Enlarge image

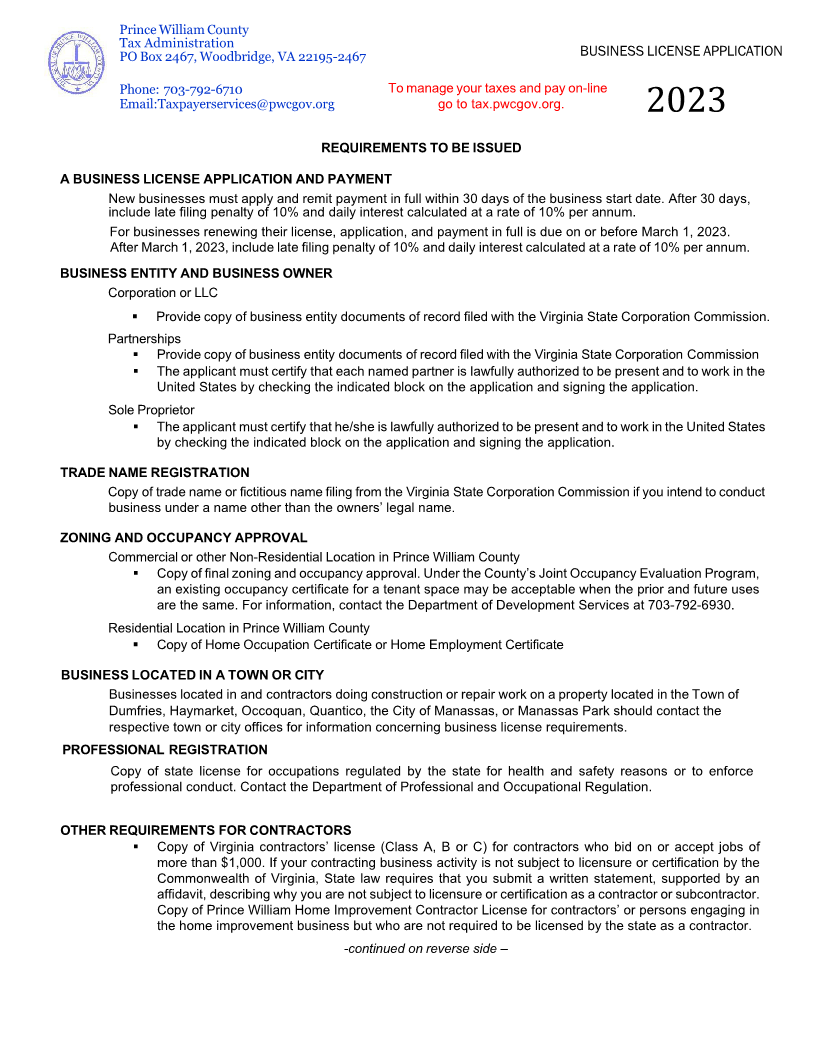

Prince William County

Tax Administration

PO Box 2467, Woodbridge, VA 22195-2467 BUSINESS LICENSE APPLICATION

Phone: 703-792-6710 To manage your taxes and pay on-line

Email:Taxpayerservices@pwcgov.org go to tax.pwcgov.org.

2023

REQUIREMENTS TO BE ISSUED

A BUSINESS LICENSE APPLICATION AND PAYMENT

New businesses must apply and remit payment in full within 30 days of the business start date. After 30 days,

include late filing penalty of 10% and daily interest calculated at a rate of 10% per annum.

For businesses renewing their license, application, and payment in full is due on or before March 1, 2023.

After March 1, 2023, include late filing penalty of 10% and daily interest calculated at a rate of 10% per annum.

BUSINESS ENTITY AND BUSINESS OWNER

Corporation or LLC

Provide copy of business entity documents of record filed with the Virginia State Corporation Commission.

Partnerships

Provide copy of business entity documents of record filed with the Virginia State Corporation Commission

The applicant must certify that each named partner is lawfully authorized to be present and to work in the

United States by checking the indicated block on the application and signing the application.

Sole Proprietor

The applicant must certify that he/she is lawfully authorized to be present and to work in the United States

by checking the indicated block on the application and signing the application.

TRADE NAME REGISTRATION

Copy of trade name or fictitious name filing from the Virginia State Corporation Commission if you intend to conduct

business under a name other than the owners’ legal name.

ZONING AND OCCUPANCY APPROVAL

Commercial or other Non-Residential Location in Prince William County

Copy of final zoning and occupancy approval. Under the County’s Joint Occupancy Evaluation Program,

an existing occupancy certificate for a tenant space may be acceptable when the prior and future uses

are the same. For information, contact the Department of Development Services at 703-792-6930.

Residential Location in Prince William County

Copy of Home Occupation Certificate or Home Employment Certificate

BUSINESS LOCATED IN A TOWN OR CITY

Businesses located in and contractors doing construction or repair work on a property located in the Town of

Dumfries, Haymarket, Occoquan, Quantico, the City of Manassas, or Manassas Park should contact the

respective town or city offices for information concerning business license requirements.

PROFESSIONAL REGISTRATION

Copy of state license for occupations regulated by the state for health and safety reasons or to enforce

professional conduct. Contact the Department of Professional and Occupational Regulation.

OTHER REQUIREMENTS FOR CONTRACTORS

Copy of Virginia contractors’ license (Class A, B or C) for contractors who bid on or accept jobs of

more than $1,000. If your contracting business activity is not subject to licensure or certification by the

Commonwealth of Virginia, State law requires that you submit a written statement, supported by an

affidavit, describing why you are not subject to licensure or certification as a contractor or subcontractor.

Copy of Prince William Home Improvement Contractor License for contractors’ or persons engaging in

the home improvement business but who are not required to be licensed by the state as a contractor.

-continued on reverse side –