Enlarge image

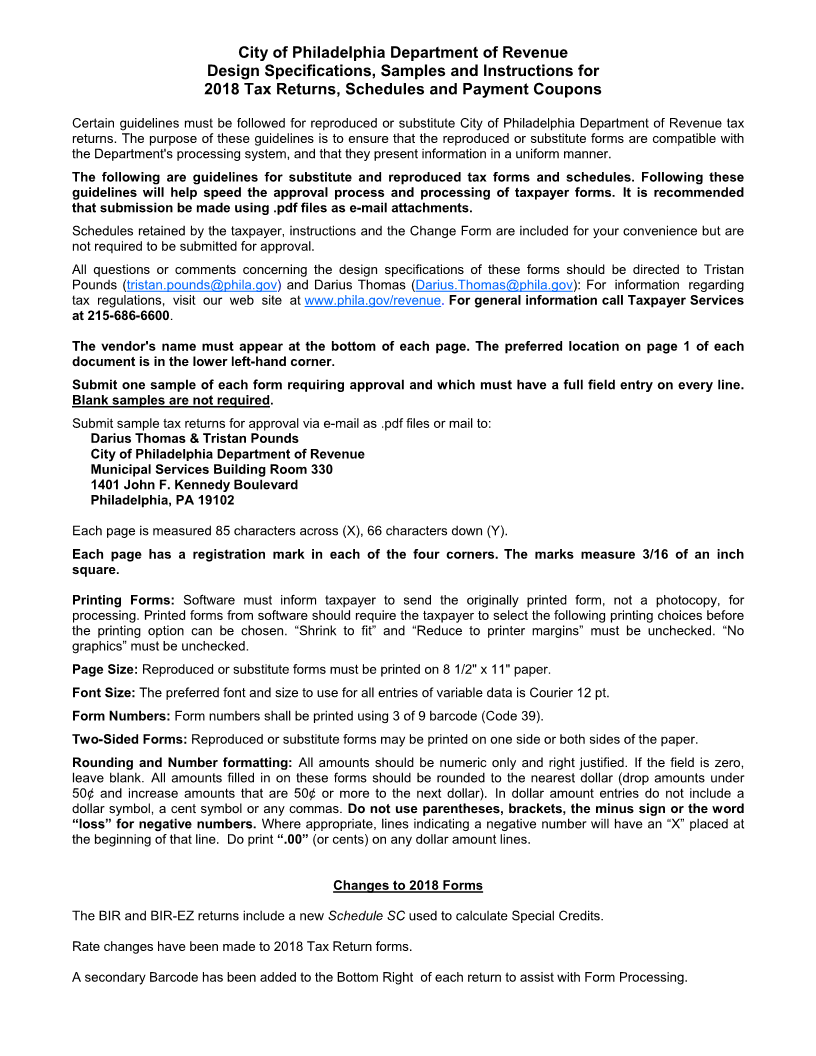

City of Philadelphia Department of Revenue

Design Specifications, Samples and Instructions for

2018 Tax Returns, Schedules and Payment Coupons

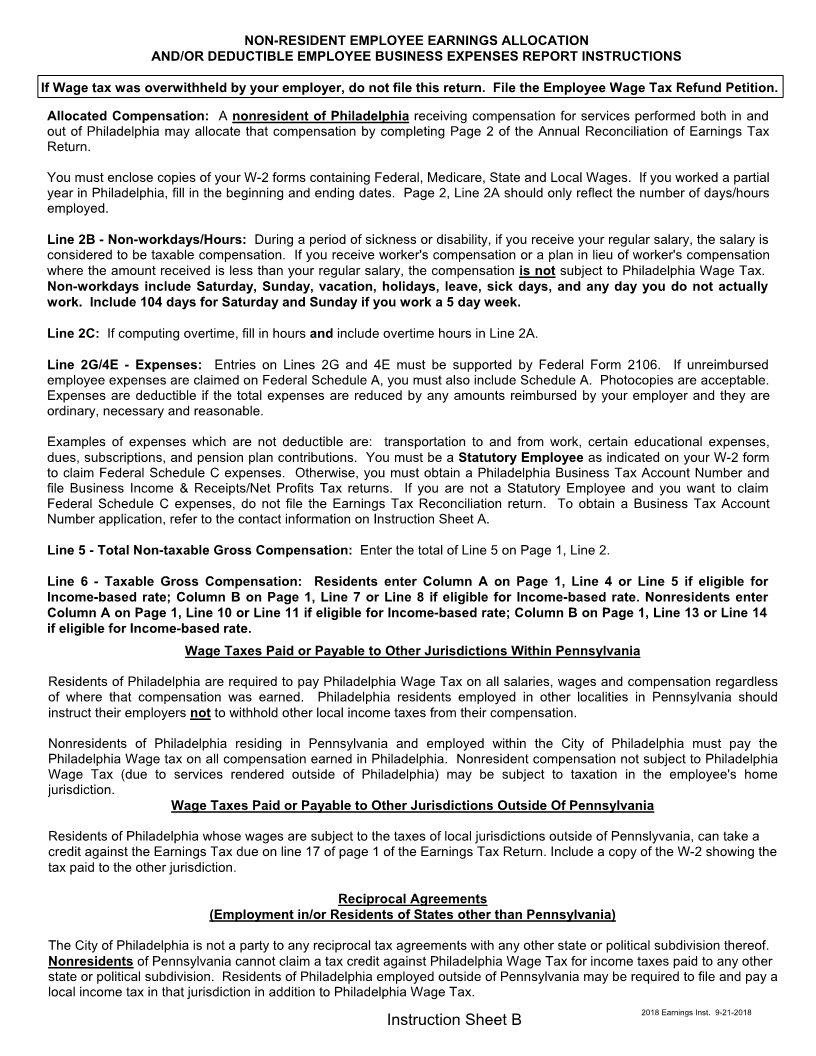

Certain guidelines must be followed for reproduced or substitute City of Philadelphia Department of Revenue tax

returns. The purpose of these guidelines is to ensure that the reproduced or substitute forms are compatible with

the Department's processing system, and that they present information in a uniform manner.

The following are guidelines for substitute and reproduced tax forms and schedules. Following these

guidelines will help speed the approval process and processing of taxpayer forms. It is recommended

that submission be made using .pdf files as e-mail attachments.

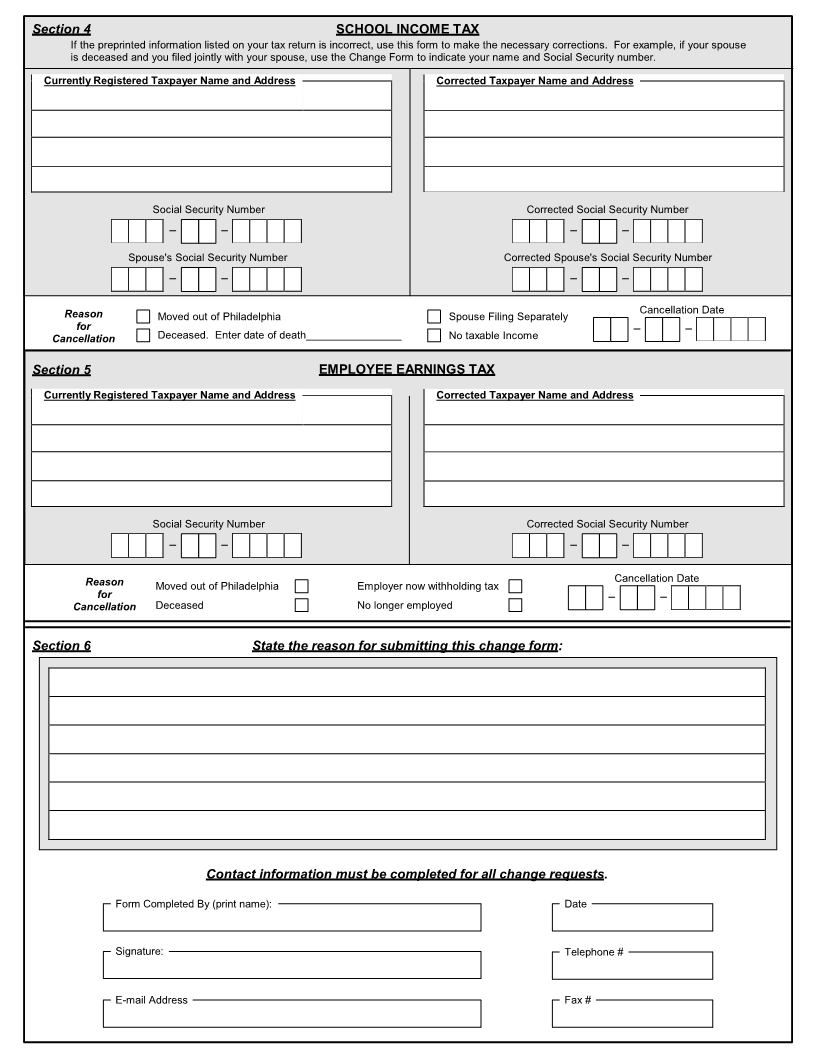

Schedules retained by the taxpayer, instructions and the Change Form are included for your convenience but are

not required to be submitted for approval.

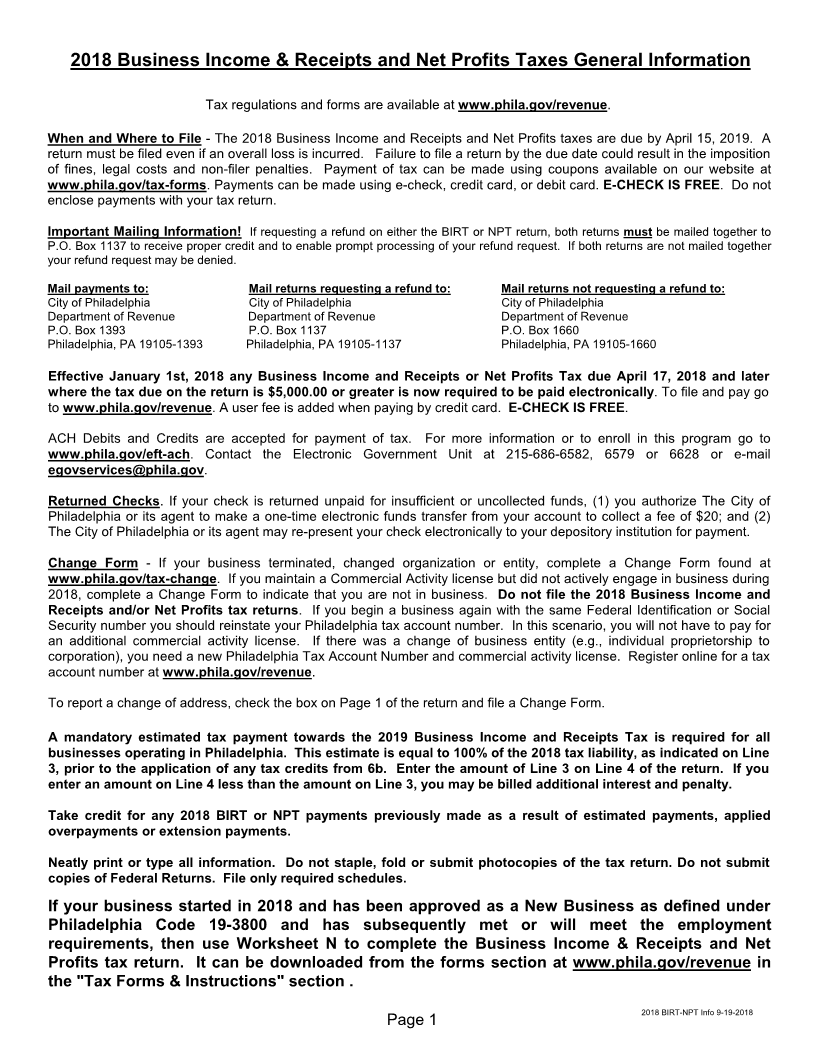

All questions or comments concerning the design specifications of these forms should be directed to Tristan

Pounds (tristan.pounds@phila.gov) and Darius Thomas (Darius.Thomas@phila.gov): For information regarding

tax regulations, visit our web site at www.phila.gov/revenue. For general information call Taxpayer Services

at 215-686-6600.

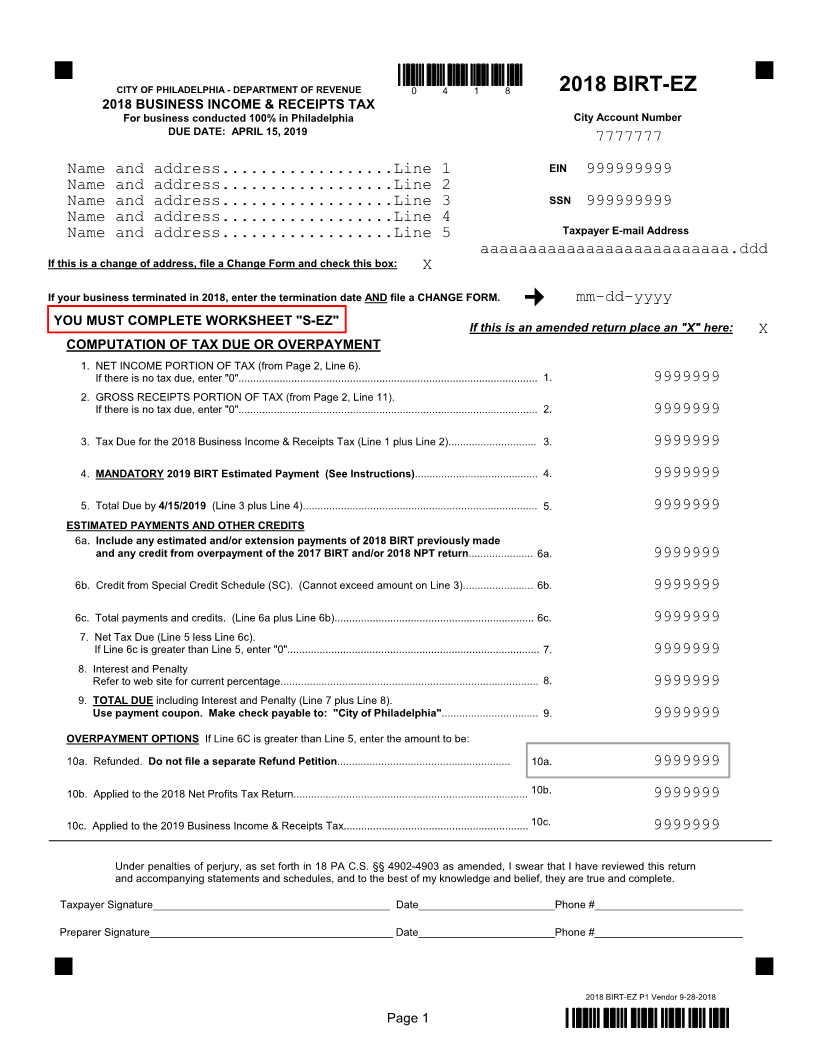

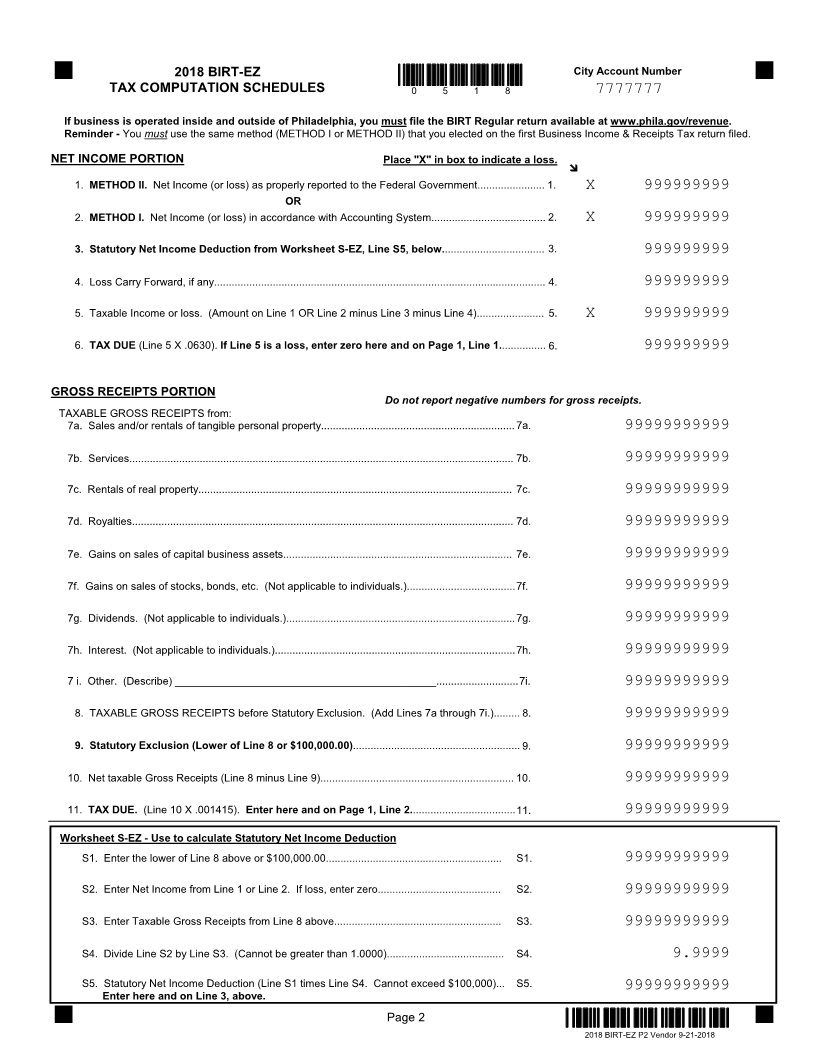

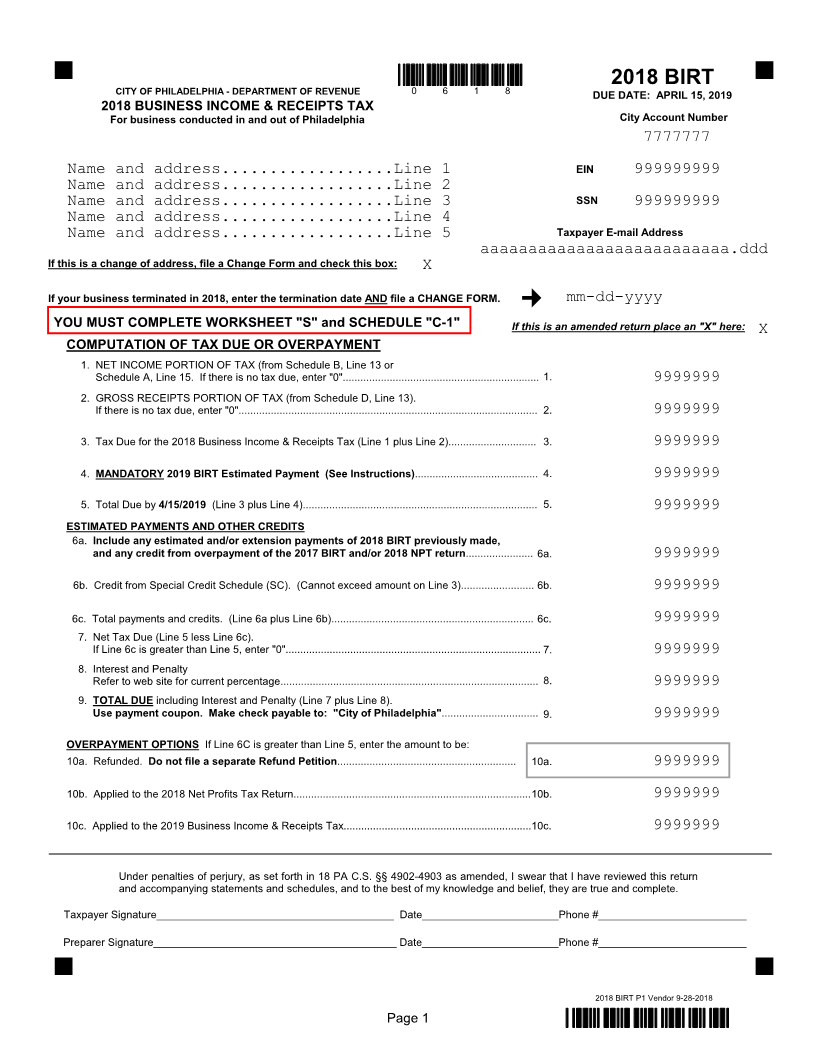

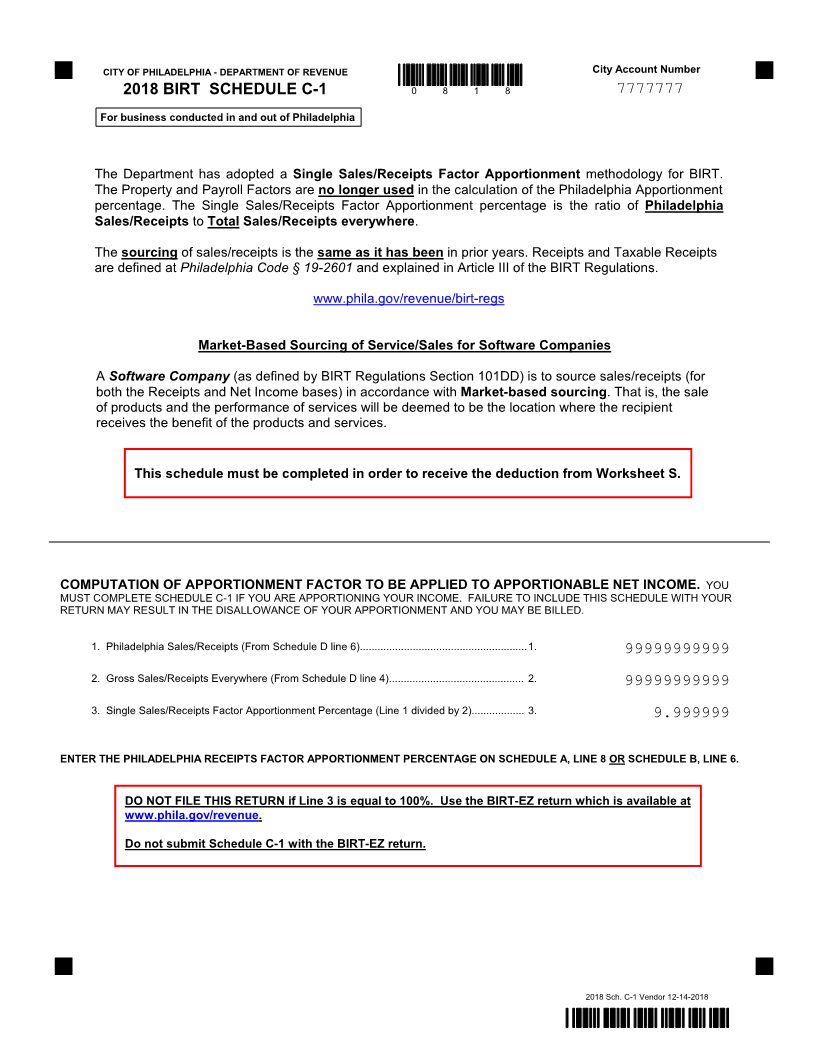

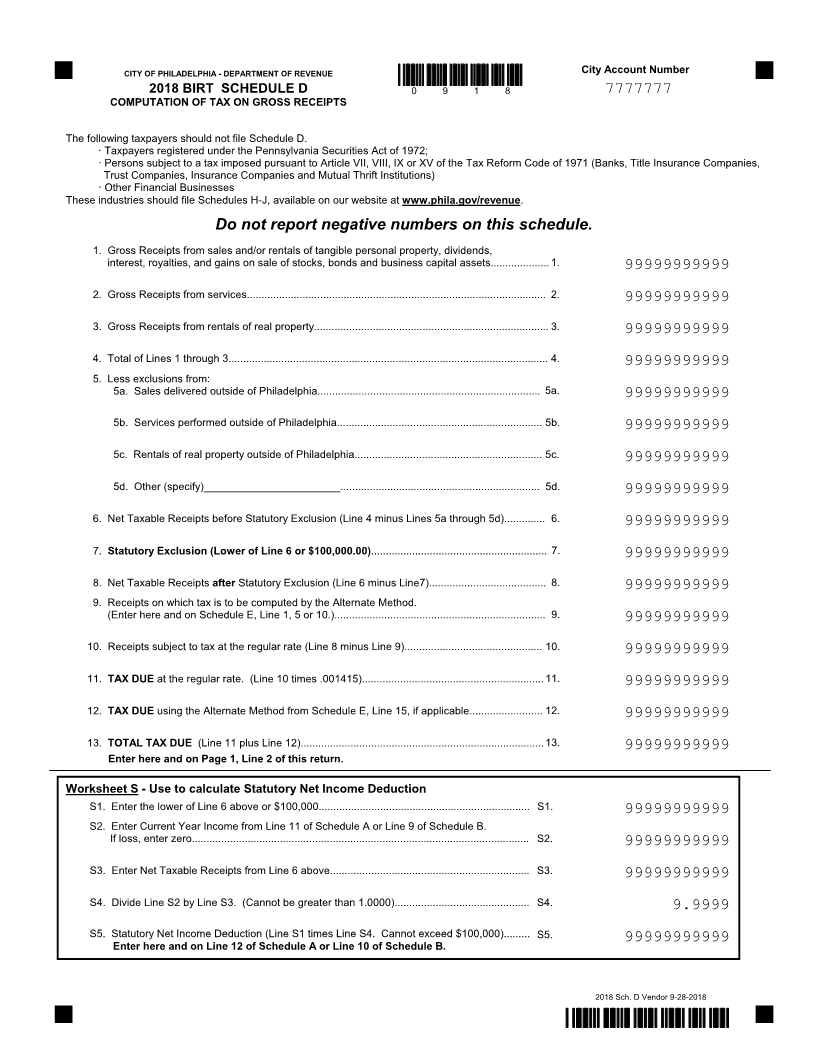

The vendor's name must appear at the bottom of each page. The preferred location on page 1 of each

document is in the lower left-hand corner.

