Enlarge image

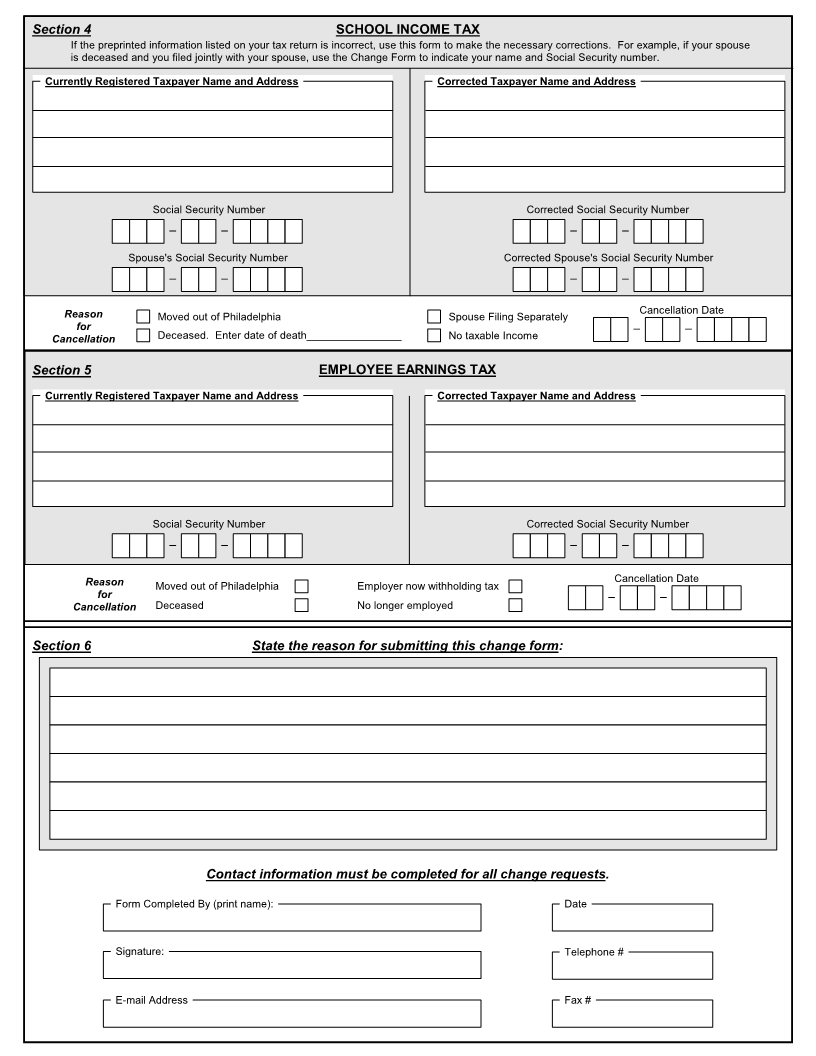

CITY OF PHILADELPHIA DEPARTMENT OF REVENUE

CHANGE FORM

USE TO UPDATE ACCOUNT INFORMATION OR TO CANCEL A TAX LIABILITY

MAIL THE COMPLETED CHANGE FORM TO:

CITY OF PHILADELPHIA, DEPARTMENT OF REVENUE, P.O. BOX 1410, PHILADELPHIA, PA, 19105-1410

OR FAX TO: 215-686-6635

PHONE: 215-686-6600 E-MAIL: revenue@phila.gov INTERNET: www.phila.gov/revenue

Businesses complete Sections 1 and 2 to add a tax, request payment coupons or to close a business account. For a change

of entity you must cancel your account and apply for a new Tax Account Number and Commercial Activity License. Contact

the department to obtain an application or to register on-line visit our web site. For property subject to Use and Occupancy

