Enlarge image

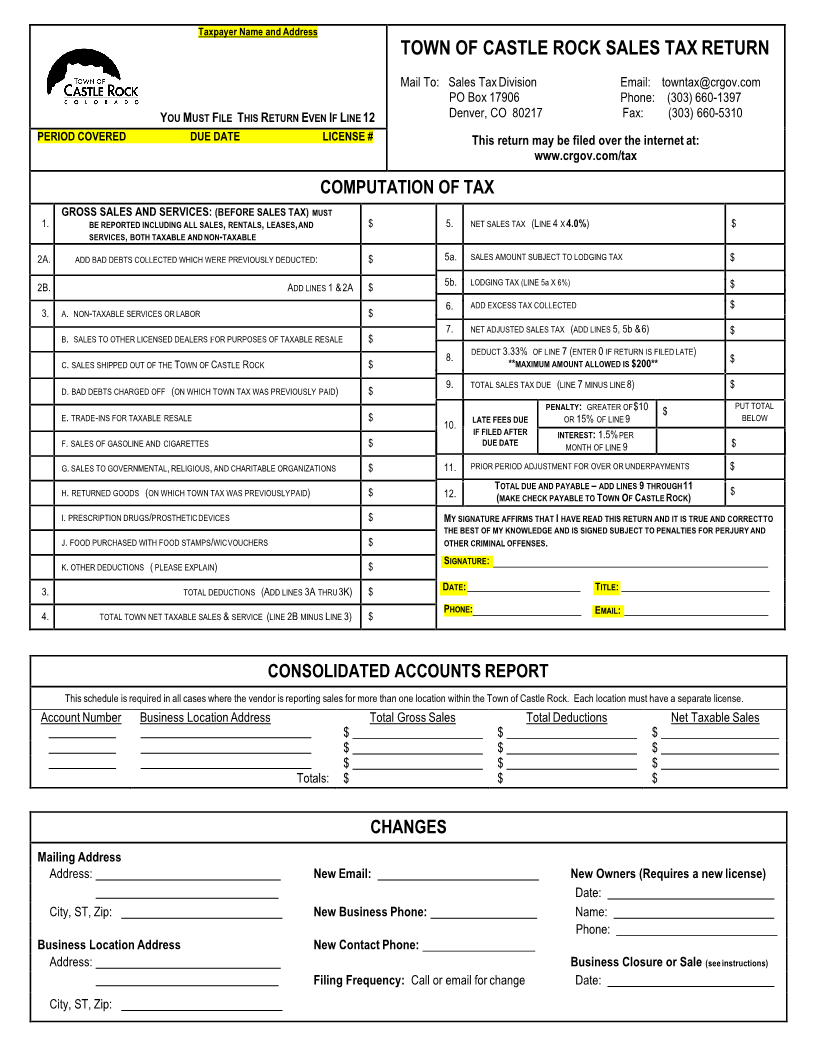

Taxpayer Name and Address

TOWN OF CASTLE ROCK SALES TAX RETURN

Mail To: Sales Tax Division Email: towntax@crgov.com

PO Box 17906 Phone: (303) 660-1397

YOU MUST ILE F HIS T ETURN R VEN EF INEI L 12 Denver, CO 80217 Fax: (303) 660-5310

PERIOD COVERED DUE DATE LICENSE # This return may be filed over the internet at:

www.crgov.com/tax

COMPUTATION OF TAX

GROSS SALES AND SERVICES: (BEFORE SALES TAX) MUST

1. BE REPORTED INCLUDING ALL SALES RENTALS, LEASES, AND, $ 5. NET SALES TAX (LINE X4 4.0%) $

SERVICES,BOTH TAXABLE AND NON TAXABLE-

2A. ADD BAD DEBTS COLLECTED WHICH WERE PREVIOUSLY DEDUCTED: $ 5 .a SALES AMOUNT SUBJECT TO LODGING TAX $

2B. ADD LINES 1 & 2A $ 5 .b LODGING TAX (LINE 5a X 6%) $

6. ADD EXCESS TAX COLLECTED $

3. A. NON TAXABLE- SERVICES OR LABOR $

7. NET ADJUSTED SALES TAX (ADD LINES 5, 5b & 6) $

B. SALES TO OTHER LICENSED DEALERS ORFPURPOSES OF TAXABLE RESALE $

DEDUCT3.33% OF LINE7 (ENTER 0IF RETURN IS FILED LATE )

8. **MAXIMUM AMOUNT ALLOWED IS $200** $

C.SALES SHIPPED OUT OF THE OWNT OF ASTLE C OCKR $

TOTAL SALES TAX DUE (LINE 7MINUS LINE 8) $

D.BAD DEBTS CHARGED OFF ON( WHICH TOWN TAX WAS PREVIOUSLY PAID ) $ 9.

PENALTY: GREATER OF $10 PUT TOTAL

E.TRADE INS- FOR TAXABLE RESALE $ LATE FEES DUE OR15%OF LINE9 $$ BELOW

10. IF FILED AFTER INTEREST: 1.5% PER

F.SALES OF GASOLINE AND CIGARETTES $ DUE DATE MONTH OF LINE9 $

G.SALES TO GOVERNMENTAL RELIGIOUS, AND, CHARITABLE ORGANIZATIONS $ 11. PRIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENTS $

TOTAL DUE AND PAYABLE ADD– LINES THROUGH9 11

H.RETURNED GOODS ON( WHICH TOWN TAX WAS PREVIOUSLY PAID ) $ 12. (MAKE CHECK PAYABLE TO OWN T F OASTLE C OCKR ) $

I.PRESCRIPTION DRUGS PROSTHETIC/ DEVICES $ MY SIGNATURE AFFIRMS THAT IHAVE READ THIS RETURN AND IT IS TRUE AND CORRECT TO

THE BEST OF MY KNOWLEDGE AND IS SIGNED SUBJECT TO PENALTIES FOR PERJURY AND

J.FOOD PURCHASED WITH FOOD STAMPS WIC/ VOUCHERS $ OTHER CRIMINAL OFFENSES .

K.OTHER DEDUCTIONS PLEASE( EXPLAIN) $ SIGNATURE:

3. TOTAL DEDUCTIONS (ADD LINES 3A THRU 3K) $ DATE: TITLE:

4. TOTAL TOWN NET TAXABLE SALES &SERVICE LINE( 2BMINUS LINE 3) $ PHONE: EMAIL:

CONSOLIDATED ACCOUNTS REPORT

This schedule is required in all cases where the vendor is reporting sales for more than one location within the Town of Castle Rock. Each location must have a separate license.

Account Number Business Location Address Total Gross Sales Total Deductions Net Taxable Sales

$ $ $

$ $ $

$ $ $

Totals: $ $ $

CHANGES

Mailing Address

Address: New Email: New Owners (Requires a new license)

Date:

City, ST, Zip: New Business Phone: Name:

Phone:

Business Location Address New Contact Phone:

Address: Business Closure or Sale (see instructions)

Filing Frequency: Call or email for change Date:

City, ST, Zip: