Enlarge image

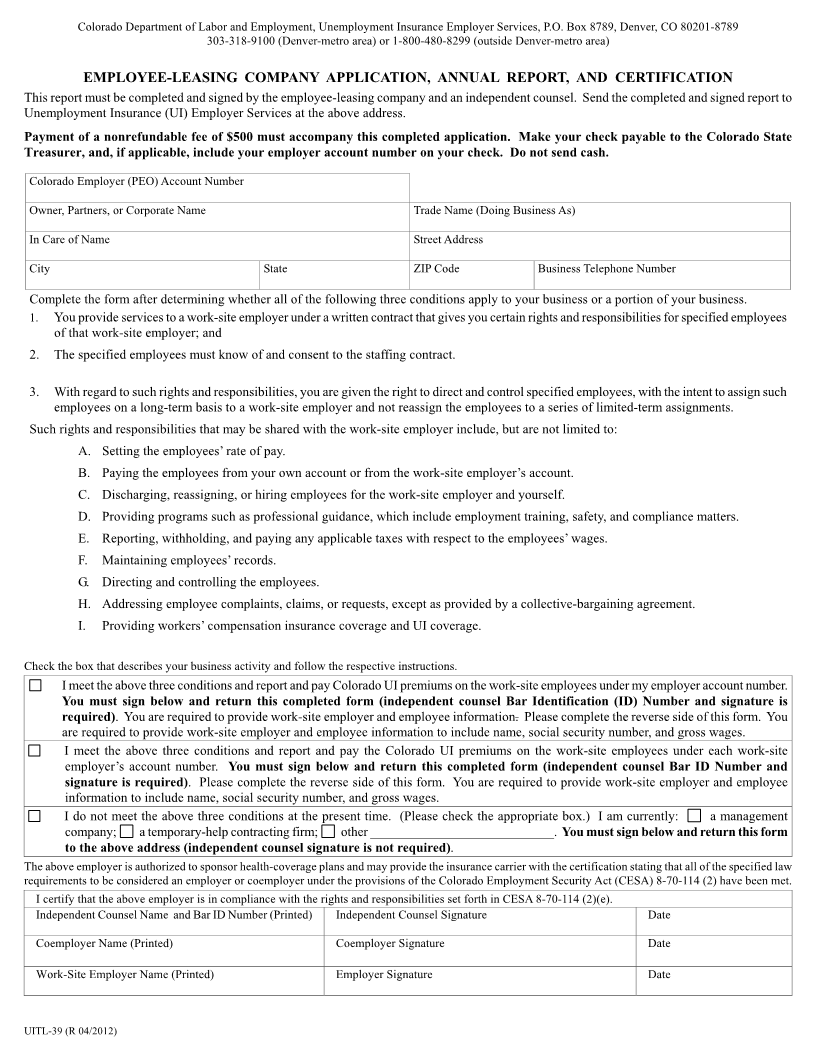

Colorado Department of Labor and Employment, Unemployment Insurance Employer Services, P.O. Box 8789, Denver, CO 80201-8789

303-318-9100 (Denver-metro area) or 1-800-480-8299 (outside Denver-metro area)

EMPLOYEE-LEASING COMPANY APPLICATION, ANNUAL REPORT, AND CERTIFICATION

This report must be completed and signed by the employee-leasing company and an independent counsel. Send the completed and signed report to

Unemployment Insurance (UI) Employer Services at the above address.

Payment of a nonrefundable fee of $500 must accompany this completed application. Make your check payable to the Colorado State

Treasurer, and, if applicable, include your employer account number on your check. Do not send cash.

Colorado Employer (PEO) Account Number

Owner, Partners, or Corporate Name Trade Name (Doing Business As)

In Care of Name Street Address

City State ZIP Code Business Telephone Number

Complete the form after determining whether all of the following three conditions apply to your business or a portion of your business.

1. You provide services to a work-site employer under a written contract that gives you certain rights and responsibilities for specified employees

of that work-site employer; and

2. The specified employees must know of and consent to the staffing contract.

3. With regard to such rights and responsibilities, you are given the right to direct and control specified employees, with the intent to assign such

employees on a long-term basis to a work-site employer and not reassign the employees to a series of limited-term assignments.

Such rights and responsibilities that may be shared with the work-site employer include, but are not limited to:

A. Setting the employees’ rate of pay.

B. Paying the employees from your own account or from the work-site employer’s account.

C. Discharging, reassigning, or hiring employees for the work-site employer and yourself.

D. Providing programs such as professional guidance, which include employment training, safety, and compliance matters.

E. Reporting, withholding, and paying any applicable taxes with respect to the employees’ wages.

F. Maintaining employees’ records.

G. Directing and controlling the employees.

H. Addressing employee complaints, claims, or requests, except as provided by a collective-bargaining agreement.

I. Providing workers’ compensation insurance coverage and UI coverage.

Check the box that describes your business activity and follow the respective instructions.

I meet the above three conditions and report and pay Colorado UI premiums on the work-site employees under my employer account number.

You must sign below and return this completed form (independent counsel Bar Identification (ID) Number and signature is

required). You are required to provide work-site employer and employee information. Please complete the reverse side of this form. You

are required to provide work-site employer and employee information to include name, social security number, and gross wages.

I meet the above three conditions and report and pay the Colorado UI premiums on the work-site employees under each work-site

employer’s account number. You must sign below and return this completed form (independent counsel Bar ID Number and

signature is required). Please complete the reverse side of this form. You are required to provide work-site employer and employee

information to include name, social security number, and gross wages.

I do not meet the above three conditions at the present time. (Please check the appropriate box.) I am currently: a management

company; a temporary-help contracting firm; other ____________________________. You must sign below and return this form

to the above address (independent counsel signature is not required).

The above employer is authorized to sponsor health-coverage plans and may provide the insurance carrier with the certification stating that all of the specified law

requirements to be considered an employer or coemployer under the provisions of the Colorado Employment Security Act (CESA) 8-70-114 (2) have been met.

I certify that the above employer is in compliance with the rights and responsibilities set forth in CESA 8-70-114 (2)(e).

Independent Counsel Name and Bar ID Number (Printed) Independent Counsel Signature Date

Coemployer Name (Printed) Coemployer Signature Date

Work-Site Employer Name (Printed) Employer Signature Date

UITL-39 (R 04/2012)