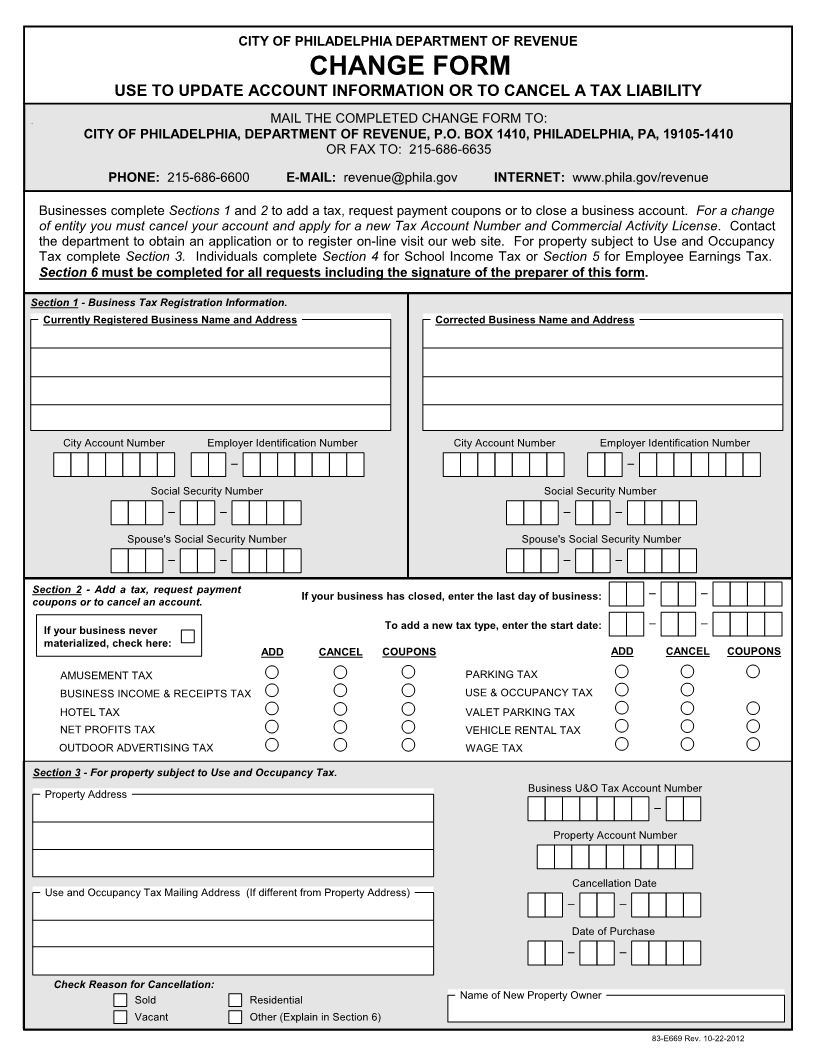

Tax complete Section 3. Individuals complete Section 4 for School Income Tax or Section 5 for Employee Earnings Tax.

Section 6 must be completed for all requests including the signature of the preparer of this form.

Section 1 - Business Tax Registration Information.

Currently Registered Business Name and Address Corrected Business Name and Address

City Account Number Employer Identification Number City Account Number Employer Identification Number

- -

Social Security Number Social Security Number

-- --

Spouse's Social Security Number Spouse's Social Security Number

-- --

Section 2 - Add a tax, request payment If your business has closed, enter the last day of business:

coupons or to cancel an account. --

If your business never To add a new tax type, enter the start date: --

materialized, check here:

ADD CANCEL COUPONS ADD CANCEL COUPONS

AMUSEMENT TAX PARKING TAX

BUSINESS INCOME & RECEIPTS TAX USE & OCCUPANCY TAX

HOTEL TAX VALET PARKING TAX

NET PROFITS TAX VEHICLE RENTAL TAX

OUTDOOR ADVERTISING TAX WAGE TAX

Section 3 - For property subject to Use and Occupancy Tax.

Property Address Business U&O Tax Account Number

-

Property Account Number

Cancellation Date

Use and Occupancy Tax Mailing Address (If different from Property Address)

--

Date of Purchase

--

Check Reason for Cancellation:

Sold Residential Name of New Property Owner

Vacant Other (Explain in Section 6)

83-E669 Rev. 10-22-2012