 24 67 , Woodb r i dg e, VA 2 2 195 - 24 67

Phon e : 7 03 -7 92- 67 10 E mai l: taxpayerservices@pwcgov.org To manage your taxes and pay on-line go to

tax.pwcgov.org.

2023

RENEWAL APPLICATION AND PAYMENT IN FULL IS DUE ON OR BEFORE MARCH 1, 2023.NEW BUSINESSES BEGINNING ON OR AFTER JANUARY 1, 202 ,3HAVE 30 DAYS TO

MAKE APPLICATION AND REMIT PAYMENT.

Company/Owner Name ___________________________________________ ADDITIONAL INFORMATION REQUIRED FOR CONSTRUCTION,

Business Trade Name ____________________________________________ REMOVAL, REPAIR, OR IMPROVEMENT CONTRACTORS

All new license applicants must provide proof of trade/fictitious name registration with the Virginia To be issued a license for a contractor/home improvement business,

State Corporation Commission. you must provide the license number and a copy of a valid Virginia

Federal ID / SSN ________________________________________________ Class A, B, or C Contractors License issued in your business name

by the Board for Contractors.

Sole Proprietor –Business Owner is Legally Present in the United States

Partnership –All Partners are Legally Present in the United States Virginia Contractors License No. ____________________________

The applicant, in submitting this business license application on behalf of a sole Class ‘A’ Class ‘B’ Class ‘C’

proprietor or partnership as business owner, hereby certifies that the sole

proprietor or each and every partner is lawfully authorized to be present and to All Contractors must complete a Contractor’s Certificate of Workers’

work in the United States pursuant to all applicable federal laws and regulations Compensation Insurance. Code of Virginia 58.1-3714 prohibits a

for the full duration of the license period covered by this application. For General county from issuing or reissuing a business license to a contractor

or Limited Partnerships, you must provide proof that your business entity is who has not obtained or is not maintaining workers’ compensation

registered with the Virginia State Corporation Commission.

Corporation LLC or PLLC coverage for his employees if such coverage is required.

Home Based Complete the following only if applicant is a Virginia-based Contractor

Provide business entity registration with Virginia State Corporation Commission. with a principal office located in a jurisdiction other than Prince

William County:

Tax Contact Name _______________________________________________

▪ Name of Virginia jurisdiction where

E-mail Address __________________________________________________ principal office is located ______________________________

Mailing Address _________________________________________________

▪ Does locality impose a local business license tax? __________

______________________________________________________________ If yes, please provide a copy of the Home Jurisdiction current

Phone Number __________________________________________________ year Business License or completed renewal form.

Date Business Began in Prince William County _________________________

Business Location _______________________________________________ OFFICE USE

All new license applicants must provide either a copy of your Certificate of Occupancy, Home

Occupation Certificate, or Home Employment Certificate Acct. No.

Code

Detailed Description of Business ____________________________________

Date Filed

NAICS Code ________________ Number of Employees _________________

CALCULATE LICENSE TAX DUE

Gross receipts means whole, entire, total gross receipts, without any deductions.

Enter tax rate for business classification from reverse side Table C, Part A ...............................................

1.

2. Enter total 202 2business gross receipts, or if a new business (business started on or after January 1,

2023), an estimate of your 202 3gross receipts. Wholesale merchants report total gross purchases rather

than gross receipts ......................................................................................................................................

3. Enter allowable adjustments from reverse side Table A, Line 4 ..................................................................

4. Subtract Line 3 from Line 2. This is your taxable gross receipts .................................................................

5. Enter $0 if the amount on Line 4 above is less than $500,000

otherwise– –

Divide Line 4 by $100, and then multiply by the tax rate entered on Line 1 ...............................................

6. If business began after 1/1/202 2but before 1/1/202 ,3complete reverse side Table B. Then enter the

adjustment amount to the 202 2license tax for new businesses from reverse side Table B, Line 5 ...........

7. Enter flat rate license tax from reverse side Table C, Part B. NOTE: Restaurants serving mixed drinks must

include the appropriate Flat Rate License Tax in addition to the license tax due calculated above ............

8. Add the amounts on Line 5, Line 6 and Line 7 above. This is your 20 23license tax due ........................... Tax ____________________

Make check payable to: PRINCE WILLIAM COUNTY, PO BOX 2467, WOODBRIDGE VA 22195-2467 Penalty ____________________

Add a 10% late payment penalty and daily interest calculated at a rate of 10% per annum if paying after MARCH 1, 2023, for Interest ____________________

existing businesses or MORE THAN 30 DAYS PAST THE START DATE for new businesses. TOTAL ____________________

It is a misdemeanor for any person to willfully subscribe an application that he does not believe to be true and correct as to every material matter. Businesses are subject to audit by Prince

William County pursuant to Virginia Code 58.1-3109. I declare that the statements and figures herein given are true, full and correct to the best of my knowledge and belief.

APPLICANT’S SIGNATURE DATE