Enlarge image

FAIRFAX COUNTY DEPARTMENT OF TAX ADMINISTRATION

2023 BUSINESS RETURN OF TANGIBLE PERSONAL PROPERTY

Account: Federal ID: NAICS:

Owner Name / Trade Name

Mailing Address

Location Address

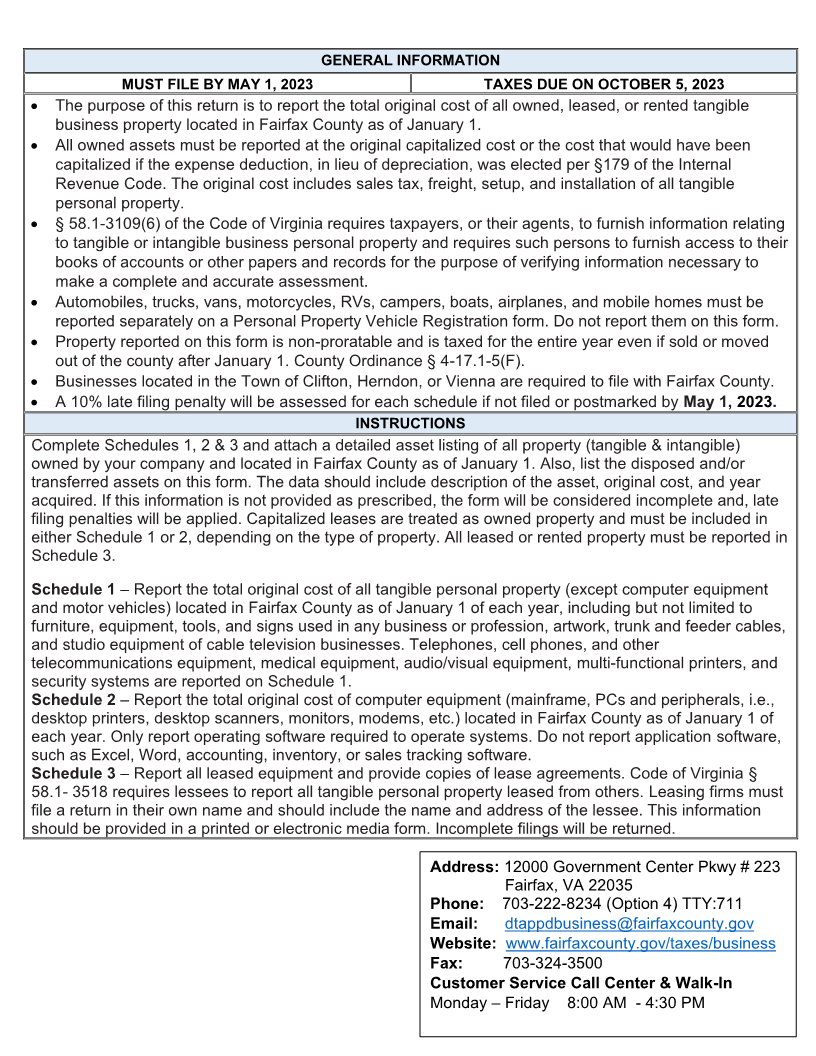

Schedule 1- Furniture & Fixtures Date Business Began:

Report the total original cost by year of all tangible personal property owned and located in the Property #

County as of January 1, 2023. Additional instructions on the back. Detailed Asset List Required.

Year Property Cost Property Cost by Year of Purchase

Total Cost Value

Purchased Reported Disposed Acquired

DO NOT EDIT

2022 VALUES BELOW 80%

2021 70%

2020 60%

2019 50%

2018 40%

2017 30%

2016/Prior 20%

Schedule 2- Computer Equipment

Report the total original cost by year of all computer equipment owned and located in the Property #

County as of January 1, 2023. Additional instructions on the back. Detailed Asset List Required.

Year Property Cost Property Cost by Year of Purchase

Total Cost Value

Purchased Reported Disposed Acquired

DO NOT EDIT

2022 VALUES BELOW 50%

2021 35%

2020 20%

2019 10%

2018/Prior 2%

Schedule 3- Leased Tangible Property (Exclude Real Estate & Vehicles)

List all business tangible personal property leased from others. Capitalized leases are to be reported on Sch. 1 or 2.

Additional instructions on the back. Lease Agreement & Detailed Asset List Required.

Name of

Address

Lessor

Description of

Start Date / / End Date / /

Property

Original Cost Purchase Option Fair Market Value Bargain Buyout

Pursuant to the Code of Virginia Section §58.1-11 it is a Class 1 misdemeanor for any person to willfully subscribe

inaccurate information as true and accurate on this application.

Signature:_________________________ Name/Position: __________________________________

..

Date:____________Email:__________________________________Phone:____________________

Office Use Only Date Received: Reviewed by: