Enlarge image

LANCASTER COUNTY EARNED INCOME TAX RETURN INSTRUCTIONS

uuOnline Filing is available @ https://efile.lctcb.orguu

GENERAL INFORMATION:

This tax return covers the tax period from January 1, through December 31, and must be completed and filed with this bureau by April 15th. This is an earned income and net profits tax,

levied by school districts and municipalities, collected by this Bureau, and distributed to the school district and municipality where you reside. The Bureau retains the right to request additional

documentation to substantiate the information reported.

WHO MUST FILE:

All residents of Lancaster County and the Octorara Area School District in Chester County who were 16 years of age or older; not fully retired or had earned income at any time during the tax

year. A tax return must be filed even if no tax is due or your employer(s) withheld all tax due. Failure to receive a tax return shall not excuse the taxpayer from filing a return, or paying any

tax due. Tax return forms are available on our website, www.lctcb.org, or by contacting the Bureau.

INSTRUCTIONS FOR COMPLETING TAX RETURN

• If the information is not pre-printed, please provide your name, current address, city, state and zip code in the space(s) provided.

• If a taxpayer is to be removed from this form, draw a line through the taxpayer to be removed and check the appropriate box.

• If you are requesting an extension or filing an amended return check the appropriate box.

• Taxpayers reporting no earned income must check the applicable box.

• Check the appropriate filing status box.

• Complete the Part Year Resident Schedule on the reverse side of the return if you moved during the tax year. Account for all 12 months.

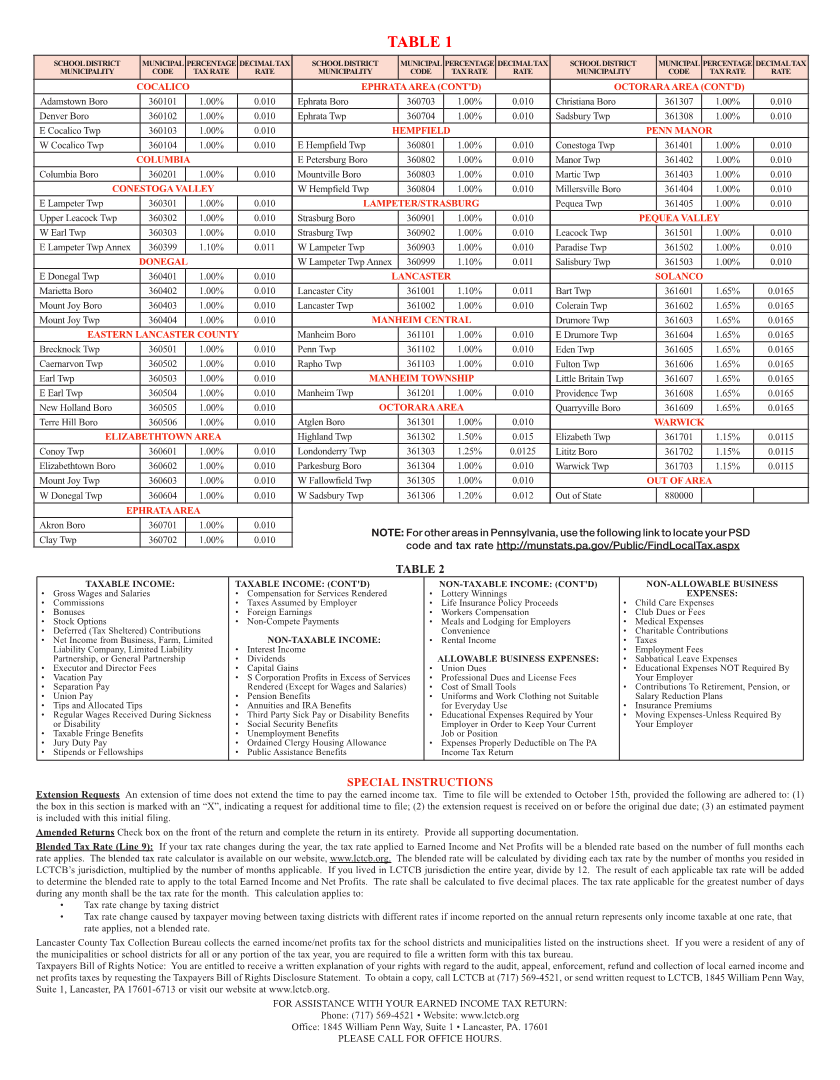

• Enter the municipal code from Table 1 for your residence as of December 31.

