Enlarge image

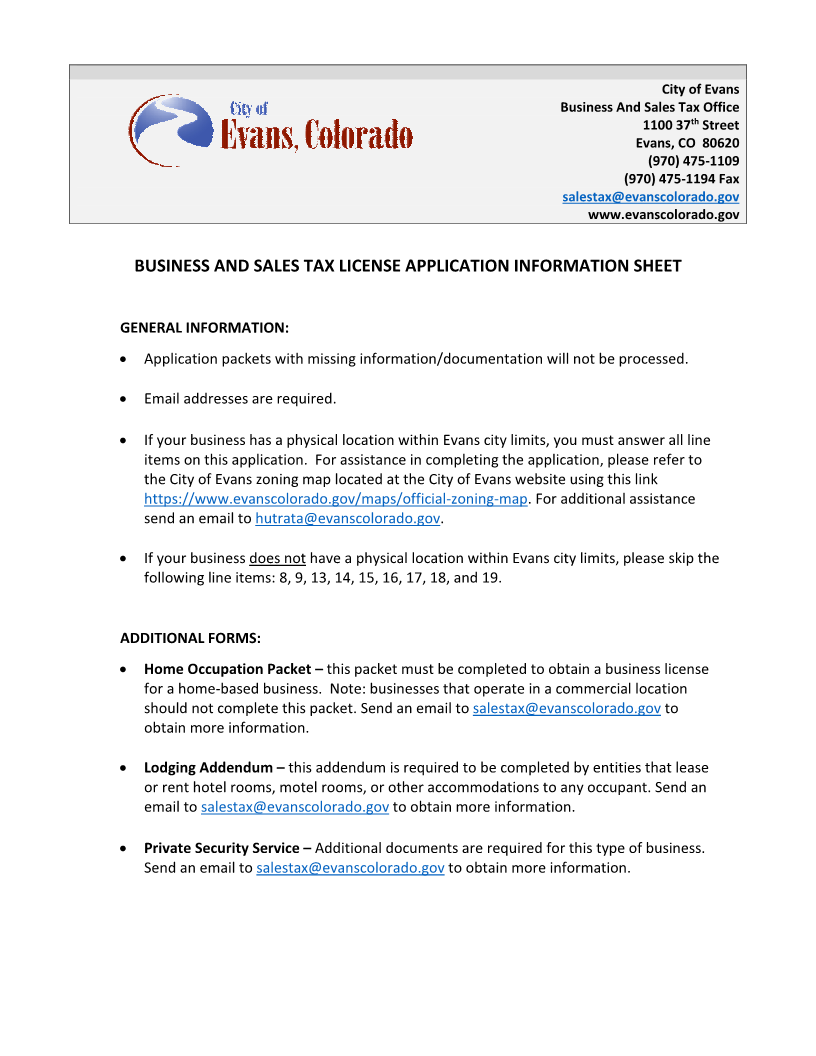

City of Evans

Business And Sales Tax Office

th

1100 37 Street

Evans, CO 80620

(970) 475-1109

(970) 475-1194 Fax

salestax@evanscolorado.gov

www.evanscolorado.gov

BUSINESS AND SALES TAX LICENSE APPLICATION INFORMATION SHEET

GENERAL INFORMATION:

Application packets with missing information/documentation will not be processed.

Email addresses are required.

If your business has a physical location within Evans city limits, you must answer all line

items on this application. For assistance in completing the application, please refer to

the City of Evans zoning map located at the City of Evans website using this link

https://www.evanscolorado.gov/maps/official-zoning-map. For additional assistance

send an email to hutrata@evanscolorado.gov.

If your business does not have a physical location within Evans city limits, please skip the

following line items: 8, 9, 13, 14, 15, 16, 17, 18, and 19.

ADDITIONAL FORMS:

Home Occupation Packet – this packet must be completed to obtain a business license

for a home-based business. Note: businesses that operate in a commercial location

should not complete this packet. Send an email to salestax@evanscolorado.gov to

obtain more information.

Lodging Addendum – this addendum is required to be completed by entities that lease

or rent hotel rooms, motel rooms, or other accommodations to any occupant. Send an

email to salestax@evanscolorado.gov to obtain more information.

Private Security Service – Additional documents are required for this type of business.

Send an email to salestax@evanscolorado.gov to obtain more information.