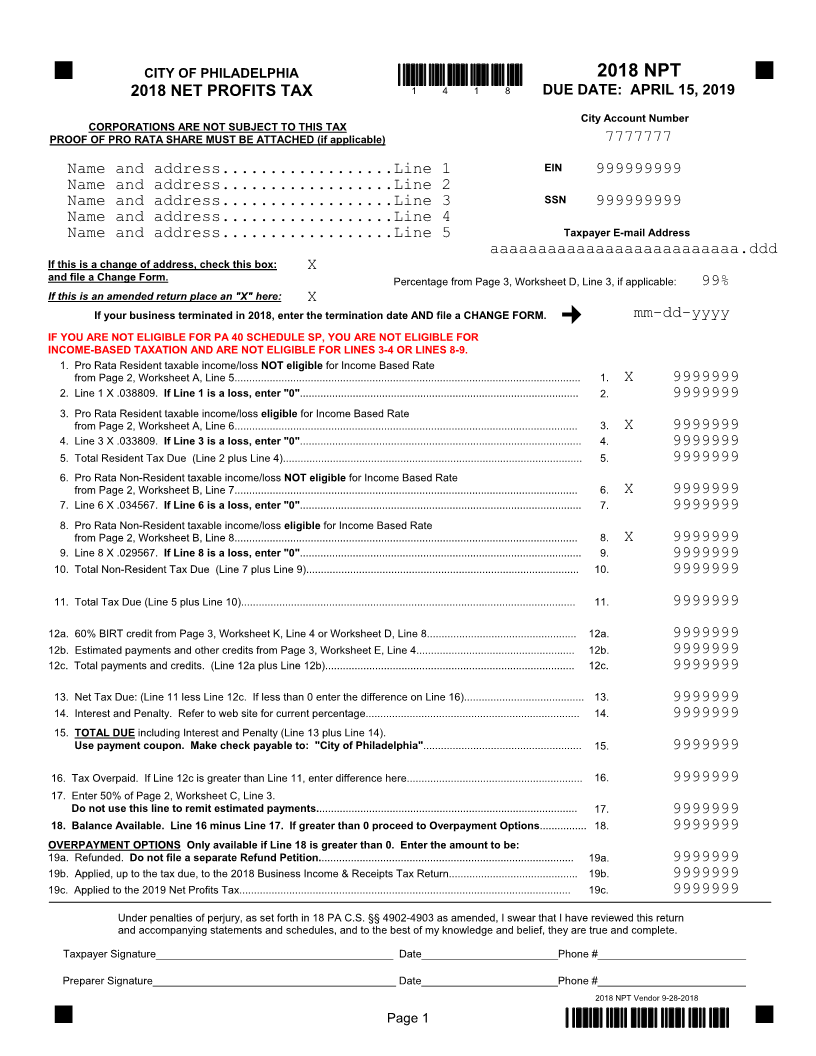

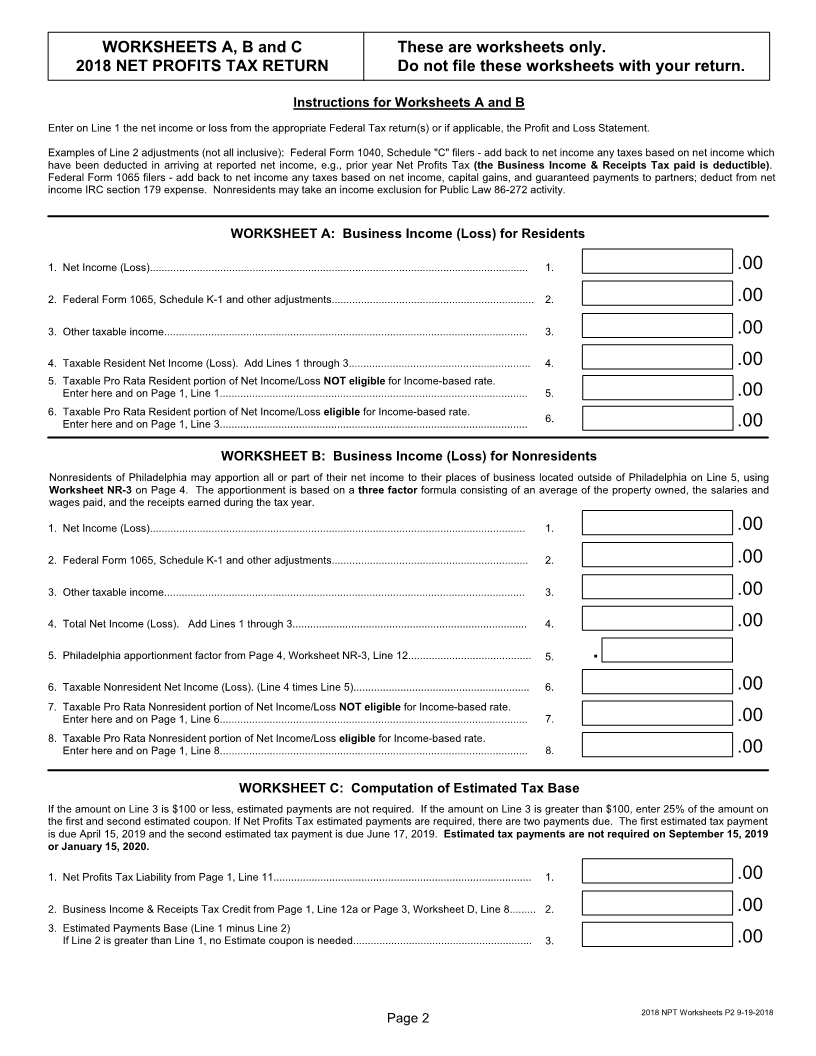

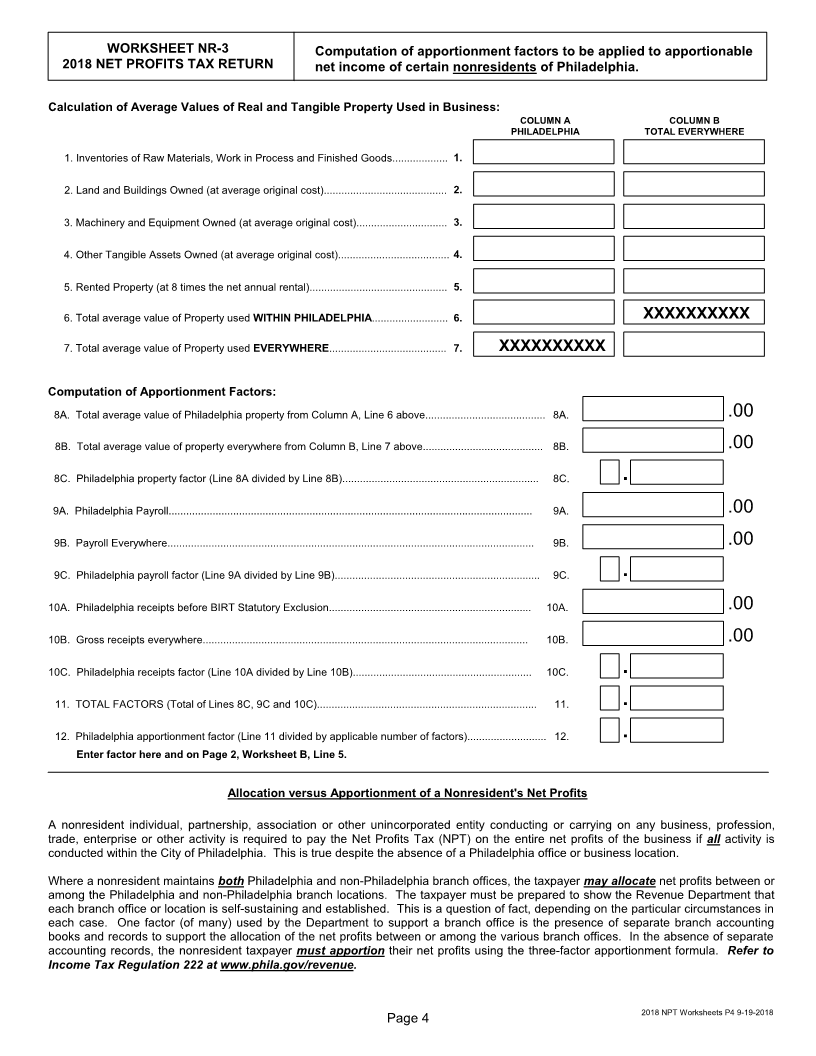

Submit one sample of each form requiring approval and which must have a full field entry on every line.

Blank samples are not required.

Submit sample tax returns for approval via e-mail as .pdf files or mail to:

