Enlarge image

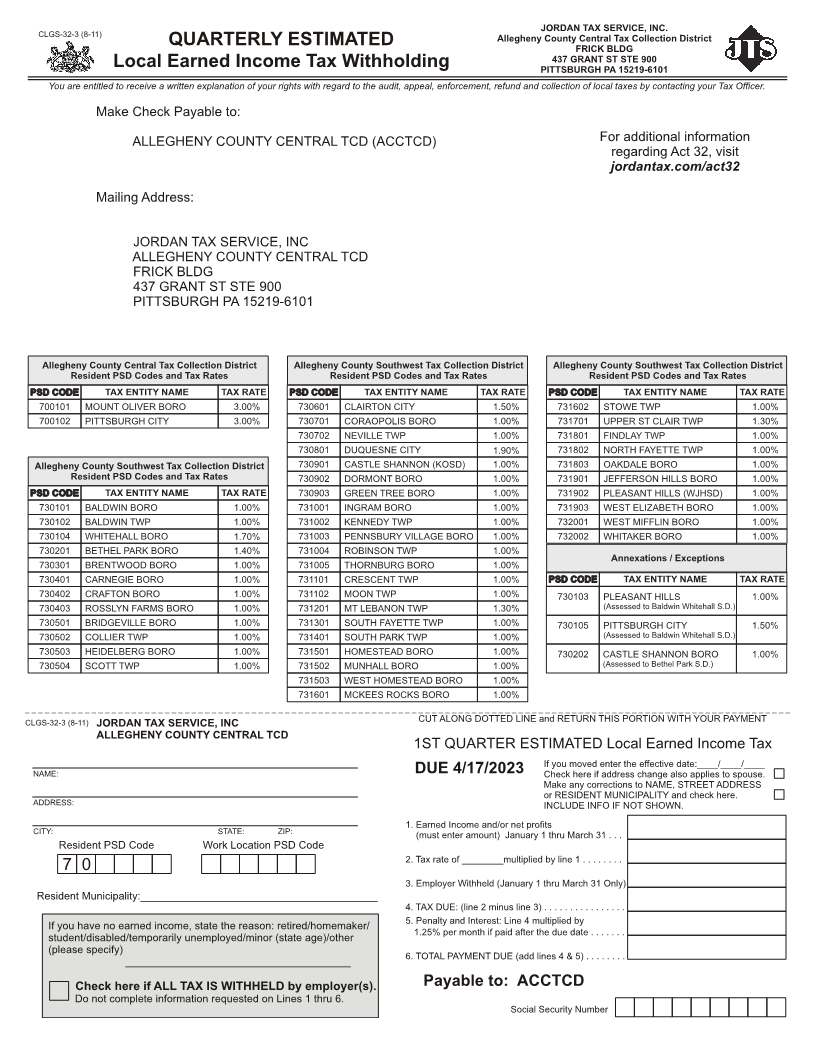

CLGS-32-3 (8-11) JORDAN TAX SERVICE, INC.

Allegheny County Central Tax Collection District

QUARTERLY ESTIMATED FRICK BLDG

437 GRANT ST STE 900

Local Earned Income Tax Withholding PITTSBURGH PA 15219-6101

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by contacting your Tax Officer.

Make Check Payable to:

ALLEGHENY COUNTY CENTRAL TCD (ACCTCD) For additional information

regarding Act 32, visit

jordantax.com/act32

Mailing Address:

JORDAN TAX SERVICE, INC

ALLEGHENY COUNTY CENTRAL TCD

FRICK BLDG

437 GRANT ST STE 900

PITTSBURGH PA 15219-6101

Allegheny County Central Tax Collection District Allegheny County Southwest Tax Collection District Allegheny County Southwest Tax Collection District

Resident PSD Codes and Tax Rates Resident PSD Codes and Tax Rates Resident PSD Codes and Tax Rates

PSD CODE TAX ENTITY NAME TAX RATE PSD CODE TAX ENTITY NAME TAX RATE PSD CODE TAX ENTITY NAME TAX RATE

700101 MOUNT OLIVER BORO 3.00% 730601 CLAIRTON CITY 1.50% 731602 STOWE TWP 1.00%

700102 PITTSBURGH CITY 3.00% 730701 CORAOPOLIS BORO 1.00% 731701 UPPER ST CLAIR TWP 1.30%

730702 NEVILLE TWP 1.00% 731801 FINDLAY TWP 1.00%

730801 DUQUESNE CITY 1.90% 731802 NORTH FAYETTE TWP 1.00%

Allegheny County Southwest Tax Collection District 730901 CASTLE SHANNON (KOSD) 1.00% 731803 OAKDALE BORO 1.00%

Resident PSD Codes and Tax Rates 730902 DORMONT BORO 1.00% 731901 JEFFERSON HILLS BORO 1.00%