• Enter your complete social security number(s) in the appropriate column(s).

LINE BY LINE INSTRUCTIONS

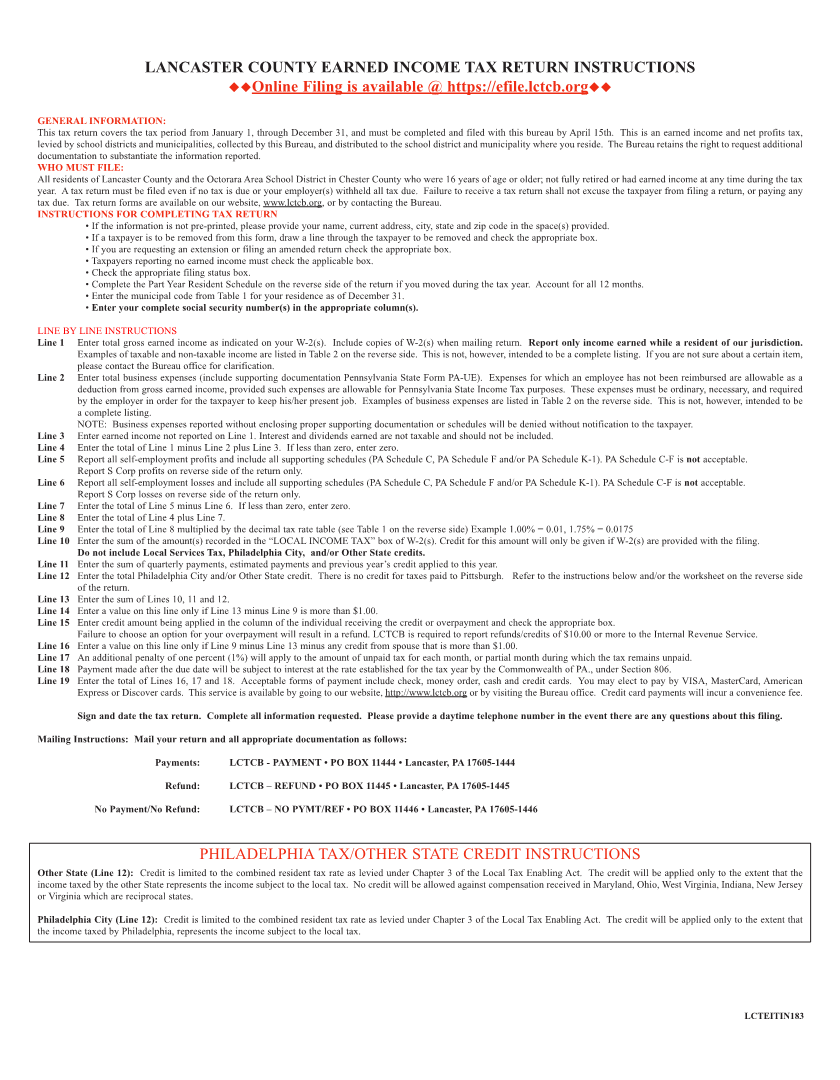

Line 1 Enter total gross earned income as indicated on your W-2(s). Include copies of W-2(s) when mailing return. Report only income earned while a resident of our jurisdiction.

Examples of taxable and non-taxable income are listed in Table 2 on the reverse side. This is not, however, intended to be a complete listing. If you are not sure about a certain item,

please contact the Bureau office for clarification.

Line 2 Enter total business expenses (include supporting documentation Pennsylvania State Form PA-UE). Expenses for which an employee has not been reimbursed are allowable as a

deduction from gross earned income, provided such expenses are allowable for Pennsylvania State Income Tax purposes. These expenses must be ordinary, necessary, and required

by the employer in order for the taxpayer to keep his/her present job. Examples of business expenses are listed in Table 2 on the reverse side. This is not, however, intended to be

a complete listing.