Darius Thomas & Tristan Pounds

City of Philadelphia Department of Revenue

Municipal Services Building Room 330

1401 John F. Kennedy Boulevard

Philadelphia, PA 19102

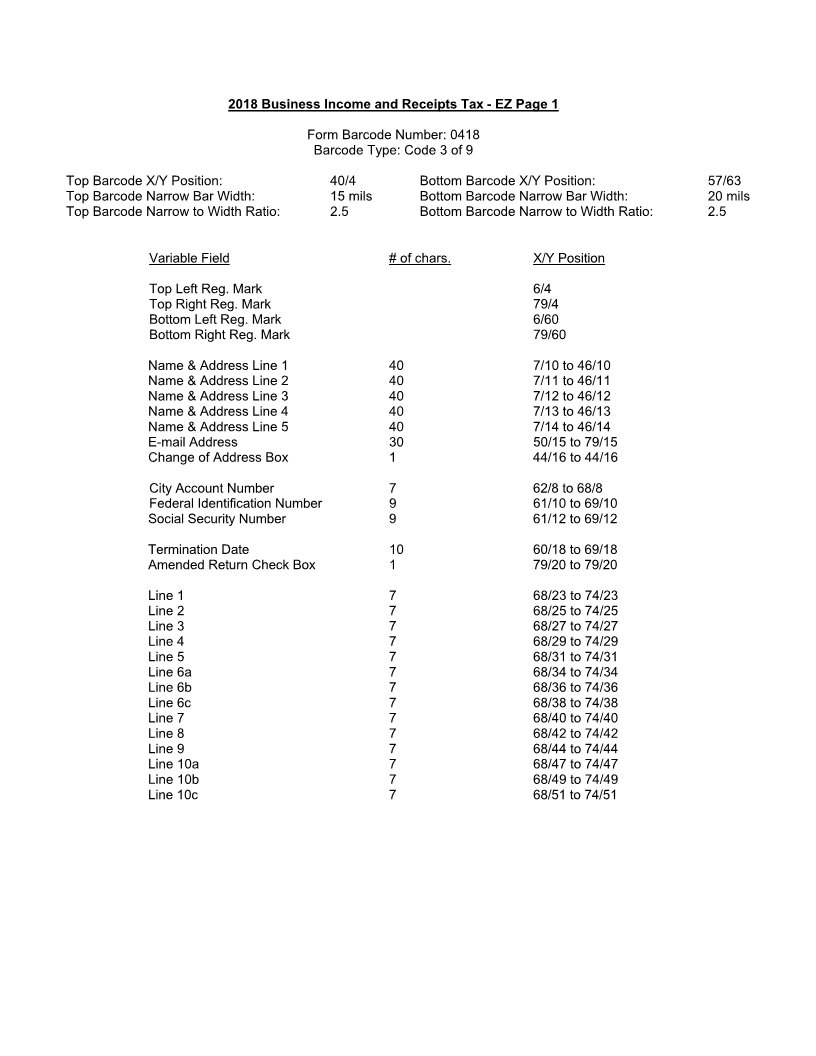

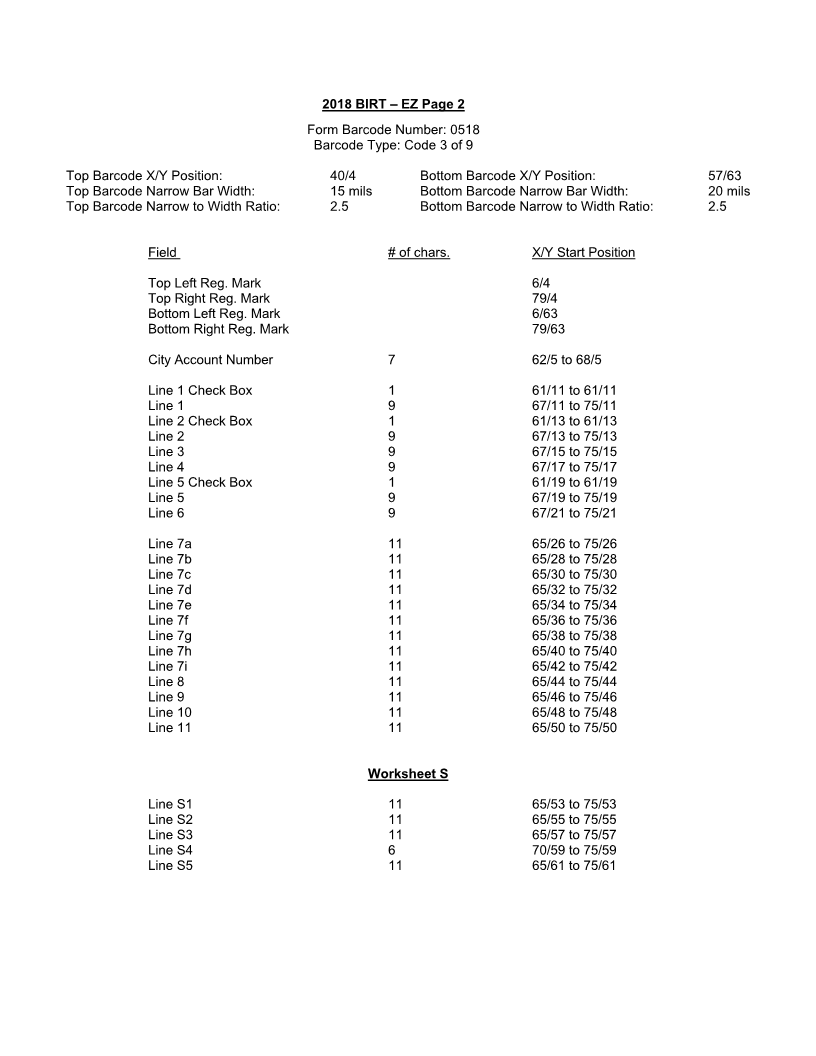

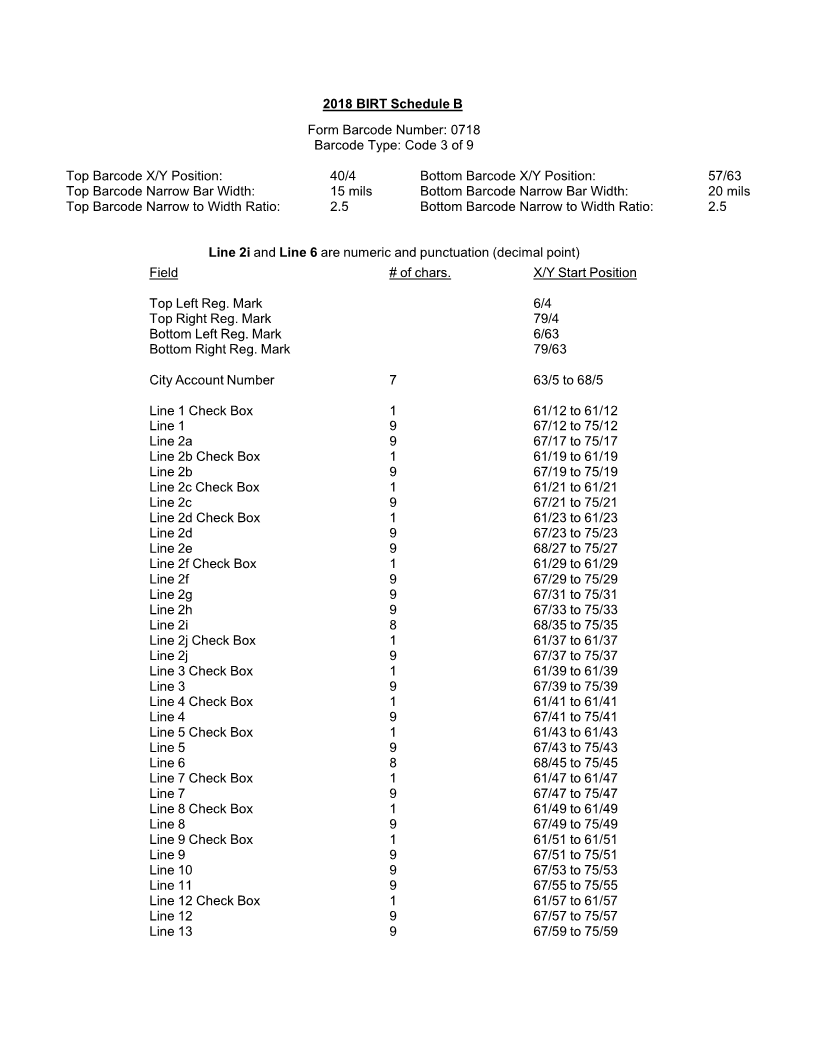

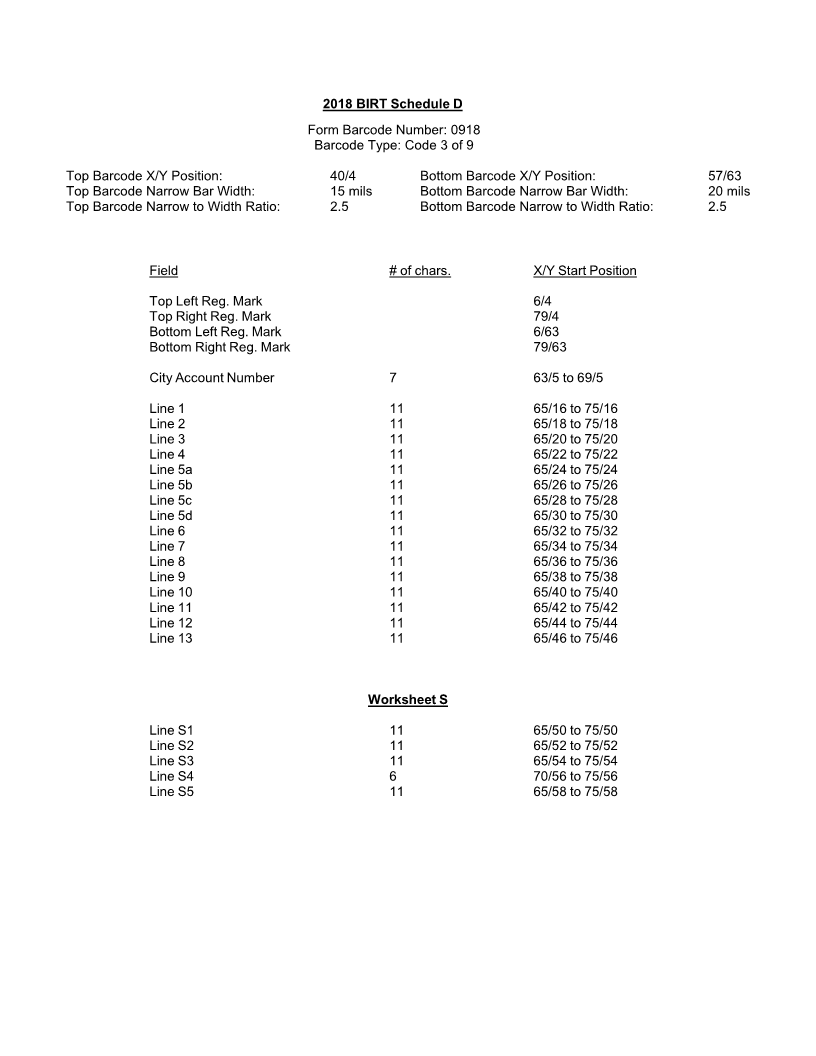

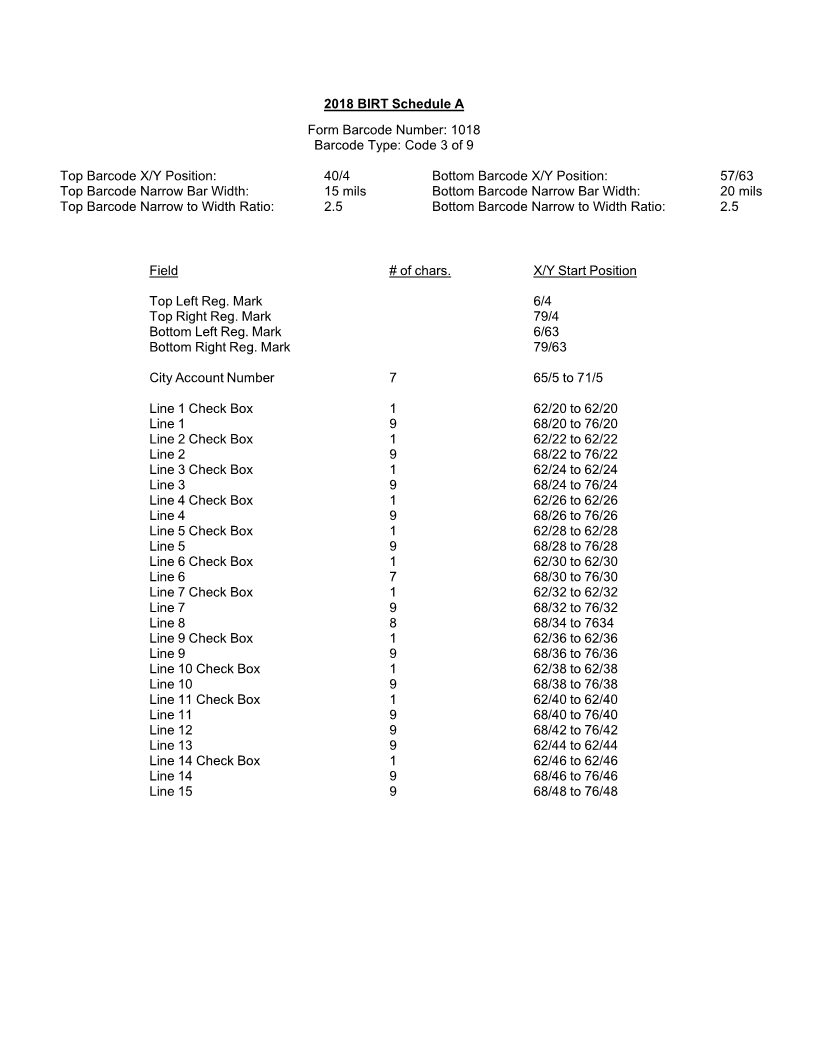

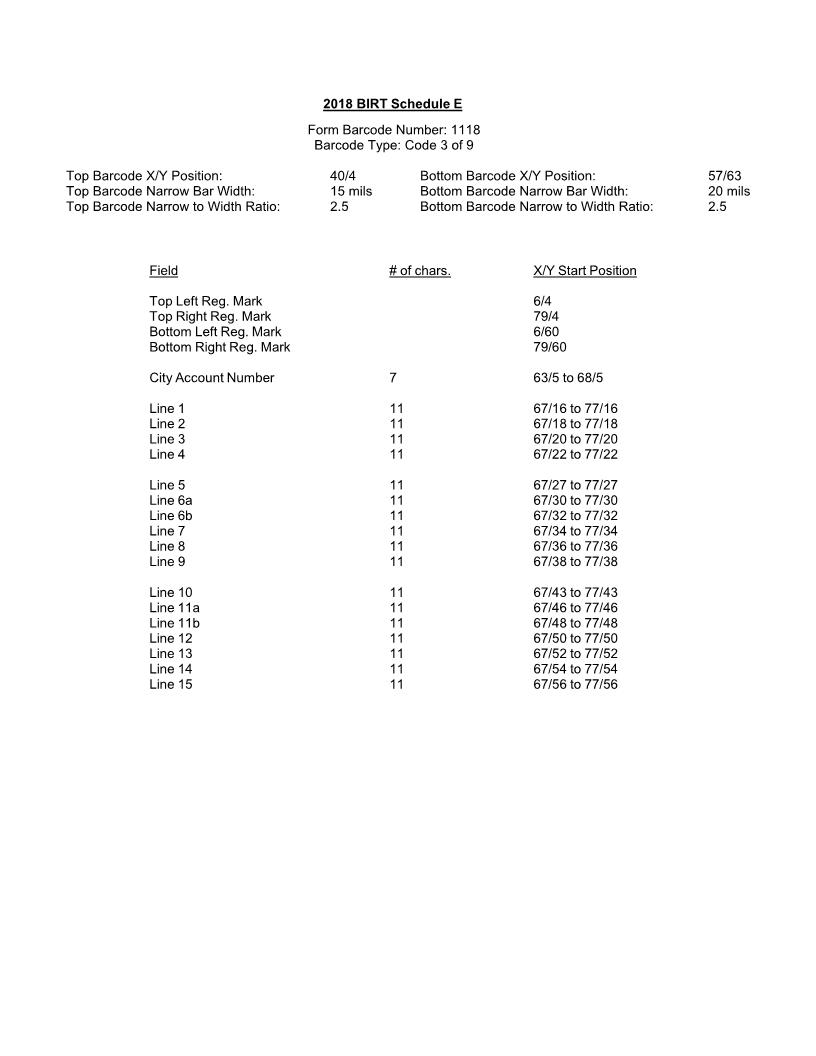

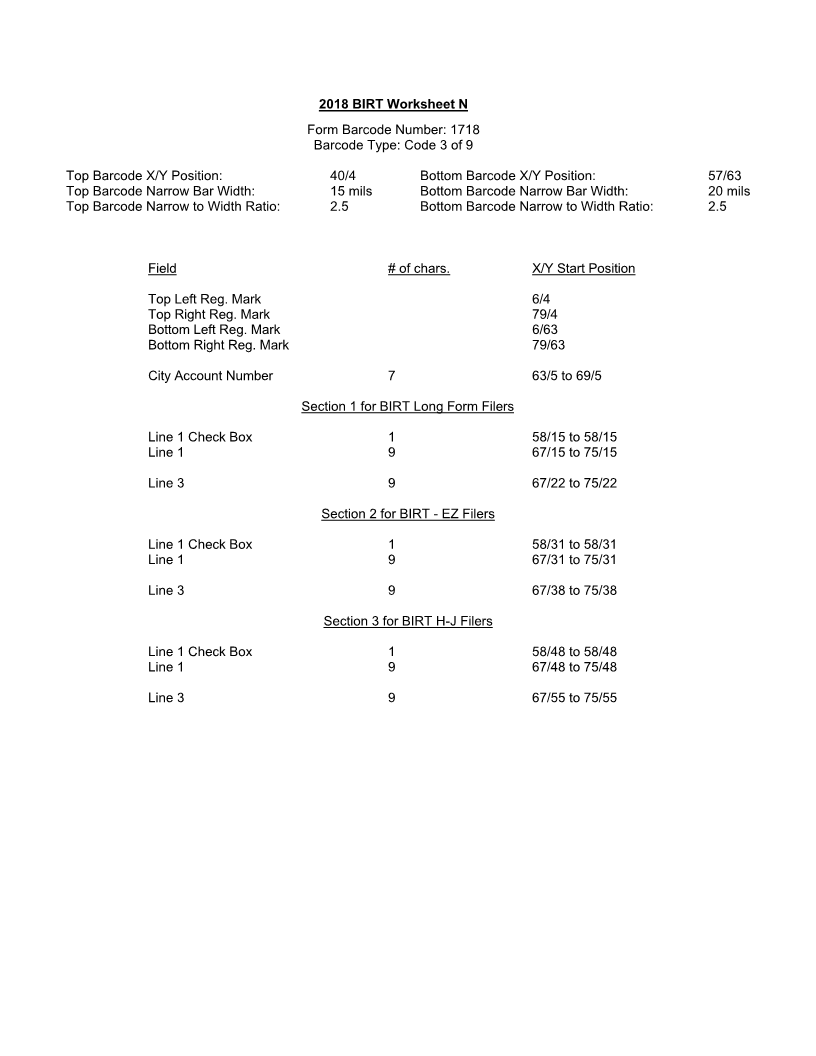

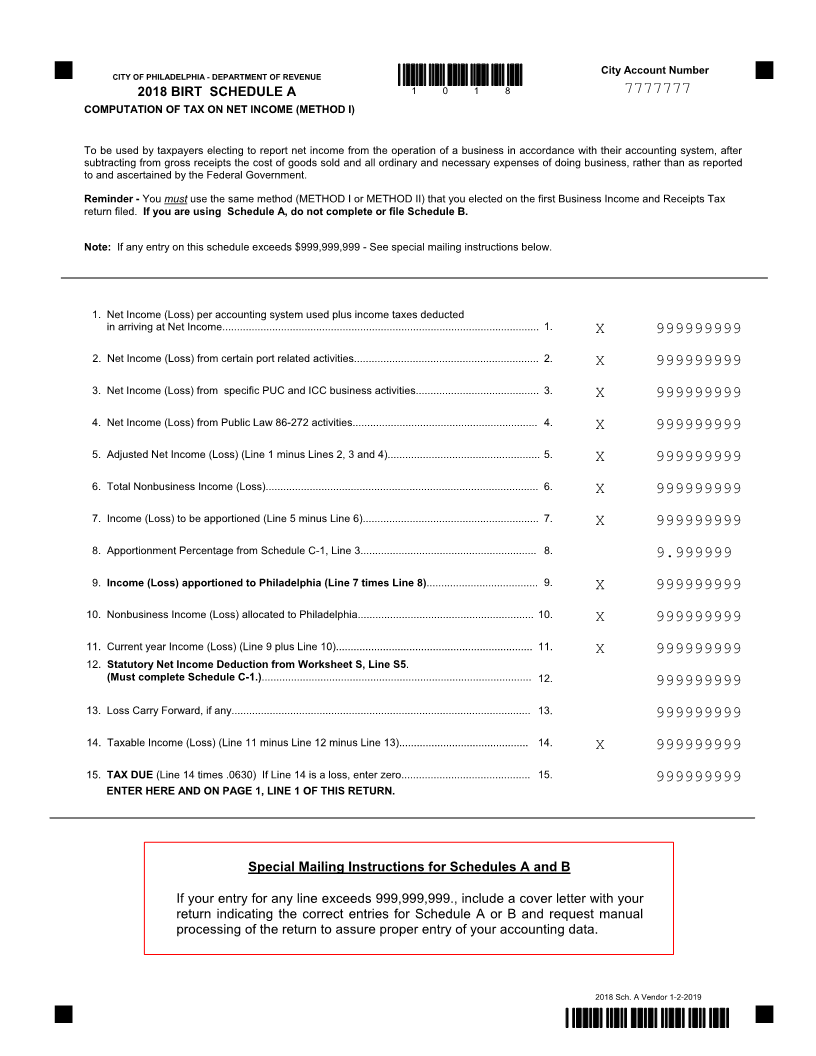

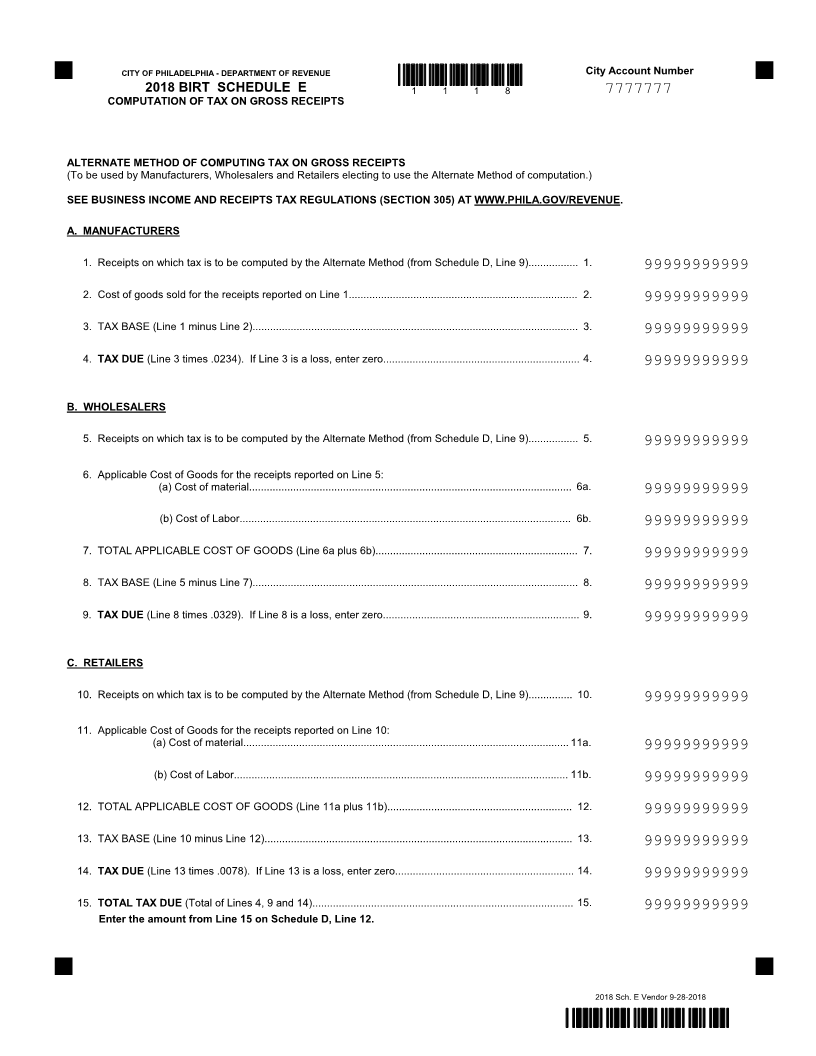

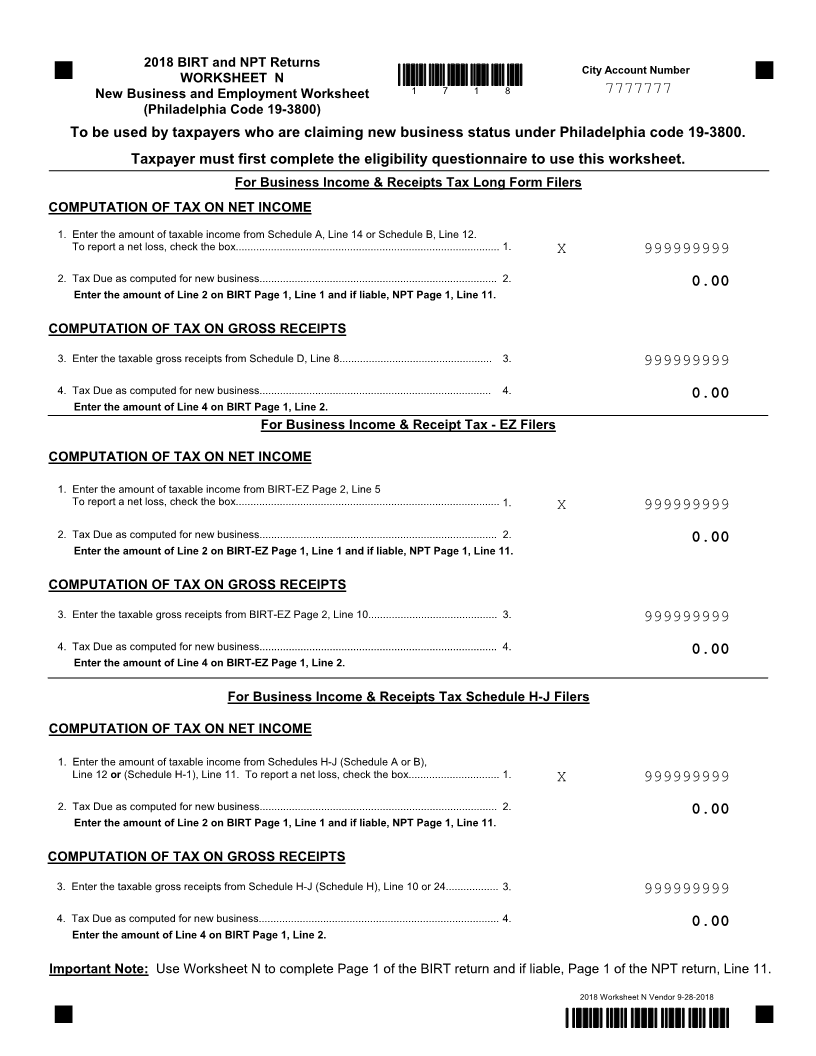

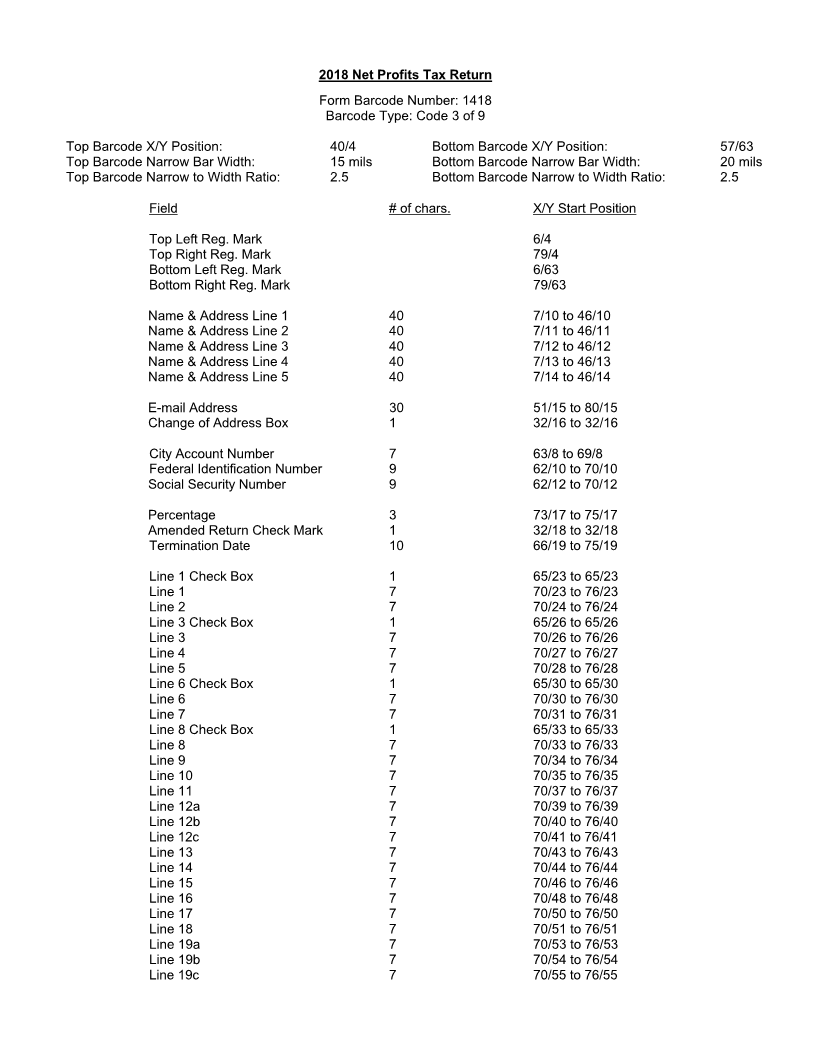

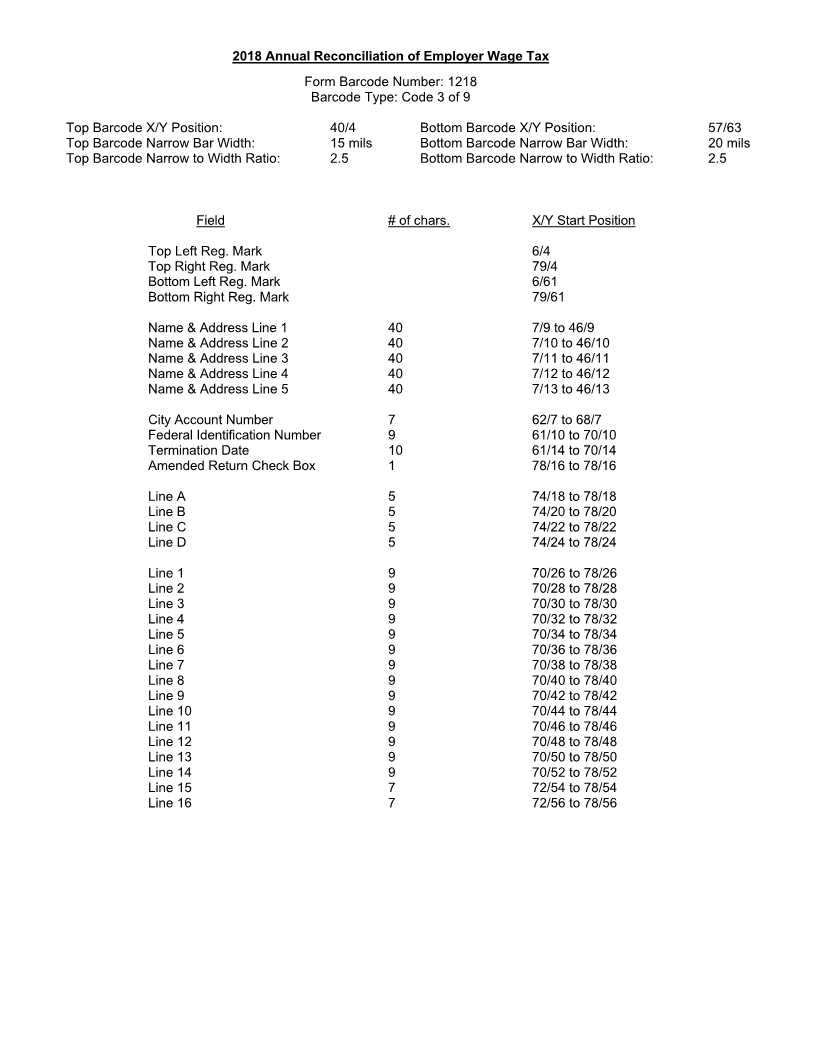

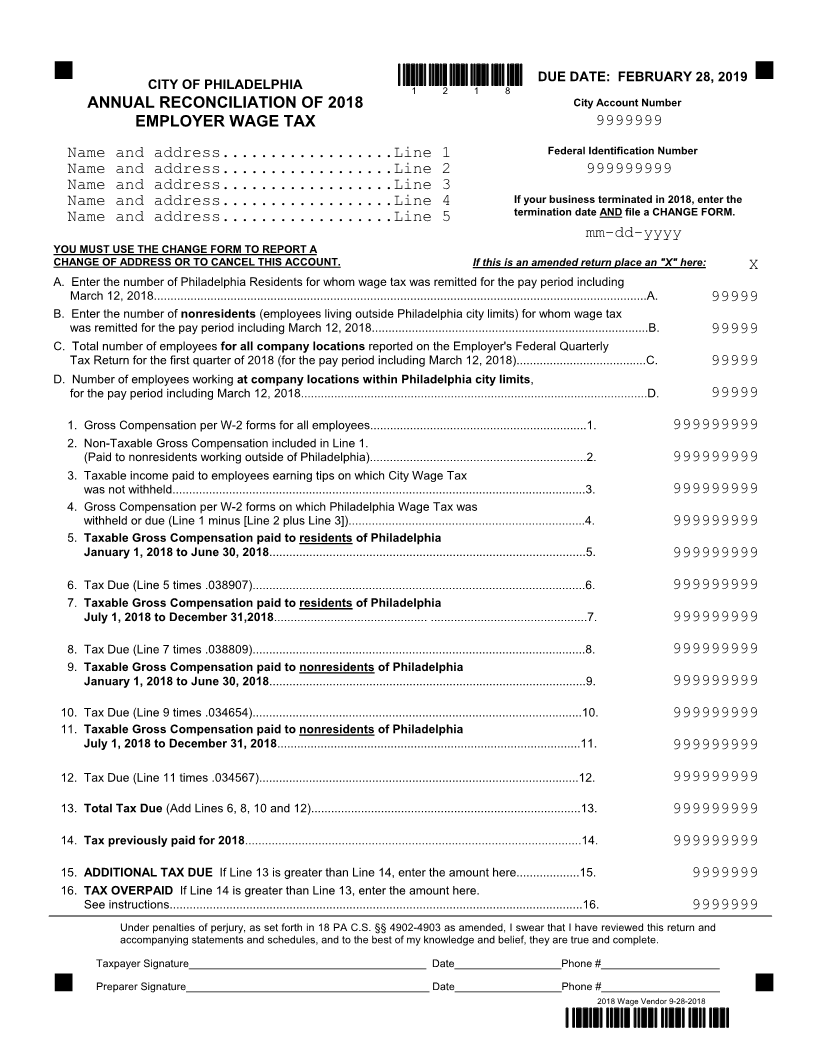

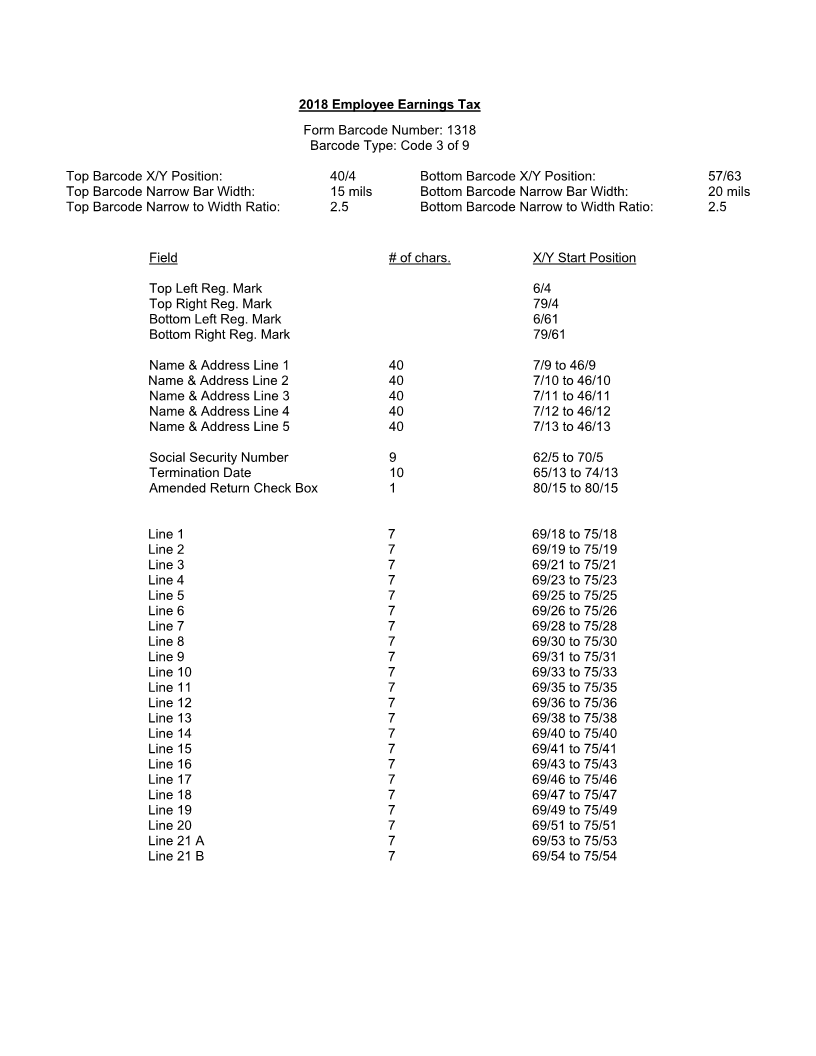

Each page is measured 85 characters across (X), 66 characters down (Y).

Each page has a registration mark in each of the four corners. The marks measure 3/16 of an inch

square.

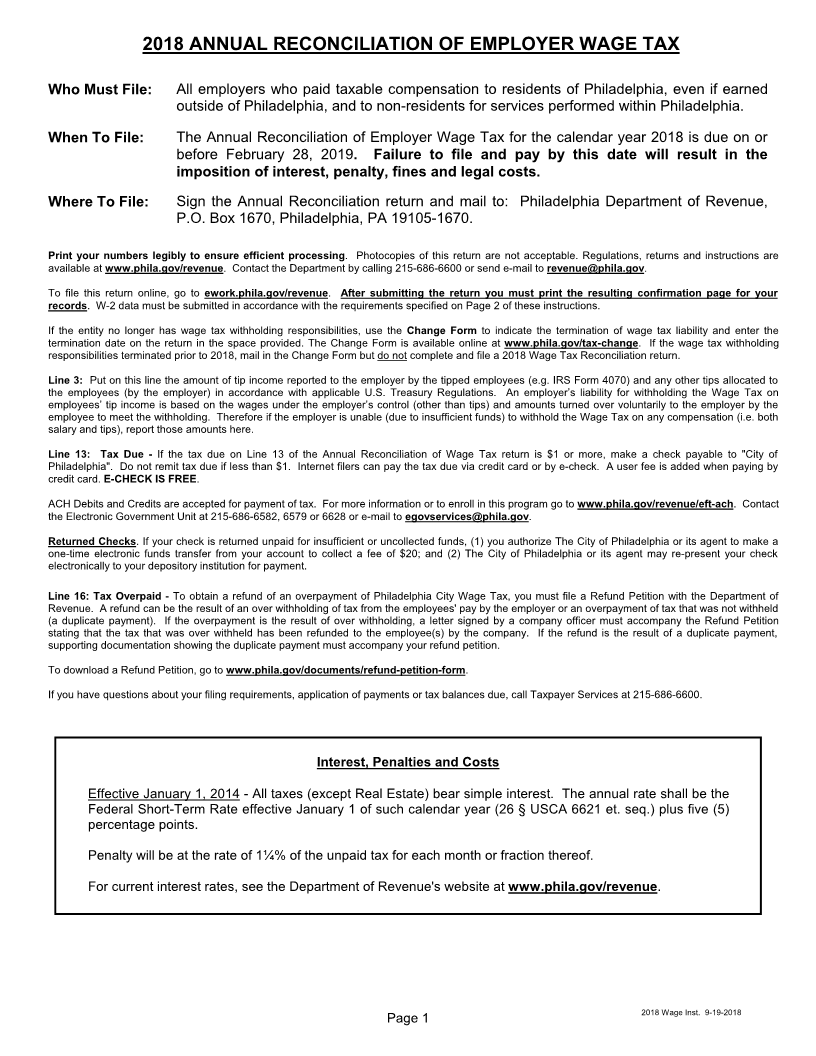

Printing Forms: Software must inform taxpayer to send the originally printed form, not a photocopy, for

processing. Printed forms from software should require the taxpayer to select the following printing choices before

the printing option can be chosen. “Shrink to fit” and “Reduce to printer margins” must be unchecked. “No

graphics” must be unchecked.

Page Size: Reproduced or substitute forms must be printed on 8 1/2" x 11" paper.

Font Size: The preferred font and size to use for all entries of variable data is Courier 12 pt.

