Enlarge image

CUMBERLAND COUNTY TAX BUREAU

21 Waterford Drive, Suite 201 Mechanicsburg, PA 17050

(717) 590-7997

www.cumberlandtax.org

ONLINE FILING AVAILABLE: To view eligibility requirements and file your return visit www.cumberlandtax.org

INSTRUCTIONS

A. General Information

WHO MUST FILE: All residents of the municipalities and school districts shown on the next page who are employed

or self-employed, and all non-residents who work or are self-employed within the municipalities and school districts listed

must file. If you receive a tax form but did NOT work, you must still return the form and indicate the reason that no

income is shown (student, homemaker, disabled, retired, unemployed, etc.) .

A non-resident is someone who lives in another state or country but works in PA. Please provide the physical work address,

a copy of your Visa and/or Domicile State Return and PA Non-Resident State Return.

IMPORTANT: The accompanying tax return must be filed with this office by the indicated due date, even if no tax is due or if

all has been withheld by your employer. Failure to file your return may subject you to a fine of up to $500.00. Failure to

receive a Local Earned Income Tax Return shall not excuse the failure to file any required returns or to pay any tax due.

WHEN TO FILE: This return must be completed and filed by all persons subject to the tax on or before April 15 regardless of

whether or not tax is due. If you file a Federal or State Application for Extension, check the extension box on the front of the

form and send this form along with your estimated payment by April 15.

WHERE TO FILE: Remit to the local earned income tax collector for each address in which you lived during the year. Non-

resident taxpayers should remit to the collector for their physical work location in PA.

AMENDED RETURNS: If a taxpayer amends his federal income tax return, an amended local earned income tax return must

also be filed with the local earned income tax collector.

RECEIPT/COPY: Your cancelled check is sufficient proof of payment.

PENALTY AND INTEREST: If for any reason the tax is not paid when due, penalty and interest will be charged. Any late,

incorrect filing or payment may result in additional costs of collection.

ROUND OFF CENTS to the nearest whole dollar. Do not include amounts under 50 cents. Increase amounts from 50 to 99

cents to the next dollar amount.

USE BLACK OR BLUE INK ONLY WHEN COMPLETING THIS FORM.

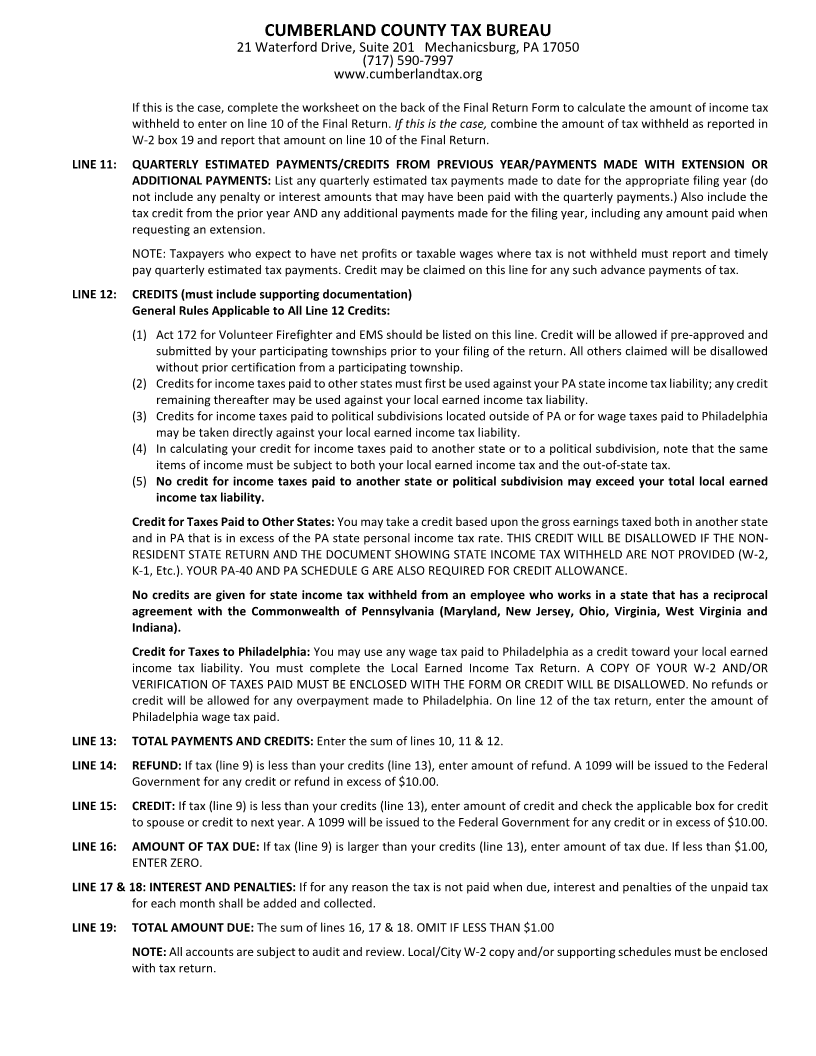

B. Regulations/Line by Line Instructions

LINE 1: GROSS EARNINGS FOR SERVICES RENDERED

Documentation Required: W-2’s must be enclosed (legible photocopies are accepted).

LINE 2: ALLOWABLE EMPLOYEE BUSINESS EXPENSES

Documentation Required: Pennsylvania form PA-UE must be enclosed (legible photocopies are accepted).

LINE 3: OTHER TAXABLE EARNED INCOME: Include income, from work or services performed, which has not been included

on line 1 or 5. Do not include interest, dividends or capital gains.

LINE 4: TOTAL TAXABLE EARNED INCOME: Subtract line 2 from line 1 and add line 3.

LINES 5 & 6: NET PROFITS/NET LOSSES FROM BUSINESS: Use line 5 for profit and line 6 for loss.

Documentation Required: 1099(s), PA schedules C, E, F or RK-1 must be enclosed (legible photocopies are accepted).

Rule: A taxpayer may NOT offset a business loss against wages and other compensation (W-2 earnings – line 1). “Pass-

through” income from an S-Corp is NOT taxable and loss is not deductible. A taxpayer may offset a loss from one

business entity against a net profit from another business entity.

LINE 7: TOTAL TAXABLE NET PROFIT: Subtract line 6 from line 5; if less than zero, enter zero.

LINE 8: TOTAL TAXABLE EARNED INCOME AND NET PROFIT: Add lines 4 & 7.

LINE 9: TAX LIABILITY: Multiply line 8 by your local earned income tax rate. If you don’t know your rate, please reference the

table on the next page.

LINE 10: EARNED INCOME TAX WITHHELD: If you work in an area that taxes non-residents at a higher rate than the resident

rate where you live, you may not be able to claim the entire amount of tax withheld on your W-2’s.