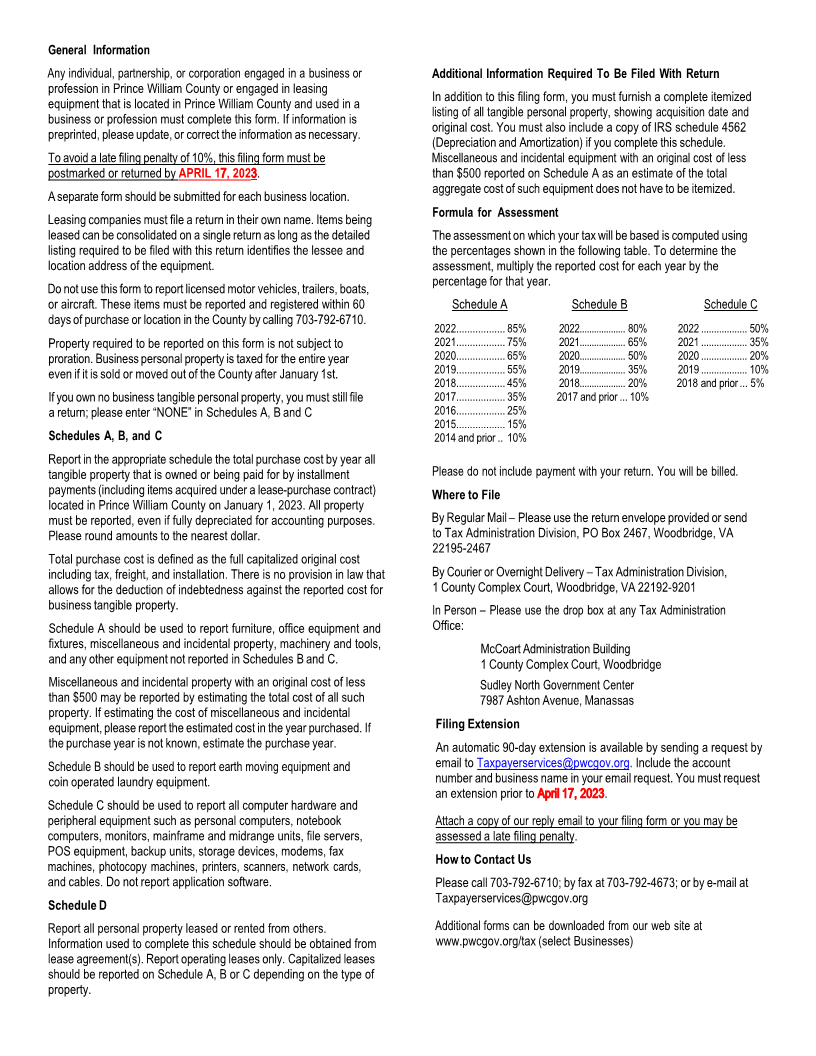

Enlarge image

Prince William County BUSINESS TANGIBLE

Tax Administration Division PROPERTY RETURN

PO Box 2467, Woodbridge, VA 22195- 2467

202 3

RETURN OF BUSINESS TANGIBLE PERSONAL PROPERTYFILE ON OR BEFOREAPRIL 17,

2023TO MANAGE YOUR TAXES AND PAY ONLINE GO TO tax.pwcgov.org

Business Name: OFFICE USE

Contact Person:

BUSINESS LOCATION: Acct. No.

Address:

City, State, Zip: Date Filed

Phone: Late Filing Penalty YES NO

E-mail:

FEIN or SSN:

Business Location:

Business Start Date:

Please read the instructions on the back of this form before completing. Report all personal property located in

Prince William County on January 1, 2023. Do not include licensed vehicles or certified short-term rental

property. Enter amounts rounded to the nearest dollar.

SCHEDULE A SCHEDULE B SCHEDULE C

All tangible personal property owned except Earth moving equipment, coin operated Programmable computer equipment and

that included in Schedules B and C laundry equipment peripherals, and computer equipment and

peripherals used in a data center

Year Purchased Cost of Property Year Purchased Cost of Property Year Purchased Cost of Property

202 2 202 2 202 2

202 1 202 1 202 1

20 20 20 20 20 20

20 19 20 19 20 19

201 8 201 8 201 8and prior

201 7 201 7and prior

201 6

201 5 You must include with your return an itemized list of all personal property

reported showing acquisition date and cost and a copy of IRS Schedule 4562

201 4and prior (Depreciation and Amortization) if you complete this IRS schedule.

SCHEDULE D

Tangible personal property leased or rented from others

Year Put Into Cost

Name of Owner(s) Address of Owner(s) Type of Equipment Use at Purchase

Check if applicable to your business activity –

The property declared in Schedules A, B and C is used in a manufacturing, mining, processing, and reprocessing, radio, or television

broadcasting, dairy business, dry cleaning, or laundry business.

The property declared in Schedules A, B and C is used in a research and development business.

DECLARATION: I declare that the statements and figures herein given, including any accompanying schedules and statements, are true, full,

and correct to the best of my knowledge and belief.

TAXPAYER DAYTIME

SIGNATURE DATE PHONE NO.