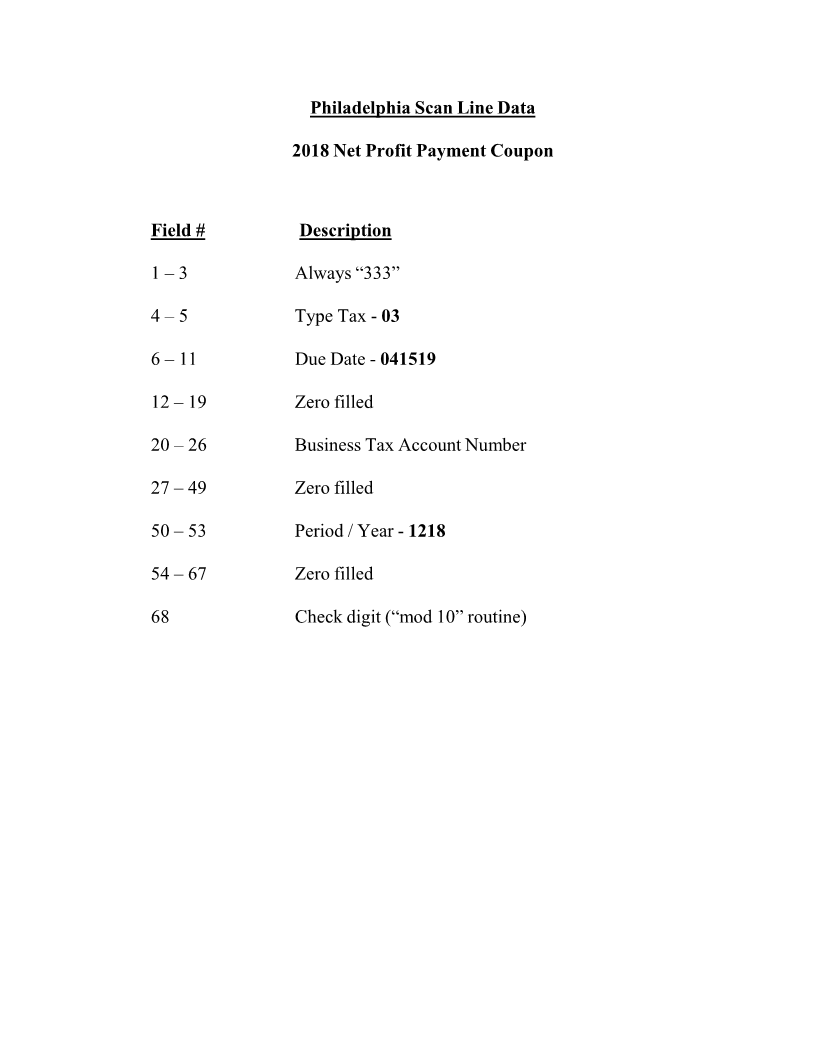

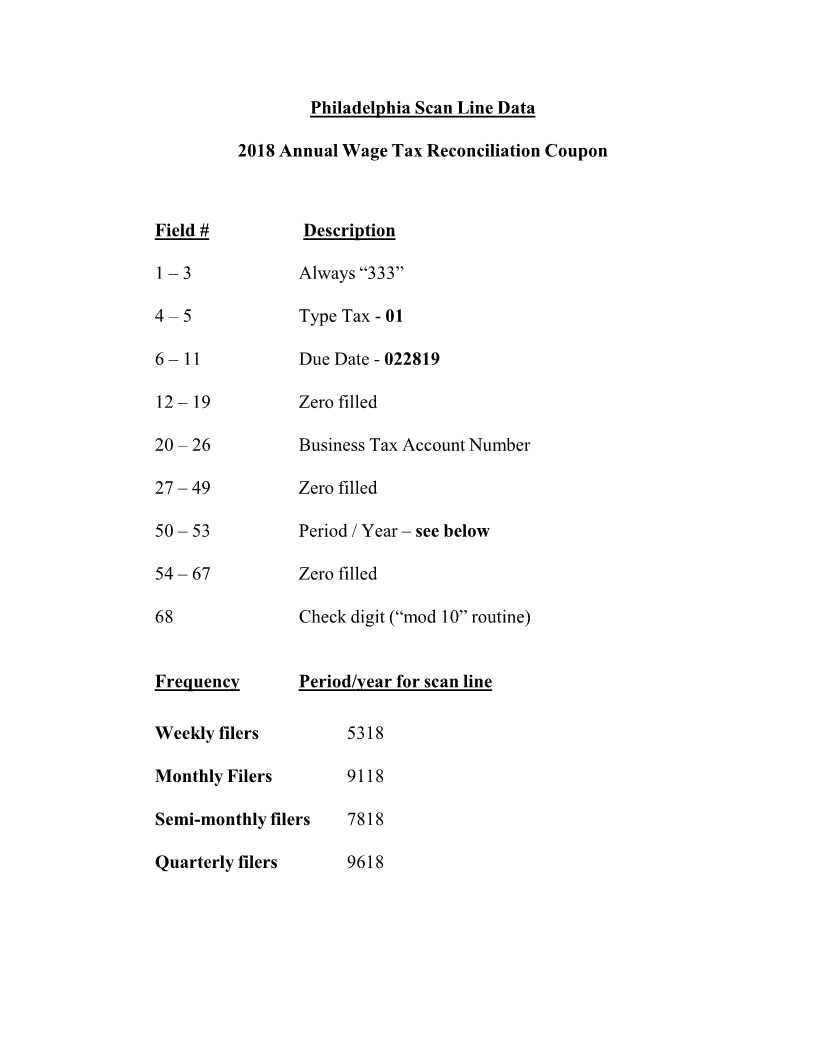

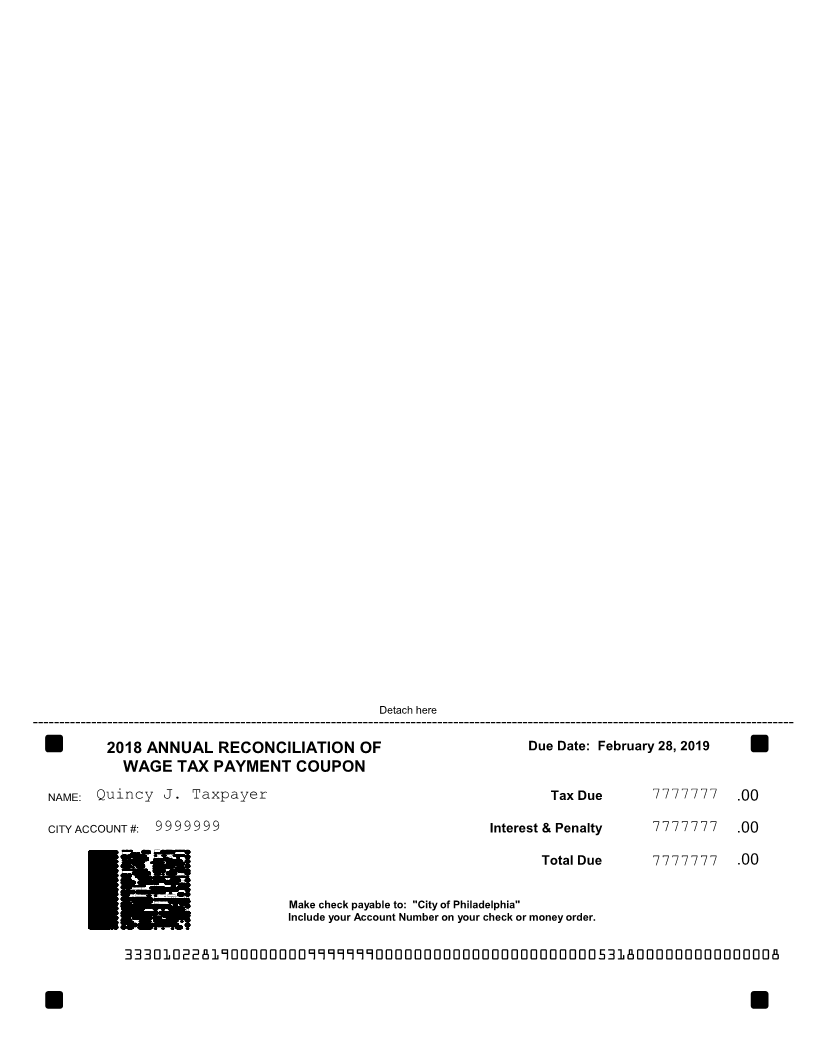

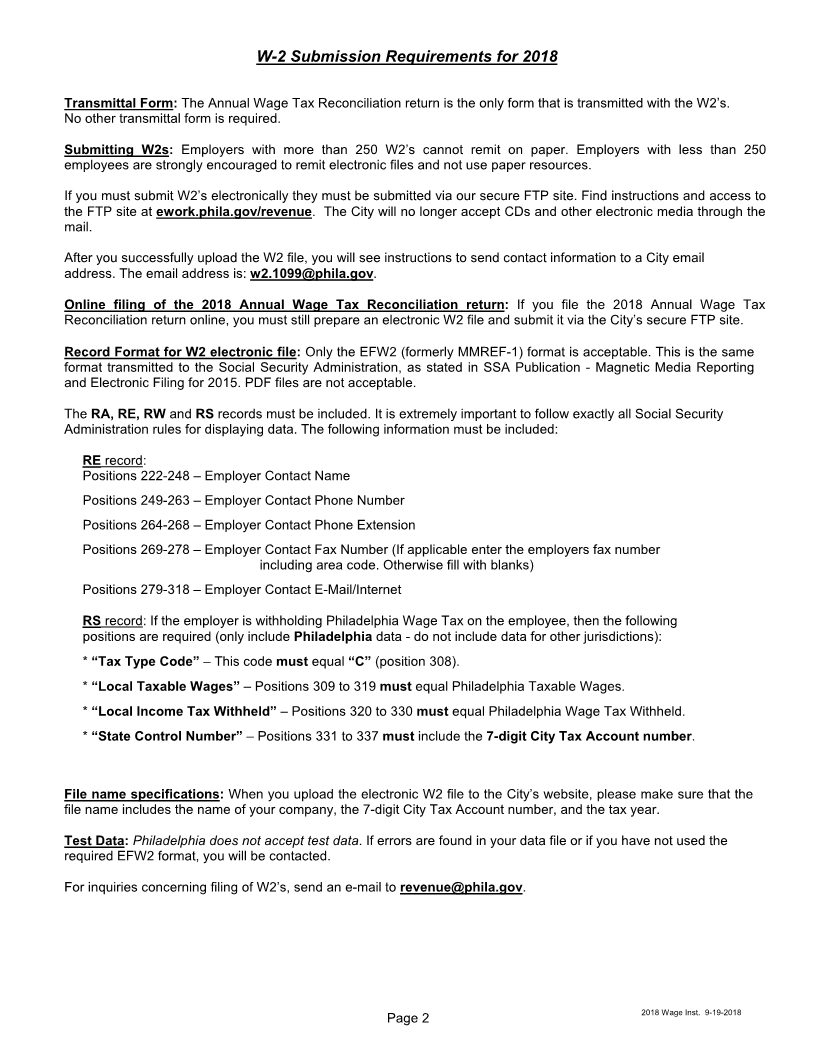

Form Numbers: Form numbers shall be printed using 3 of 9 barcode (Code 39).

Two-Sided Forms: Reproduced or substitute forms may be printed on one side or both sides of the paper.

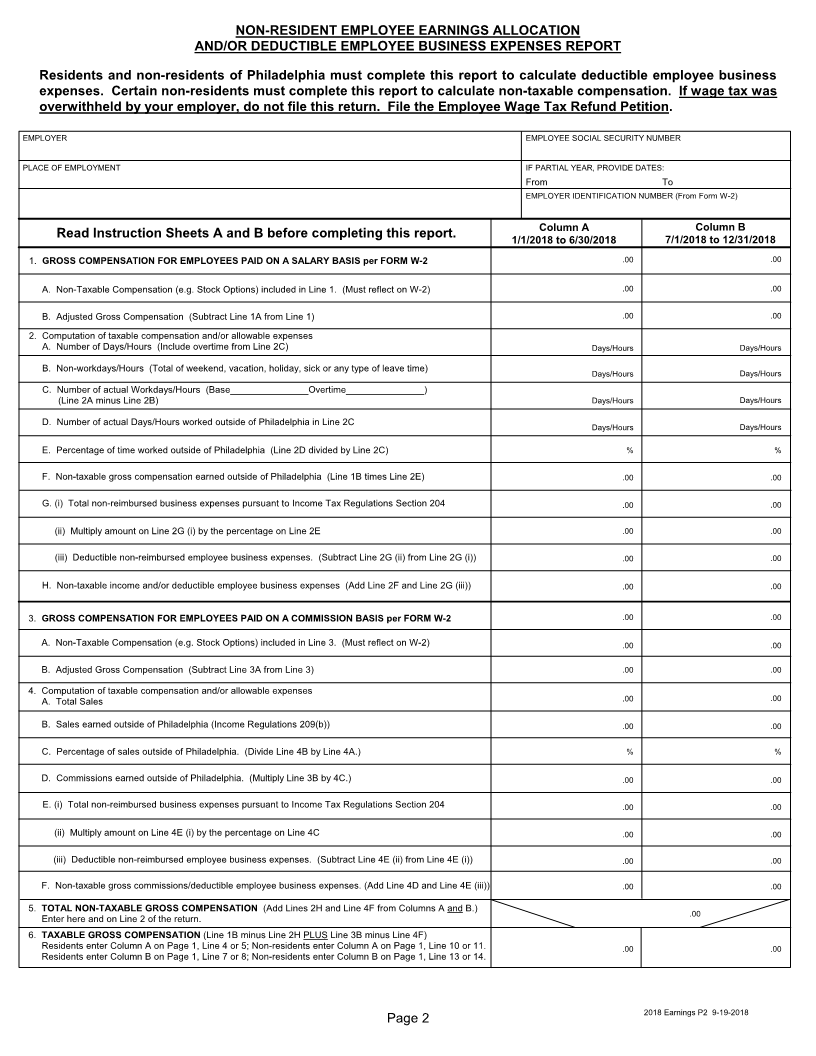

Rounding and Number formatting: All amounts should be numeric only and right justified. If the field is zero,

leave blank. All amounts filled in on these forms should be rounded to the nearest dollar (drop amounts under

50¢ and increase amounts that are 50¢ or more to the next dollar). In dollar amount entries do not include a

dollar symbol, a cent symbol or any commas. Do not use parentheses, brackets, the minus sign or the word

“loss” for negative numbers. Where appropriate, lines indicating a negative number will have an “X” placed at

the beginning of that line. Do print “.00” (or cents) on any dollar amount lines.

