Enlarge image

City of Northglenn

11701 Community Center Drive

Northglenn, CO 80233-8061

P: 303.450.8729

F: 303.450.8708

salestax@northglenn.org

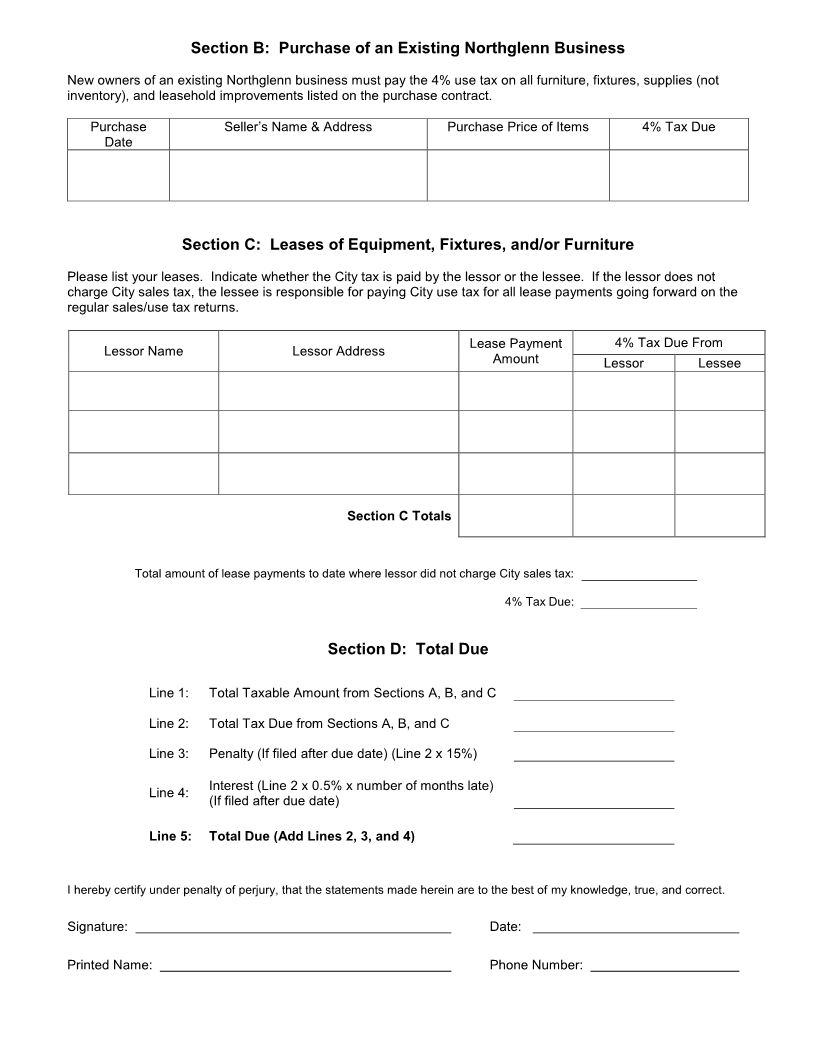

Initial Use Tax Return

This form is to be used by new businesses or organizations located in the City of Northglenn to report initial use tax.

Since use tax applies to all businesses and organizations, please make sure to understand the use tax explained in

the Sales and Use Tax Information Brochure. If no use tax is due, this return must still be filed. If the initial use tax

was reported on a regular sales/use tax already filed, please file this return with a note stating this fact. Please fill

out all applicable sections of this return. Please report all subsequent taxable purchases on the regular sales/use

tax returns.

Business Name

Business Address

Account Number Payment Due Date

Section A: Startup of a New Business

Itemize all purchases made incidental to the startup of the business for furniture, fixtures, and/or supplies (not

inventory) that were purchased from a vendor that did not charge a City sales tax on the item (many vendors

charge State tax but not City tax). If a vendor charged less than 4% city sales tax, the difference of the tax rates

must be multiplied by the taxable amount and reported on the “Excess Tax Due” space below.

Invoice Date Vendor’s Name & Address Taxable Amount 4% Tax Due Excess Tax

Due

Section A Totals

(OVER)