Enlarge image

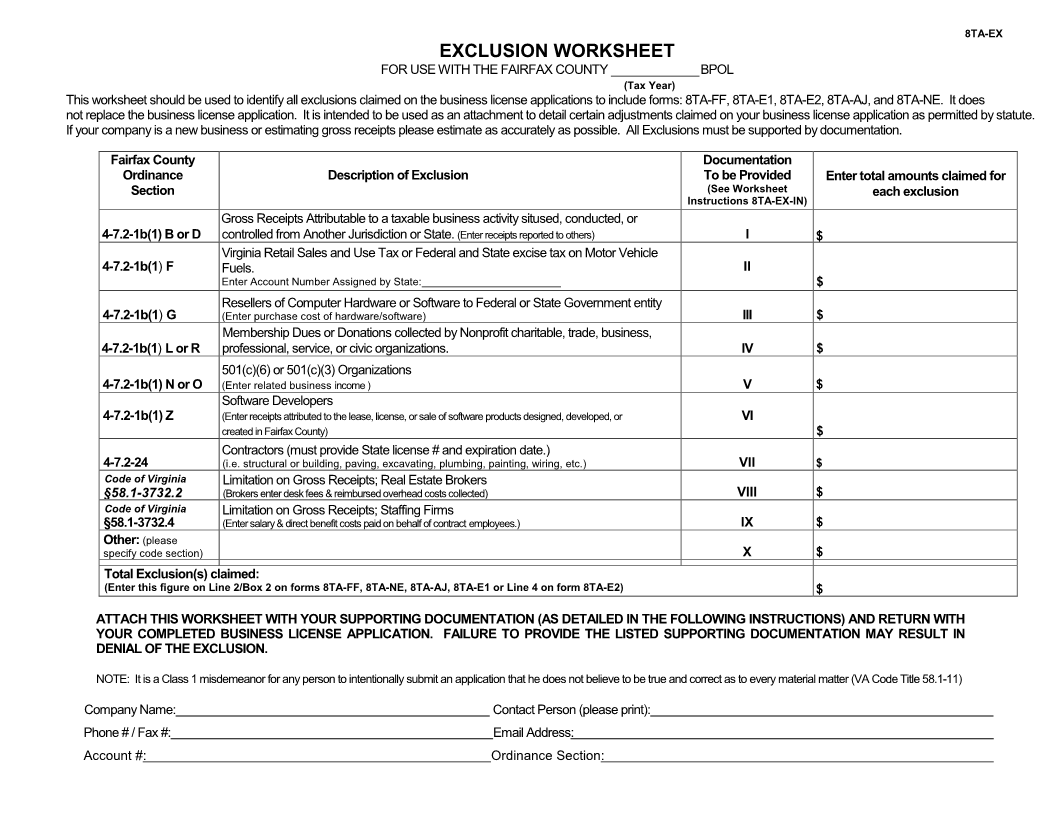

8TA-EX

EXCLUSION WORKSHEET

FOR USE WITH THE FAIRFAX COUNTY ____________ BPOL

(Tax Year)

This worksheet should be used to identify all exclusions claimed on the business license applications to include forms: 8TA-FF, 8TA-E1, 8TA-E2, 8TA-AJ, and 8TA-NE. It does

not replace the business license application. It is intended to be used as an attachment to detail certain adjustments claimed on your business license application as permitted by statute.

If your company is a new business or estimating gross receipts please estimate as accurately as possible. All Exclusions must be supported by documentation.

Fairfax County Documentation

Ordinance Description of Exclusion To be Provided Enter total amounts claimed for

Section (See Worksheet each exclusion

Instructions 8TA-EX-IN)

Gross Receipts Attributable to a taxable business activity sitused, conducted, or

4-7.2-1b(1) B or D controlled from Another Jurisdiction or State. (Enter receipts reported to others) I $

Virginia Retail Sales and Use Tax or Federal and State excise tax on Motor Vehicle

4-7.2-1b(1) F Fuels. II

Enter Account Number Assigned by State: $

Resellers of Computer Hardware or Software to Federal or State Government entity

4-7.2-1b(1) G (Enter purchase cost of hardware/software) III $

Membership Dues or Donations collected by Nonprofit charitable, trade, business,

4-7.2-1b(1) L or R professional, service, or civic organizations. IV $

501(c)(6) or 501(c)(3) Organizations

4-7.2-1b(1) N or O (Enter related business income ) V $

Software Developers

4-7.2-1b(1) Z (Enter receipts attributed to the lease, license, or sale of software products designed, developed, or VI

created in Fairfax County) $

Contractors (must provide State license # and expiration date.)

4-7.2-24 (i.e. structural or building, paving, excavating, plumbing, painting, wiring, etc.) VII $

Code of Virginia Limitation on Gross Receipts; Real Estate Brokers

§58.1-3732.2 (Brokers enter desk fees & reimbursed overhead costs collected) VIII $

Code of Virginia Limitation on Gross Receipts; Staffing Firms

§58.1-3732.4 (Enter salary & direct benefit costs paid on behalf of contract employees.) IX $

Other: (please

specify code section) X $

Total Exclusion(s) claimed:

(Enter this figure on Line 2/Box 2 on forms 8TA-FF, 8TA-NE, 8TA-AJ, 8TA-E1 or Line 4 on form 8TA-E2) $

$

ATTACH THIS WORKSHEET WITH YOUR SUPPORTING DOCUMENTATION (AS DETAILED IN THE FOLLOWING INSTRUCTIONS) AND RETURN WITH

YOUR COMPLETED BUSINESS LICENSE APPLICATION. FAILURE TO PROVIDE THE LISTED SUPPORTING DOCUMENTATION MAY RESULT IN

DENIAL OF THE EXCLUSION.

NOTE: It is a Class 1 misdemeanor for any person to intentionally submit an application that he does not believe to be true and correct as to every material matter (VA Code Title 58.1-11)

Company Name: Contact Person (please print):

Phone # / Fax #: Email Address:

Account #: Ordinance Section: