Enlarge image

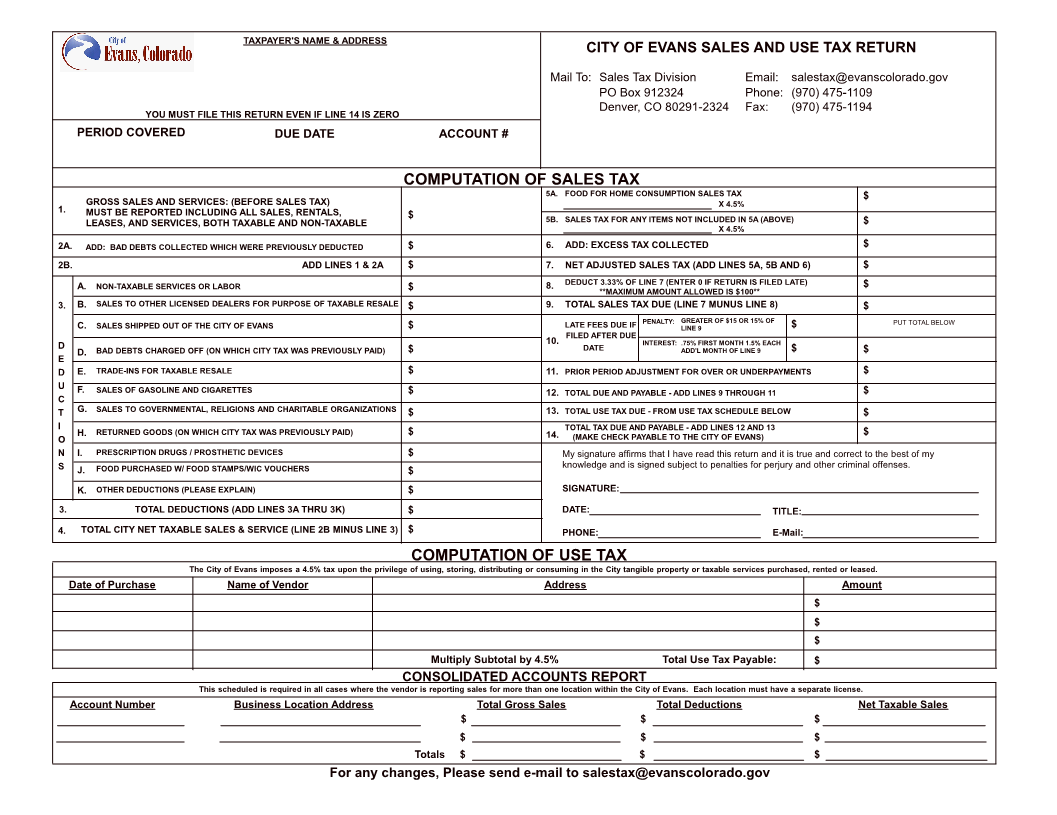

TAXPAYER'S NAME & ADDRESS

CITY OF EVANS SALES AND USE TAX RETURN

Mail To: Sales Tax Division Email: salestax@evanscolorado.gov

PO Box 912324 Phone: (970) 475-1109

YOU MUST FILE THIS RETURN EVEN IF LINE 14 IS ZERO Denver, CO 80291-2324 Fax: (970) 475-1194

PERIOD COVERED DUE DATE ACCOUNT #

COMPUTATION OF SALES TAX

5A. FOOD FOR HOME CONSUMPTION SALES TAX

GROSS SALES AND SERVICES: (BEFORE SALES TAX) $

X 4.5%

1. MUST BE REPORTED INCLUDING ALL SALES, RENTALS, $ 5B. SALES TAX FOR ANY ITEMS NOT INCLUDED IN 5A (ABOVE) $

LEASES, AND SERVICES, BOTH TAXABLE AND NON-TAXABLE X 4.5%

2A. ADD: BAD DEBTS COLLECTED WHICH WERE PREVIOUSLY DEDUCTED $ 6. ADD: EXCESS TAX COLLECTED $

2B. ADD LINES 1 & 2A $ 7. NET ADJUSTED SALES TAX (ADD LINES 5A, 5B AND 6) $

A. NON-TAXABLE SERVICES OR LABOR $ 8. DEDUCT 3.33% OF LINE 7 (ENTER 0 IF RETURN IS FILED LATE) $

**MAXIMUM AMOUNT ALLOWED IS $100**

3. B. SALES TO OTHER LICENSED DEALERS FOR PURPOSE OF TAXABLE RESALE $ 9. TOTAL SALES TAX DUE (LINE 7 MUNUS LINE 8) $

C. SALES SHIPPED OUT OF THE CITY OF EVANS $ LATE FEES DUE IF PENALTY: GREATERLINE 9 OF $15 OR 15% OF $ PUT TOTAL BELOW

10. FILED AFTER DUE INTEREST: .75% FIRST MONTH 1.5% EACH

D D. BAD DEBTS CHARGED OFF (ON WHICH CITY TAX WAS PREVIOUSLY PAID) $ DATE ADD'L MONTH OF LINE 9 $ $

E

D E. TRADE-INS FOR TAXABLE RESALE $ 11. PRIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENTS $

U F. SALES OF GASOLINE AND CIGARETTES $ 12. TOTAL DUE AND PAYABLE - ADD LINES 9 THROUGH 11 $

C

T G. SALES TO GOVERNMENTAL, RELIGIONS AND CHARITABLE ORGANIZATIONS $ 13. TOTAL USE TAX DUE - FROM USE TAX SCHEDULE BELOW $

TOTAL TAX DUE AND PAYABLE - ADD LINES 12 AND 13

I H. RETURNED GOODS (ON WHICH CITY TAX WAS PREVIOUSLY PAID) $ 14. (MAKE CHECK PAYABLE TO THE CITY OF EVANS) $

O

N I. PRESCRIPTION DRUGS / PROSTHETIC DEVICES $ My signature affirms that I have read this return and it is true and correct to the best of my

S J. FOOD PURCHASED W/ FOOD STAMPS/WIC VOUCHERS $ knowledge and is signed subject to penalties for perjury and other criminal offenses.

K. OTHER DEDUCTIONS (PLEASE EXPLAIN) $ SIGNATURE:

3. TOTAL DEDUCTIONS (ADD LINES 3A THRU 3K) $ DATE: TITLE:

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS LINE 3) $ PHONE: E-Mail:

COMPUTATION OF USE TAX

The City of Evans imposes a .5%4tax upon the privilege of using, storing, distributing or consuming in the City tangible property or taxable services purchased, rented or leased.

Date of Purchase Name of Vendor Address Amount

$

$

$

Multiply Subtotal by 4.5% Total Use Tax Payable: $

CONSOLIDATED ACCOUNTS REPORT

This scheduled is required in all cases where the vendor is reporting sales for more than one location within the City of Evans. Each location must have a separate license.

Account Number Business Location Address Total Gross Sales Total Deductions Net Taxable Sales

$ $ $

$ $ $

Totals $ $ $

For any changes, Please send e-mail to salestax@evanscolorado.gov