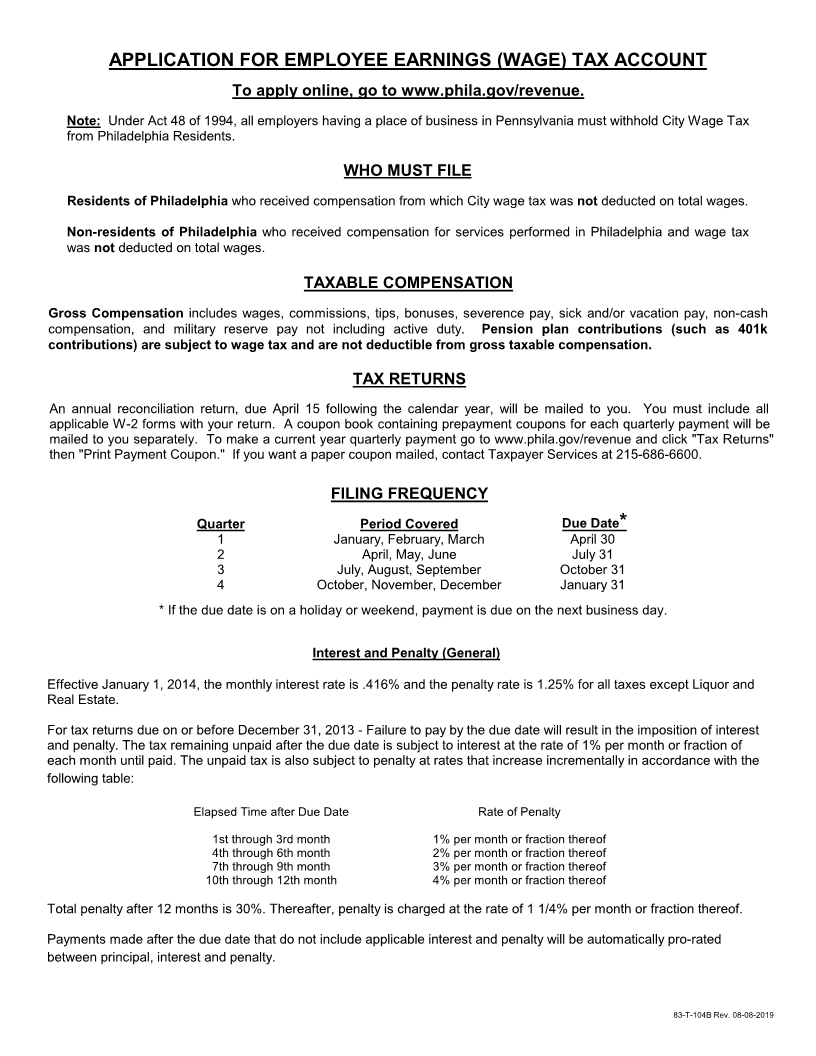

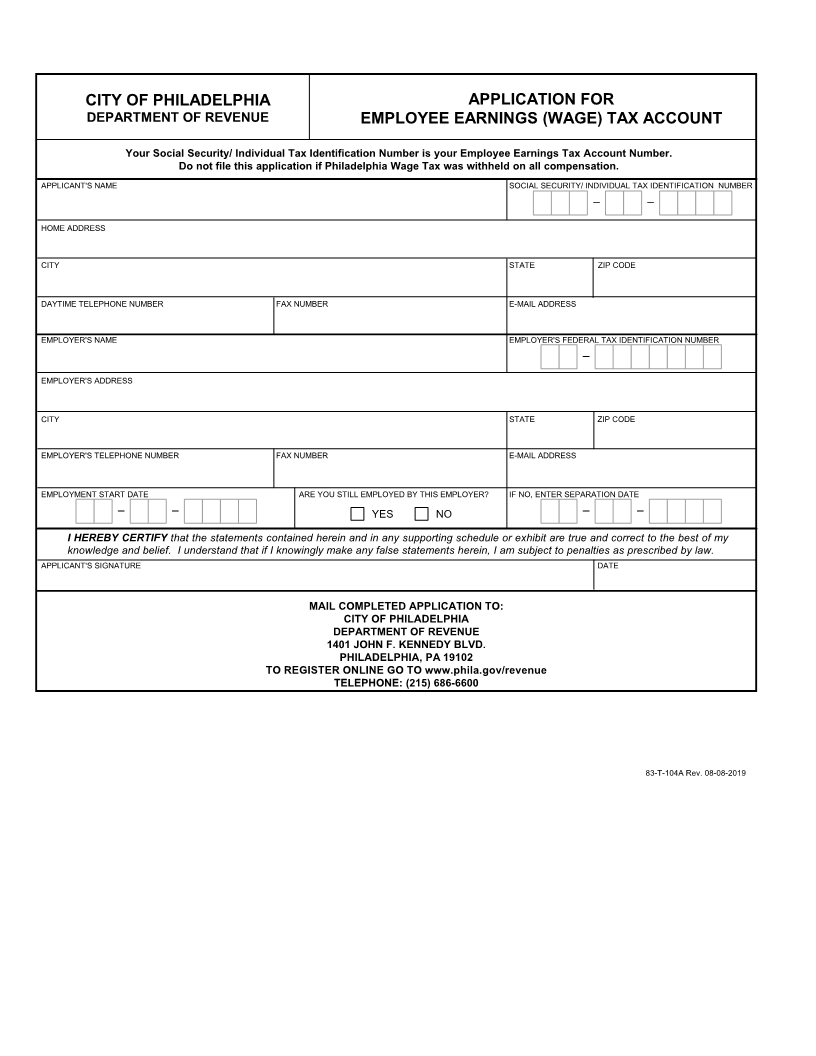

Enlarge image

CITY OF PHILADELPHIA APPLICATION FOR

DEPARTMENT OF REVENUE EMPLOYEE EARNINGS (WAGE) TAX ACCOUNT

Your Social Security/ Individual Tax Identification Number is your Employee Earnings Tax Account Number.

Do not file this application if Philadelphia Wage axTwas withheld on all compensation.

APPLICANT'S NAME SOCIAL SECURITY/ INDIVIDUAL TAX IDENTIFICATION NUMBER

--

HOME ADDRESS

CITY STATE ZIP CODE

DAYTIME TELEPHONE NUMBER FAX NUMBER E-MAIL ADDRESS

EMPLOYER'S NAME EMPLOYER'S FEDERAL TAX IDENTIFICATION NUMBER

-

EMPLOYER'S ADDRESS

CITY STATE ZIP CODE

EMPLOYER'S TELEPHONE NUMBER FAX NUMBER E-MAIL ADDRESS

EMPLOYMENT START DATE ARE YOU STILL EMPLOYED BY THIS EMPLOYER? IF NO, ENTER SEPARATION DATE

-- YES NO --

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my

knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to penalties as prescribed by law.

APPLICANT'S SIGNATURE DATE

MAIL COMPLETED APPLICATION TO:

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

1401 JOHN F. KENNEDY BLVD.

PHILADELPHIA, PA 19102

TO REGISTER ONLINE GO TO www.phila.gov/revenue

TELEPHONE: (215)686-6600

83-T-104A Rev. 08-08-2019