Enlarge image

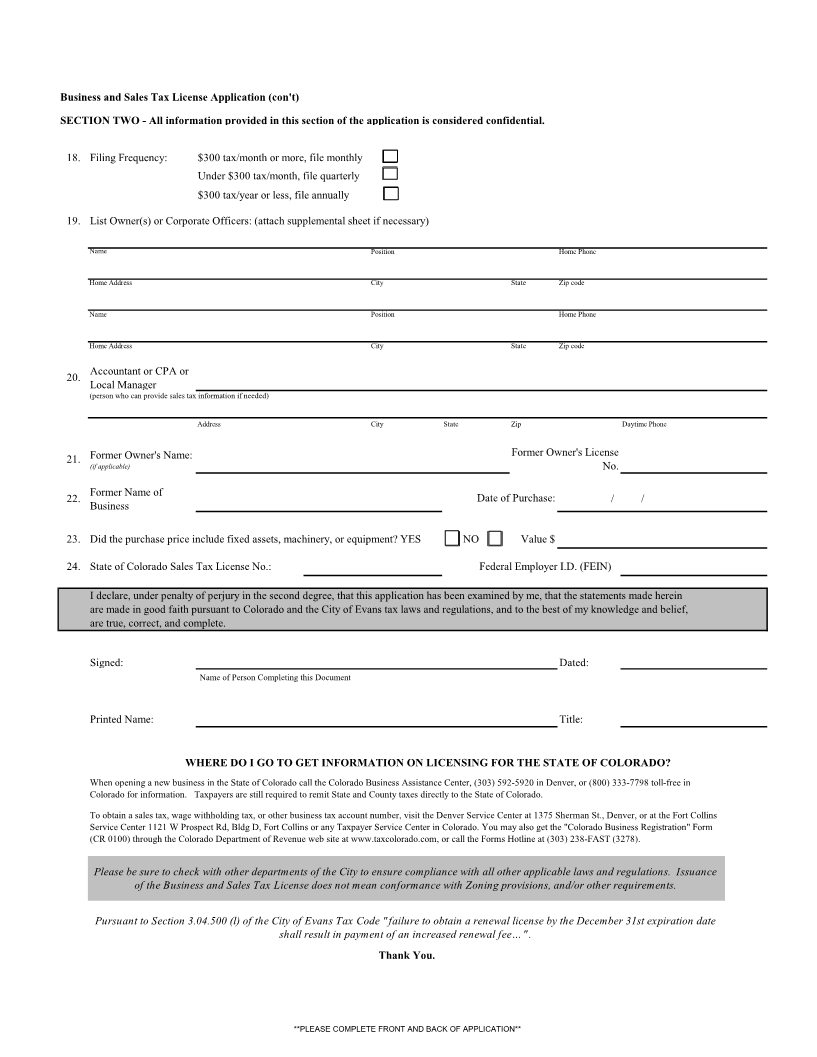

CITY OF EVANS, COLORADO

BUSINESS AND SALES TAX LICENSE APPLICATION

BUSINESS AND SALES TAX LICENSE FEE: $25.00 Annual Renewal Due NOT LATER THAN December 31st

AFTER EXPIRATION DATE, RENEWAL FEES INCREASE TO $50.00

Important: Please keep a copy of this application for your records.

Mail to: For City Use Only

Monthly Sales Tax License

City of Evans Quarterly General Registration

BUSINESS AND SALES TAX OFFICE Annual NAICS Code

1100 37th Street GEO Code

EVANS, CO 80620

(970) 475-1109 Amount Paid:

(970) 330-3472 Fax Check No.

salestax@evanscolorado.gov Property Zoning:

www.evanscolorado.gov Zoning Approval:

PLEASE TYPE OR COMPLETE IN BLACK INK. PLEASE COMPLETE APPLICATION IN FULL

(Illegible and/or incomplete forms may be rejected)

SECTION ONE - All information provided in this section of the application is considered public information and is required to be released upon

public request.

1. Type of Ownership: Sole Proprietor Partnership Corporation Limited Liability Corp. Other

2. Taxpayer Name (Owner, Partners or Corporate Name):

3. Trade Name ("Doing Business As"):

4. Business Address:

Street City State Zip

5. Mailing Address:

Street/ Post Office Box (If Different than Business Address) City State Zip

6. Business Phone No: First Day of Business in Evans: / /

7. Web Site Address: E-mail Address:(required)

8. Nature of Business (Check all that apply): Wholesale Manufacturing Construction Service Retail

Office Only Mail Order Communications/Telecom Finance/Insurance/Real Estate

9. What is your main product/service?

10. Do you sell, distribute, deliver, or grow Medical Marijuana? Yes No

11. Is this business in a: Commercial Building Private Residence (if private residence, fill out Home Occupation Certificate form)

12. If a private residence, do your customer come to your home? Yes No

13. If located in Evans, what are your hours of operation?

14. If located in Evans, approximate sq. ft. of business:

15. If located in Evans, no. of employees (include self): Full Time Part-time

16. Do you have other locations in Evans? Yes No

If "YES", a separate application must be completed per business location.

17. Contact Person:

Address City State Zip Phone Email (required)

**PLEASE COMPLETE FRONT AND BACK OF APPLICATION**