Enlarge image

County of Fairfax, Virginia

To protect and enrich the quality of life for the people, neighborhoods and diverse communities of Fairfax County

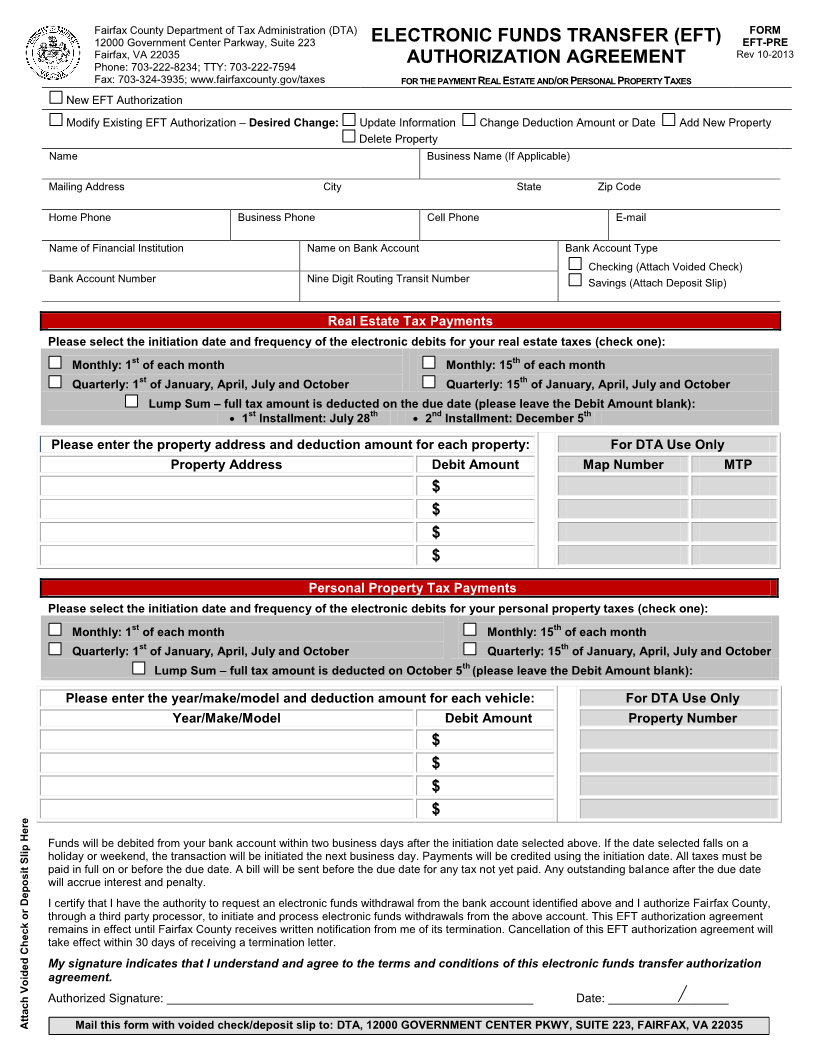

Thank you for your interest in the Fairfax County Electronic Funds Transfer (EFT) program. The EFT program is

an automated payment agreement designed to make paying your taxes easy, convenient, and hassle-free. To

participate, you will need to complete the following form and provide a voided blank check. Completion of this

contract authorizes the Department of Tax Administration (DTA) to deduct agreed upon payment(s) from your

financial institution.

Please read the details below before committing to the program:

th th

1. Real estate tax is due July 28 and December 5 . Personal property tax is due October 5. For vehicles

st th

moved into the county after July 1 , personal property tax is due February 15 of the following calendar

year.

2. You may choose to pay one or more real estate and/or personal property tax accounts. Deductions may be

made monthly, quarterly, or as one lump sum.

3. Electronic deductions will continue in the amount and frequency according to your completed application

form. If you wish to cancel your plan, add or remove property (to include purchase of new vehicle), or

change the amount or frequency of deductions, you will need to notify DTA in writing 30 days in advance

of the requested change.

4. You will receive a bill prior to the due date for any remaining balance not included in your plan. For real

estate, any amount overpaid will be credited to the following installment, unless requested as a refund. For

personal property, any amount overpaid will automatically be returned to you as a refund. If you are unsure

of the amount due or need assistance determining the deduction amount, please call DTA at 703-222-8234.

5. DTA will not automatically send receipts for EFT deductions. Please retain a copy of your bank statement

for receipt confirmation.

Please return completed form and voided check to:

Fairfax County Department of Tax Administration

12000 Government Center Parkway, Suite 223

Fairfax, VA 22035

For further assistance, please call 703-222-8234 or email DTAEFT@Fairfaxcounty.gov

Sincerely,

E. Scott Sizemore, Director

Revenue Collection Division

DEPARTMENT OF TAX ADMINISTRATION(DTA)

REVENUE COLLECTION DIVISION

12000 Government Center Parkway, Suite 223

Fairfax, VA 22035

Phone: 703-222-8234

TTY:711; Fax: 703-324-2699

www.fairfaxcounty.gov/taxes