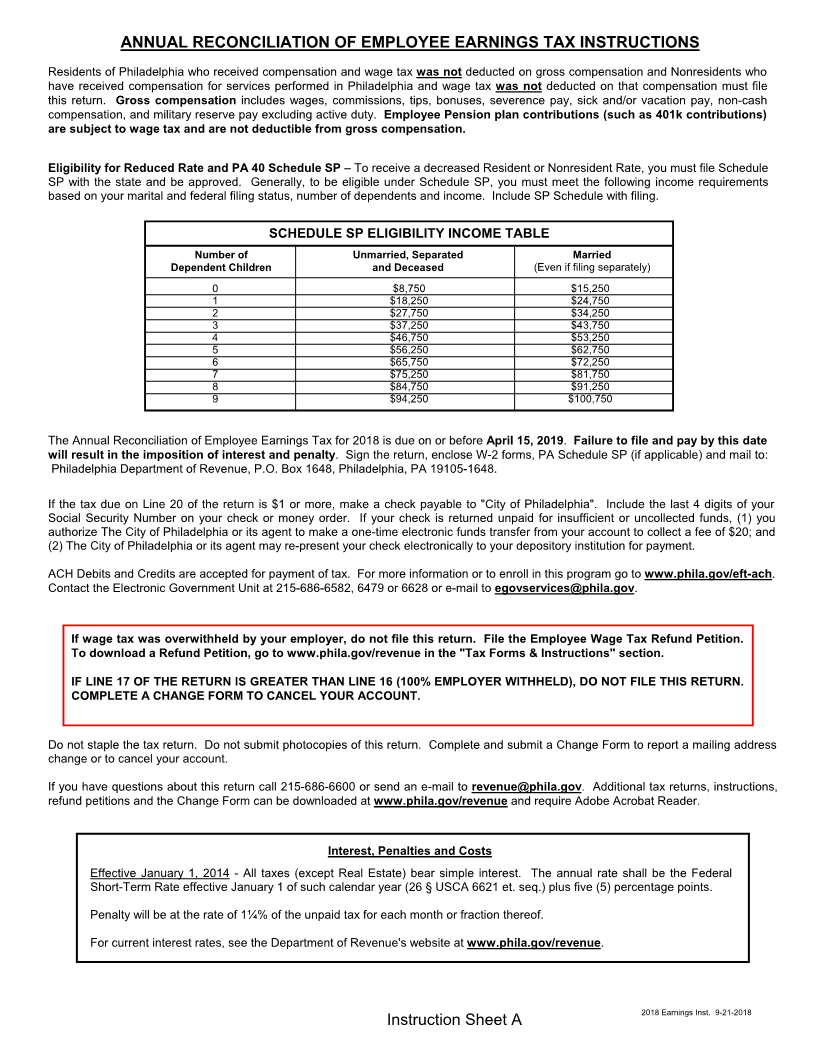

Changes to 2018 Forms

The BIR and BIR-EZ returns include a new Schedule SC used to calculate Special Credits.

Rate changes have been made to 2018 Tax Return forms.

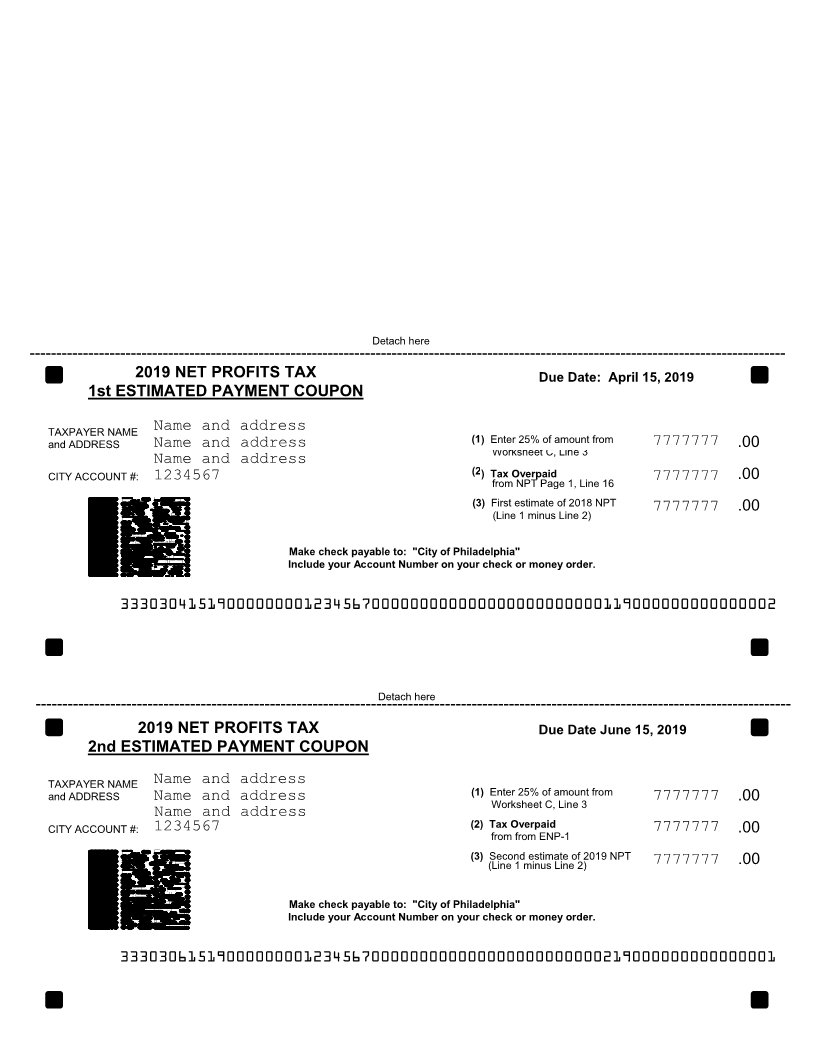

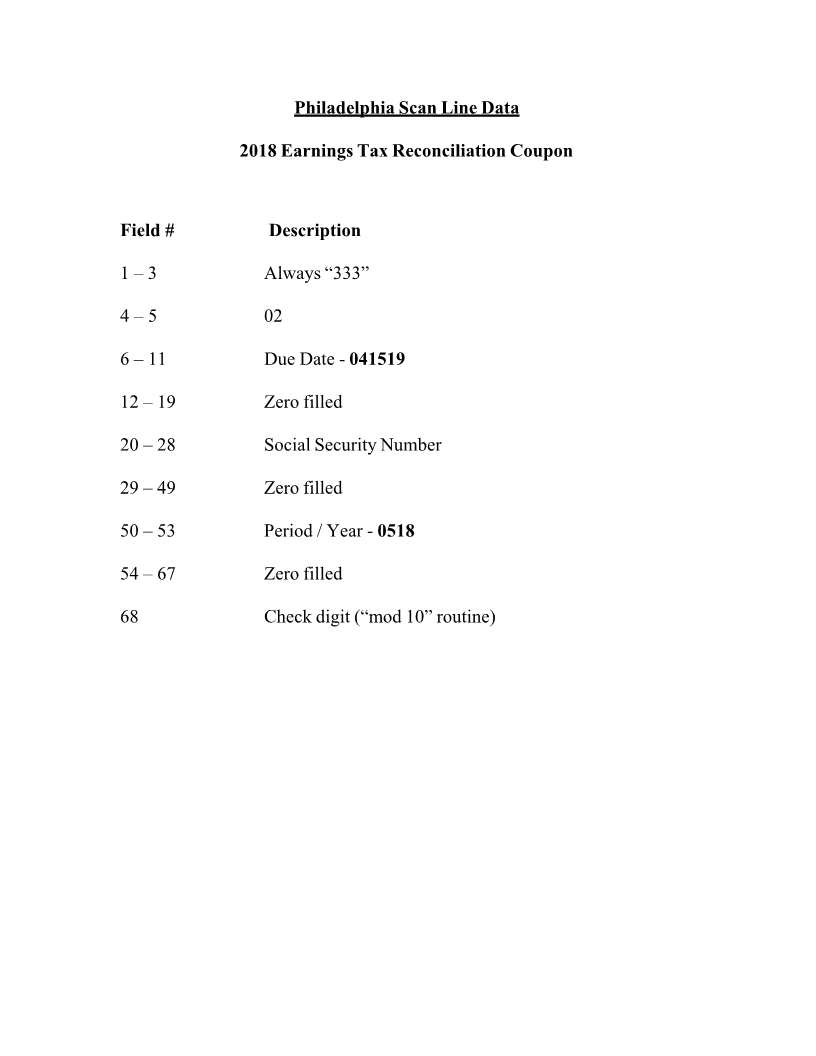

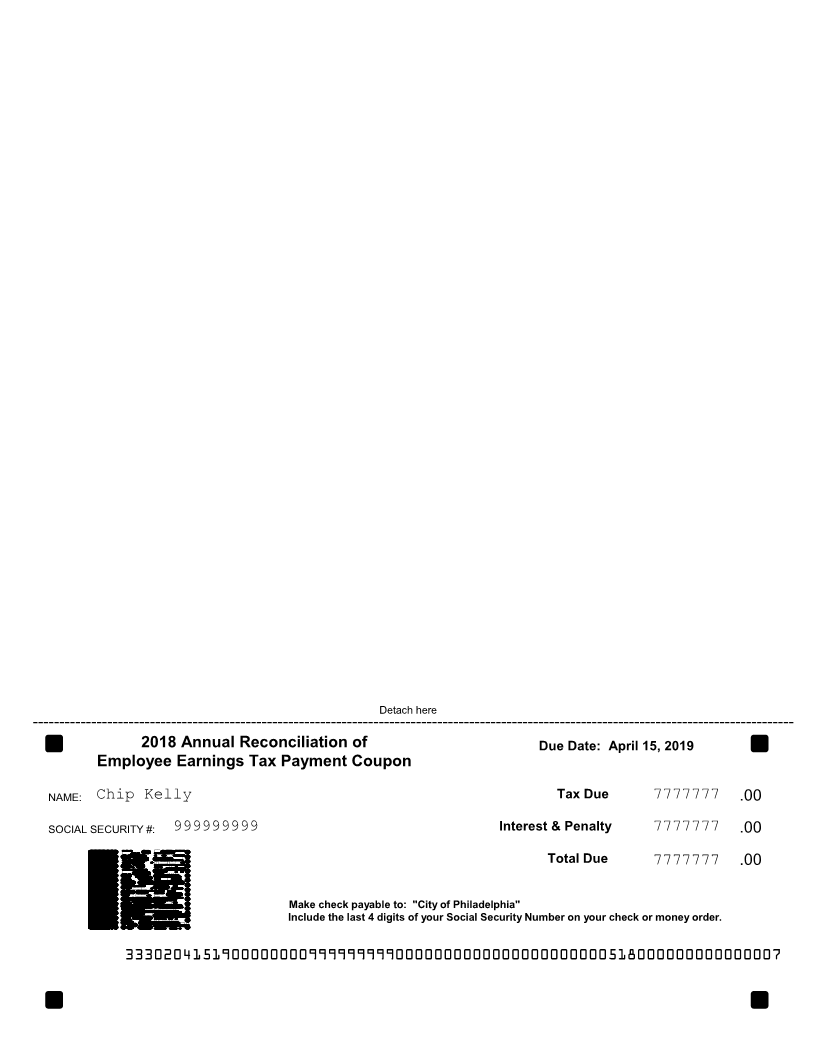

A secondary Barcode has been added to the Bottom Right of each return to assist with Form Processing.