PSD CODE TAX ENTITY NAME TAX RATE 730903 GREEN TREE BORO 1.00% 731902 PLEASANT HILLS (WJHSD) 1.00%

730101 BALDWIN BORO 1.00% 731001 INGRAM BORO 1.00% 731903 WEST ELIZABETH BORO 1.00%

730102 BALDWIN TWP 1.00% 731002 KENNEDY TWP 1.00% 732001 WEST MIFFLIN BORO 1.00%

730104 WHITEHALL BORO 1.70% 731003 PENNSBURY VILLAGE BORO 1.00% 732002 WHITAKER BORO 1.00%

730201 BETHEL PARK BORO 1.40% 731004 ROBINSON TWP 1.00%

730301 BRENTWOOD BORO 1.00% 731005 THORNBURG BORO 1.00% Annexations / Exceptions

730401 CARNEGIE BORO 1.00% 731101 CRESCENT TWP 1.00% PSD CODE TAX ENTITY NAME TAX RATE

730402 CRAFTON BORO 1.00% 731102 MOON TWP 1.00% 730103 PLEASANT HILLS 1.00%

730403 ROSSLYN FARMS BORO 1.00% 731201 MT LEBANON TWP 1.30% (Assessed to Baldwin Whitehall S.D.)

730501 BRIDGEVILLE BORO 1.00% 731301 SOUTH FAYETTE TWP 1.00% 730105 PITTSBURGH CITY 1.50%

730502 COLLIER TWP 1.00% 731401 SOUTH PARK TWP 1.00% (Assessed to Baldwin Whitehall S.D.)

730503 HEIDELBERG BORO 1.00% 731501 HOMESTEAD BORO 1.00% 730202 CASTLE SHANNON BORO 1.00%

730504 SCOTT TWP 1.00% 731502 MUNHALL BORO 1.00% (Assessed to Bethel Park S.D.)

731503 WEST HOMESTEAD BORO 1.00%

731601 MCKEES ROCKS BORO 1.00%

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

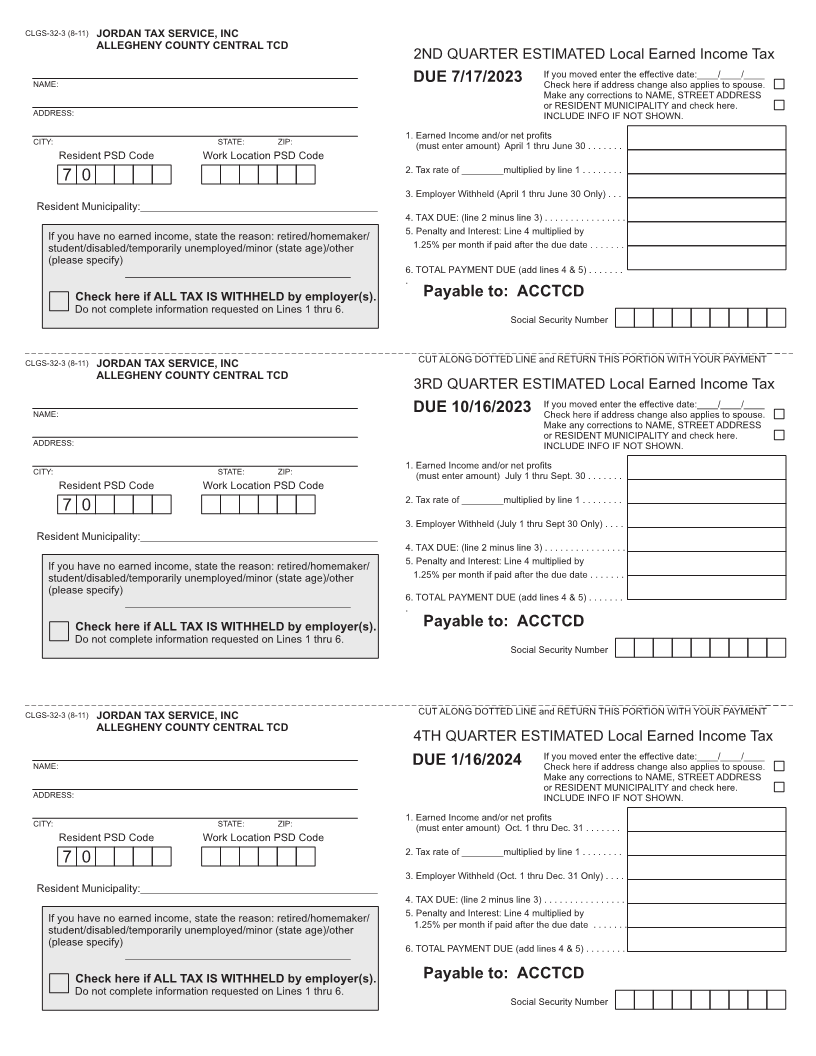

CLGS-32-3 (8-11) JORDAN TAX SERVICE, INC CUT ALONG DOTTED LINE and RETURN THIS PORTION WITH YOUR PAYMENT

ALLEGHENY COUNTY CENTRAL TCD

1ST QUARTER ESTIMATED Local Earned Income Tax

If you moved enter the effective date:____/____/____

NAME: DUE 4/17/202 3 Check here if address change also applies to spouse.

Make any corrections to NAME, STREET ADDRESS

ADDRESS: or RESIDENT MUNICIPALITY and check here.

INCLUDE INFO IF NOT SHOWN.

CITY: STATE: ZIP: 1. Earned Income and/or net profits

(must enter amount) January 1 thru March 31 . . .

Resident PSD Code Work Location PSD Code

2. Tax rate of ________multiplied by line 1 . . . . . . . .

7 0

3. Employer Withheld (January 1 thru March 31 Only)

Resident Municipality:________________________________________

4. TAX DUE: (line 2 minus line 3) . . . . . . . . . . . . . . . .

5. Penalty and Interest: Line 4 multiplied by

If you have no earned income, state the reason: retired/homemaker/ 1.25 % per month if paid after the due date . . . . . . .

student/disabled/temporarily unemployed/minor (state age)/other

(please specify) 6. TOTAL PAYMENT DUE (add lines 4 & 5) . . . . . . . .

______________________________________

Check here if ALL TAX IS WITHHELD by employer(s). Payable to: ACCTCD

Do not complete information requested on Lines 1 thru 6.

Social Security Number