NOTE: Business expenses reported without enclosing proper supporting documentation or schedules will be denied without notification to the taxpayer.

Line 3 Enter earned income not reported on Line 1. Interest and dividends earned are not taxable and should not be included.

Line 4 Enter the total of Line 1 minus Line 2 plus Line 3. If less than zero, enter zero.

Line 5 Report all self-employment profits and include all supporting schedules (PA Schedule C, PA Schedule F and/or PA Schedule K-1). PA Schedule C-F is not acceptable.

Report S Corp profits on reverse side of the return only.

Line 6 Report all self-employment losses and include all supporting schedules (PA Schedule C, PA Schedule F and/or PA Schedule K-1). PA Schedule C-F is not acceptable.

Report S Corp losses on reverse side of the return only.

Line 7 Enter the total of Line 5 minus Line 6. If less than zero, enter zero.

Line 8 Enter the total of Line 4 plus Line 7.

Line 9 Enter the total of Line 8 multiplied by the decimal tax rate table (see Table 1 on the reverse side) Example 1.00% = 0.01, 1.75% = 0.0175

Line 10 Enter the sum of the amount(s) recorded in the “LOCAL INCOME TAX” box of W-2(s). Credit for this amount will only be given if W-2(s) are provided with the filing.

Do not include Local Services Tax, Philadelphia City, and/or Other State credits.

Line 11 Enter the sum of quarterly payments, estimated payments and previous year’s credit applied to this year.

Line 12 Enter the total Philadelphia City and/or Other State credit. There is no credit for taxes paid to Pittsburgh. Refer to the instructions below and/or the worksheet on the reverse side

of the return.

Line 13 Enter the sum of Lines 10, 11 and 12.

Line 14 Enter a value on this line only if Line 13 minus Line 9 is more than $1.00.

Line 15 Enter credit amount being applied in the column of the individual receiving the credit or overpayment and check the appropriate box.

Failure to choose an option for your overpayment will result in a refund. LCTCB is required to report refunds/credits of $10.00 or more to the Internal Revenue Service.

Line 16 Enter a value on this line only if Line 9 minus Line 13 minus any credit from spouse that is more than $1.00.

Line 17 An additional penalty of one percent (1%) will apply to the amount of unpaid tax for each month, or partial month during which the tax remains unpaid.

Line 18 Payment made after the due date will be subject to interest at the rate established for the tax year by the Commonwealth of PA., under Section 806.

Line 19 Enter the total of Lines 16, 17 and 18. Acceptable forms of payment include check, money order, cash and credit cards. You may elect to pay by VISA, MasterCard, American

Express or Discover cards. This service is available by going to our website, http://www.lctcb.org or by visiting the Bureau office. Credit card payments will incur a convenience fee.

Sign and date the tax return. Complete all information requested. Please provide a daytime telephone number in the event there are any questions about this filing.

Mailing Instructions: Mail your return and all appropriate documentation as follows:

Payments: LCTCB - PAYMENT • PO BOX 11444 • Lancaster, PA 17605-1444

Refund: LCTCB – REFUND • PO BOX 11445 • Lancaster, PA 17605-1445

No Payment/No Refund: LCTCB – NO PYMT/REF • PO BOX 11446 • Lancaster, PA 17605-1446

PHILADELPHIA TAX/OTHER STATE CREDIT INSTRUCTIONS

Other State (Line 12): Credit is limited to the combined resident tax rate as levied under Chapter 3 of the Local Tax Enabling Act. The credit will be applied only to the extent that the

income taxed by the other State represents the income subject to the local tax. No credit will be allowed against compensation received in Maryland, Ohio, West Virginia, Indiana, New Jersey

or Virginia which are reciprocal states.

Philadelphia City (Line 12): Credit is limited to the combined resident tax rate as levied under Chapter 3 of the Local Tax Enabling Act. The credit will be applied only to the extent that

the income taxed by Philadelphia, represents the income subject to the local tax.

LCTEITIN183